(SUMMARY OF JOHN’S SEPTEMBER 25TH 2024 WEBINAR)

September 27, 2024

Hello everyone

TITLE – The Market Melt Up

TRADE ALERT PERFORMANCE

September +9.67% MTD

2024 YTD +44.36%

Average annualized return +52.43%

Trailing one year return +63.00%

Since inception +720.99%

PORTFOLIO

Risk On

(GLD) 10/$220/$225 call spread 10%

(CCJ) 10/$33/$36 call spread 10%

(NEM) 10 $47/$50 call spread 10%

(TSLA) 10/$180/$190 call spread 10%

(DHI) 10 $165/$175 call spread 10%

(TLT) 10 $93/$96 call spread 10%

Risk Off

(TLT) 10 $103/$106 put spread -10%

Total Net Position = 50.00%

Total Aggregate Position = 70.00%

THE METHOD TO MY MADNESS

The Presidential debate and a surprise monster 50 bps cut trigger massive “risk on” move in all asset classes.

All interest rate plays deliver massive upside moves

John says we are unlikely to see a more than 5% drop in indexes for the rest of 2024.

US dollar weakness hits and could continue for years.

Technology stocks will recover after a much-needed correction.

Energy gets dumped on slowdown fears.

Buy stocks and bonds on dips – buy ALL sectors.

THE GLOBAL ECONOMY – PANIC CUT

Fed shocks market with a 50-bps rate cut.

Inflation is running slower than expected, at a 1.8% annualized rate for the last four months.

Consumer sentiment rises to the highest level in four months according to the University of Michigan.

US retail sales unexpectedly rose in August, supported by online purchases.

US Household wealth hits new all-time high, or the value of American home equity at $163.8 trillion.

Foreign Direct Investment into China collapses, down 31.5% in the first eight months of 2024.

Foreign investors pour $31 billion into Emerging Markets in August.

US Import prices are in free fall.

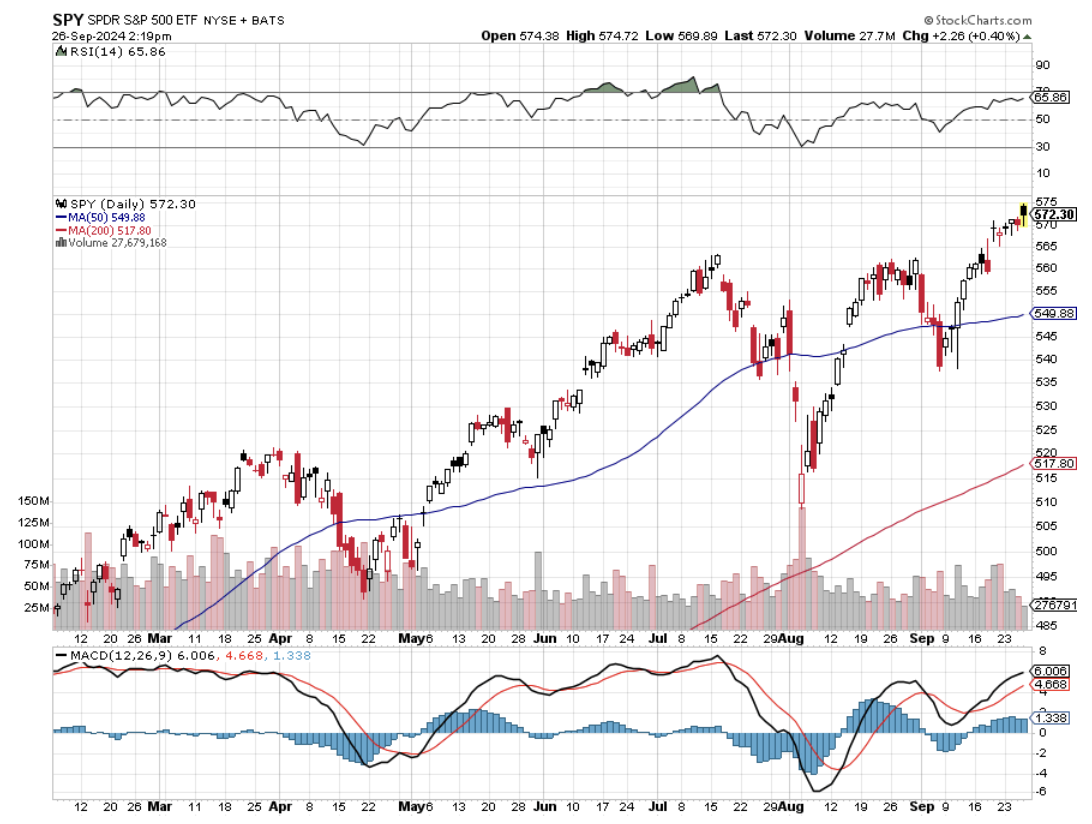

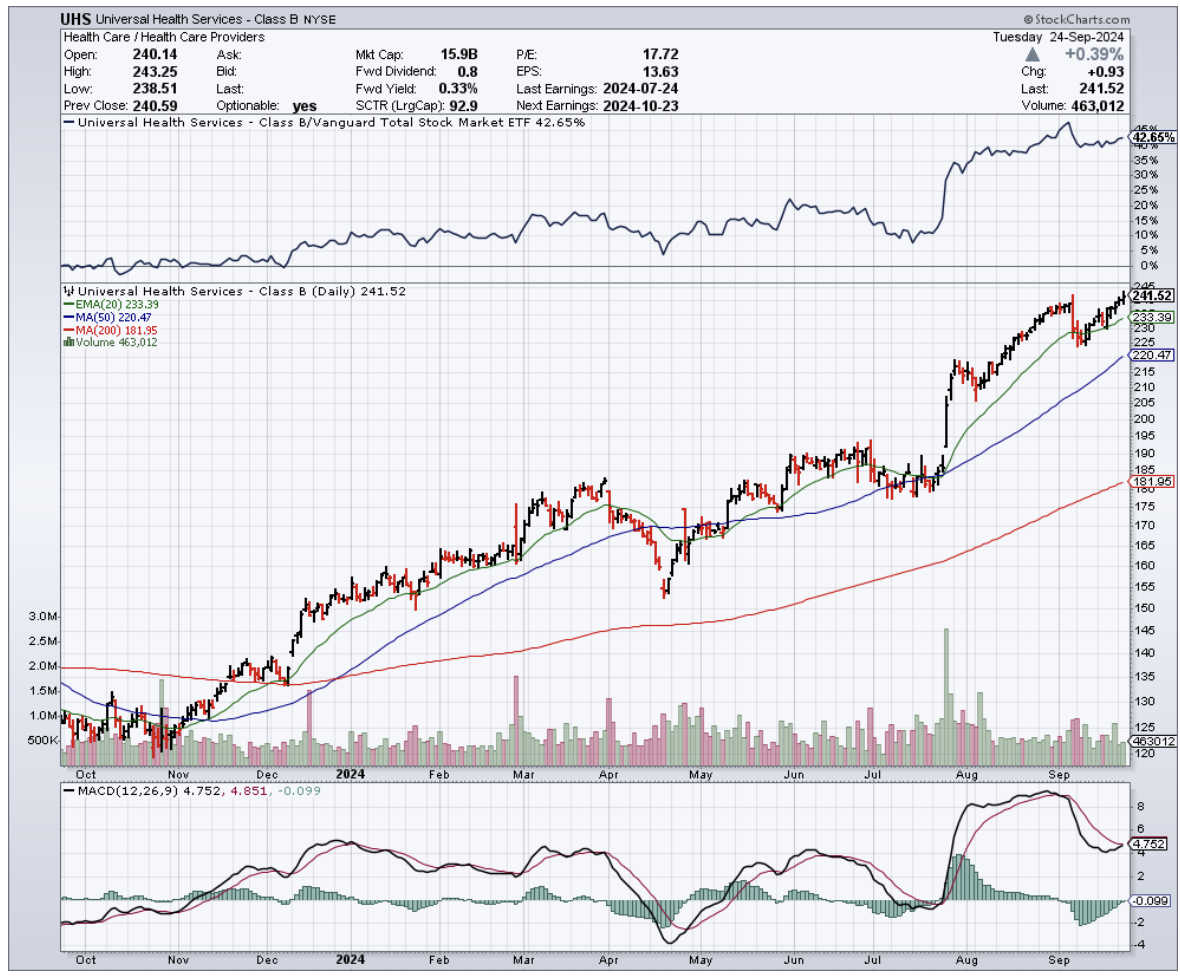

STOCKS – NOW LEASE ON LIFE

Market scores biggest turnaround in two years, now that the presidential debate is history, scoring an amazing 900-point intraday swing.

Solar stocks get Harris nudge.

FedEx (FDX) gets crushed 10% on disappointing earnings and guidance.

Intel (INTC) cuts Amazon deal to supply the online marketing giant with a steady supply of high-end chips.

Charles Schwab (SCHW) rallies 5% after the brokerage firm reported steady growth in new assets.

Wells Fargo (WFC) gets hit with another regulatory action for failure to control money laundering.

Palantir (PLTR), Dell (DELL) and Erie Indemnity (ERIE) to join S&P500.

Buy Apple (AAPL), (AMZN).

Snowflake (SNOW) - consider two-year LEAPS.

(FCX) buy – a recovering China play.

Also consider Cameco (CCJ), First Solar (FSLR), and NextEra Energy (NEE)

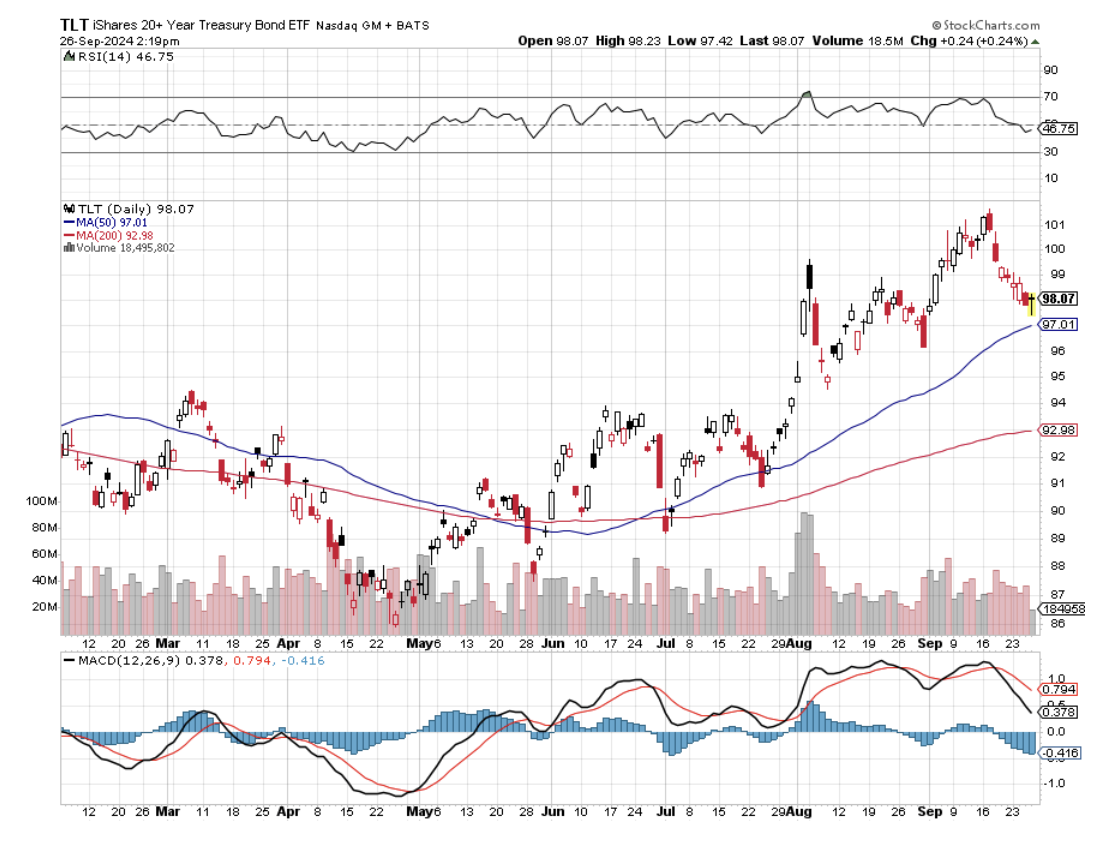

BONDS – EXHAUSTION

Another government shutdown is in the works in five days, with the house unable to pass a spending bill with only a four-seat majority.

Interest payments on national debt top $1 trillion per year.

The jump in debt service costs came as the U.S. budget deficit surged in August, edging closer to $2 trillion for the full year.

The Treasury really wants to see the Fed cut interest rates more.

The yield curve has de-inverted, meaning that short term interest rates have fallen below long-term ones.

Yield chasers post record demand for Junk Bonds.

Buy (TLT), (JNK), (NLY), (SLRN) and REITS on dips.

FOREIGN CURRENCIES – DOLLAR WEAKNESS

Dollar hits seven month low as US interest rate cuts loom. It could be a decade long move.

The Yen carry trade is back, with hedge funds piling back into positions they baled on only two weeks ago.

No more interest rate hikes by the Bank of Japan in the near future.

What this means is more leverage, risk, and volatility for global financial markets.

Falling interest rates in the US = a lower US dollar.

Buy (FXA), (FXE), (FXB), (FXC).

ENERGY & COMMODITIES – A BIG MOVE TOWARD NUCLEAR RENAISSANCE

John’s Cameco (CCJ) trade alert came through in a week, immediately tacking on 20%.

While advanced nuclear power plant design and fuels (low enriched uranium oxide with an M5TM zirconium-based cladding) have been around for years.

Microsoft (MSFT) announced the reopening of Three Mile Island, the site of the worst nuclear accident in US history in 1979.

Microsoft will purchase the carbon-free energy produced from it to power its data centres to support AI.

12 U.S. nuclear power reactors have permanently closed since 2012. Another seven U.S. reactor retirements have been announced through 2025, with total generating capacity of7,109 MW (equal to roughly 7% of U.S. nuclear capacity).

PRECIOUS METALS – NEW HIGHS

Gold hits new high, at $2,650 an ounce, as hedge funds pour in.

Seasonals for the barbarous relic are now the post positive of the year.

Look for $3,000 an ounce by next year.

Notice how (GLD) gaps higher every morning, signifying that the bulk of buying is coming from Asia. Buy (GLD) on dips.

Buy (GLD), (SLV), (AGQ) and (WPM) on dips.

REAL ESTATE – RATE SHOCK

Existing home sales drop 4.2% in August to a seasonally adjusted annualized rate of 3.86 million unit.

There were 1.35 million units for sale at the end of August.

That’s up 0.7% from July and up 22.7% year over year.

Median price of an existing home sold in August was $416,700, up 3.1% from August 2023, a new all-time high.

Real estate should pick up once lower interest rates feed through.

US Homebuilder sentiment rises, in the wake of the massive drop-in mortgage rates in recent months.

The NAHB/Wells Faro Housing Market Index of builder confidence rose to 41 this month from 39 in August.

Buy (DHI), (LEN), (PHM) and (KBH) on dips.

TRADE SHEET

Stocks – buy the next big dip.

Bonds – buy dips.

Commodities – buy dips.

Currencies – sell dollar rallies, buy currencies.

Precious Metals – buy dips.

Energy – avoid.

Volatility – sell over $30

Real Estate – buy dips.

===========================================

MY CORNER

Scale into Tesla.

Tesla will unveil its Robo taxi on October 10 at a Warner Bros. studio in Burbank, California.

The stock is likely to rally into that event.

Check out the charts here. You can see a very large, inverse head and shoulders pattern, which started forming in November last year. This pattern indicates that there is potential for a bullish move in the stock.

Daily Chart (TSLA)

Weekly Chart (TSLA)

Cheers

Jacquie