Think of the market as a body fighting off an infection. Tech stocks might be the flashy antibodies, but healthcare is the steady, reliable immune system, keeping things stable when the going gets tough. And right now, that immune system is looking stronger than ever.

Skeptical? I get it. We've heard the hype about healthcare before. But this time, it's different.

The Healthcare Select Sector SPDR ETF (XLV) has been on a tear, up 9.3% this year as of Thursday's close. That's nearly keeping pace with the broader S&P 500's 12% gain - a remarkable feat in a market that's been anything but stable.

But what's even more impressive is the turnaround. Back in mid-July, XLV was lagging behind like a three-legged horse in the Kentucky Derby, up only 8.3% while the S&P 500 was showing off with an 18% gain.

In fact, out of the 63 healthcare stocks in the S&P 500, only a dozen have been slacking off since July. The rest? They've been outperforming like it's going out of style.

So what changed?

Well, it wasn't so much that healthcare stocks suddenly discovered the fountain of youth. No, my friends, it was more like the rest of the market decided to take a swan dive off the high board.

You see, while tech stocks were busy doing their best Icarus impression – flying too close to the sun and then plummeting back to earth – healthcare stocks were steady as she goes. It's like the old tortoise and hare story, except in this version, the hare got distracted by shiny objects and ran off a cliff.

Now, let's shine the spotlight on some of the key players driving this healthcare rally.

Remember those health insurers everyone was worried about back in spring? The ones that had investors biting their nails over the future of Medicare Advantage? Well, they've made a comeback.

The S&P 500 Managed Health Care index was down 12% in mid-April, looking about as healthy as a chain smoker with a Big Mac habit. But now? It's up 4.5% since the start of the year.

Companies like Centene (CNC) and UnitedHealth Group (UNH) have bounced back faster than a rubber band on steroids.

And it's not just the insurers. Big Pharma's been flexing, too.

Pfizer (PFE), the company that became a household name faster than you can say "vaccine," is holding steady. Johnson & Johnson (JNJ) is up 2.2%, probably thanks to all that baby powder they're not selling anymore.

Meanwhile, AbbVie’s (ABBV) up 11% since July. These guys are like the Energizer Bunny of the pharma world – they just keep going and going.

But the real showstopper? Eli Lilly (LLY). This biopharma has been on a tear since the beginning of 2024. Up 45% on the year at one point, they've been climbing faster than a squirrel up a tree with a dog in hot pursuit.

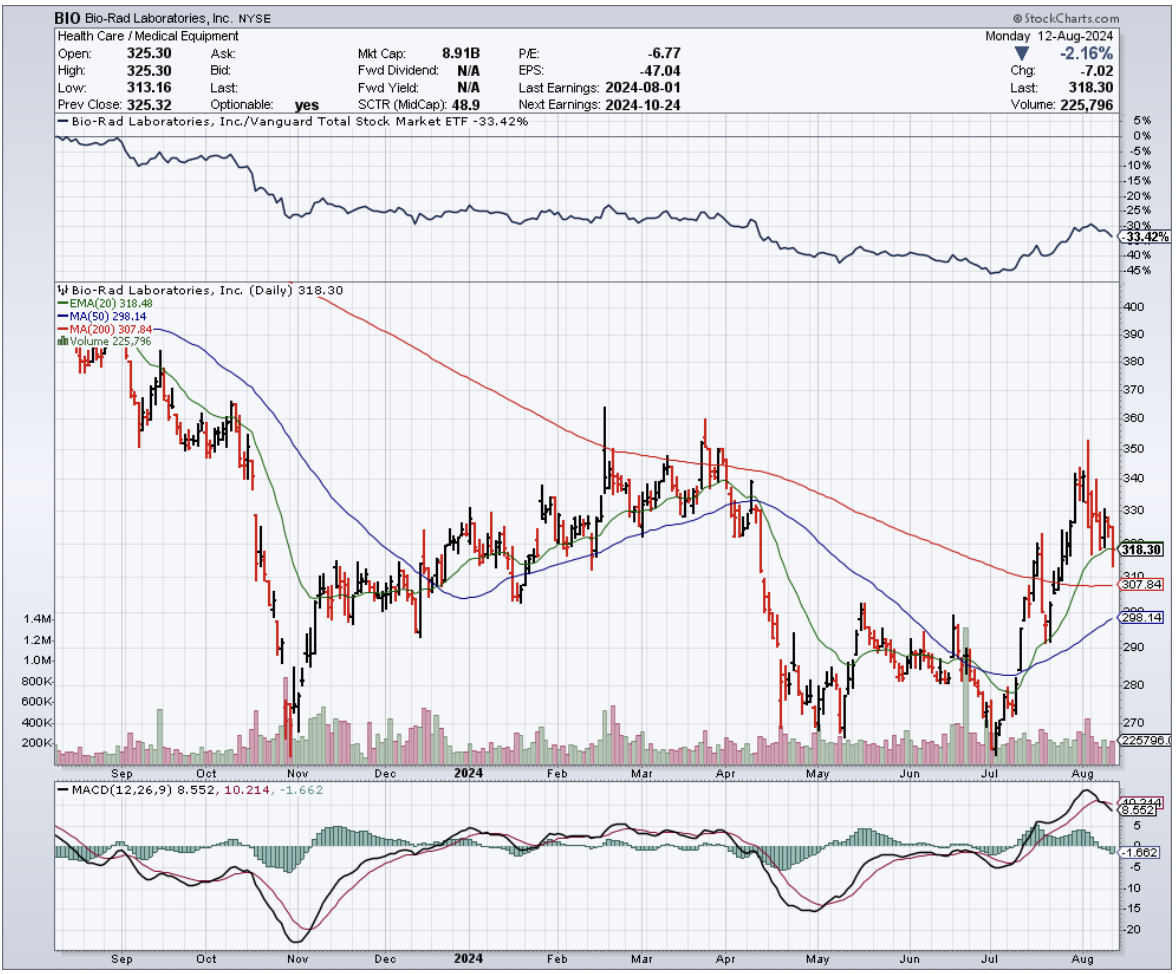

Then, there are companies like Bio-Rad Laboratories (BIO), up 20% since July. Universal Health Services (UHS)? Up 18% since July. Waters (WAT), the life sciences tools folks? Up 15%.

Even the biotechs are out to impress.

Amgen (AMGN), the granddaddy of biotech, is up 10% year-to-date. They're selling drugs like Prolia and Enbrel faster than hotcakes at a lumberjack convention.

And Amgen’s pipeline? It’s packed with potential blockbusters, setting the stage for further expansion in the future.

Gilead Sciences (GILD)? Up 15% year-to-date. Turns out, their COVID-19 treatment, Remdesivir, is back in vogue like bell-bottom jeans. And their HIV and hepatitis C drugs? They're still growing stronger.

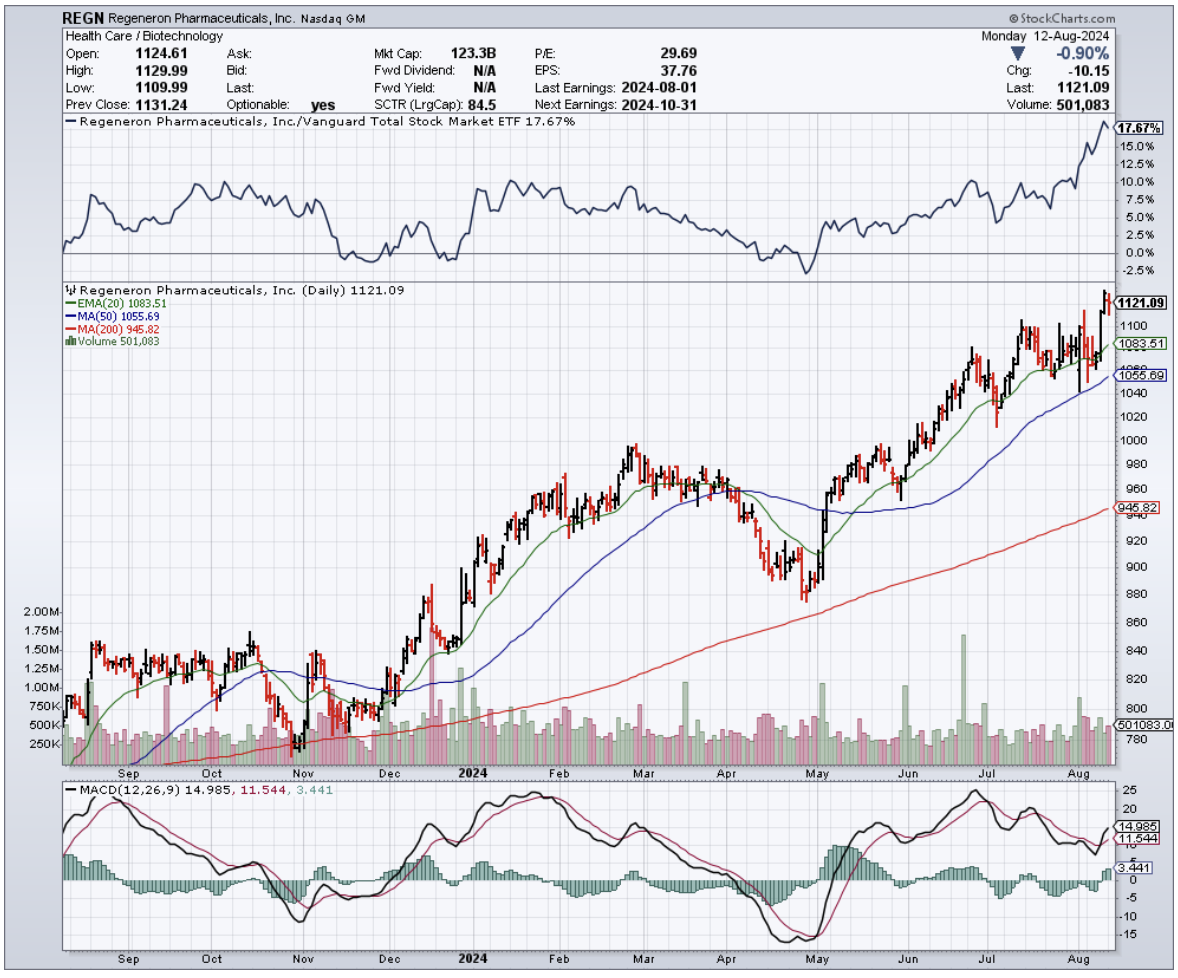

But the real rock star of biotech? That'd be Regeneron Pharmaceuticals (REGN). These guys are up over 30% year-to-date. They're treating everything from eye diseases to cancer to inflammation.

Vertex Pharmaceuticals (VRTX) is another one to watch. Up 12% this year, they've got the cystic fibrosis market cornered. And they're not stopping there – they're expanding faster thanks to their collaboration with the likes of Crispr Therapeutics (CRSP).

Now that I’ve mentioned gene therapy, I know you're wondering about Moderna (MRNA). After all, weren’t they the darlings of the COVID era? Well, yes and no.

Their stock's down about 35% year-to-date, but don't count them out just yet. Their mRNA technology is hotter than a jalapeño popper fresh out of the fryer. They might be down, but they're definitely not out.

So, what's the takeaway here? I suggest you keep your eyes peeled on the biotechnology and healthcare sectors. After all, in this market, the best offense might just be a good defense – and what's more defensive than betting on the sector that keeps us all alive and kicking?