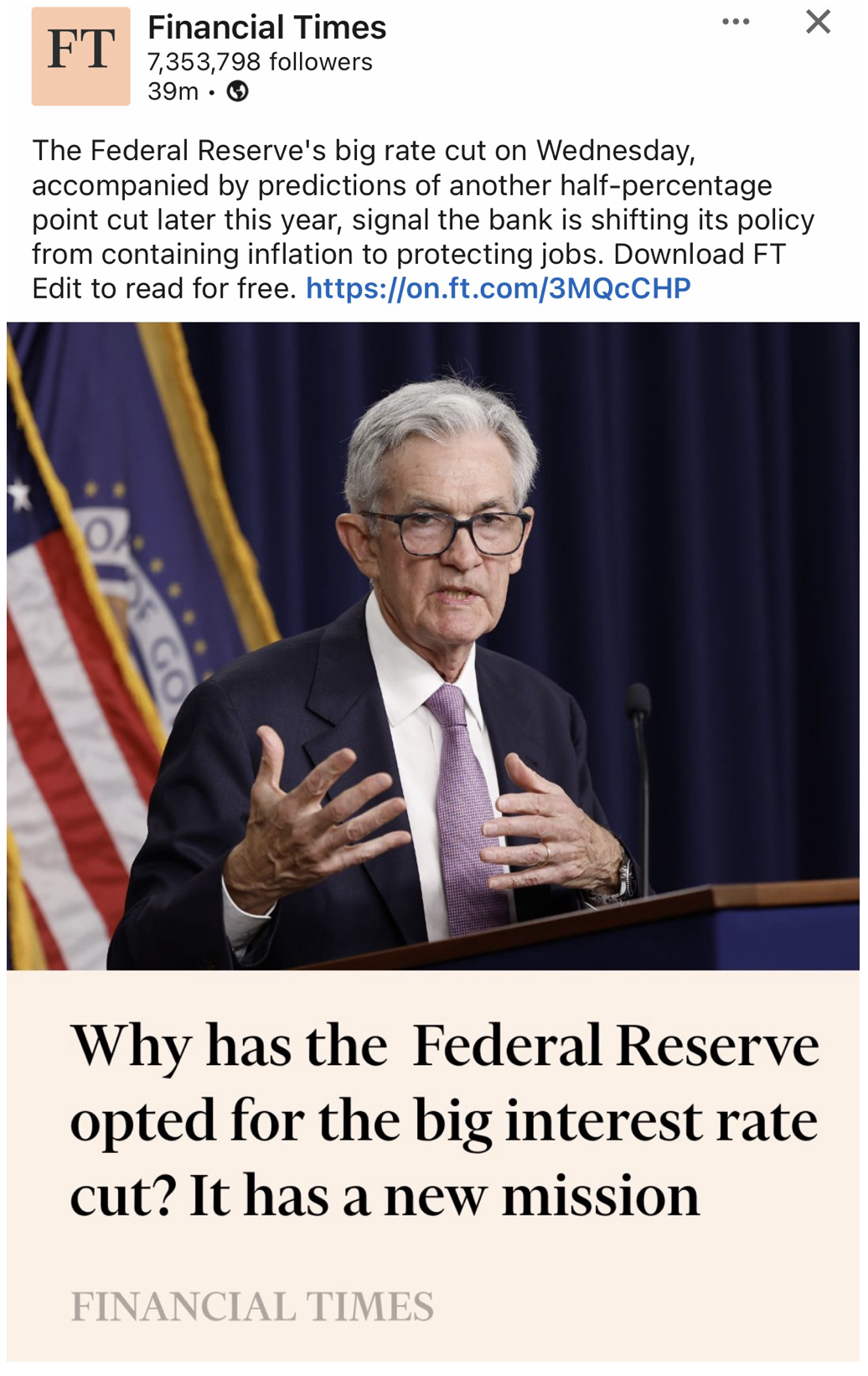

No recession – highly bullish for technology stocks ($COMPQ) in the short term.

That is my hot take from Jerome Powell’s and the Fed’s surprise 50-point basis interest rate cut.

Tech stocks will overwhelmingly outperform the rest of the equity market because that is where the profits and earnings are.

I don’t see a situation for the ‘catch up’ trade, or if it does transpire, it will be very transitory in nature.

There is no other subsector that is about to overtake technology in terms of prestige or growth, and that is where I take comfort in believing that technology will harvest the lions’ share of the gains from the Central Bank’s interest rate cut.

The cut was a jumbo one, which means even better projections for tech share prices in the short run.

It is hard not to take a look-in back at the Magnificent 7 for another winter rally that should take the Nasdaq quite a bit higher from here.

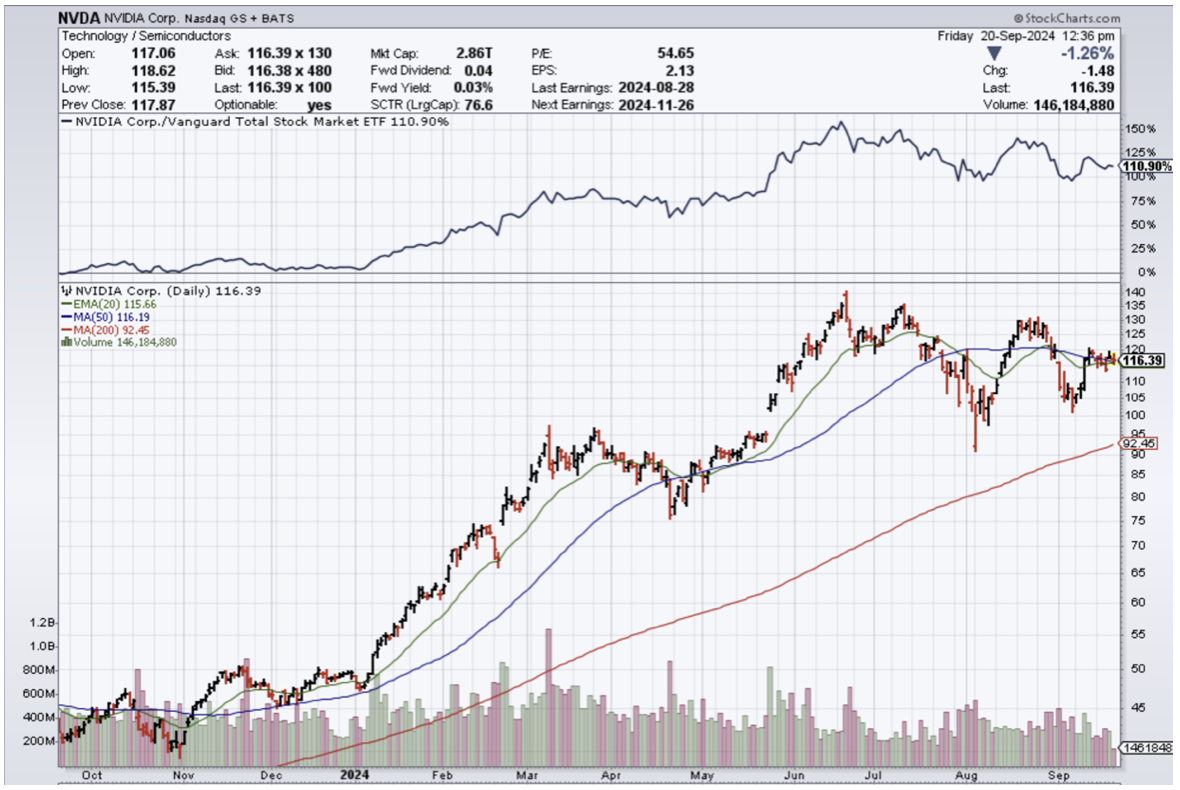

That is why I executed a deep-in-the-money call spread on chip behemoth Nvidia (NVDA) this morning.

The tech-weighted Nasdaq index hit an all-time high in 2024 around July, with prices trading around 18,700 points, and we are around 5% from that high.

Any pullback in quality tech firms will be brought up, and I urge readers to enjoy the rally because of the unexpected jumbo hike, the rally is now pulled forward.

Highlighting the hawkish cut was the FOMC vote was 11-1, with Governor Michelle Bowman preferring a quarter-point move.

Powell pushed through a half-point move instead and ironically told reporters that the economy was great.

Unemployment numbers of around 4.2% were once considered full employment back in the day.

A half-point cut into a strong economy to pre-empt a recession is an interesting move.

It is clear they don’t want to get behind the curve after they badly botched inflation on the way up.

In most normal cases, tech stocks would rocket higher, and bond yields would sink, but the 10-year yield has gone the other way, signaling that this hawkish cut could ignite another bout of higher inflation at the long end of the yield curve.

The Nasdaq index gained 3%, showing that it can power through no matter what bonds are doing, and that has been the case since 2020.

The Japanese yen also shot higher from the 140 level to the 144 to the US dollar today.

A weaker trending yen is a highly bullish signal for the trajectory of U.S. tech stocks.

The committee expects the long-run neutral rate to be around 3%, a level that has drifted higher as the Fed has struggled to get inflation down to 2%.

Gross domestic product has been rising steadily, and the Atlanta Fed is tracking 3% growth in the third quarter based on continuing strength in consumer spending. Moreover, the Fed chose to cut even though most gauges indicate inflation well ahead of the central bank’s 2% target. The Fed’s preferred measure shows inflation running around 2.5%, well below its peak but still higher than policymakers would like.

The current jobless level is 4.2%, drifting higher over the past year, though still at a level that would be considered full employment.

A 50 basis point rate cut into an economy growing 3% per year will surely get GDP moving closer to 4%.

Think about it in terms of housing and all the buyers waiting on the sidelines waiting to get into the housing market.

Inflation is sure to come back again in the long term, but in the short term, this nudges 3% GDP to 4%, and that is highly bullish for tech stocks. This also should help unemployment stick close to the 4.2% in, which the Fed is worried about, which is a victory for equity markets.

The tech rally is here, and don’t miss out on it!