If you've been following my adventures in the market jungle for any length of time, you know I've got a nose for opportunity that'd make a bloodhound jealous. Well, folks, that nose is twitching something fierce, and it's pointed straight at Johnson & Johnson (JNJ).

Now, I know what you're thinking: "John, J&J? Aren't they as exciting as watching paint dry?" Before you dismiss this company, let me tell you—this isn't your grandma's Band-Aid shop anymore.

First off, let's talk about their pharmaceutical arm. It's not just flexing; it's practically bench-pressing the competition with one hand tied behind its back. I'm talking about a lineup that includes immunology juggernauts like Stelara and Tremfya, and cancer-fighting dynamos such as Darzalex and Erleada.

But here's the kicker—they've got over 40 late-stage clinical trials cooking. That's no mere pipeline; it's a veritable gusher of potential blockbusters.

The surprises from J&J don't end there. They recently spun off their consumer health unit faster than you can say "No more tears." Why? To zero in on their real money-makers: pharmaceuticals and medical devices. It's like watching a prizefighter shed weight before a title bout—leaner, meaner, and ready to deliver a knockout punch to the market.

Speaking of punches, J&J has been on an acquisition spree that'd make a Silicon Valley startup blush. On October 9th, they snatched up V-Wave for a cool $1.7 billion, adding to their previous grabs of Abiomed ($16.6 billion in 2022) and Shockwave Medical ($13.1 billion in 2024). And if you think they're splurging just for the heck of it, think again. This triple play gives J&J a solid foothold in the $60 billion cardiovascular device market, which is growing at a heart-racing 8% annually.

So, what does V-Wave bring to a giant like J&J? It's not just another cog in the medical machine. V-Wave is developing innovative treatment options for heart failure patients. Their device has already snagged the FDA's breakthrough device designation in 2019 and Europe's CE mark in 2020. For J&J, this means they can hit the ground running, spreading V-Wave's Ventura Interatrial Shunt across the globe faster than you can say "cardiovascular revolution."

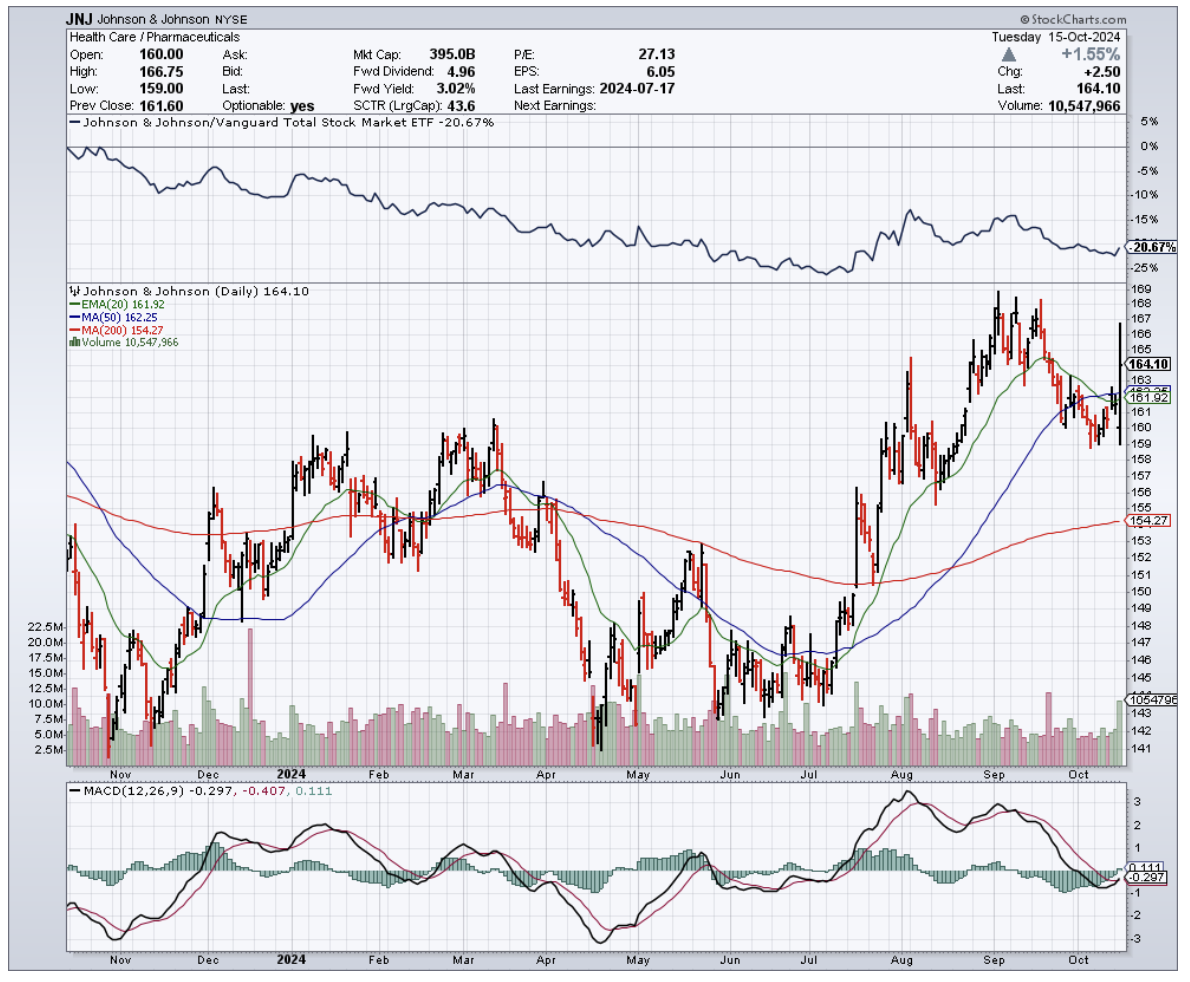

As for their Q3 results? Let's just say J&J didn't settle for merely meeting expectations—they exceeded them. We're looking at a 5.4% adjusted operational revenue growth, with their cardiovascular business shooting up 26.5% year-over-year.

Now, I'm no fortune teller—if I were, I'd be writing this from my private island—but I'd bet my favorite Bloomberg terminal that their cardiovascular business is going to keep pumping life into J&J's MedTech segment. With more folks lining up for cardiovascular procedures than a Black Friday sale, J&J is poised to ride this wave like a pro surfer at Pipeline.

Of course, it's not all sunshine and rainbows. Their China business is facing more headwinds than a kite in a hurricane, thanks to an anti-corruption campaign that's thrown a monkey wrench into their marketing machine.

But hey, this is J&J we're talking about—a company that's been around since Grover Cleveland was in the White House. They've seen tougher times than this and come out swinging.

So, what's the bottom line? I'm slapping a "Buy" rating on this stock, with a fair value of $195 per share. For those of you looking for a stock that combines the stability of a mountain with the growth potential of a tech startup, J&J might just be your golden ticket.

Now, if you'll excuse me, I've got a sudden urge to go check my own blood pressure after all this excitement.

P.S. If J&J ever decides to venture into stem cell therapy for aging knees, you can bet I'll be first in line. These well-worn joints have a few more mountains to climb!