When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

February 12, 2025

Fiat Lux

Featured Trade:

(THE ABC’s OF THE VIX),

(VIX), (VXX), (SVXY)

Mad Hedge Biotech and Healthcare Letter

February 11, 2025

Fiat Lux

Featured Trade:

(SPLICING THROUGH SKEPTICISM)

(CSRP), (VRTX), (AMZN), (TSLA)

When I pioneered fracking technology in Texas years ago, skeptics said we were crazy. Today's skeptics are saying the same thing about CRISPR Therapeutics (CRSP), and they're just as wrong.

Here's a company sitting on a $1.9 billion cash fortress, burning through a mere $100 million per quarter – giving them enough runway to circle the Earth 19 times – and yet the stock has drifted down to $40, shedding 15% since my last analysis when it was perched at $48.

Talk about the market missing the forest for the trees.

Remember when everyone thought Amazon (AMZN) was just a bookstore? Well, CRISPR Therapeutics isn't just another biotech company – it's the Tesla (TSLA) of gene editing, with Vertex Pharmaceuticals (VRTX) riding shotgun.

And just like Tesla wasn't just about making electric cars, CRISPR isn't just about Casgevy, their FDA-approved treatment for Sickle Cell Disease (SCD) and Transfusion-Dependent Beta Thalassemia (TDT).

Speaking of Casgevy, let's tackle the elephant in the room. Yes, patient enrollment has been slower than a government committee deciding on lunch options. They've collected cells from over 50 patients by year-end, up from 20 in mid-October.

Not exactly setting speed records, but here's what the market is missing: the Centers for Medicare and Medicaid Services just inked a deal with Vertex/CRISPR that could be a game-changer.

Why? Because 50-60% of SCD patients are on Medicaid.

But wait, there's more happening behind the scenes. The company has been quietly building an empire across 5 clinical programs and 10 preclinical programs.

Let's break down what's cooking in their kitchen.

The Casgevy rollout has expanded from 35 treatment centers in October to over 50 by year-end.

Eight jurisdictions have given them the green light, including Saudi Arabia – a market where SCD is about as common as sand.

The UK just signed on for reimbursement, first for TDT in August 2024, and now for SCD.

Their CAR-T program isn't just targeting blood cancers anymore. They've expanded into autoimmune diseases like Systemic sclerosis (SSc) and Idiopathic inflammatory myopathy (IIM).

We're talking about potential treatments for 2.5 million SSc patients globally (125,000 in the US) and 1 million IIM patients (50,000 in the US).

That's not just a market – it's an ocean.

They're even taking shots at liver cancer and cardiovascular diseases. Their latest trial for Heterozygous familial hypercholesterolemia could be a lifeline for patients with this genetic cholesterol disorder.

And speaking of cash runways, their $1.9 billion war chest means they can keep this scientific symphony playing for 19 quarters without passing around the collection plate.

In biotech terms, that's like having enough food to last through three winters.

Institutions are noticing, too. Cathie Wood just backed up the truck, dropping $10 million more into CRISPR, making it her 9th largest holding at $350 million. Her ARK funds now own over 9% of the company.

When smart money moves like this, I pay attention.

Here's the kicker: While most analysts raise their ratings as speculative stocks climb (a strategy that makes as much sense as buying umbrella futures during a drought), I'm doing the opposite.

After all, the fundamentals are stronger than ever, but the price is lower.

Looking ahead to 2025, we've got more potential catalysts than a chemistry textbook. Phase 1/2 trial data for CTX 112 is coming in Q2/Q3, CTX 131 in Q3/Q4, and updates on their Type 1 Diabetes program in the second half of the year.

Remember, this is the same company that has Vertex Pharmaceuticals – the biotech equivalent of having Warren Buffett as your investment advisor – as a partner.

They're not just getting financial support; they're getting a masterclass in how to commercialize breakthrough treatments.

The verdict? Load up on shares while the market gives us this gift wrapped in fear and uncertainty.

Twenty years ago, they called us crazy for thinking we could extract oil from solid rock. Today, they're just as skeptical about editing genes.

History has a funny way of repeating itself.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

February 11, 2025

Fiat Lux

SPECIAL VOLATILITY ISSUE

Featured Trade:

(TESTIMONIAL)

(MAKING VOLATILITY YOUR FRIEND),

(VIX), (VXX), (XIV)

(PLTR), (AMZN), (MSFT), (GOOG)

Last weekend, I watched my daughter absolutely demolish me in a game of Go on her smartphone.

As I nursed my wounded pride with a cup of coffee, I couldn't help but smile - not because I lost, but because I remembered something remarkable that happened in 2016 that changed everything we thought we knew about artificial intelligence.

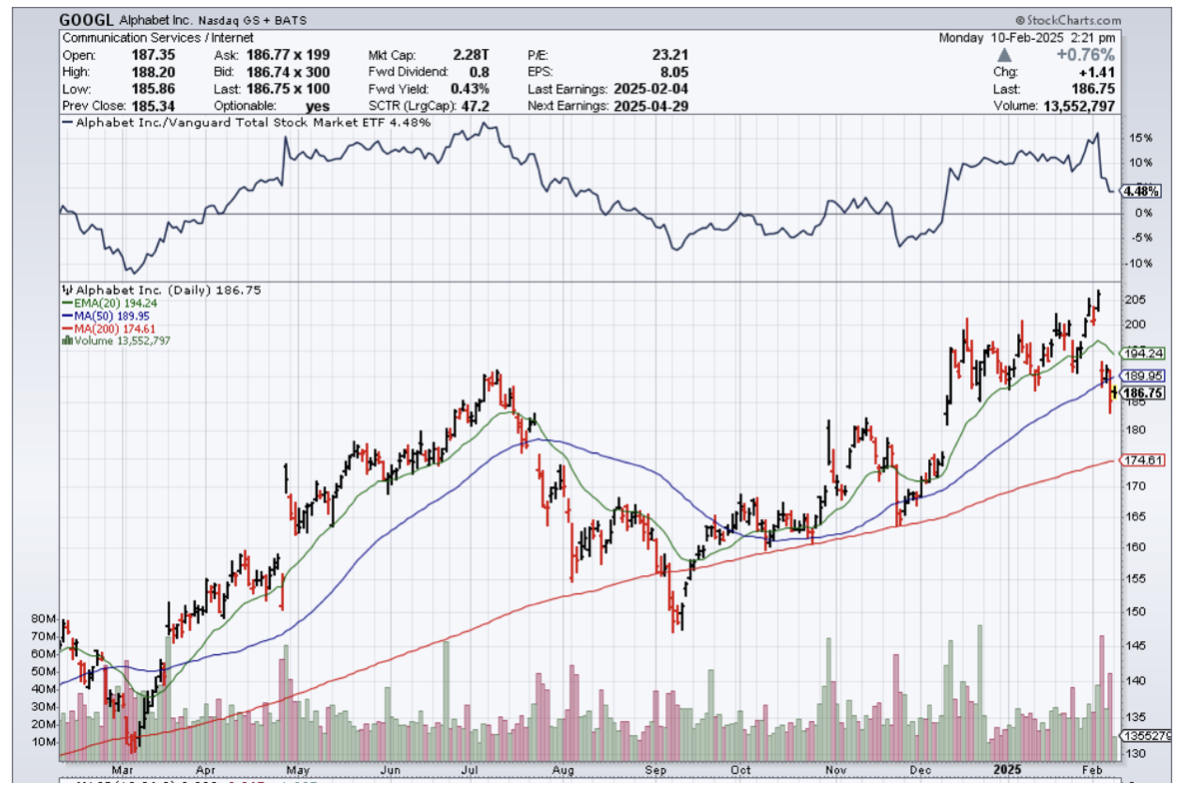

You see, back then, Google's (GOOG) AlphaGo made what became known as "move 37" against Go champion Lee Sedol. It was a move so bizarre, so seemingly nonsensical, that human experts thought it was a glitch.

Turns out, it was pure genius. That single move didn't just win a game - it showed us that AI could think in ways humans never imagined.

Fast forward to today, and I'm seeing something equally revolutionary happening in the AI space.

Just like AlphaGo's famous move, we're witnessing what I call the "chain-of-thought revolution," and it's about to reshape everything we know about AI investing.

Speaking of investing, Palantir (PLTR) has once again caught my attention lately, and not just because it's up 300% in 2024. There's something much bigger brewing here, and it reminds me of that pivotal AlphaGo moment.

Let me break down why this matters.

Remember how the later version of AlphaGo, called AlphaGo Zero, absolutely crushed its predecessor? Here's the kicker - it did it by completely ignoring human knowledge.

That means pure machine learning, no human training wheels needed. This isn't just some tech trivia - it's a blueprint for what's happening right now in the AI industry.

Through recent breakthroughs in what's called "chain-of-thought" processing and reinforcement learning (RL), we're seeing AI models that can actually improve themselves.

Think of it like a digital version of compound interest, but for intelligence. OpenAI's "o" series and DeepSeek-R1 are already showing us glimpses of this future.

Why is this important to us? Because we're approaching what AI researchers call a "hard takeoff" – a moment when AI capabilities could improve exponentially.

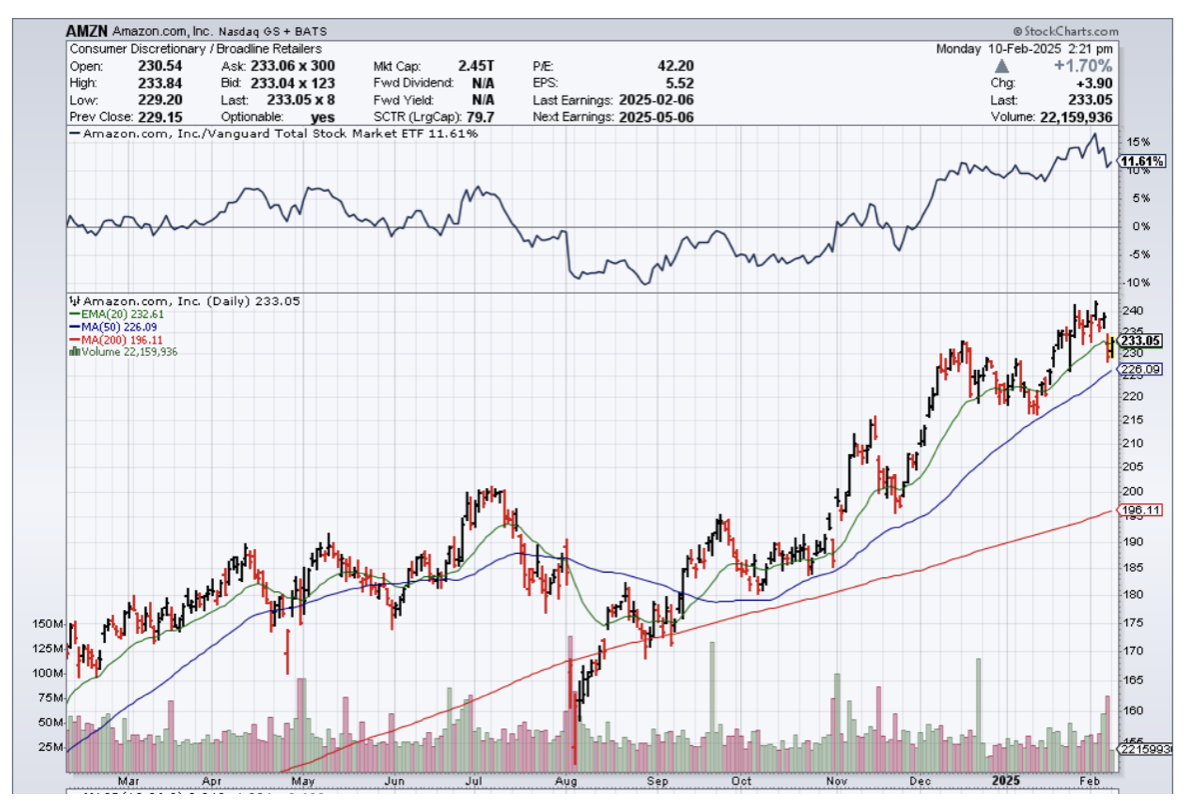

And just like buying Amazon (AMZN) in the early days of e-commerce, positioning yourself correctly now could be life-changing.

This brings us back to Palantir, which reported Q4 revenue of $828 million, up 36% year-over-year.

Their U.S. commercial revenue jumped 54%, and government revenue grew 45%.

But here's what really got my attention - they achieved this with a 45% adjusted operating margin. Now, that's the kind of margin most software companies only dream about.

The company is projecting $3.75 billion in revenue for 2025, representing 31% annual growth.

Sure, at $236 billion market cap and a P/E of 525, it looks expensive. But so did Microsoft (MSFT) when it first started dominating the PC market.

Here's why I think Palantir is uniquely positioned.

First, they've built what I call the "infrastructure for intelligence" - systems that can deploy these new self-improving AI models securely and at scale. It's like owning the railroad tracks during the steam engine revolution.

Second, their government contracts provide stable cash flow while their commercial business offers explosive growth potential. It's a rare combination that reminds me of early AWS.

Third, and most importantly, they're perfectly positioned to benefit from the chain-of-thought revolution. While others are still figuring out how to make AI work in the real world, Palantir already has the plumbing in place.

Now, let's talk risks because I've been around long enough to know nothing is a sure bet.

Competition is fierce - Microsoft, Google, and an army of well-funded startups are all fighting for a piece of the pie. The valuation is steep, and any slowdown in growth could hit the stock hard.

But here's what keeps me bullish: Unlike companies building the AI models themselves (which become commoditized quickly), Palantir operates on the application layer.

They're not selling picks and shovels during the gold rush - they're building the entire mining infrastructure.

Think about it this way: When I was learning to code in the early days of the internet, we were writing basic HTML.

Today, my kid who beat me at Go is creating AI agents that can write their own code. That's the kind of exponential progress we're seeing, and Palantir is right at the center of it.

At its current valuation, Palantir might look scary. But remember what happened when we doubted Tesla's (TSLA) valuation? Sometimes, the market prices in the future before most investors can see it.

Just like AlphaGo's "move 37" seemed crazy until it proved brilliant, investing in Palantir at these levels might seem nuts to some.

But when you understand the technological revolution happening under the surface - this chain-of-thought AI breakthrough combined with reinforcement learning - the potential becomes clear.

Just like in Go, sometimes the winning move in investing isn't the obvious one.

And right now, while others are still learning the rules of the AI game, I'm putting my money where my mouth is and making my move with Palantir on dips.

Mad Hedge Technology Letter

February 10, 2025

Fiat Lux

Featured Trade:

(SILICON VALLEY GHOST CITY)

(AMZN), (GOOGL), (MSFT), (DEEPSEEK)

This AI infrastructure build-out is starting to smell more and more like the Chinese ghost city phenomenon.

Yeh, I said it.

It is starting to feel more like that type of “growth”, and that is not good for the future of tech stocks.

If the AI build-out becomes something trending closer to a Chinese ghost city, then we can expect a sharp pullback in tech stocks.

When that abrupt pullback will be is the hard question to answer, but each day we inch closer to that scenario.

There are 65 million empty homes in China that were built by developers and registered as “growth.” This type of parallel growth or paper growth can’t be ignored, and the concrete producers and wiring folks made large fortunes off that whole racket.

Sam Altman, head of OpenAI, is starting to seem more like one of these construction contractors selling 65 million appliances and calling it a success while the apartments are unused and investors get fleeced.

Wasteful spending by corporations swept into the dustbin of history. Looks more like it by the day.

When tech managers are asked about the specific numbers about what kind of revenue we can expect from the AI investment, they tell us to “spend now and ask questions later.”

That is a massive red flag, and I am calling out the whole movement now.

That being said, I bought the dip in mid-January on the Deepseek news, and I am riding that technical reversion to profits as it stands.

If there are no short-term pullbacks, we will end the month up over 15% YTD.

Meta (META), Microsoft (MSFT), Amazon (AMZN), and Google parent Alphabet (GOOGL) are expecting to spend a cumulative $325 billion in capital expenditures and investments in 2025, driven by a continued commitment to building out artificial intelligence infrastructure.

Taken together, this marks a 46% increase from the roughly $223 billion those companies reported spending in 2024.

The Chinese startup Deepseek rattled markets last week after it debuted open-source AI models competitive with OpenAI’s for a fraction of the price. Tech stocks sold off across the board as the model cast doubt on the rationale behind tech giants’ mammoth spending on artificial intelligence infrastructure.

But the DeepSeek surprise didn't seem to impact tech companies' big spending plans.

Amazon is by far the biggest spender on capital investments of the group, with its $78 billion for 2024 far eclipsing Microsoft's $56 billion and Alphabet's $53 billion.

Looking ahead, Amazon said in a post-earnings call Thursday evening that its spending of $26.3 billion in its most recent quarter is "reasonably representative" of its 2025 investment plans, suggesting investments will total roughly $105 billion this year.

Late last month, Meta confirmed that it would spend $60 billion-$65 billion in 2025, a massive bump from its prior guidance to investors of $38 billion-$40 billion in investment for the year.

Google said on Tuesday that it expects to spend $75 billion this year.

In the short-term, I expect earnings reports to be met with a selloff producing optimal buying opportunities.

These dips are bought by traders then take profits – rinse and repeat.

It’s not guaranteed that tech will go up in a straight line, so it’s better to use the volatility in your favor for some profits.

“The goal of auditing the Social Security Administration is to stop the extreme levels of fraud taking place, so that it remains solvent and protects the social security checks of honest Americans! That’s it. That’s the goal. End of story.” – Said Elon Musk

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.