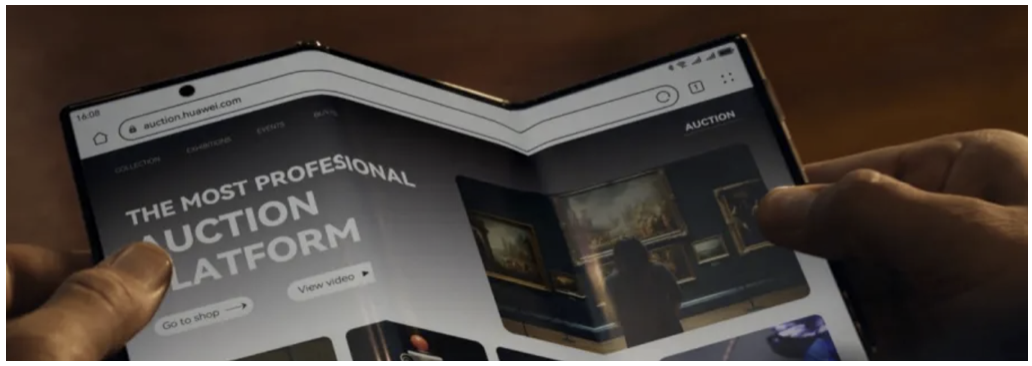

Silicon Valley is usually on top of the innovation game and as Huawei announced the launching of its trifold smartphone, one must ask whether Silicon Valley is late to the party or if this technology is even worth their time.

My guess is that foldable devices won’t move the needle and these announcements aren’t really about moving revenue, but to offer bluster in a global game of cat and mouse.

In general, the smartphone super cycle is about tapped out and I don’t see a foldable phone as a reason for another re-acceleration of revenue.

There is a higher chance that in the next few years, this foldable technology is adapted for some other technology and written off on the balance sheet.

To think it could be some revolutionary new trend is beggars’ belief.

To be honest, many consumers are tired of screen time and can’t get off their screen because work duties connect them to the screen.

When needing a bigger screen to watch global sporting events, many would prefer a large-screen TV that doesn’t fold. This phone is no TV screen – not by a long shot.

It is a little difficult for me to understand the use case here for Huawei going big in the foldable screen business.

It’s not like the new phone will be cheap either, the new trifold smartphone will start at around $2,800 which is more expensive than most premium laptops.

Huawei announced its foldable product on the same day as Apple unveiling the new iPhone.

Apple announced its iPhone 16 Pro Max will start at $1,199, and the iPhone 16 at $799.

The first set of Apple Intelligence AI features will be available in a free software update next month.

Huawei’s Mate XT also comes with artificial intelligence features, such as text translation and cloud-based content generation.

The device is 3.6 millimeters thick when unfolded, with a 10.2-inch screen.

More than 3.5 million people had pre-ordered Huawei’s trifold Mate XT smartphone as of midday Tuesday.

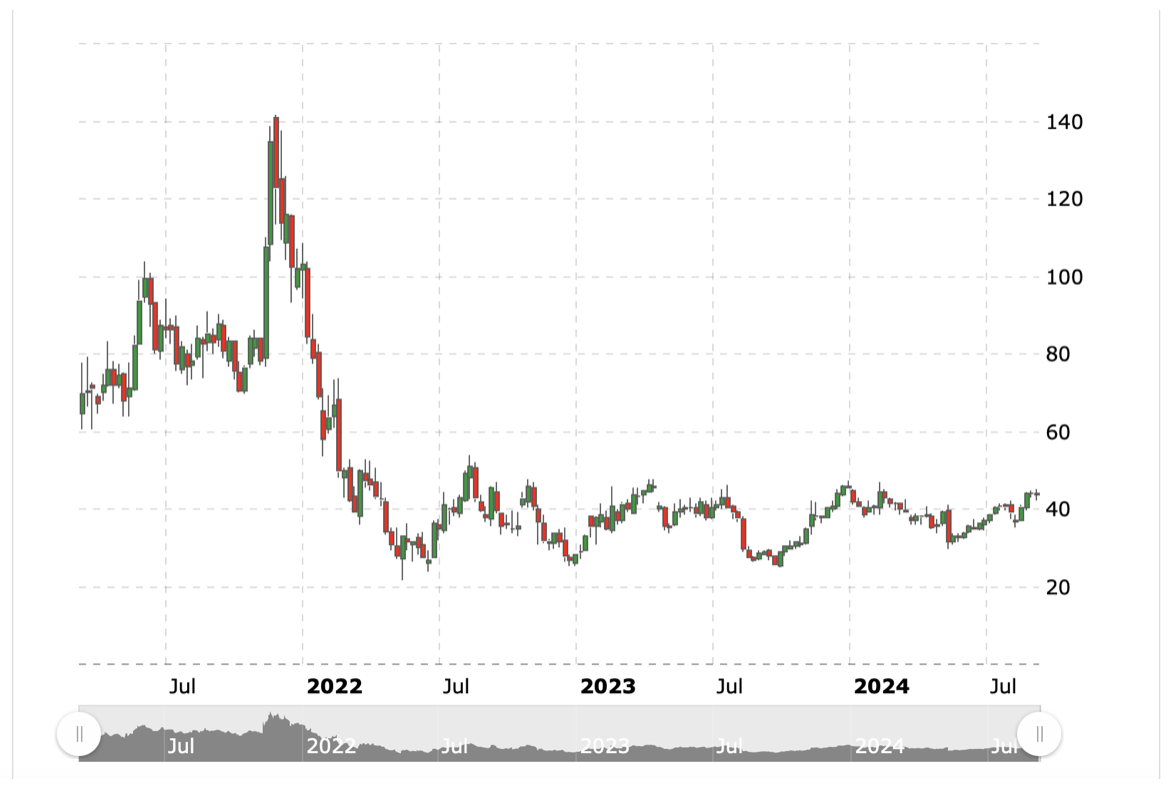

The Chinese company has sought to make a comeback in the smartphone industry, which was hard hit after the U.S. slapped sanctions on the company in 2019. The U.S. in October 2022 imposed broader restrictions on American sales of advanced chips to Chinese businesses.

Apple fell out of the list of top five smartphone vendors in China in the second quarter of this year. It was the first time that domestic players held all five spots.

Clearly, Chinese tech views Apple as the top dog to compete against, but I would say that Apple’s star is waning in China.

They are being pushed out by the Chinese government who are indirectly suggesting to Chinese consumers to go with domestic alternatives.

National champions and protecting them are the modus operandi in the age of deglobalization and that will not change anytime soon.

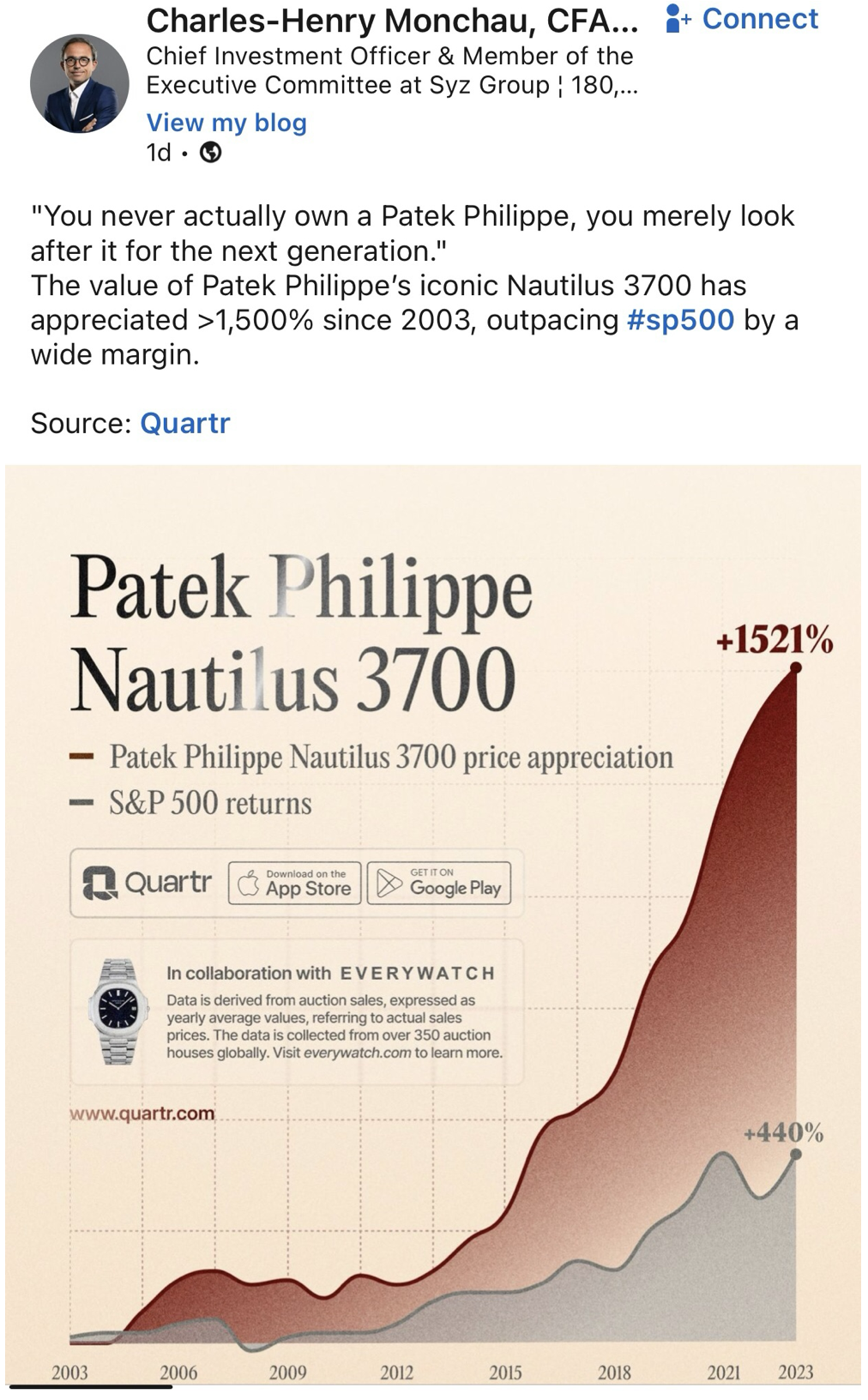

As for the tech, foldable screens are a mediocre and lateral upgrade.

The size of a screen has a size limit to its usefulness and building gargantuan screens does not suggest that it could trigger some new wave of untapped profits.

I believe Apple is smart in not aggressively pursuing foldables and the quest continues to find the new killer tech that will take over.

Until then, tech stocks should grind up but not in a dramatic fashion.