When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

September 18, 2024

Fiat Lux

Featured Trade:

(ORACLE’S PLAN TO DOMINATE AI)

(ORCL)

Larry Ellison, who founded Oracle back in the day and was once a legacy data center company, has now transformed into a cutting-edge AI company, and when he talks, people should take note.

The boom in his stock Oracle from the AI mania has meant that he is now almost as rich as Amazon’s Jeff Bezos.

To say the least, Ellison has his pulse on what is going on in the AI community and what is next in store, which is why Oracle, who recently moved to Texas, should be on the radar of every investor who has an interest in technology.

Ellison gave his candid view on how his company, Oracle, along with other AI companies, will profit from the hard pivot to everything and anything AI.

Essentially, everything will become generative AI, which delivers profitable solutions when anything happens.

Let me explain.

Ellison believes super-invasive, if not totally omnipresent, algorithmic overseers will be the new normal for human society, and that will give a way for tech companies to make a killing.

Powerful and fascinating AI will bring about a new paradigm of supercharged surveillance, guaranteeing that the "citizens" — all behave and stay in line.

"We're going to have supervision," Ellison said.

"Every police officer is going to be supervised at all times, and if there's a problem, AI will report that problem and report it to the appropriate person."

"Citizens will be on their best behavior," he added, "because we are constantly recording and reporting everything that's going on."

Ironically, many of these surveillance apparatuses — security cameras, bodycams — are already in place.

Why have them engaged in a risky car chase, for example, when you can get an AI drone to tail a suspect instead?

"You just have a drone follow the car," Ellison said.

Under Ellison's stewardship, Oracle has been attempting to position itself as another leader in the AI race and has quickly integrated the tech into its cloud computing services.

The examples that Ellison gives are by no mistake.

Ellison plans for Oracle to be the heart and center of this surveillance business, and rightly so, with all the investments and years of getting to this new technology.

Oracle’s data centers and software will be central to how surveillance will operate. CCTV cameras will be absolutely everywhere, “helping” police do their job and identifying if a drone needs to be sent in for more helping.

Police won’t be the only use case in drones and cameras powered by AI helping to build business.

Take the industry of logistics.

They are fast moving towards a time when humans won’t need to be working in the warehouse moving products.

Robots, cameras, and drones in that type of tripartite cooperation will be able to unload, store, organize, and ship powered by Oracle software. Now, that is a really efficient concept!

Humans will really only need to be present to receive the Amazon package at the last mile deliver high likely delivered by a robotic drone in an electric Tesla powered by Oracle software. Oracle is about to hit pay dirt once they are integrated into every business process in the world that happens 24 hours per day.

The future of commerce will look a lot different, and there is a reason why the trajectory is so fluid: and Ellison sits at the intersection of business profits and AI.

Readers should be inclined to buy Oracle on the dip.

(THE SCIENCE OF AGEING BACKWARDS MAY BE IN OUR POCKETS WITHIN THE NEXT TEN YEARS)

September 18, 2024

Hello everyone.

Today will be a refreshing change of pace and content, as I think we all have endured a lot of noise about this week’s events.

So, let’s jump right in.

Ageing. Or should I say the study and research into ageing backwards is gaining steam? It’s no longer the stuff of science fiction. Affordable treatments that could slow, stop or even reverse your ageing are, thanks to new breakthroughs, less than a decade away. Without even realizing it, you may even be taking some of these pills already.

The biology of ageing essentially causes diseases like cancer, cardiovascular disease, and dementia. For example, while having high blood pressure roughly doubles your chance of a heart attack, being aged 80 rather than 40 multiplies that risk by 10. That means understanding the biology behind these enormous risk increases could lead to the greatest revolution in medicine since the discovery of antibiotics. It could transform not just the treatment but the prevention of disease in the first place.

The pay-off, if we can identify and treat these underlying causes of ageing, is enormous. If we could make people in middle age a bit biologically younger with drugs that address the ageing process, we could improve everything from heart health to wrinkles and delay the onset of cancer, dementia, and frailty, all at the same time.

Andrew Steele, in his text, Ageless: The New Science of Getting Older Without Getting Old, reveals how scientists have identified several so-called ‘hallmarks’ of the ageing process – underlying biological and biochemical processes…

So, what are these biological hallmarks, and what might treatments to slow or stop their currently relentless march look like?

According to Steele, the most promising treatments are:

1/ A Miracle Drug from Easter Island

Easter Island, known for its giant stone heads, is also the origin of one of our most promising drugs to improve longevity: rapamycin.

Discovered in a soil sample returned by a Canadian expedition in the 1960s, it was named after the Polynesian name for Easter Island, Rap Nui. The molecule, produced by a species of bacterium, is a pharmaceutical Swiss army knife with applications ranging from treating cancer to suppressing transplant patients’ immune systems to help prevent organ rejection. And we could soon add ‘slowing down the ageing process’ to that list.

It all comes down to the hallmarks of ageing: the accumulation of dysfunctional proteins as we get older.

‘Autophagy’ – which literally means ‘self-eating’ – allows our cells to recycle malformed molecules and turn them into fresh, functional proteins. Rapamycin can increase our cells’ ability to engage in this anti-ageing spring-cleaning.

Scientists believe that we could improve everything from heart health to wrinkles and delay the onset of cancer, dementia, and frailty.

2/ Drugs in your Medicine Cabinet

Diabetes drugs known as SGLT -2 inhibitors – canagliflozin, dapagliflozin, or empagliflozin – might be giving you health and lifespan benefits beyond helping with your blood sugar. These drugs have been shown to improve wider health in patients that take them, and canagliflozin extended lifespan by 14% in male mice.

Other drugs include Metformin and Acarbose – diabetes drugs, and bisphosphonate drugs- usually used to reduce bone loss, weight-loss treatments like semaglutide, commonly known under brand names like Wegovy or Ozempic.

3/ Bottling Up a Baby’s Biology

An immortal jellyfish (Turritopsis dohrnii) can, in times of stress, simply revert their biology to the junior ‘polyp’ stage and then grow up all over again, seemingly as many times as they like. In other words, ageing backward isn’t against the laws of biology. But is it possible in humans?

Steele argues that ageing biology, as a field, needs more funding to begin human trials for the promising interventions. If it gets it, Steele says there’s no reason why some of these real anti-ageing medicines couldn’t be approved within a decade, allowing us all to stay healthy for longer.

AUSTRALIAN CORNER

That’s Wednesday evening, September 18 (Australian time) Hope you enjoyed it.

QI CORNER

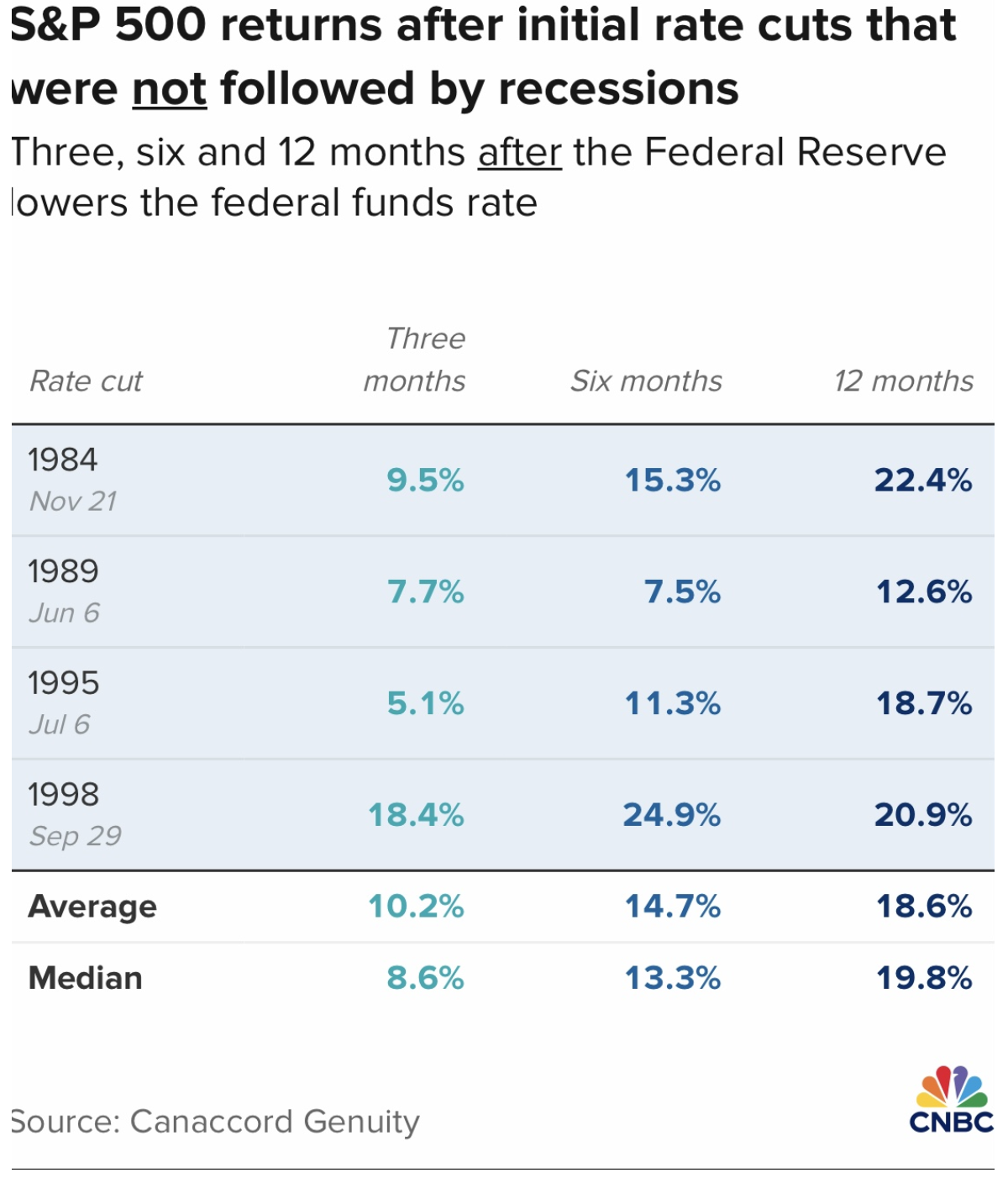

Shaded areas indicate cuts not followed by recessions.

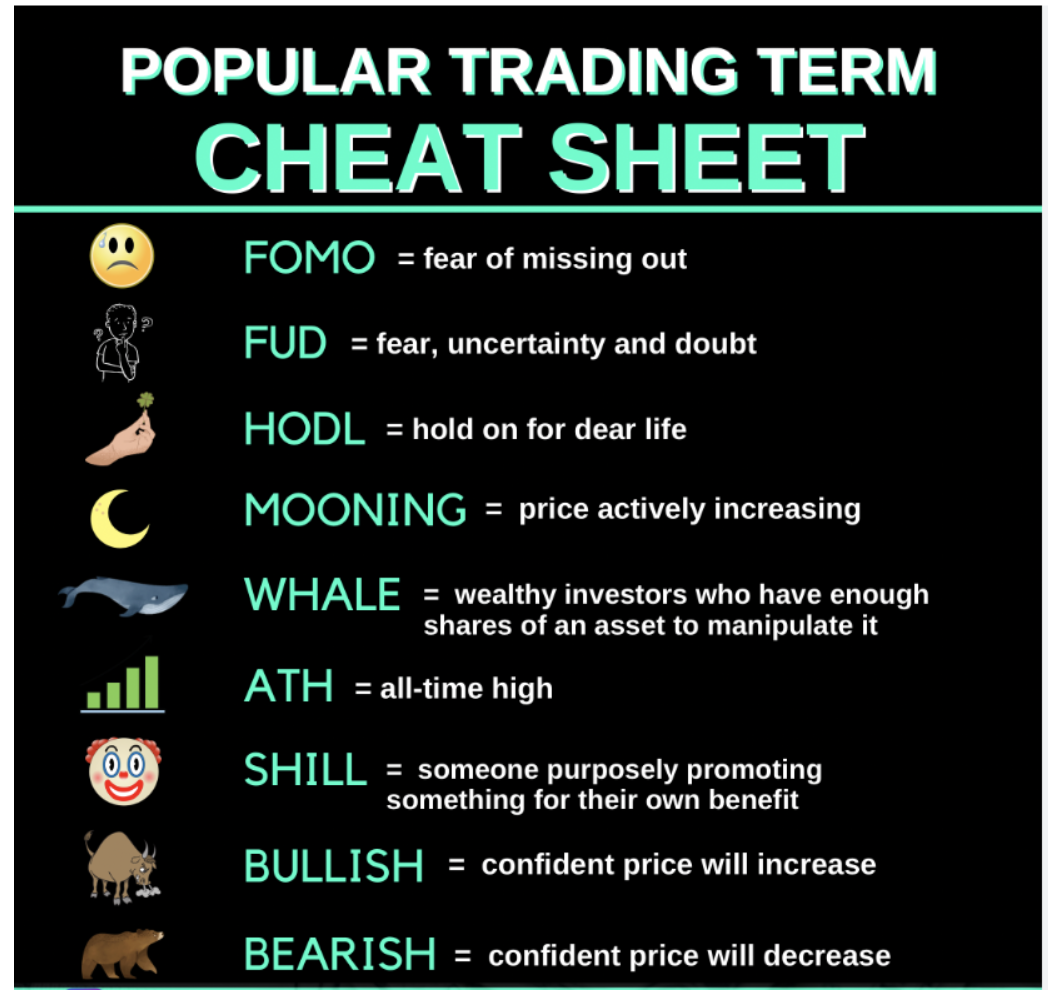

WHAT IS…?

SOMETHING TO THINK ABOUT

Cheers

Jacquie

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

September 18, 2024

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(HOW TO SPOT A MARKET TOP),

(SPY), (NFLX), (TSLA), (FB), (LEN), (TLT), (BAC)

Mad Hedge Biotech and Healthcare Letter

September 17, 2024

Fiat Lux

Featured Trade:

(A JAB WELL DONE OR A SHOT IN THE DARK)

(MRNA), (RHHBY), (NVS), (BMY)

Moderna (MRNA), the wunderkind of the COVID vaccine era, is facing a bit of a hangover. Remember when this biotech darling was riding high on vaccine sales? Well, those days are looking as distant as your last booster shot.

The company's stock had a decent first half, climbing about 20%. They even scored a win with their new RSV vaccine approval. But hold your horses, because things are getting a bit dicey.

Last month, Moderna had to revise its COVID vaccine revenue downward. Translation: people aren't lining up for jabs like they used to.

And just last week? They dropped another bombshell: Moderna's planning to slash its annual R&D spending by over $1 billion starting in 2027. On top of that, they're also pulling the plug on five programs.

But wait, there's more. Remember when Moderna was supposed to break even in 2026? Well, now they're saying it'll be 2028. That's like telling your date you'll be there in 5 minutes, then showing up two hours later.

Now, let's talk numbers. The consensus for 2025 sales was sitting pretty at $3.9 billion. Moderna's new projection? A potential downside of $2.5 billion, with a best-case scenario of $3.5 billion. As for 2024, they're looking at $3 to $3.5 billion.

And here's another head-scratcher: Despite 800,000 people over 65 in the U.S. being hospitalized last season, only 41% of this population has the COVID vaccine. Compare that to 74% with the flu vaccine. It looks like people trust the old-school flu shot more than the new kid on the block.

So, what's Moderna's game plan? They're focusing on delivering 10 products over the next three years. That's down from their previous bold claim of 15 new products in five years.

Here’s what CEO Stéphane Bancel has to say about this: "The size of our late-stage pipeline combined with the challenge of launching products means we must now focus on delivering these 10 products to patients, slow down the pace of new R&D investment, and build our commercial business."

In other words, they bit off more than they could chew and now they're trying to swallow.

Moderna's slashing its R&D investment for 2025 through 2028 by 20%, down to $16 billion. That's a $4 billion haircut.

But here's the twist - they're actually increasing investment in oncology, presumably to hopefully build a portfolio that could rival the likes of Roche (RHHBY), Novartis (NVS), and Bristol Myers Squibb (BMY).

Now, before you start thinking it's all doom and gloom, let's look at the silver lining.

Moderna expects its respiratory vaccines to be profitable this year and beyond. They're also aiming to file for approval of three new products by year-end: a next-gen COVID vaccine, a combo flu/COVID vaccine, and an RSV vaccine for younger high-risk adults.

Now, is Moderna a buy or a sell? Well, that really depends on your investment style.

Moderna's in a tight spot, but it's not game over. They're trimming the fat, focusing on what works, and betting big on oncology.

Plus, they actually have the cash to see this strategy through. So, they won't need to pass around the collection plate to reach their break-even goal. Their current situation is admittedly not pretty, but it's not a death spiral either.

For most of us, this is where the rubber meets the road. If you're up on Moderna, consider taking some profits, but don't bail completely. This could be a classic "buy the dip" opportunity for the bold.

Remembert, biotech is boom or bust, and Moderna's loaded pipeline needs just one hit to soar. Their combo vaccines could be game-changers if they pan out. And let's not forget, they cracked the mRNA code - that's not small potatoes in the world of drug development.

Bottom line: If you're risk-averse, look elsewhere. But for those with iron stomachs and long-term vision, this might be your chance to snag a potential biotech giant on sale.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

September 17, 2024

Fiat Lux

Featured Trade:

(CAMECO LEAPS),

(CCJ)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.