When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

September 12, 2024

Fiat Lux

Featured Trade:

(A SURPRISE UPPERCUT)

(MRK), (SMMT)

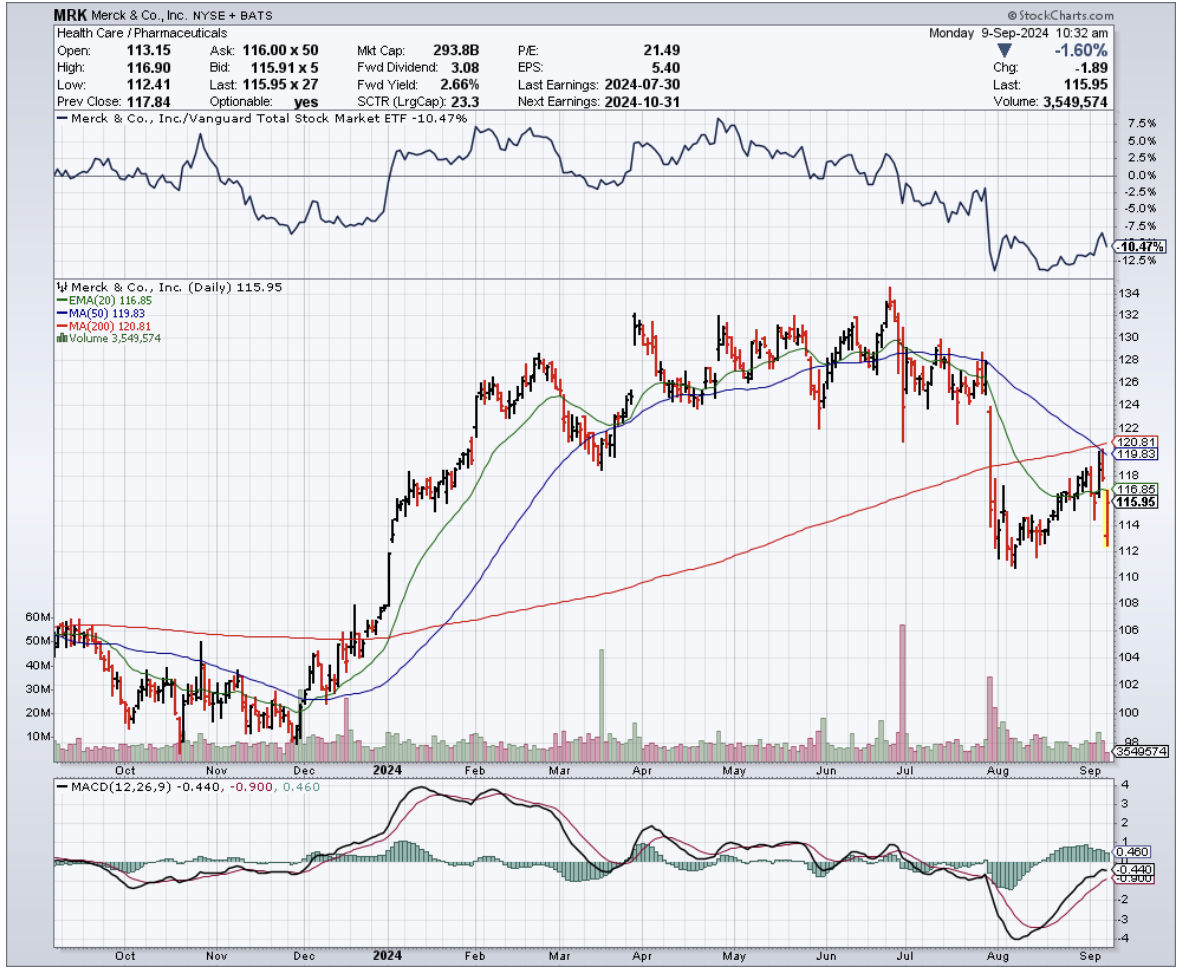

Remember when Muhammad Ali got knocked down by Joe Frazier? Well, Merck (MRK) just had its Ali moment, courtesy of a plucky little biotech named Summit Therapeutics (SMMT).

Ivonescimab, a cancer drug developed by this relatively under-the-radar biotech company, just gave Merck's golden goose, Keytruda, a serious run for its money—and not by a small margin.

In a recent announcement, Summit Therapeutics revealed that Ivonescimab reduced the risk of disease progression or death by a whopping 49% compared to Keytruda. Let that sink in for a moment

In the trial, aptly named HARMONi-2 (these folks love their capitalization), Ivonescimab held tumor progression at bay for a median of 11.1 months. Keytruda? A mere 5.8 months.

Needless to say, Summit just landed a haymaker that has Merck seeing stars.

Now, before you rush to dump your Merck stock faster than a hot potato, let's put this in perspective. The trial was conducted in China with Summit's collaboration partner, Akeso. It's a significant result, no doubt, but we're not talking FDA approval just yet.

Still, Wall Street took notice. Summit's stock shot up 61% in Monday's premarket while Merck's stock took a hit.

But here's where it gets interesting. Merck's been the undisputed heavyweight champ of pharma for years, with Keytruda as its championship belt. This wonder drug has been laying billion-dollar eggs for nearly a decade, and the nest keeps growing.

In 2022, the Keytruda market was valued at $20.8 billion, and by 2023, it raked in a staggering $25.01 billion.

With AbbVie’s (ABBV) Humira out of the running, projections for 2024 now peg Keytruda as the top-ranked drug worldwide, with sales expected to surpass $27 billion.

By 2032, it's expected to soar to $45.9 billion, with a compound annual growth rate (CAGR) of 9.20% from 2024 to 2032.

Just last quarter, Keytruda accounted for a whopping 45% of Merck’s $16.1 billion revenue—that’s $7.3 billion from a single drug. Talk about putting all your eggs in one basket.

And therein lies the rub. Keytruda's patent expires in 2028. That's not tomorrow, but in the pharma world, it's just around the corner.

It's like watching the countdown timer on a bomb in an action movie - you know it's coming, but you can't look away.

Merck's not blind to this. They've been diversifying as fast as they could.

Their next largest product, Gardasil, brought in $2.5 billion last quarter, growing at a modest 4%. Not Keytruda numbers, but nothing to sneeze at.

They're also betting big on new drugs. There's Winrevair, a treatment for pulmonary arterial hypertension that could bring in up to $11 billion by 2029.

Then there's Capvaxive, a pneumococcal vaccine that could hit $1 billion in sales by 2027. And let's not forget their $5.5 billion deal with Daiichi Sankyo for three antibody-drug conjugates.

So, what's the play here? Merck's trading at 15 times next year's earnings. That's like finding a designer suit at a thrift store price.

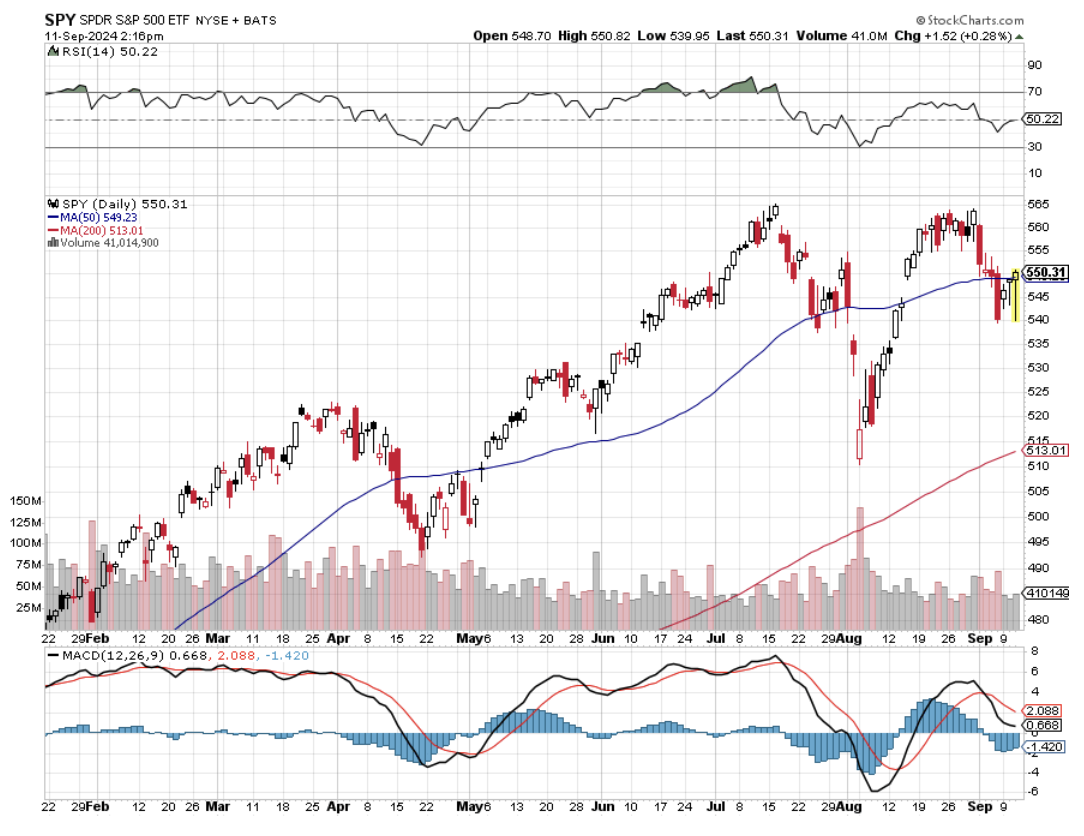

The stock's up 5.3% this year, lagging behind the S&P 500's 16% growth. Some might see a bargain, others a warning sign.

Here's my take: Merck's got challenges, no doubt. But they've also got a track record of success and a pipeline that could make a pharmacist drool.

If you've got the patience of Job and the stomach for biotech's wild rides, Merck could be a solid long-term play.

But don't take your eyes off Summit Therapeutics. They’ve just proved they can punch above their weight class.

Besides, in this high-stakes arena of biotech, where one breakthrough can knock the competition to the mat, it’s the unexpected contenders that often deliver the biggest surprises. So, keep your eyes on the ring—the next round promises to be a thriller.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

September 12, 2024

Fiat Lux

Featured Trade:

(The Mad SEPTEMBER traders & Investors Summit is ON!)

(THE 13 NEW TRADING RULES FOR 2025)

I’m sitting here at my Lake Tahoe lakefront mansion watching the Dow Average open down 700 points from its Friday intraday high.

It is one of those perfect picture postcard days, with a blue sky and cobalt lake. The fields outside are covered with snow crystals sparkling in the sunshine.

In these heart-stopping trading conditions, it is more important for me to teach you how to avoid doing the wrong thing than pursuing the right thing.

I am therefore going to introduce my 13 Rules for Trading in 2025. Tape them to the top of your computer monitor, commit them to memory, and maintain iron discipline.

They will save your wealth, if not your health. Here they are:

1) Dump all hubris, pretensions, and stubbornness. It will only cost you money.

2) The market is always right, even if all the prices appear wrong.

3) Only buy the pukeouts and sell the euphoria. Do anything in the middle, and you will get whipsawed.

4) Outright calls and puts are offering a far better risk/reward right now than vertical bull call and bear put spreads, which have a built-in short volatility element. It is also better to buy stocks and ETFs outright with a tight stop loss. This won’t last forever.

5) If you do trade spreads, you can no longer run them into expiration. If you have a nice profit, take it, don’t hang on to the last 30 basis points, even if it means paying more commission. The world could end three times, and then recover three times before the monthly expiration date rolls around.

6) Tighten up your stop loss limits. Not losing money is the key to winning in this market. There is nothing worse than having to dig yourself out of a hole. Don’t run hemorrhaging losses.

7) Buy every foreign crisis and sell every recovery. It really makes no difference to assets here in the US.

8) Several asset classes are becoming untradeable for long periods oil, and gas). Stay away and stick to the asset classes that are working (stocks and gold).

9) Keep positions small enough to sleep well at night. The doubled volatility will make up for your reduced risk. This is not the time to get greedy and bet the ranch.

10) Turn off the TV and just look at your screens and data. Public entertainers have no idea what the market is going to do, especially if their last job was sports reporting. Their job is to get you to watch the ads for General Motors and Interactive Brokers.

11) As the bull market in stocks enters its fifth year, too many traders, analysts, and strategists have become complacent. You are going to have to work for your crust of bread this year. This is an earnings, technology, and cash flow-driven bull, not a QE-driven momentum one.

12) It is clear that more money was allocated to high-frequency traders this year. That is driving the new, breakneck volatility, increasing stopouts. A sneeze now generates a 500-point intraday move.

13) It is no accident these tempestuous conditions are occurring in an election year. Some $10 billion will be spent on media convincing you how terrible this is. But over the long term, the stock market goes up 80% of the time.

Oh, and you better change your password from 12345 to DKFGGIDKFOKBJGELXPEVJBKDLKFBBJFCJCKVLBKGTY69!, and hope that the 69 doesn’t give you away. AI hackers are getting close.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Martin B26 Marauder

Artificial intelligence (AI) stands poised to revolutionize various aspects of our lives, promising unprecedented advancements in efficiency, productivity, and innovation. However, this technological leap also raises concerns about job displacement, societal disruption, and unforeseen consequences.

The Rise of the Machines: Jobs at Risk

One of the most pressing concerns surrounding AI is its potential to automate jobs currently performed by humans. As AI systems become increasingly sophisticated, they are capable of taking on tasks that were once considered the exclusive domain of human intelligence.

- The Blue-Collar Blues: Manufacturing and transportation sectors are already witnessing the impact of automation. Robots and AI-powered systems are replacing assembly line workers, truck drivers, and warehouse staff, leading to job losses and economic insecurity for many blue-collar workers.

- The White-Collar Worries: The white-collar workforce is not immune to AI's disruptive potential either. Data entry clerks, customer service representatives, and even financial analysts are facing the threat of automation. AI-powered chatbots, virtual assistants, and data analysis tools are increasingly capable of handling tasks that were once considered the purview of human employees.

- The Creative Conundrum:

Even creative professions are not entirely safe from AI's encroachment. AI-powered tools can now generate art, music, and even write articles and reports, albeit with varying degrees of success. While AI may not fully replace human creativity, it is certainly capable of assisting and even competing with human artists and writers.

The Silver Lining: AI's Potential to Enhance and Create

While the potential for job displacement is a legitimate concern, it's important to recognize that AI also has the potential to enhance and create new opportunities for humans.

- Augmenting Human Capabilities: AI can augment human capabilities, enabling us to achieve more than we could alone. AI-powered tools can assist doctors in diagnosing diseases, lawyers in conducting legal research, and engineers in designing complex systems. By taking on routine and repetitive tasks, AI can free up humans to focus on more creative and strategic work.

- Creating New Industries and Jobs: Just as the Industrial Revolution led to the creation of new industries and jobs, AI is likely to spawn new economic opportunities. The development, deployment, and maintenance of AI systems will require skilled professionals in fields such as data science, machine learning, and AI ethics.

- Improving Efficiency and Productivity: AI has the potential to significantly improve efficiency and productivity across various sectors. By automating tasks, optimizing processes, and providing real-time insights, AI can help businesses operate more efficiently and effectively. This can lead to increased economic growth and prosperity.

The Societal Impact: Beyond the Workplace

The impact of AI extends beyond the workplace, with potential implications for society as a whole.

- The Wealth Gap Widens: One concern is that AI could exacerbate existing inequalities, leading to a concentration of wealth and power in the hands of a few. As AI automates jobs and creates new opportunities, those with the skills and resources to adapt to the changing landscape are likely to benefit disproportionately. This could lead to a widening gap between the haves and the have-nots.

- The Privacy Predicament:

AI systems rely on vast amounts of data to function effectively. This raises concerns about privacy and data security. As AI becomes more integrated into our lives, there is a risk that our personal information could be collected, analyzed, and used in ways that we may not fully understand or consent to. - The Bias Backlash: AI systems are only as good as the data they are trained on. If the data is biased, the AI system is likely to perpetuate and even amplify those biases. This could lead to discriminatory outcomes in areas such as hiring, lending, and criminal justice.

- The Existential Enigma:

Some experts have raised concerns about the long-term implications of AI, particularly the possibility of creating superintelligent AI that could pose an existential threat to humanity. While this scenario remains largely speculative, it underscores the importance of developing AI responsibly and ethically.

Preparing for the Future: Navigating the AI Revolution

As we stand on the cusp of the AI revolution, it is imperative that we proactively address the challenges and opportunities that it presents.

- Education and Upskilling: Equipping individuals with the skills and knowledge to thrive in an AI-driven world is crucial. Education systems need to adapt to the changing landscape, focusing on STEM fields, critical thinking, and problem-solving skills. Lifelong learning and upskilling will become increasingly important as jobs evolve and new opportunities emerge.

- Ethical and Responsible AI Development: Ensuring that AI is developed and deployed ethically and responsibly is paramount. This includes addressing issues such as bias, transparency, and accountability. AI systems should be designed to serve humanity's best interests and avoid unintended consequences.

- Social Safety Nets and Income Redistribution: As AI disrupts the labor market, it is essential to have robust social safety nets in place to support those who are displaced. Universal basic income and other forms of income redistribution may become necessary to ensure that everyone benefits from the AI revolution.

- International Cooperation: The development and deployment of AI is a global issue that requires international cooperation. Governments, businesses, and civil society need to work together to establish ethical guidelines, regulatory frameworks, and best practices for AI development and use.

Conclusion: The Future is Now

The AI revolution is already upon us, and its impact on our lives is only set to grow in the coming years. While AI presents both opportunities and challenges, it is ultimately up to us to shape its trajectory and ensure that it serves humanity's best interests. By proactively addressing the potential downsides and harnessing the power of AI for good, we can create a future where AI enhances our lives and empowers us to achieve our full potential.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Technology Letter

September 11, 2024

Fiat Lux

Featured Trade:

(IS THE TRIFOLD SMARTPHONE A GENIUS IDEA?)

(HUAWEI), (APPL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.