When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Mad Hedge Biotech and Healthcare Letter

December 17, 2024

Fiat Lux

Featured Trade:

(THE BIG BATCH THEORY)

(CTLT), (DHR), (RGEN), (AVTR), (NVO), (PFE), (LLY), (MRK)

If I had a nickel for every time someone said pharmaceutical manufacturing was boring, I could’ve started bidding against Novo Holdings for Catalent (CTLT) myself.

Sure, I’d still be $16.5 billion short, but you get the point—this deal is huge, and it’s about to make some smart money look even smarter.

Here’s the deal: Novo Holdings is shelling out $16.5 billion to snap up Catalent, a contract development and manufacturing organization (CDMO).

If that acronym sounds like alphabet soup, let me translate: CDMOs are where the real action happens.

These are the guys behind the curtain making sure your miracle drugs and life-saving treatments aren’t just ideas—they’re products hitting the market at scale.

The numbers don’t lie. The CDMO market sits at $146 billion right now.

Fast-forward to next year, and that balloons to $243.3 billion. By 2029, it’s cruising toward a cool $332 billion.

And if you think that’s impressive, just wait: the broader pharmaceutical outsourcing trend is nowhere near slowing down.

In 2014, Big Pharma still clung to in-house production for 66.3% of its output.

Today? That figure’s down to 51%, and dropping fast. Why? Because outsourcing lets the specialists handle the hard stuff—faster, cheaper, and more efficiently.

For investors, Catalent’s immediate upside is a no-brainer. The acquisition premium is pure gravy, but that’s not the whole story.

Rivals like Lonza Group (SWX: LONN) and Samsung Biologics are already feeling the heat.

The biologics CDMO market alone is expected to expand by $10.63 billion between 2024 and 2028, and you better believe those two are scrambling to stay ahead.

If you own shares, keep your seatbelt fastened. If you don’t, well… you might want to rethink that.

And here’s where it gets really interesting: Novo Holdings may be private, but its publicly traded golden child, Novo Nordisk (NVO), is set to ride this wave like a pro surfer.

They’re already a global powerhouse in biologics, and Catalent’s souped-up manufacturing capabilities are going to help them scale production with military-grade efficiency.

Lower costs, tighter operations, bigger margins—it’s like handing a Formula 1 car to an already championship-winning team.

So if you’re not watching Novo Nordisk stock, you’re doing it wrong.

Of course, it’s not just the big CDMO players who stand to win here. Companies like Danaher (DHR), Repligen (RGEN), and Avantor (AVTR) are quietly cashing in on this gold rush.

These firms supply the picks, shovels, and critical bioprocessing tools that CDMOs need to keep production humming.

As Catalent scales under Novo Holdings, demand for these essentials will go through the roof.

Zooming out, the pharma manufacturing landscape is evolving at a breakneck pace.

The CDMO market is expected to hit $530.3 billion by 2033, growing at a steady 7.7% CAGR.

That’s not speculative growth—it’s a structural shift, backed by demand for biologics, gene therapies, and personalized medicine.

In short, we’re entering an era where outsourcing is king, and companies with the infrastructure to capitalize on it are poised to dominate.

Don’t forget about the big dogs in Big Pharma, either.

Pfizer (PFE), Eli Lilly (LLY), and Merck (MRK) aren’t just spectators in this game. They’re snapping up CDMO capacity, investing in biologics, and doubling down on therapies with blockbuster potential.

The Catalent deal is just the latest chess move in a game where the stakes keep getting higher.

So what does this mean for you? If you’re holding Catalent, congratulations—your portfolio is about to get a nice bump.

But the real play here isn’t Catalent alone. It’s understanding that CDMOs, suppliers, and adjacent players are the unsung heroes of this industry transformation.

You want exposure to the companies enabling the next wave of medical innovation? This is where you look.

Novo Holdings just threw down the gauntlet, and the smart money is already moving. The pharmaceutical manufacturing sector isn’t boring—it’s booming.

So, while everyone’s chasing flashy biotech startups and blockbuster drugs, the real smart money is quietly following the companies that make those breakthroughs possible.

Catalent isn’t just a $16.5 billion deal—it’s proof that outsourcing is the new backbone of pharma’s future. Call it “The Big Batch Theory:” scale up, outsource smart, and watch the returns multiply.

Ignore this shift, and you’re leaving money on the table.

Now, if you’ll excuse me, I need to check my CDMO positions. Just like a perfectly run batch, they’re growing fast—and that’s exactly how I like it."

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

December 17, 2024

Fiat Lux

Featured Trade:

(I’M TAKING OFF FOR THE YEAR)

By the time you read this, I will be 200 miles off the west coast of Mexico on the Coral Princess. I’ll be occupying the spacious owner's suite and packing all three of my tuxes (and all my black socks) just to make sure I am never underdressed.

You see, I need a vacation.

I have been working nonstop for decades and desperately need a break. It seems that the older I get, the more I know the more in demand I become. Why quit taking tests when I already know all the answers?

You can tear up your Rolodex card for me, unfriend me on Facebook, designate my email address as SPAM, and block my Twitter account. It won’t do you any good.

If I don’t take some time off, I am going to start raving MAD!

Over the last 17 years, I have worked the hardest in my entire life. And the last year, I have had to work with a bullet wound in my hip courtesy of the Russian Army in Ukraine. Whenever I have free time, I go fight a war. That’s who you want calling your trades.

This year, I have brought in a total return of +75.25%, versus +27% for the S&P 500, far and away among the best of my life and almost certainly yours as well. If you got half of my performance, you beat virtually everyone else in the industry, even the best hedge funds. In other words, I underpromised and over delivered….in spades. That is my way.

If you wonder why I do this, it’s really very simple. Read my inbox, and you would burst into tears.

Every day, I learn tales of mortgages paid off, student loans dealt with, college educations financed, and early retirements launched. I am improving lives by the thousands. That’s far better than any hedge fund bonus could offer me, although I wouldn’t mind owning the Golden State Warriors.

At this late stage in my life, the most valuable thing is to be needed and listened to. If that means becoming a cult leader, that’s fine with me. After all, the last guy to try this route got crucified.

When horrific uncontrollable wildfires broke out in California, I flew volunteer spotter planes for Cal Fire, holding the stick with one hand and a pair of binoculars with the other, looking for trouble and radioing in coordinates, and directing aerial tankers. Nobody can fly wildfires like I can.

I lost access to my Lake Tahoe house when the big fire hit right in the middle of a remodel. All the contractors disappeared, chasing much higher-paying insurance work. At least we now have a 20-mile-wide fire break to the southwest of the house.

I have high hopes for next summer, starting with my seminar at sea across the Atlantic in June, then a trip on the Orient Express to Venice, another Matterhorn climb in July, client visits in Europe for August, flying Spitfires in England in September, and hiking the 170 mile Tahoe Rim Trail in October.

On top of all this, I was on speed dial at the Joint Chiefs and the US Marine Corps. A major? Really? And now I’m a major in two armies, the US and Ukraine. Seems you’re not the only one in desperate need of global macro advice.

So, I will spend the next 16 days reading the deep research, speaking with old hedge fund buddies, the few still left alive, and trying to come up with a game plan for 2025. One thing is certain: we will likely make a lot more money next year, the setup is so clear. Market volatility is about to go through the roof.

Instead of sending out urgent trade alerts, emergency news flashes, and more research than you can read, I’ll be playing Monopoly and Risk, practicing my banjo, and catching up on some classic films.

I already have one trade-on: I’ll watch Elf for the millionth time if the kids watch Gary Cooper’s 1949 Task Force, the history of Naval Aviation (semper fi).

In the meantime, I’ll be running some of my favorite research pieces from the past over the next two weeks. Hot Tips will include the same.

So, everyone, please have some great holidays, spend your monster Tesla profits well, and get well rested.

We have some serious work to do in 2025.

Merry Christmas and Happy New Year,

John Thomas

CEO and Publisher

The Diary of a Mad Hedge Fund Trader

Selling Christmas Trees for the Boy Scouts

(AMD), (NVDA), (GOOG), (MSFT), (META), (AMZN)

I was at MIT last month, watching a tiny roundworm wiggle around in a petri dish, when one of the researchers dropped a bombshell: "This creature," he said, pointing to something smaller than a period, "just helped us raise $250 million from AMD."

Welcome to the strange world of Liquid AI, where a worm with 302 neurons is teaching Silicon Valley how to build better artificial brains.

And by better, I mean cheaper, faster, and far more efficient.

Here's why I’m thrilled about this discovery: the AI industry has a dirty little secret. These massive language models everyone's obsessing over? They're burning through cash faster than a Tesla (TSLA) on ludicrous mode.

GPT-4 reportedly cost over $100 million just to train. The electricity bill alone would make your eyes water.

But Liquid AI has found a different path. By studying how that little worm processes information, they've created neural networks that slash computing costs by 90% while matching the performance of the big boys.

No wonder AMD (AMD) just wrote them a check that pushed their valuation north of $2 billion.

For AMD, this isn't just another tech bet. They're gunning for Nvidia (NVDA), who currently owns 80% of the AI chip market.

Last week, I spoke with some engineers at AMD who couldn't stop grinning about their new processors. They're talking about 5-10x better performance per watt compared to current GPUs.

With Nvidia reporting $18.1 billion in data center revenue for Q4 2023, you can see why AMD is excited.

The timing couldn't be perfect. Companies are getting tired of building massive GPU farms that consume enough power to light up Las Vegas.

Google's (GOOG) DeepMind is sweating bullets. Microsoft (MSFT) is scrambling to get this technology into Azure.

Intel (INTC) is still trying to figure out which end is up. And Meta (META)? They're too busy building digital playgrounds to notice.

Even Amazon's (AMZN) AWS, which powers about 40% of the world's large language models, sees the writing on the wall.

They've already poured $100 million into AI optimization research. When Amazon starts writing checks that big, you know something's coming.

Just yesterday, a hedge fund manager friend called me and asked if I'd lost my mind getting excited about a worm-inspired AI company.

I reminded him that in 2002, Sydney Brenner won the Nobel Prize for mapping that same worm's nervous system.

Back then, nobody imagined this research would spawn a multi-billion dollar AI company. But that's how innovation works - the biggest breakthroughs often come from the smallest places.

For those looking into the AI sector, the signals are clear. While Liquid AI remains private, keep your eyes on AMD, Microsoft, and Amazon.

They're positioning themselves for the next big shift in AI. When the efficiency revolution hits quarterly earnings reports, you'll want to be ahead of the curve.

What fascinates me most isn't just the technology - it's the irony. In an industry obsessed with building bigger, more powerful systems, the solution to AI's biggest problems might come from studying one of the simplest nervous systems in nature.

And I know the tech bears keep telling us AI valuations are too high, the bubble's about to pop, head for the hills. But they're missing the point.

The rules have changed. This is not just about building bigger AI anymore - it's about building smarter AI. And sometimes, as our tiny worm friend shows us, smarter means smaller.

Just don't tell that to Nvidia yet. Let them figure it out when their next power bill arrives.

Mad Hedge Technology Letter

December 16, 2024

Fiat Lux

Featured Trade:

(OVERCOMING UNCERTAINTY IN 2025)

($COMPQ), (SOFTBANK)

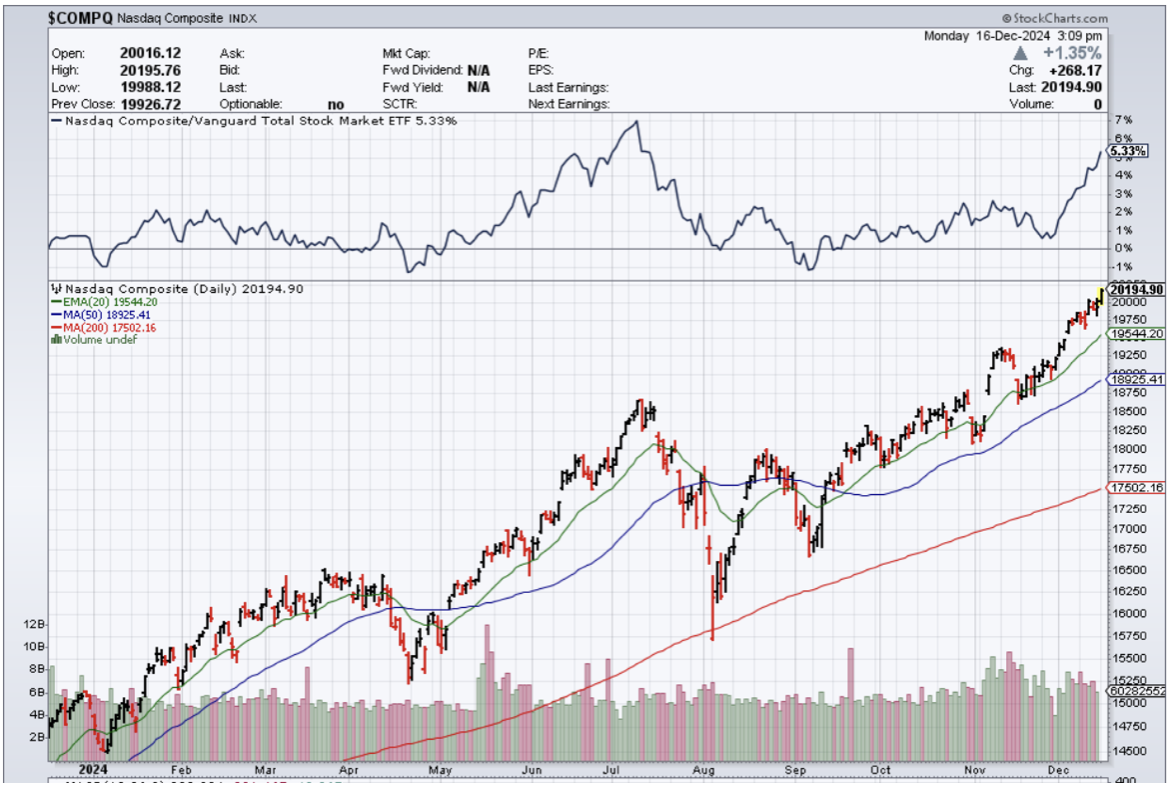

There have been many prognosticators concerned that next year is trouble for tech stocks, but I am here to dispel that notion.

The uncertainty has permeated into global investment fund management with some even calling for a mild pullback in tech valuations ($COMPQ).

Concerns are concerns and that doesn’t mean we will get a wild selloff or a crash.

There are still too many drivers that tech can pull to bail itself out of any hole they or others might dig for them.

I do agree with the notion that the era of super growth for the current tech business model is over and we are really trying hard to eke over the bar every quarter now.

One trend that could go into overdrive next year is the acceleration of AI investment from funds waiting on the sidelines.

I’ve mentioned to people off the record the staggering amount of capital that has poured into the US after the election.

The surprising part of this is that a meaningful amount of these funds are foreign.

Remember that in places like China and Europe, economics are going in the wrong direction and investment funds have nowhere to place their capital.

Europe has overregulated itself to death more interested in protecting the old money and destroying anything closely relating a start-up.

I argue to clients that Europe is the last place on earth I would ever start a tech company.

China has reached the end of its current growth phase and now has a system that won’t change just to protect the incumbents.

Inherently, Chinese tech could turn into the next Japan.

The end results are a terrible foreign tech scene in most places not named the United States.

Japan, for a matter of fact, has produced people like Softbank CEO Masayoshi Son who try to scrape as many billions together to throw into US tech.

Part of the foreign capital I talk about comes from him, but also other massive funds such as Norway’s sovereign fund valued at over $2 trillion now.

More than 40% of that portfolio is in US tech stocks giving them ammunition for an even bigger step up next year.

President-elect Donald Trump, with SoftBank Group CEO Masayoshi Son at his side, announced that SoftBank would invest $100 billion in the U.S. over the next four years in what would be a boost to the U.S. economy.

Trump said in his joint appearance with Son that the investment would create 100,000 jobs focused on artificial intelligence (AI) and related infrastructure, with the money to be deployed before the end of Trump's term.

Son has been a strong proponent of the potential for AI and has been pushing to expand SoftBank's exposure to the sector, taking a stake in OpenAI and acquiring chip startup Graphcore.

The uncertainty is warranted, because we will replace a U.S. administration with a vastly different view of the economy and tech scene.

I do believe we missed a bullet. If Harris won, she would of choked off the vitality of Silicon Valley and placed power and control in the hands of a few.

I say that even though tech stocks performed greatly the past 4 years.

I don’t believe that tech stocks are about to lose steam and the case for the new administration turbo charging the economy is definitely realistic.

Trump wants to cut U.S. corporate tax to 15% and that 6% drop for U.S. tech firm would represent a gargantuan windfall to the bottom line.

If Silicon Valley is the beneficiary pro-corporate legislation, the sky is the limit for tech stocks next year even if they don’t create anything game changing.

Playing with house money is fun and we could be in a situation next year where U.S. tech firms can shoot for the stars.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.