When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

January 27, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE TRADE WAR BEGINS),

(SPY), (TLT), (TSLA), (NFLX)

The punitive 25% tariff against Columbia for refusing to take back their own immigrants clearly signals how international relations will be conducted going forward. Never mind that it was rolled back 25 hours later. The intentions are clear. Notice that it is America’s biggest exporters, the Magnificent Seven, that are getting absolutely slaughtered this morning.

Who’s next? There are no allies anymore.

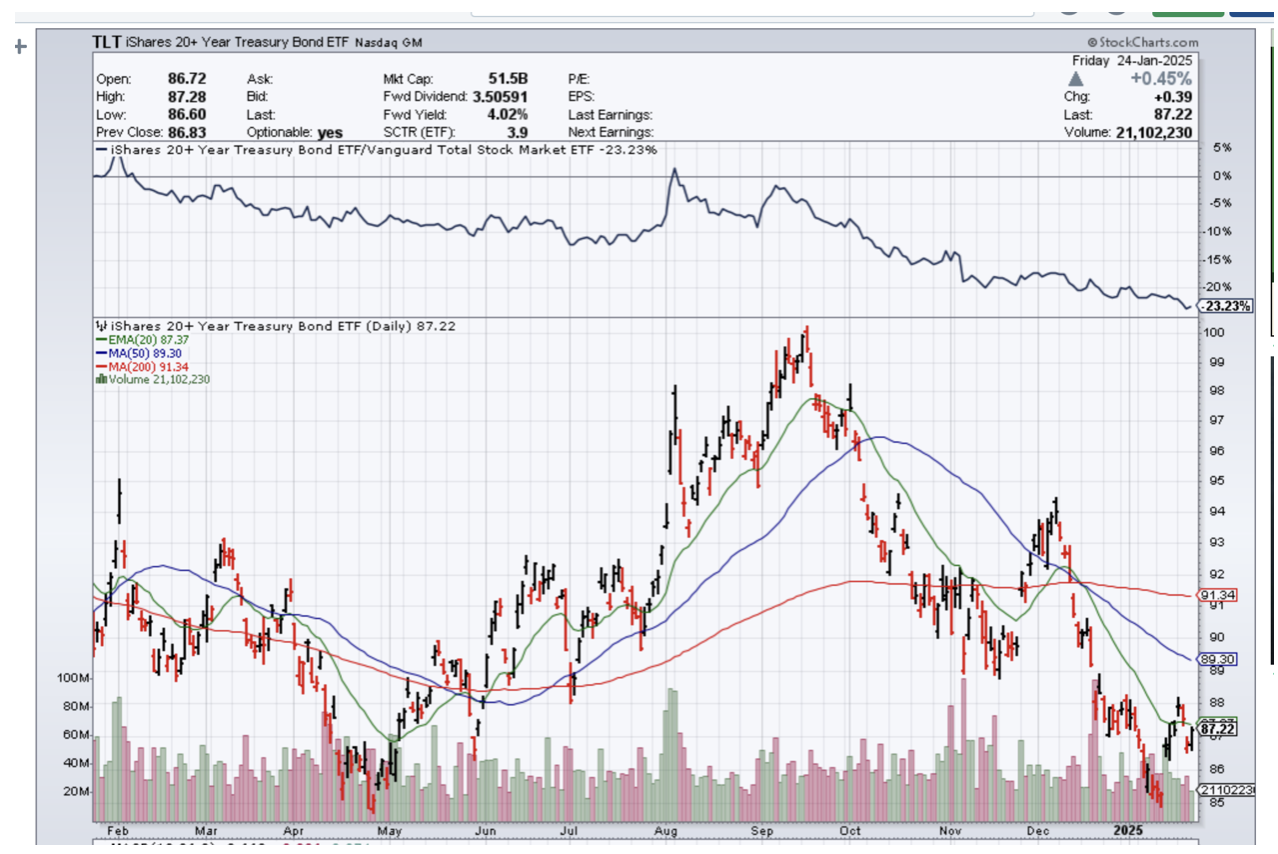

I am normally not a shy, retiring, or timid person, as those who know me will testify heartily. However, given that I have only executed three trades this month, one might be forgiven for thinking so. Those would be successful longs and shorts in Tesla (TSLA) and a stop loss in bonds (TLT). Still, up 2.29% so far in such an indecisive month is better than a poke in the eye with a sharp stick.

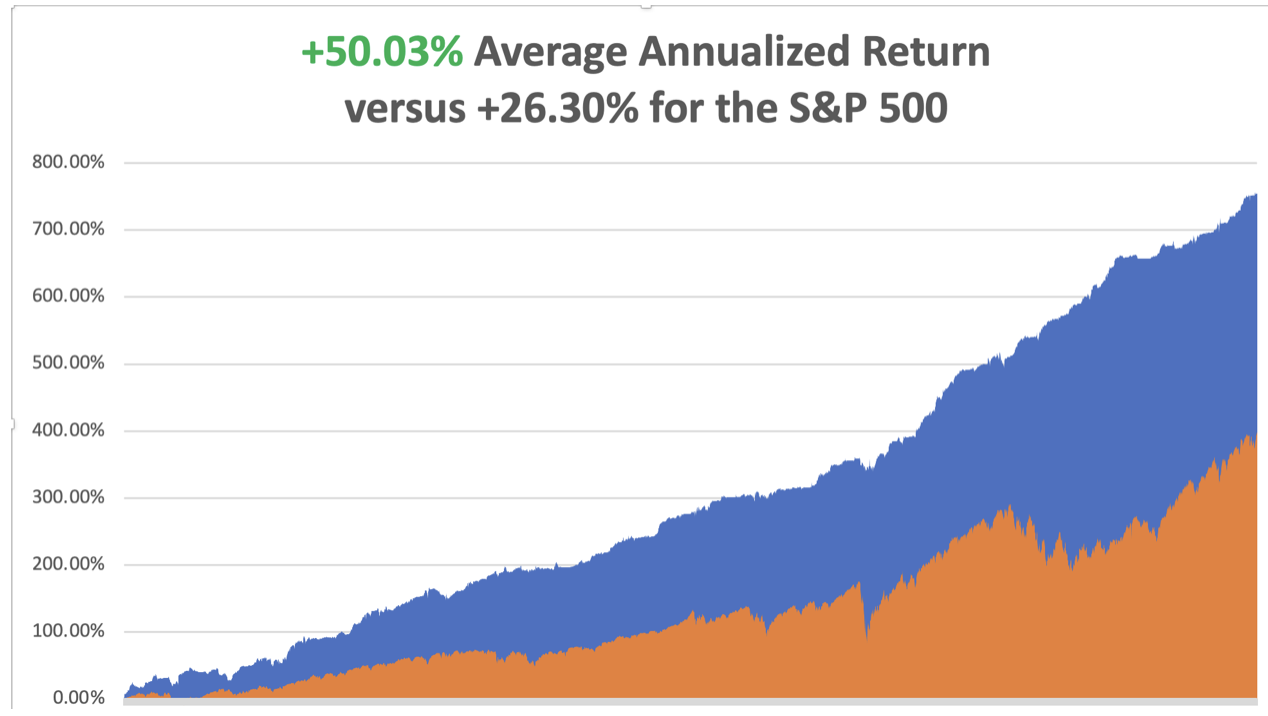

Partly I have acquired a newfound shyness because I don’t want to spoil a near-perfect record for the last five months of 2025. During this period, I executed 47 trades and lost on only 4 of them for a win rate of 91.49%. This is the highest success rate in the nearly 17-year history of the Mad Hedge Fund Trader. What’s more, we took in a staggering 57.9% during this time when the stock market was earning almost nothing.

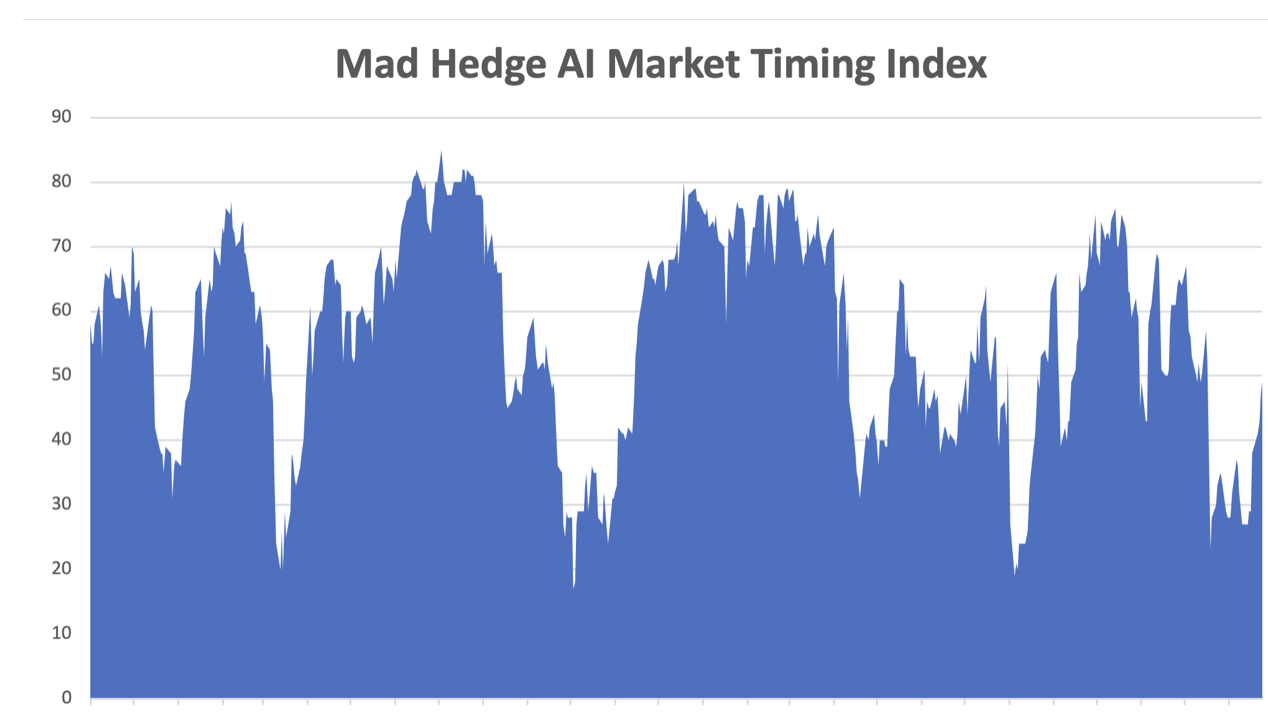

But the market is certainly indecisive, can’t decide where to go, and is awaiting its marching orders. This is not a time to bet the ranch as we did in Q4 with financials, but only to stick a nervous toe in the water until the market tells you what to do. For now, better to bet just a single cow.

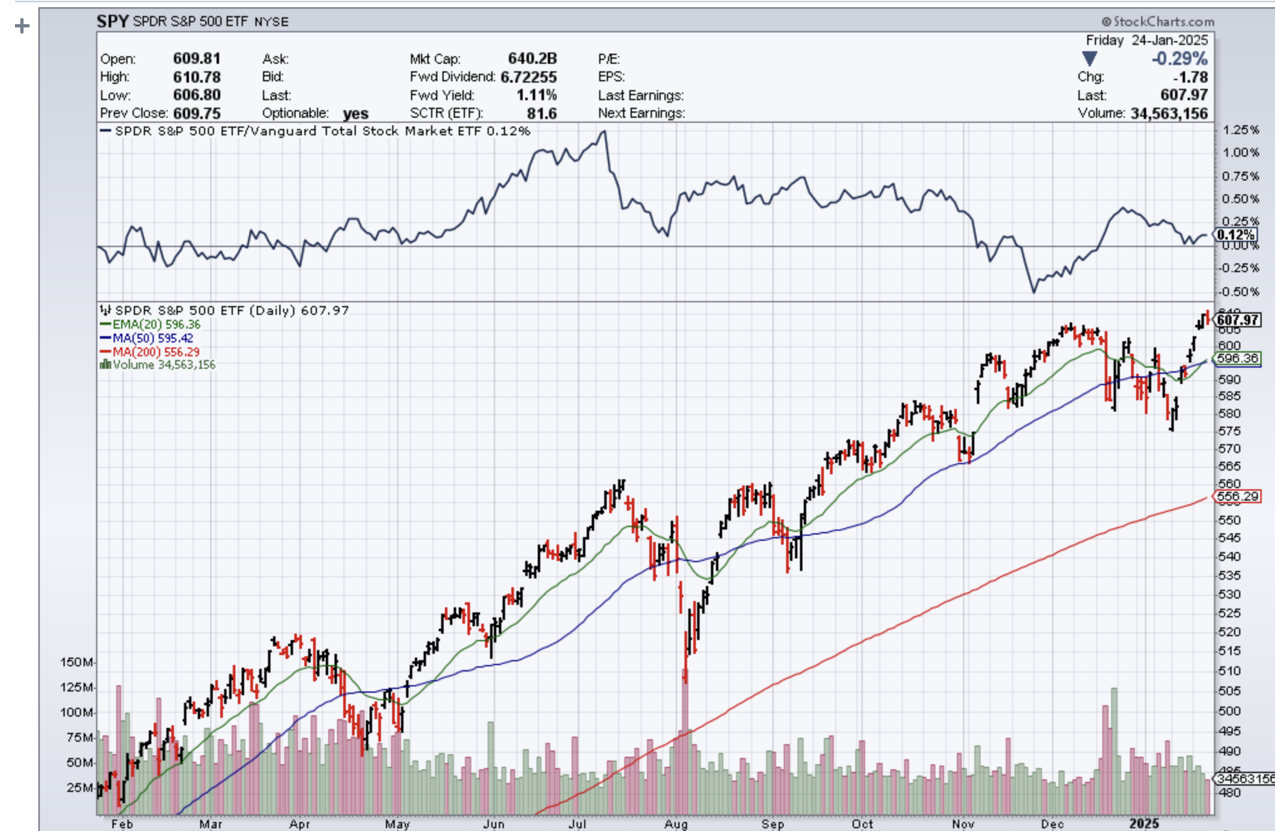

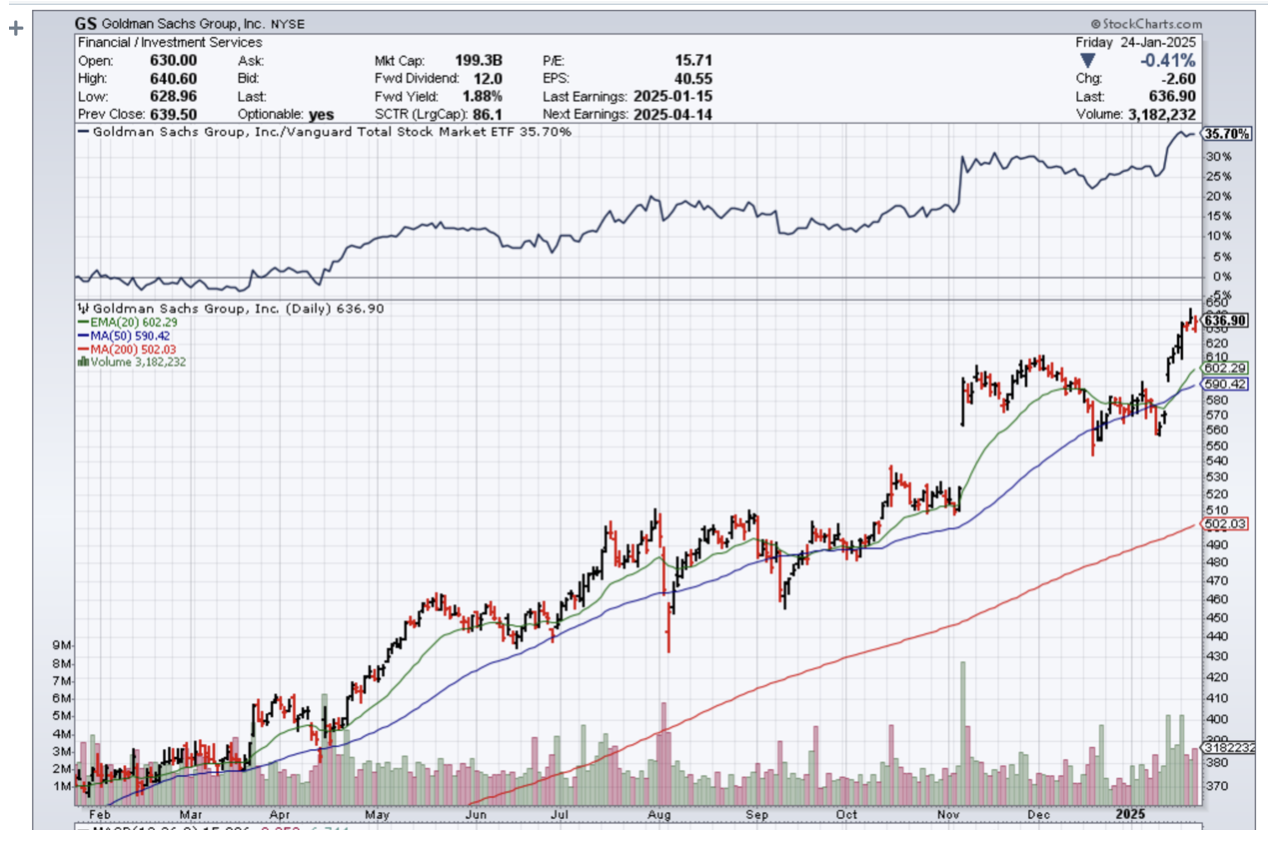

By far the most interesting chart last week is that for the S&P 500 (SPY). Two weeks ago, we saw a lower low at $575 followed by a higher high up to $610 the following week. This is known as an “outside trade” in the trade and always presages an increase in volatility. And volatility we shall get.

All of the traditional market valuation indicators followed by Wall Street are now at their 98% to 100% levels of extreme. This is a clear warning signal of hard times ahead. Apple is giving us the best “tell” having its worst start to the year since 2008, down $40, or 15.38%, some $600 billion in market cap.

It could be a long wait.

The new administration is attempting to pass a Grand policy bill that will approve all of its policy initiatives in a single bill. That might take until May at the earliest and November at the latest, if it passes at all. That is a very long time for the market to wait for a result.

I explained last week that the bull case is that the new administration does nothing. We got a step in that direction last week when Trump said he would “study” tariffs rather than implement them. If Trump ends up not implementing tariffs, or only token ones, it would be good news for the growth of the US economy.

Let me summarize how the China-US trade works in a single sentence. China makes a widget for $1.00 which it then sells to an American buyer for $2.00, reaping a 100% profit. The American buyer then sells its Chinese widget for $20. Some 5% of the profit stream stays in China and 95% with the American seller. Stop this trade and that $18 US profit is lost, wiping out two million US small businesses. I argue that 95% of something is better than 100% of nothing.

By the way, the same argument applies to TikTok, which probably supports another two million single individual revenue streams.

Netflix Earnings Rocketed on the back of 19 million new subscribers. The streaming giant reported better-than-expected fourth-quarter results and raised its 2025 revenue forecast. For the fourth quarter, earnings of $4.27 per share topped Street estimates of $4.18. Revenue of $10.25 billion also topped the Bloomberg consensus estimate of $10.11 billion. Netflix added 18.91 million subscribers in the quarter versus an expected 9.18 million. Mad Hedge already took profits on a long going into the announcement.

The streaming wars are well and truly over.

Apple is in Free Fall, after multiple downgrades, taking the stock down $40, or 15% in a month. Apple has lost some market share in China and has had limited traction with its AI offerings. Even a strong dollar is hurting. Apple sells a lot of things overseas. That’s the fundamental backdrop. The technical picture shows investors what can happen if investors continue to see a deterioration in the company’s business. Avoid (AAPL) for now.

Morgan Stanley (MS) Warns Customers to Cut Stock Exposure. With the S&P 500 index touching a new all-time high Wednesday, U.S. stocks remaining pricey and valuations appearing stretched, investors should make sure to keep a diversified portfolio. The S&P 500 index’s valuation is too high, expectations for earnings growth are too ambitious, and that it’s unclear what President Donald Trump’s policies will mean for Wall Street.

Credit Card Delinquencies Soar, as have minimum monthly payments. The share of active credit card holders just making minimum payments rose to 10.75% in the third quarter of 2024, the highest ever in data going back to 2012. The share of cardholders more than 30 days past due rose to 3.52%, an increase from 3.21%, for a gain of more than 10%. Even with the rising delinquency rate, it is still well below the 6.8% peak during the 2008-09 financial crisis and not yet indicative of serious strains.

Home Insurance Costs are Soaring, for homeowners in the most-affected regions, California and Florida. For consumers living in the 20% of zip codes with the highest expected annual losses, premiums averaged $2,321, or 82% more than those living in the 20% of lowest-risk zip codes from 2018-22. This is going to get worse before it gets better.

Ban Lifted on New Natural Gas Export Facilities in 4 Years, reversing a Biden-era climate initiative. Cheniere Energy (LNG), an old Mad Hedge favorite has risen 75% since the summer and sold off on the news. The big winner here? China, which can now buy more low-priced natural gas.

Housing Starts were up 3.0% in December, with single-family homes up only 3%, while multifamily saw a 59% rise. It should be the shift away from home sales crushed by 7.2% mortgage rates. You can write off real estate in 2025.

EV and Hybrid Sales Reach a Record 20% of US Vehicle Sales in 2024 and now account for 10% of the total US fleet. And you wonder why oil prices are so low. That includes 1.9 million hybrid vehicles, including plug-in models, and 1.3 million all-electric models. Tesla continued to dominate sales of pure EVs but Cox Automotive estimated its annual sales fell and its market share dropped to about 49%.

SpaceX Starship Blows Up on test launch number seven. The Federal Aviation Administration issued a warning to pilots of a “dangerous area for falling debris of rocket Starship,” according to a pilots’ notice. Looks like that Mars trip will be delayed.

We managed to grind out a +2.29% return so far in January. That takes us to a year-to-date profit of +2.29% so far in 2025. My trailing one-year return stands at +88.88% as a bad trade a year ago fell off the one-year record. That takes my average annualized return to +50.03% and my performance since inception to +754.13%.

I used a 19% spike in Tesla shares to add a new short position there. The combination of my long and short hedging each other is known as a “short strangle.” It is a combined bet that Tesla will not fall below $310 or rise above $540 by the February options expiration in 19 trading days. Sounds pretty good to me.

Some 63 of my 70 round trips, or 90%, were profitable in 2023. Some 74 of 94 trades have been profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties is now looking at a headwind. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

My Dow 240,000 target has been pushed back to 2035.

On Monday, January 27, at 8:30 AM EST, Leading Economic Indicators are out.

On Tuesday, January 28 a 8:30 AM, the Durable Goods are released.

On Wednesday, January 29 at 8:30 AM, the Federal Reserve Interest Rate Decision is announced. A press conference follows at 2:30.

On Thursday, January 30 at 8:30 AM, the Weekly Jobless Claims are disclosed. We also get an update on GDP growth.

On Friday, January 31 at 8:30 AM, Core PCE is printed. At 2:00 PM the Baker Hughes Rig Count is printed.

As for me, occasionally I tell my close friends that I hitchhiked across the Sahara Desert alone when I was 16 and met with looks that are amazed, befuddled, and disbelieving, but I actually did it in the summer of 1968.

I had spent two months hitchhiking from a hospital in Sweden all the way to my ancestral roots in Monreale, Sicily, the home of my Italian grandfather. My next goal was to visit my Uncle Charles, who was stationed at the Torreon Air Force base outside of Madrid, Spain.

I looked at my Michelin map of the Mediterranean and quickly realized that it would be much quicker to cut across North Africa than hitching all the way back up the length of Italy, cutting across the Cote d’Azur, where no one ever picked up hitchhikers, then all the way down to Madrid, where the people were too poor to own cars.

So one fine morning, I found myself taking a deck passage on a ferry from Palermo to Tunis. From here on, my memory is hazy and I remember only a few flashbacks.

Ever the historian, even at age 16, I made straight for the Carthaginian ruins where the Romans allegedly salted the earth to prevent any recovery of a country they had just wasted. Some 2,000 years later, it worked as there was nothing left but an endless sea of scattered rocks.

At night, I laid out my sleeping bag to catch some shut-eye. But at 2:00 AM, someone tried to bash my head in with a rock. I scared them off but haven’t had a decent night of sleep since.

The next day, I made for the spectacular Roman ruins at Leptus Magna on the Libyan coast. But Muamar Khadafi pulled off a coup d’état earlier and closed the border to all Americans. My visa obtained in Rome from King Idris was useless.

I used the opportunity to hitchhike over Kasserine Pass into Algeria, where my uncle served under General Patton in WWII. US forces suffered an ignominious defeat until General Patton took over the army in 1943. Some 25 years later, the scenery was still littered with blown-up tanks, destroyed trucks, and crashed Messerschmitts.

Approaching the coastal road, I started jumping trains headed west. While officially the Algerian Civil War ended in 1962, in fact, it was still going on in 1968. We passed derailed trains and smashed bridges. The cattle were starving. There was no food anywhere.

At night, Arab families invited me to stay over in their mud brick homes as I always traveled with a big American Flag on my pack. Their hospitality was endless, and they shared what little food they had.

As the train pulled into Algiers, a conductor caught me without a ticket. So, the railway police arrested me and on arrival, they took me to the central Algiers prison, not a very nice place. After the police left, the head of the prison took me to a back door, opened it, smiled, and said “Si vou plais”. That was all the French I ever needed to know. I quickly disappeared into the Algiers souk.

As we approached the Moroccan border, I saw trains of camels 1,000 animals long, rhythmically swaying back and forth with their cargoes of spices from central Africa. These don’t exist anymore, replaced by modern trucks.

Out in the middle of nowhere, bullets started flying through the passenger cars splintering wood. I poked my Kodak Instamatic out the window in between volleys of shots and snapped a few pictures.

The train juddered to a halt and robbers boarded. They shook down the passengers, seizing whatever silver jewelry and bolts of cloth they could find.

When they came to me, they just laughed and moved on. As a ragged backpacker, I had nothing of interest for them.

The train ended up in Marrakesh on the edge of the Sahara and the final destination of the camel trains. It was like visiting the Arabian Nights. The main Jemaa el-Fna square was amazing, with masses of crafts for sale, magicians, snake charmers, and men breathing fire.

Next stop was Tangiers, the site of the oldest foreign American Embassy, which is now open to tourists. For 50 cents a night, you could sleep on a rooftop under the stars and pass the pipe with fellow travelers which contained something called hashish.

One more ferry ride and I was at the British naval base at the Rock of Gibraltar and then on a train for Madrid. I made it to the Torreon base main gate where a very surprised master sergeant picked up my half-starved, rail-thin, filthy nephew and took me home. Later, Uncle Charles said I slept for three days straight. Since I had lice, Charles shaved my head when I was asleep. I fit right in with the other airmen.

I woke up with a fever, so Charles took me to the base clinic. They never figured out what I had. Maybe it was exhaustion, maybe it was prolonged starvation. Perhaps it was something African. Possibly, it was all one long dream.

Afterward, my uncle took me to the base commissary where I enjoyed my first cheeseburger, French fries, and chocolate shake in many months. It was the best meal of my life and the only cure I really needed.

I have pictures of all this which are sitting in a box somewhere in my basement. The Michelin map sits in a giant case of old, used maps that I have been collecting for 60 years.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

North Africa in 1968

Welcome to Florida

“To pursue the mosquito theory as a cause of yellow fever would be a complete waste of government money,” said an army doctor in 1898.

From Siri's simple voice commands to sophisticated AI capable of managing our lives, the evolution of personal assistants is accelerating at an unprecedented pace. But where are we headed, and what does this mean for our future?

Just a decade ago, the idea of having a personal AI assistant felt like science fiction. Today, millions of people interact with Siri, Alexa, or Google Assistant daily, using them for mundane tasks like setting alarms, playing music, or checking the weather. Yet, these interactions barely scratch the surface of what's coming. The future of personal AI assistants is far more profound, promising to reshape our lives in ways we're only beginning to imagine.

Beyond Task Management: The Dawn of Personalized AI

The next generation of AI assistants will transcend simple task management. They will evolve into personalized companions, capable of understanding our individual needs, preferences, and even emotions. Imagine an AI that not only knows your schedule but also senses your mood, offering a calming meditation when you're stressed or an upbeat playlist when you need motivation.

This personalization will be driven by several factors:

-

Advanced Machine Learning: AI models are becoming increasingly sophisticated at understanding natural language, recognizing patterns, and making inferences. This allows them to learn from our interactions, anticipate our needs, and offer truly personalized experiences.

-

Emotional Intelligence: Researchers are developing AI systems that can recognize and respond to human emotions. This will enable assistants to provide empathetic support, offer tailored advice, and even act as companions for those who need it.

-

Contextual Awareness: Future AI assistants will be deeply integrated into our lives, accessing data from our devices, calendars, and social media to understand our context and offer relevant assistance. Imagine an AI that knows you're in a meeting and automatically silences your phone or reminds you of a relevant document you might need.

The AI-Powered Workforce: Collaborating with Intelligent Machines

The impact of personal AI will extend far beyond our personal lives, revolutionizing the way we work. AI assistants will become indispensable collaborators, augmenting our capabilities and boosting productivity.

-

Intelligent Automation: Repetitive tasks will be delegated to AI assistants, freeing up humans to focus on creative problem-solving and strategic thinking. Imagine an AI that handles your email, schedules your meetings, and even generates reports, allowing you to concentrate on higher-level tasks.

-

Personalized Learning: AI tutors will provide personalized learning experiences, adapting to individual learning styles and pacing. This will revolutionize education and professional development, making knowledge more accessible and learning more efficient.

-

Decision Support: AI assistants will analyze vast amounts of data to provide insights and recommendations, helping us make informed decisions. Imagine an AI that analyzes market trends to advise on investments or sifts through research papers to support scientific discovery.

The Ethical Landscape: Navigating the Challenges of AI

The rise of personal AI brings with it a host of ethical considerations that we must address proactively:

-

Privacy Concerns: As AI assistants become more integrated into our lives, they will have access to vast amounts of personal data. Ensuring the privacy and security of this data is paramount.

-

Bias and Discrimination: AI models are trained on data, and if that data reflects existing biases, the AI can perpetuate and even amplify those biases. We must ensure that AI assistants are developed and deployed in a way that is fair and equitable.

-

Job Displacement: As AI takes over tasks previously performed by humans, there is a risk of job displacement. We need to invest in education and training programs to prepare the workforce for the changing job market.

-

Dependence and Autonomy: As we rely more on AI assistants, there is a risk of becoming overly dependent on them, potentially eroding our own skills and autonomy. We must find a balance between utilizing AI's capabilities and maintaining our human agency.

The Future is Personal: A Glimpse into the Possibilities

While the exact trajectory of personal AI is uncertain, we can envision several potential scenarios:

-

The AI Companion: AI assistants could evolve into true companions, offering emotional support, engaging in meaningful conversations, and even forming bonds with humans. This could have profound implications for those who struggle with loneliness or social isolation.

-

The AI-Powered Self: AI could become seamlessly integrated with our bodies and minds, augmenting our cognitive abilities, enhancing our physical performance, and even blurring the lines between human and machine.

-

The AI-Managed Society: AI could play a central role in managing our societies, optimizing resource allocation, improving public services, and even assisting in governance.

Navigating the Future: A Call for Responsible Development

The future of personal AI is filled with both promise and peril. It is crucial that we approach the development and deployment of AI responsibly, prioritizing human well-being, ethical considerations, and societal impact.

We need to engage in open and inclusive dialogue about the future we want to create with AI. We need to establish clear ethical guidelines and regulations to ensure that AI is used for good. And we need to invest in education and research to stay ahead of the curve and harness the full potential of this transformative technology.

The rise of personal AI is not merely a technological revolution; it is a societal one. It is a journey into uncharted territory, and the choices we make today will determine the kind of future we create for ourselves and generations to come.

Mad Hedge Technology Letter

January 24, 2025

Fiat Lux

Featured Trade:

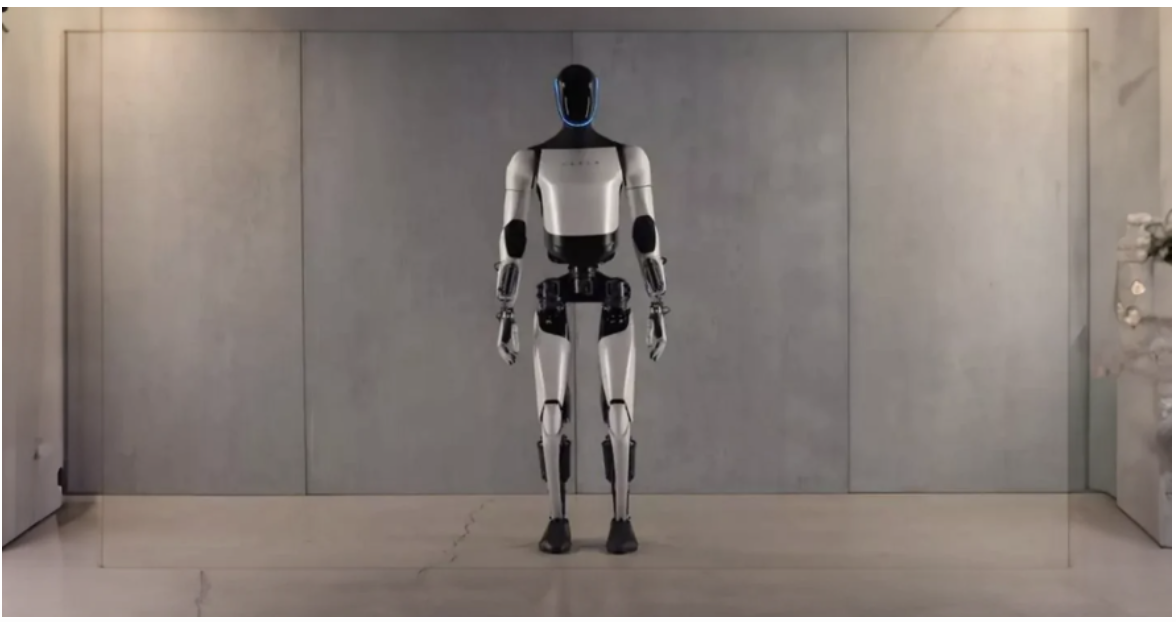

(HUMANOIDS TO THE RESCUE OR NOT)

(TSLA)

Dr. Doom Nouriel Roubini needs to lay off the fear porn – I’m not taking the bait this time. Sorry Roubs!

Roubini is sounding the alarm bells on humanoid robots, but I think it is more of a case of fear-mongering than anything else.

After all, like most economists, Roubini isn’t a trader, he is an academic who sits behind the scenes and goes after those juicy sound bites that the media need to publish stories.

He wasn’t taking profits in great tech trades like when I captured profits on Netflix just the other day.

His idea goes like this…

He thinks the big breakthrough right now is the evolution of humanoid robots that essentially follow individual workers on the factory floor, on a construction site, even a chef in a restaurant, or a housekeeper. It's terrifying, but it's happening in the next literally year or two.

For this level of transformation in one year, I believe the percentage chance of this coming to fruition is less than 2%.

My understanding of the humanoids is that the software will take 10 years to figure out the nuances.

Roubini — known as Dr. Doom for his bleak economic forecasts — said human jobs would be lost to humanoids.

Instead, an LLM (large language mode) learns about everything in the world, the entire internet follows your job, my job or anybody else's job in a few months, then learns everything that a construction worker, factory worker, or any other service worker can do, and then can replace them. And I think that it's going to be a revolution — it's going to affect blue-collar jobs like we've never, ever seen before.

The humanoid robot market could reach $7 trillion by 2050, Citi research recently found. Those robots — such as Tesla's (TSLA) Optimus — may be able to do everything from cleaning your home to folding your laundry. The robots could create job loss as routine tasks get automated.

There is a higher likelihood that this humanoid from Tesla will be used as staging to convince investors to buy more tech stocks.

Tech companies have a huge problem on their hands and there hasn’t been a lot of great brain activity to find a real solution.

Venture capitalists have been lamenting the lack of real innovation in tech products like Mark Andreessen and Peter Thiel.

The humanoid is here to get investors to buy more tech stocks in companies that aren’t innovating.

Tech companies are cutting staff to beat earnings and that isn’t a sign for top-notch growth.

Investors need to separate the fluff from reality.

The reality is that big tech companies still make enormous amounts of profit but have failed miserably in finding something new.

Apple CEO Tim Cook is still figuring out what next to do after selling the iPhone to Chinese people.

The humanoid operating on AI software might give tech stocks an extra 6-month cushion before investors pull the rug.

Enjoy the bull market while it lasts. I executed a bullish trade in Dell which is part of the AI story.

AI stocks will go higher and humanoid stocks will too – not because they will make money, but because investors still buy the hype.

(PRESIDENT TRUMP IS PRIORITIZING AI)

January 24, 2025

Hello everyone

President Trump is prioritizing the push forward of AI.

Which companies are likely to benefit?

Think of (ORCL) Oracle, (MSFT) Microsoft, and (ANET) Arista Networks

Earlier this week, a $500 billion joint venture was announced between OpenAI Oracle, and Softbank, which aims to strengthen artificial intelligence infrastructure in the U.S.

Shares of Oracle and Microsoft have rallied nearly 15% and 3%, respectively, since the start of the week. Microsoft is an investor in OpenAI.

Solita Marcelli from UBS notes that the project requires more computing and electricity, which may point to greater investments in grid infrastructure and power transmission.

Kash Rangan, a Goldman Sachs analyst, believes Oracle and Microsoft are prime winners from the government’s prioritization of AI.

Rangan notes that Microsoft is in a prime position to benefit from this project as the company has a strong balance sheet and capital expenditure for 2025. Oracle, however, may take longer to benefit, but the tailwind will certainly gather strength in the years to come. Analysts are seeing the probability of more capital AI investments for Oracle, which could boost its cloud infrastructure revenues at a compounded annual growth rate exceeding 50% through 2027.

The Stargate venture also sees Arista Networks as a potential big winner too. The company has exposure to Oracle, Microsoft, and OpenAI, as well as the strength of its ethernet switching portfolio. Piper Sandler’s James Fish argues that “given switching represents >50% of networking spends, and Arista’s? 30% share of high-end datacentre switching, we see this as a +$6B [serviceable addressable market] over 5 years.”

Fish also points to (PSTG) Pure Storage, as an “underappreciated way” to invest behind Stargate to meet storage capacity, estimating a $10 billion total addressable market.

(I recommended Oracle, Microsoft, and Arista Networks on January 6, 2024.

Oracle was at $104, Microsoft was at $372, and Arista Networks was at $248.00. Arista Networks had a stock split on December 4, 2024, which took it back to $62.00.

TRADE ALERT

(TPB) TURNING POINT BRANDS

Turning Point Brands manufactures, markets, and distributes branded consumer products. The company operates through three segments: Zig-Zag Products, Stoker’s Products, and Creative Distribution Solutions. Zig-Zag Products segment markets and distributes rolling papers, tubes, finished cigars, make-your-own cigar wraps, and related products as well as lighters and other accessories under the Zig-Zag brand. The Stoker’s Products segment manufactures and markets moist snuff tobacco and loose-lead chewing tobacco products under the Stocker’s, Beech-Nut, Durango, Trophy, and Wind River brands. Its Creative Distribution Solutions segment markets and distributes other products without tobacco and/or nicotine to individual consumers through the VaporFi B2C online platform, as well as non-traditional retail through Vapor Beast. In addition, it markets and distributes cannabis accessories and tobacco products. The company sells its products to wholesale distributors and retail merchandising, drug stores, and non-traditional retail channels. The company was formerly known as North Atlantic Holding Company Inc. It changed its name to Turning Point Brands Inc in November 2015. The company was founded in 1988 and is headquartered in Louisville, Kentucky.

A shareholder return of 138% over the last 12 months is not too shabby for this company. Most analysts rate it a strong buy or a buy and see it rising more than 20%. Earnings are forecast to grow by 14.04% per year. Earnings grew by 294.6% over the last year.

Recommendation: Scale into the stock. And/or you could try a bull call spread like a 60/65 with an April 17 expiration, or a 60/65 with a July expiration.

So, your trade would look like this:

Buy 1 TPB 60 call

Sell 1 TPB 65 call

When I was looking at these trades the limit price for the April expiration was $1.48 and the limit price for the July expiration was $1.95.

Prices will be all over the place by the time you receive this, so purchase at best.

QI CORNER

SOMETHING TO THINK ABOUT

Cheers

Jacquie

Global Market Comments

January 24, 2025

Fiat Lux

Featured Trade:

(SOME SAGE ADVICE ON ASSET ALLOCATION)

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.