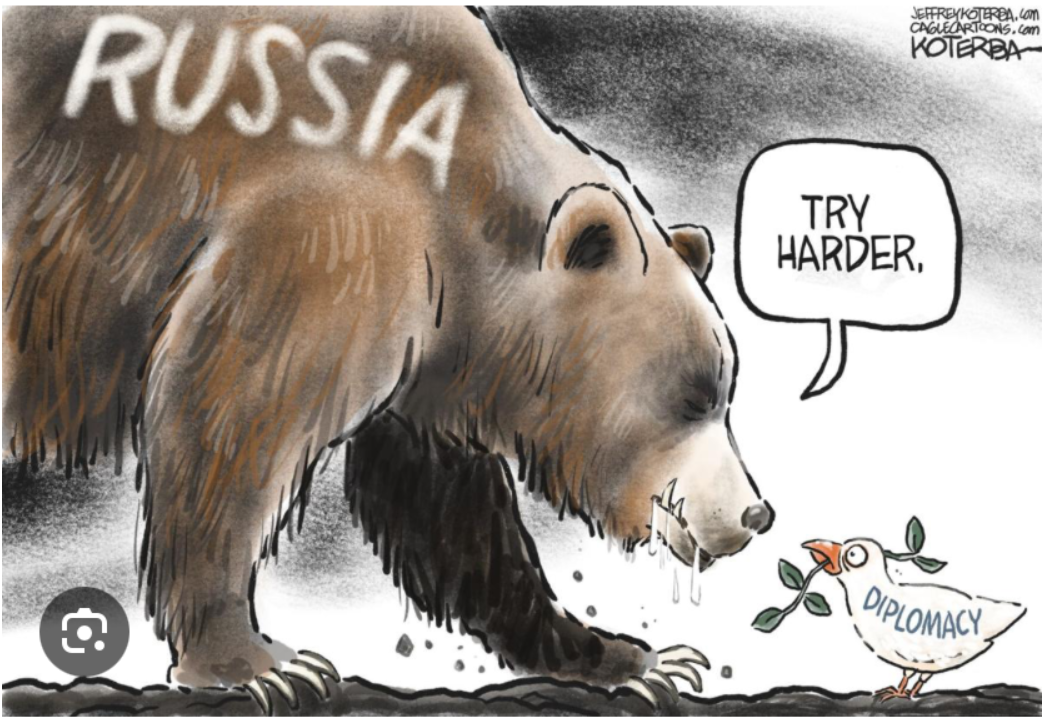

(TRUMP’S GAME OF CHESS WITH RUSSIA)

November 20, 2024

Hello everyone

Trump, the dealmaker, will have to use all his “box of tricks” and then some to secure an end to the conflict between Ukraine & Russia.

Let’s remember it was Trump’s boast that he would end the war in a day. We’re not there yet.

One thing is certain, and that is that President Zelensky will come under heavy pressure from the newly elected Trump administration to reach a settlement with Moscow.

But what if Zelensky feels backed into a corner? What will be his reaction?

For those of us who live far away from the conflict zone, we may think that the impact of this war will be minimal on our life. But, the outcome of the Ukraine conflict will have global consequences. Even Australia won’t be immune.

Let’s sit with this idea for a moment. A Putin win will encourage his expansionist impulses in Asia, as well as Europe, strengthen the axis of autocrats, devitalize the democracies, and promote a deals-based order where the strong do what they will, and the rest of us roll with the fall-out as best we can.

How Trump, the dealmaker, behaves and acts regarding this conflict will be telling, as his actions will illustrate America’s international policy in a Trump-revived world.

It is probable that Trump’s actions will be more robust than Biden’s. Biden provided enough weaponry to continue the war but not enough for the Ukrainians to fully exploit Russia’s weaknesses and gain the upper hand.

Biden’s 11th-hour concession allowing Ukraine to strike Russia with long-range US missiles may be too little, too late.

So, what does Trump’s peace plan look like?

Kyiv will likely have to give up territory in exchange for US security assurances and European financial support for post-war reconstruction. The current battle lines could become a border – a heavily fortified 1200km long demilitarised zone patrolled by a multinational peacekeeping force.

So, now Putin would be in control of 20 percent of Ukraine.

What a heavy price to pay for that territory!

600,000 Russian soldiers were killed.

And economically, the war has been a debacle.

Russia’s strategic position has been weakened by the self-inflicted enlargement of NATO to include Sweden and Finland along its northwestern border.

Without US military support, it is hard to see Ukraine winning this war with Russia. Zelensky may find himself in a position where he must accept Trump’s plan since Europe is not willing or even able to fill the gap. The EU couldn’t even provide the million 155mm artillery shells promised to Ukraine by March.

Getting Putin to agree might prove tricky for Trump.

Complicating the negotiations is the fact that North Korea’s “Storm Corps” are fighting on Russia’s side. Now, we can see how this conflict seems to be gradually changing into a Eurasia-wide struggle for geopolitical ascendancy.

In this war, North Koreans serve a good tactical and political purpose for Putin. They won’t change the course of the war. But their involvement may deepen a sense of isolation Ukrainians feel as the axis forces work together to crush their resistance. Europe’s support is softening, and under Trump, Americans are poised to bail out.

A bilateral defence pact signed in June between Russia and North Korea will see the hermit kingdom benefitting nicely.

$200m for its troops and the provision of missile and satellite technology, as well as

700,000 tonnes of rice to feed the half-starved population.

Should South Korea begin arming Ukraine, this could destabilize the relationship with North Korea and easily ignite an Asia-wide conflict. This would draw Australia into the war, as we have a historical commitment to the defense of South Korea.

How this plays out – nobody really knows.

It has become a game of chess.

But one thing has become clear – democracies will need to grow a backbone, show some brawn, and match the defense spending and singlemindedness of the autocrats. They play to win at all costs. We need to up the ante and check them before they check mate us.

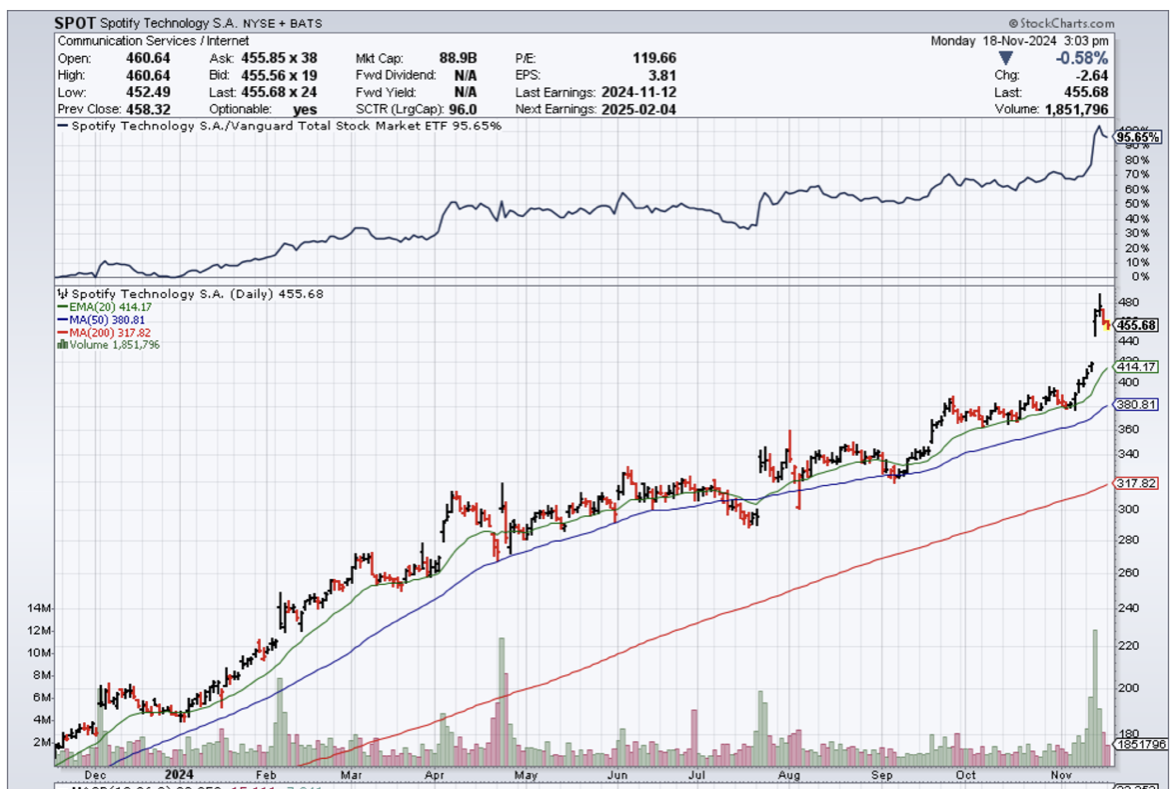

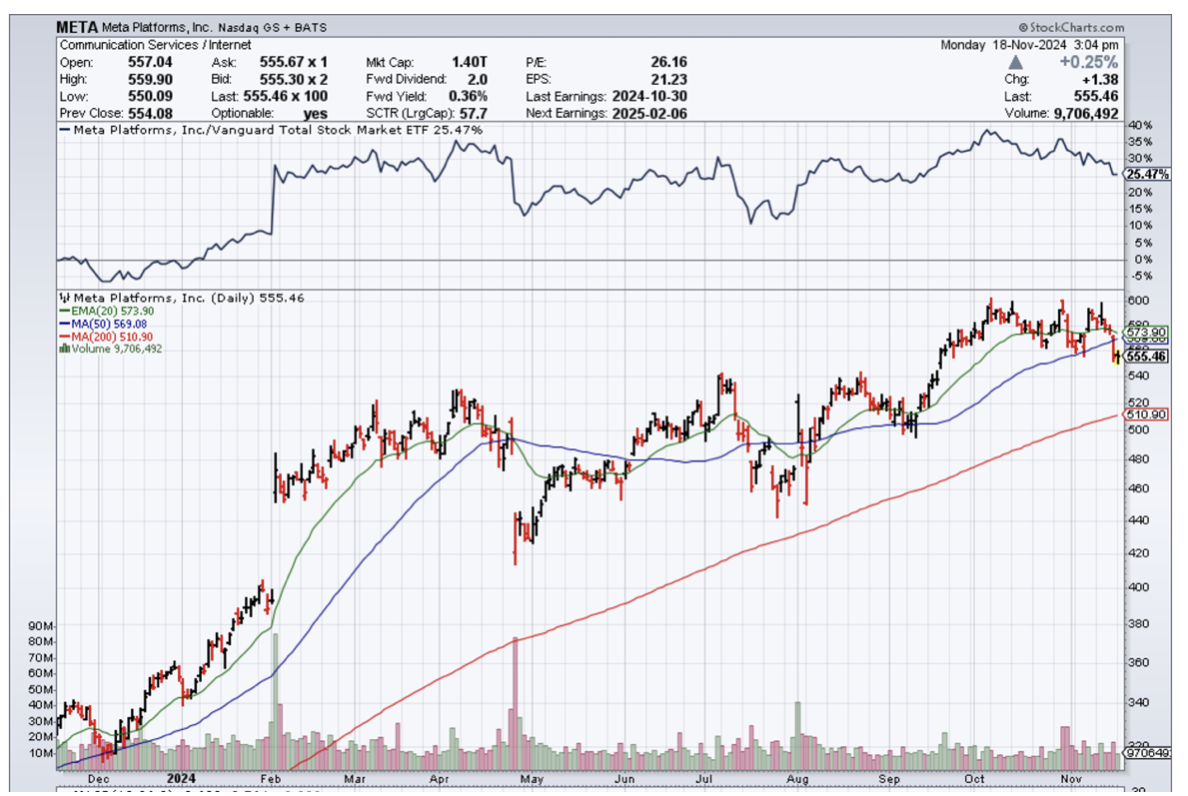

PORTFOLIO REVIEW

I would think about taking some profits from your gold stocks. Most of you will be sitting on healthy profits – take some off the table.

(GDX), (AGQ), (WPM), (GOLD), (SLV)

QI CORNER

SOMETHING TO THINK ABOUT

Cheers

Jacquie