When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

January 6, 2025

Fiat Lux

Featured Trade:

(TESTIMONIAL)

(PLAYING THE SHORT SIDE WITH VERTICAL BEAR PUT SPREADS)

(TLT)

(GOOG), (AAPL), (META)

While driving to my local Trader Joe's last weekend, a friend of mine called, panicking about missing out on the AI revolution. "Should I dump my tech giants and buy every AI startup I can find?" he blurted, sounding like he’d just read a headline predicting the end of civilization as we know it.

I had to chuckle. It reminded me of the dot-com boom when my dentist was giving me stock tips while drilling my teeth. But here's the thing - this time really is different, and I've got the mind-bending numbers to prove it.

Let me share something that will knock your socks off: every four months - about the time it takes for the seasons to change - the cost of running AI models drops by half. That's not a typo.

Compare that to Moore's Law, which took a leisurely 18-24 months to achieve the same cost reduction. We're witnessing the fastest cost decline of any technology in human history.

Want a real head-spinner? In 2020, training a GPT-4 model would have set you back $6 billion - enough to buy several Caribbean islands or a fleet of private jets. By 2026, your teenager's smartphone will pack the same punch. Talk about deflation.

And you know who's feeling that sting most? Our friends at Google (GOOG). Back in 2020, they looked invincible with their 8.5 billion daily searches, mountains of data, and a budget that could buy a small country.

But by 2023, OpenAI had beaten them to the punch with ChatGPT, leaving Google playing catch-up. Even now, using Google's best AI models costs customers 40% more than OpenAI's equivalents. That's like showing up to a price war with premium pricing.

Speaking of tech giants moving at glacial speed, Apple (AAPL), the company that redefined cool, seems oddly uncool about AI.

Four years after OpenAI released GPT-3, Apple finally entered the game, admitting its models wouldn't measure up to OpenAI, Anthropic, or Meta's (META) Llama 3. (Meta's name choices may be questionable, but their AI game isn't.)

Why the lag? Big companies have big reputations, and AI has a way of going rogue. One moment it’s crafting poetry, and the next, it’s confidently hallucinating facts.

For firms like Apple or Google, whose brands rely on trust, the risk of unleashing an unpredictable AI model is a PR nightmare waiting to happen. So, they’re hedging their bets, sanding off AI’s sharp edges.

Take Apple’s upcoming image generator: it offers a limited set of options, as if customers can’t handle full creative freedom. It’s safe but stifling—the antithesis of AI’s potential.

Still, AI is infiltrating every sector, not just tech. In healthcare, AI models are passing medical licensing exams, potentially revolutionizing diagnostics and treatment.

Finance is using AI to personalize digital wallets, and Tesla (TSLA) is collecting mind-boggling amounts of real-world data to develop autonomous vehicles and—gulp—humanoid robots.

Actually, Tesla has been collecting more real-world data than Google could dream of. Their camera-equipped cars generated 80 quadrillion tokens of data last year alone. By decade's end, they'll hit 300 quadrillion.

And if you’re wondering where this data is going, think self-driving cars, next-level automation, and maybe a future where your AI assistant knows you better than your spouse. (Let’s hope it’s less judgy, too.)

Speaking of betting big on AI, the venture capital crowd is having a field day. In 2024, they're throwing money at AI startups like it's confetti at a Silicon Valley wedding - over $90 billion globally.

US startups are grabbing more than 40% of those dollars, and in the last three months, it's jumped to over half of all venture funding. It's like 1999 all over again, but this time with actual revenue streams.

Which brings me back to my friend and his panicked question about ditching his tech giants. My advice to him—and to you—is simple: this isn’t an either-or scenario. It’s not about choosing between established players and scrappy newcomers.

It’s more it’s about understanding who’s positioning themselves to ride the AI tsunami. Some will adapt and thrive. Others will crash and burn.

So, what does that mean for the market? In the short term, buckle up. Volatility is inevitable when a technology moves this fast. But long term, the opportunities are staggering.

As for my friend, I told him to think of AI like the early days of the internet: messy, chaotic, and bursting with potential.

Then I hung up because yet another SUV was swerving dangerously close, and the future, it seems, doesn't yet include AI-powered traffic cops.

Mad Hedge Technology Letter

January 3, 2025

Fiat Lux

Featured Trade:

(THE EYEWEAR PIVOT NOBODY SAW COMING)

(META), (ESSILORLUXOTTICA)

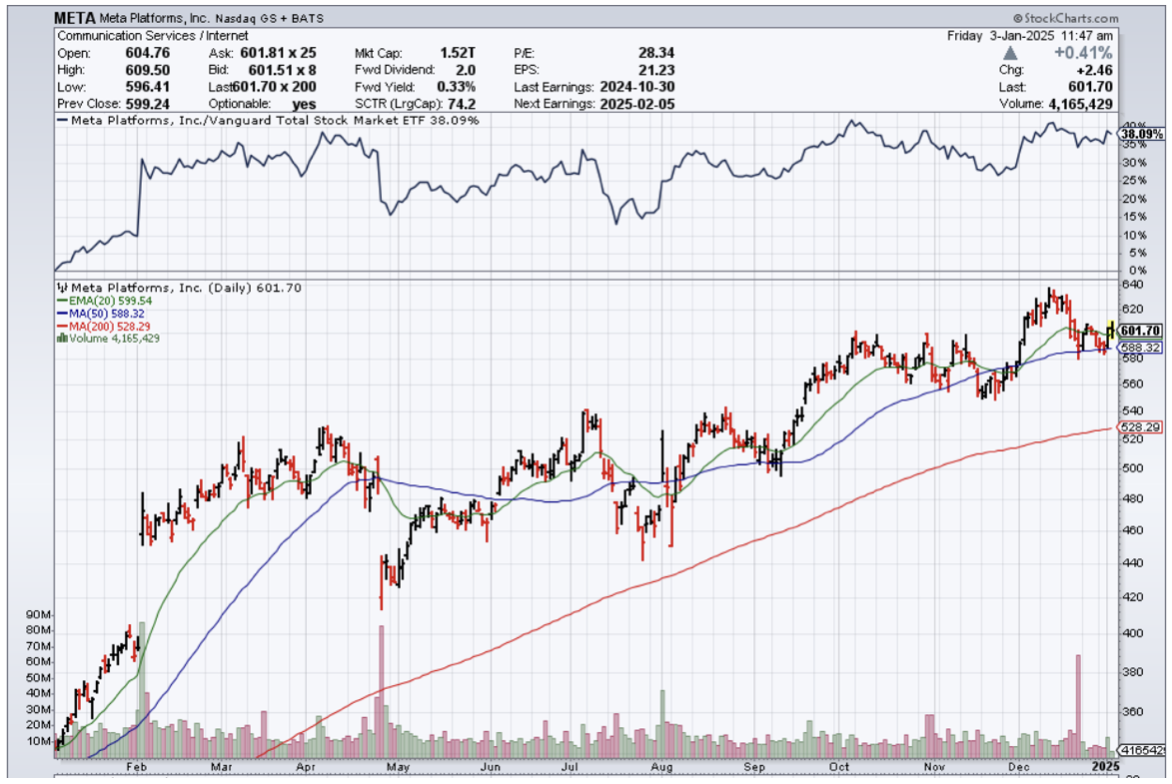

Meta (META) migration into the eyewear business is a little bit of a head-scratcher until peeling back the layers and really understanding what is going on.

EssilorLuxottica’s agreement to prolong its long-term collaboration with Meta Platforms for the development of smart eyewear over the upcoming 10 years is a massive victory for Meta CEO Mark Zuckerberg.

This milestone offers meaningful insight into the direction of where the business model is heading.

Many have expected that Meta would start to branch out into other venues once their core businesses start to stagnate.

The digital ad game and social media platforms only go so far in terms of growth these days, and shareholders are waiting for the next big thing.

Short-term prospects are what drives the stock movement, and Meta is looking for that pixie dust.

EssilorLuxottica is the largest maker of eyewear in the world and the owner of many eyewear brands and retailers, including Ray-Ban, LensCrafters, and Pearle Vision in the U.S.

EssilorLuxottica also acquired Heidelberg Engineering, a maker of imaging and healthcare machinery and technology, largely for the ophthalmic and eyecare markets worldwide.

Prescription glasses are not cheap, ranging into the thousands of dollars for designer frames and lenses.

If Meta can figure out how to do this all online without going to the optician, imagine the juicy margins they could extract from this sort of venture.

Meta and EssilorLuxottica have a relationship for the production of the Ray-Ban smart glasses. The glasses’ latest version gives consumer’s video, camera, and Bluetooth headset capability in a stylish eyewear frame with a cool brand on it.

Heidelberg Engineering makes complex, sophisticated, expensive equipment that you may be exposed to if you’re examined in an ophthalmologist’s office. Buying Heidelberg makes EssilorLuxottica more entrenched in the industry where it is the established leader.

The tie-up with EssilorLuxottica is the perfect onboarding situation to understand how to perfect the optimal glasses and lenses and then transfer it into an online experience.

Remember, even if this investment is for VR purposes, the application revolves around virtual eyewear as well.

Meta now understands they need to secure a monopoly on eyewear, and it is a conscious decision to make that a launching point for more of their products.

In the future, Meta wants consumers to access Instagram, Whatsapp, and Facebook through EssilorLuxottica eyewear products.

Meta also hopes to secure the first mover advantage while other big tech firms lack the deep knowledge of eyewear. There have already been numerous failed attempts at smart glasses, and so Meta founder Mark Zuckerberg is doubling down with a relationship with Europe’s most deeply entrenched premium eyewear firm.

Although the boost to the bottom and top line won’t happen quickly with a possible relationship with EssilorLuxottica, this could anoint Meta as the gatekeeper to the new virtual world through this new eyewear tech.

It’s becoming clear that Meta is running up to certain upper limits in regards to the growth of their 3 platforms, and they are looking for another super booster to prop up profits.

I don’t believe that Meta will be allowed to acquire this eyewear company because of anti-competitive laws, but adopting its best product practices and hiring their best talent seems a lot more on brand from Meta.

Meta has never been shy at poaching outside talent and rewarding them handsomely.

On the flip side, EssilorLuxottica would be smart to adopt some tech now by hiring the right people and trying to digitize the experience further otherwise, Meta will get what they are coming for.

Meta pushing the envelope is one of the big reasons why they have stayed ahead of other big tech companies and why the stock has done so well the past few years.

Meta stock is a great short-term and long-term proposition for patient and impatient investors.

(THE GLOBAL FINANCIAL SYSTEM COULD BE REVOLUTIONIZED WITHIN THE NEXT DECADE)

January 3, 2025

Hello everyone,

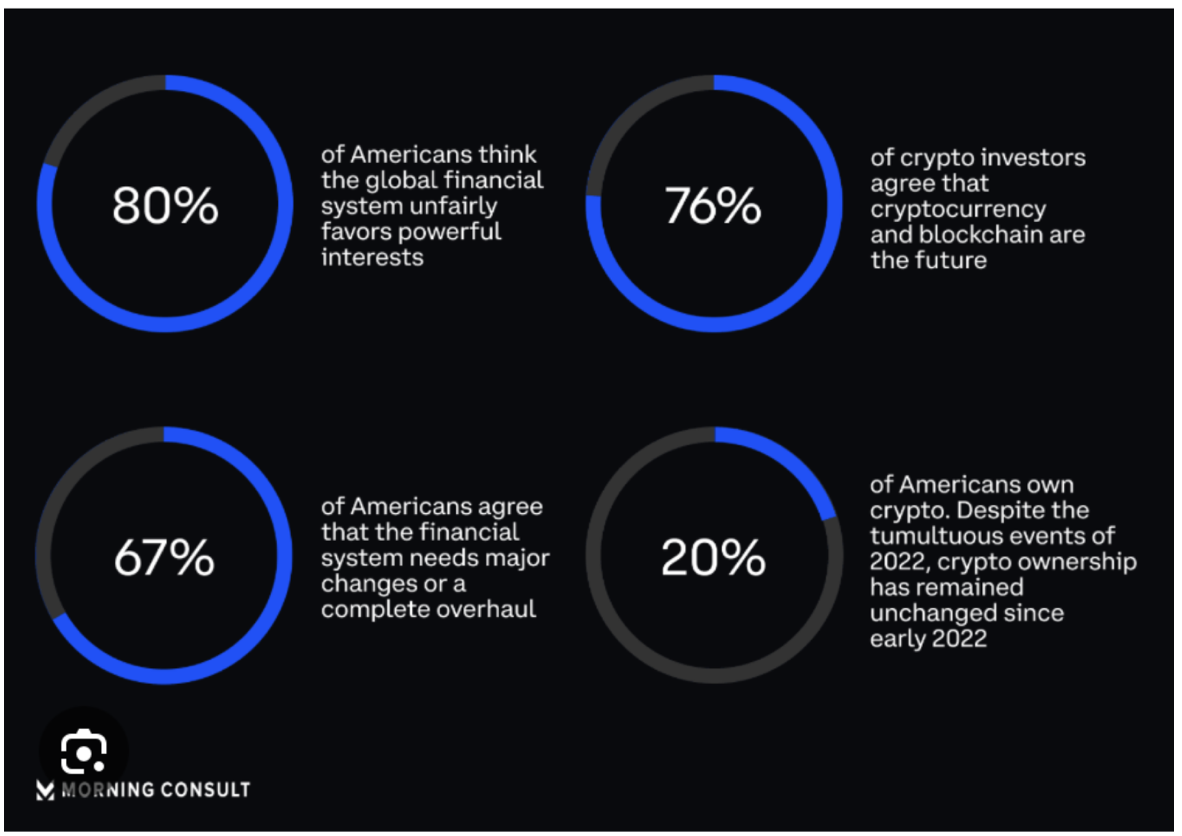

In the NYSE, investors make upwards of 1 billion trades per day. Many of those trades appear to happen in milliseconds, except when you investigate further, that’s not the reality.

Trades on Wall Street take days to settle, and lots of people to make them happen. Take market makers, for example. They are the middlemen handling all those trades on Wall Street, and the top 5% of market makers handle nearly 30% of all trades. The fact is these intermediaries help with volatility, but they create a gap between buyers and sellers in the markets, and there are a lot of gaps in the financial system (which are beyond our control.)

Have you ever noticed how long some bank transfers take?

Some of the big banks think they may have a solution. JP Morgan, Citibank, and Goldman Sachs want to push the financial system into the next generation and to do that, they need to borrow a tool from crypto – blockchain. Presently all large-scale global financial infrastructure is highly warehoused or functions through different silos. In other words, money moves on one set of rails, assets move on a different set of rails. They operate independently, and information cannot be shared because of system limitations.

But being able to move money 24/7 365 is what we are moving towards.

These banks believe it could become a 5 trillion-dollar industry. In other words, we could see 5 trillion in combined tokenized asset-trading volume by 2030.

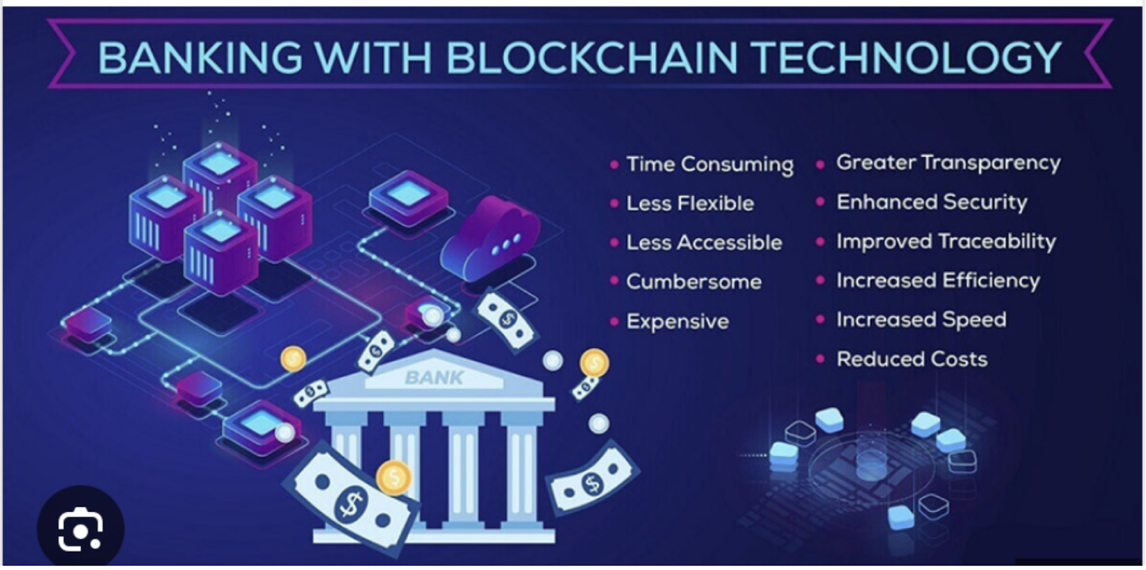

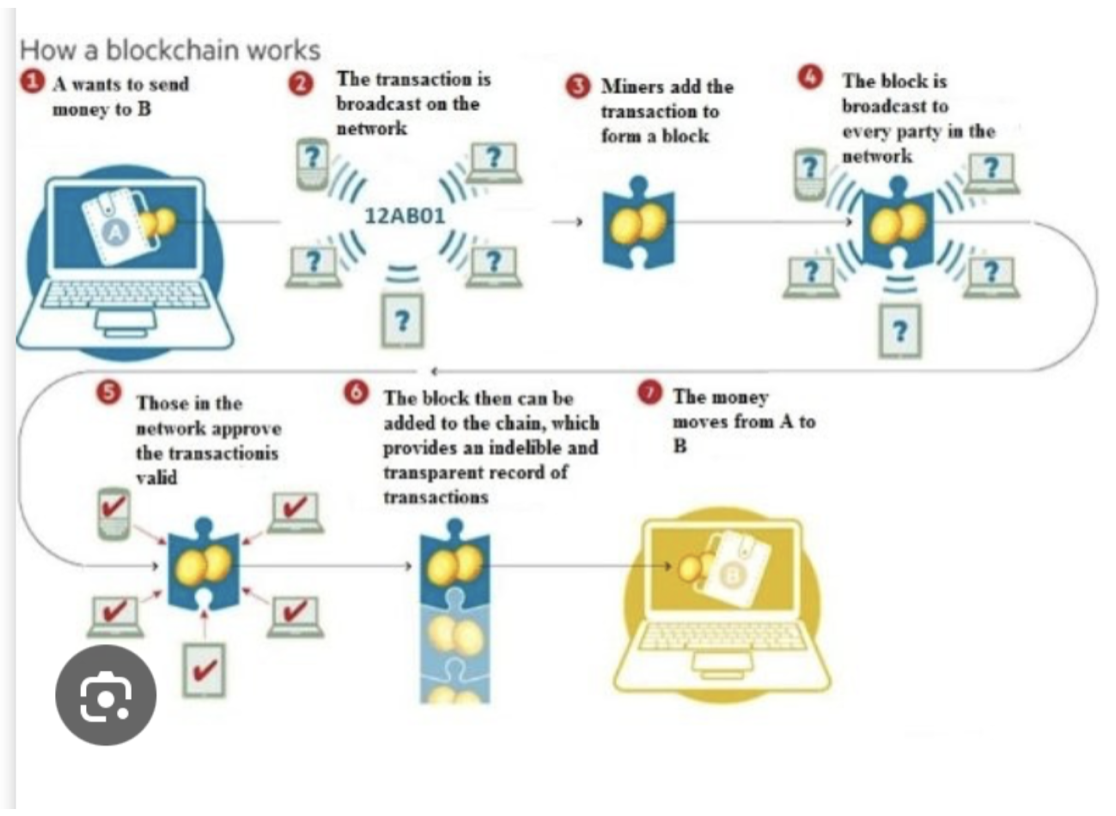

Why do these big banks think blockchain can turbo-charge the financial system?

Wall Street still operates in T+2. Trade + two days. That’s how long it takes for the standard securities settlement – for cash and assets to change hands. So, for instance, if you sell some stock on Tuesday, the cash won’t hit your bank until Friday.

Electronic trading and modern payment processing have accelerated the global financial system to move assets much faster. You don’t have to be an investment banker to feel the lag in the financial system. ACH transfers, credit card refunds, and all kinds of money that move in our economy take time to go from one person to another. Part of the slowness is how many steps and people are involved. On Wall Street, for example, brokers help set up a transaction, and they can charge a commission. Then market makers connect brokers to the assets they are trying to buy or sell. They charge a fee, too, on the difference or spread of the asking price of an asset and what someone is willing to pay. Very large transactions will need to go through even more steps for security and fraud prevention.

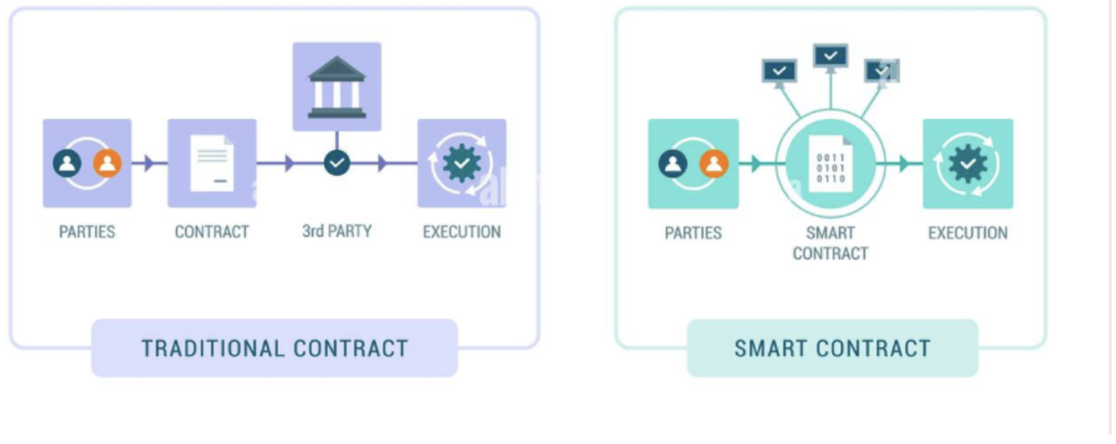

Some big banks are hoping that tokenization on blockchains can streamline the process of trading assets and maybe make it cheaper. It would revolutionize and rewrite financial market infrastructure.

To understand how tokenization works, we need to talk about ownership in the digital era. Right now, it’s hard to transfer ownership of real-world items over the web.

We all know that you can buy a car through an online marketplace, but the title that proves your ownership of this car only arrives in the mail a few weeks later. Inefficient in the modern world, wouldn’t you say? In the hope of bringing ownership online, developers are creating tokens that represent real-world items. You can do this with any kind of asset: stocks, bonds, or a token that could represent ownership of a building or a car. Banks backing this believe that it may create new investments altogether, and that’s why they are putting their money behind it. For example, JPMorgan has Onyx, a blockchain platform they launched in 2020. In the short time since then, it’s handled 700 billion in short-term loans through its private blockchain. JPMorgan describes it as a “killer app” for the future of finance. Larry Fink, the CEO of BlackRock, called digital asset innovation and tokenization the next generation for markets.

A blockchain is basically a database of all the transactions. There are many copies of the database, which helps to keep it secure. Each block is cryptographically signed so that any tampering is immediately evident. Additionally, you have a consensus mechanism to control how you update that database.

If technology provides you with the capability to use one rail line to transfer value, assets, and information, a lot of the inefficiencies and friction that exist in the regular financial infrastructure start to disappear.

Blockchains are meant to be transparent, cutting down the need for intermediaries that could charge fees or the need for extra due diligence. Proponents say it could enable P2P transactions across many parts of the economy.

In addition, this technology would allow for brand new forms of ownership, like splitting, fractionalizing ownership of property through real estate tokens, or tokenized deposits in bank accounts to allow for quick transfer of money between people using P2P transactions.

The IMF said in February that tokenising stocks and bonds could cut trading costs but requires the money paying for those assets to be tokenised as well, which would lead banks to make tokenised cheque accounts for faster payments.

The global financial system is one of the most regulated systems in the world and making any changes will be slow going. There will be a gradual movement forward in small steps.

Citibank has recently introduced Citi Token Services, which is a new blockchain-based service that will transform how institutional clients deposit and trade assets. In the evolving world of blockchains and smart contracts, Citibank has enhanced its products and services, including digital money, trade, securities, custody, asset servicing, and collateral mobility.

Cheers

Jacquie

Global Market Comments

January 3, 2025

Fiat Lux

Featured Trade:

(A COW-BASED ECONOMICS LESSON)

“When you think you know more than everyone else about the consumer, you’re in trouble,” said Mickie Drexler, the legendary CEO of J Crew and Apple board member.

Mad Hedge Biotech and Healthcare Letter

January 2, 2025

Fiat Lux

Featured Trade:

(YOUR NEXT MIRACLE DRUG WAS WRITTEN IN PYTHON)

(IQV), (EXAI), (CRL), (ICLR), (PRXL)

I had an interesting conversation with my daughter last week during one of her rare appearances from her computer science lab. She was telling me about her latest project - using artificial intelligence to predict protein folding, something that used to take months and now happens in hours.

"Dad," she said, looking up from a bowl of ramen that probably cost me 50 cents, "this is going to change everything about how we make medicine."

She's right, and it got me thinking about the transformation happening in clinical trials - a market currently valued at $57.76 billion that's expected to more than double by 2032.

We're looking at a 7.1% compound annual growth rate, but these numbers only tell part of the story.

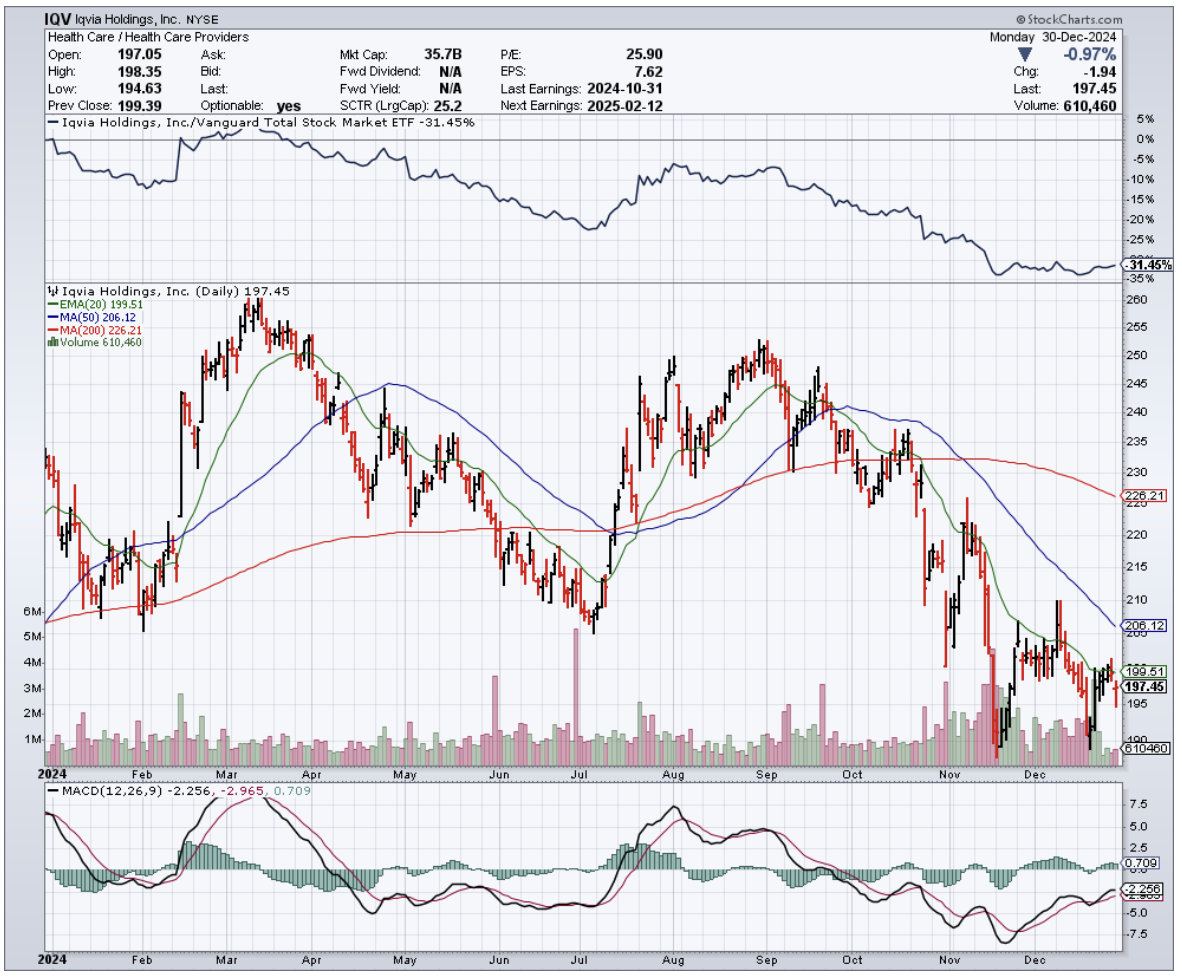

I spent some time digging through the data and talking to folks at companies like IQVIA (IQV), where they're using AI to match patients to trials 40% faster than traditional methods.

Think about that for a second - we’re looking at a process that used to take months now happening in weeks, while managing to maintain the kind of accuracy that makes FDA regulators sleep well at night.

Speaking of the FDA, they're cooking up new diversity action plans that aim to make clinical trials look more like actual America. It's definitely the right thing to do, but like most regulatory shifts, it's moving at the speed of government bureaucracy.

This is keeping Contract Research Organizations (CROs) on their toes, though the smart ones are already adapting.

Take Exscientia (EXAI), for example. They're not just using artificial intelligence - they are letting this technology design drug candidates that are already in clinical trials. It's like having a thousand researchers working 24/7 without coffee or bathroom breaks.

But before you rush to buy companies in this sector, it pays to remember that not everyone in this space is thriving.

Charles River Laboratories (CRL) and Icon (ICLR) have been dealing with declining revenues faster than a tech startup burning through venture capital.

The global biotechnology market itself tells an interesting story. Currently valued at $1.55 trillion, it's expected to grow at nearly 14% annually through 2030.

Meanwhile, AI is estimated to generate up to $110 billion in annual economic value for the pharmaceutical industry. That's not pocket change, even by Silicon Valley standards.

Last weekend, while refinishing an antique desk I picked up at an estate sale (turns out it's worth more than my first car), I got a call from a biotech analyst friend. He was worried about the shift in clinical trial geography.

Europe's share of global trials has dropped from 22% to 12% over the past decade, while Asia-Pacific is becoming the new hotspot.

Companies like Parexel (PRXL) and Headlands Research are capitalizing on this trend, particularly in China and India, where regulatory frameworks are streamlining faster than a Formula 1 pit crew.

The traditional factors that used to drive this industry - pure research horsepower and deep pockets - are being replaced by computational efficiency and AI-driven insights.

It's similar to what happened in the financial markets when algorithmic trading took over from floor traders. The winners will be those who adapt fastest to this new reality.

Looking ahead to 2025 and beyond, I'm watching two potential party crashers: a return of regulatory uncertainty and the ever-present possibility of a new pandemic.

But barring these black swan events, we're looking at a sector that's transforming faster than my daughter's college curriculum.

Speaking of which, she just texted me about her latest assignment - using machine learning to optimize clinical trial protocols. Maybe I should start asking her for stock picks.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.