When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

(EUROPE FORMS A COALITION WHILE TRUMP WAGES WAR WITH TARIFFS)

March 5, 2025

Hello everyone

GEOPOLITICS CORNER

President Zelensky meets the King at Sandringham in the U.K.

EUROPE TAKES THE REINS

British Prime Minister Keir Starmer says the UK, France, and Ukraine will devise a peace plan to end the conflict. Many European nations have vowed to join a coalition willing to help Ukraine. Member states also promised to continue supplying arms to Ukraine during the war and to provide military equipment afterward to ensure the country can defend itself in the event of further Russian aggression.

European Commission president Ursula von der Leyen said she planned to inform EU member states of her plans to strengthen the continent’s defence industry and military capabilities.

The European Commission president has stated that “lasting peace can only be built on strength, and strength begins with strengthening ourselves.”

Following the crisis summit on Sunday, French President Emmanuel Macron said that France and Britain were proposing a one-month truce in Ukraine “in the air, at sea and on energy infrastructure”, although not, initially at least, covering ground fighting.

Even our Australian Prime Minister, Anthony Albanese, has stated that he is open to Australian troops joining a Ukrainian peacekeeping coalition.

Mr Zelensky told journalists shortly before departing Britain that “it will be a failure for everyone if Ukraine is forced into a ceasefire without serious security guarantees.”

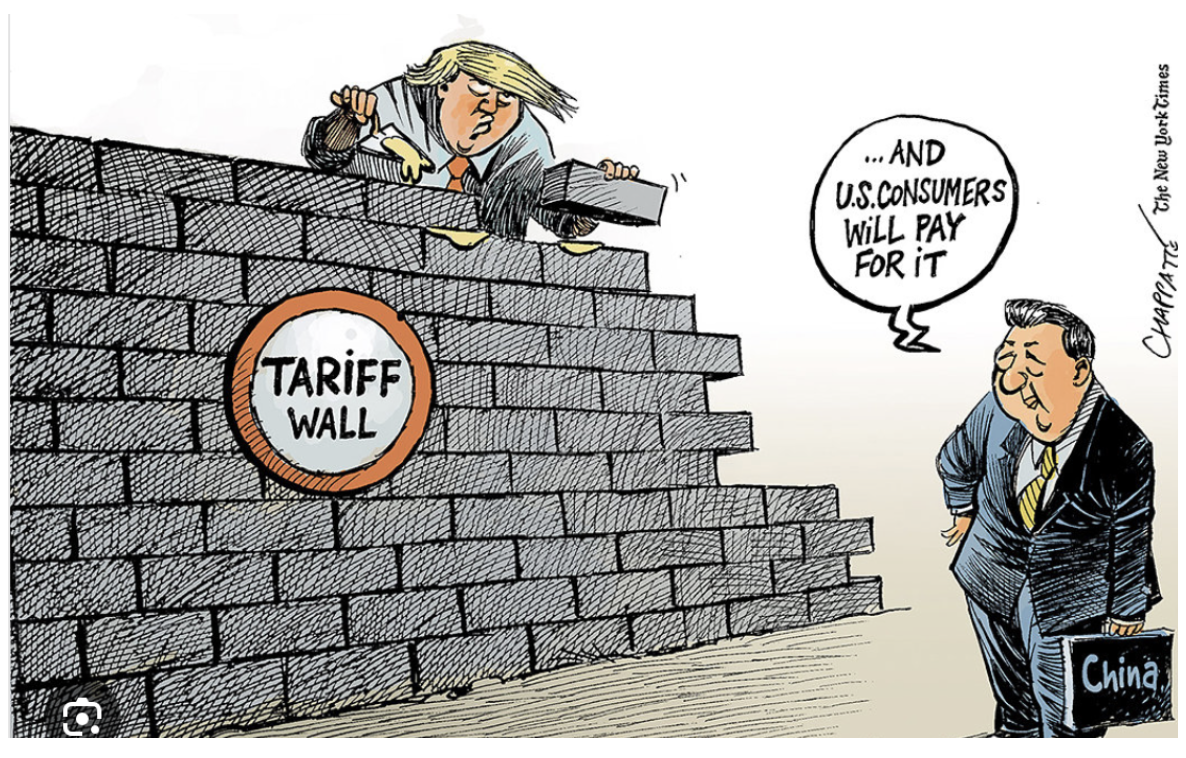

TARIFF TRADE WAR

The Trump tariffs will create victims across the world if he continues to escalate the trade war with China.

Mark Carney, the Bank of England’s governor, has warned that a trade war could cut US growth by as much as five percent, twice that of the rest of the world. But Trump does not seem to care about the disproportionate damage that the tariffs are expected to do to the US or that there could be severe unforeseen consequences.

Trump’s electoral success was partially a result of his “America First” rhetoric: Sticking up for the workers who lost their jobs when industries such as manufacturing or mining either moved abroad or became obsolete.

Globalization hasn’t been fair: it has delivered prosperity to an increasingly small few rather than to everybody. But tariffs on imports will mean higher prices for everybody, consumers and businesses alike.

The International Monetary Fund (IMF) stated on Monday that if Trump escalates the trade war with China, the US will be “especially vulnerable.” Americans will lose jobs and have to pay more for items ranging from food to electronics, and international businesses that have positioned themselves as vital cogs in the global supply will be put at risk.

To pursue policies that hurt communities that have already suffered is simply perverse. Everyone gets hurt in trade wars, but ordinary citizens get hurt more than most.

Today, China has retaliated with additional tariffs of up to 15% on some U.S. goods, from March 10.

Canada has also fired back with potential tariffs on US imports. The Canadian Prime Minister, Trudeau, has indicated that should American tariffs come into effect on Tuesday, Canada will, effective 12.01 a.m. EST tomorrow, respond with 25 percent tariffs against $155 billion of American goods. In addition, Trudeau stated that there would be a discussion with the provinces and territories to pursue several non-tariff measures.

I wonder if Mr Trump considered how these sweeping levies will affect supply chains for key sectors like cars and construction materials. Supply chains could be effectively choked, risking a hike in consumer prices.

This fact could indeed mess with Mr Trump’s effort to fulfil his campaign promises of lowering the cost of living for households.

It’s also recently come to light that tariffs on agricultural imports would come into effect on April 2.

While U.S. stocks declined yesterday, Europe’s defence stocks surged in the wake of renewed talks over the fate of the Russia Ukraine war, with BAE Systems, Thales, and Rheinmetall rallying as leaders met for crisis talks about the conflict.

QI CORNER

SOMETHING TO THINK ABOUT

Cheers

Jacquie

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 5, 2025

Fiat Lux

Featured Trade:

(I HAVE A NEW OPENING FOR THE MAD HEDGE FUND TRADER CONCIERGE SERVICE),

(TESTIMONIAL)

Mad Hedge Biotech and Healthcare Letter

March 4, 2025

Fiat Lux

Featured Trade:

(A PHARMA GIANT BUILT FOR THE LONG HAUL)

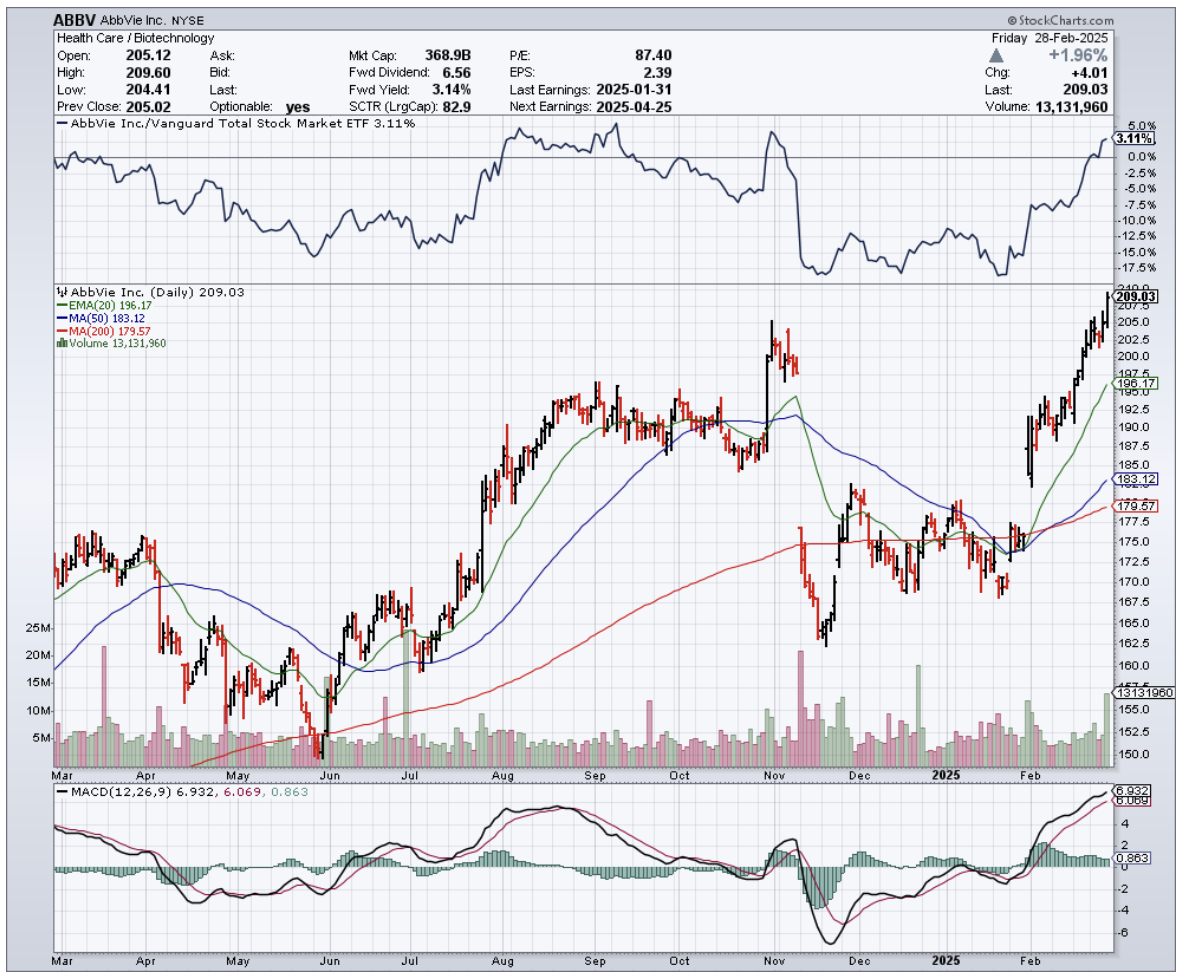

(ABBV)

I was sitting in my 1946 Ercoupe at the Nevada airfield last weekend, waiting for clearance to take off for a quick joy flight, when my phone buzzed with a text from a longtime Concierge client.

"What's the deal with AbbVie (ABBV)?" he wanted to know. "Is it worth adding to my portfolio now?"

The timing was perfect. I'd just spent the previous evening poring over AbbVie's financials while sipping a particularly good Napa Cabernet I'd picked up at an estate sale for $15 (retail: $95).

There's something about the methodical drone of analyzing pharmaceutical company balance sheets that pairs beautifully with a rich red wine.

With a market cap north of $340 billion, AbbVie isn't exactly flying under anyone's radar.

But what fascinates me about this pharmaceutical behemoth is how it's managed to construct a business that's both defensively positioned and aggressively growing. It's like finding a Sherman tank that can also win drag races.

Let's dissect this beast, shall we?

Half of AbbVie's revenue comes from its immunology portfolio. The rest flows from neuroscience, oncology, and—here's where it gets interesting—aesthetics. This diversity isn't just window dressing; it's strategic positioning in markets growing far faster than inflation or GDP.

Take the immunology market, which analysts project will deliver a 10.2% CAGR over the next decade. That's the kind of growth that makes central bankers nervous and investors giddy.

AbbVie dominates this space with Rinvoq, Skyrizi, and the now-patent-expired but still lucrative Humira.

Speaking of Humira, it's worth noting what happened when this superstar drug lost patent protection in 2023.

After nearly two decades of market dominance, Humira finally faced the onslaught of biosimilars (think generic drugs, but for biologic medications).

Most pharmaceutical companies would have curled into the fetal position watching their golden goose get plucked. But AbbVie had been preparing, transitioning patients to newer offerings like Rinvoq and Skyrizi.

How well did that strategy work? These two upstarts now command a jaw-dropping 50% market share in inflammatory bowel disease indications.

If you've ever had to overcome entrenched competition in a market, you'll appreciate just how remarkable that achievement is.

Then there's neuroscience, where AbbVie's footprint includes Botox (not just for smoothing frown lines, folks), Qulipta, and Ubrelvy.

This Central Nervous System therapeutics market is projected to grow at 10.5% annually through 2030. Again, that's the kind of growth that makes you sit up straight in your ergonomic office chair.

The oncology space is a bit more challenging for AbbVie, with other pharmaceutical giants claiming larger market shares.

Still, AbbVie managed 10.8% revenue growth in oncology for 2024. Not too shabby for a supposedly "smaller player."

But the real head-turner is aesthetics medicine, projected to grow at a blistering 12.8% CAGR through 2030.

AbbVie isn't just participating here – it's dominating with Botox and Juvéderm holding 60% and 40% market shares in the U.S. toxins segment, respectively.

I remember speaking with a plastic surgeon at a conference in New York last year who told me, "When someone walks in asking for 'Botox,' it's like when people ask for a 'Kleenex' instead of a tissue. The brand has become the generic term."

That's market penetration you simply can't buy with advertising.

AbbVie's growth strategy is two-pronged: aggressive R&D investment (which increased from 13.44% to 15.22% of revenue year-over-year) and strategic acquisitions.

The company maintains a robust pipeline of new products, with several in late-stage FDA approval processes. They're also not too proud to partner with other pharmaceutical companies to develop new offerings—a pragmatic approach I've always admired in business leaders.

For income-focused investors, AbbVie offers a particularly compelling story.

The company just declared a $1.64 quarterly dividend per share, translating to a 3.4% forward yield.

More impressively, AbbVie is a member of the S&P Dividend Aristocrats Index, meaning it has increased its dividend annually for at least 25 consecutive years.

Is AbbVie financially strong enough to maintain this dividend streak while funding growth? With over $7 billion in cash and moderate leverage, all signs point to yes.

The company's stellar profitability provides additional confidence, despite slightly higher R&D expenses eating into operating margins.

The latest quarterly earnings release should put any remaining doubts to rest, with Q4 year-over-year revenue growth accelerating to 5.6%—significantly better than previous quarters—and a slight improvement in gross margin.

Of course, no investment comes without risks.

Competition in pharmaceuticals is brutal, with both innovative giants and generic producers constantly nipping at AbbVie's heels.

The rapid decline in Humira revenue following patent expiration serves as a stark reminder of how quickly fortunes can change. While the company has successfully navigated this transition, there's no guarantee it will repeat this feat with future patent expirations.

Manufacturing complexity and supply chain vulnerabilities also present risks, though these aren't unique to AbbVie.

Perhaps more concerning is the political and regulatory uncertainty following Donald Trump's return to the White House, including potential trade wars and controversial appointments like vaccine critic Robert F. Kennedy Jr.

Despite these risks, AbbVie presents an exceptionally attractive combination of growth potential and income generation.

The company's diversified business mix, strong positions in growing markets, aggressive growth strategy, and shareholder-friendly capital allocation make it a compelling addition to almost any portfolio.

As I finally got clearance and my little Ercoupe lifted off the Nevada runway, I texted my Concierge client back: "ABBV is a buy on the dip. Rock-solid business with growth. Don't overthink this one."

One of the benefits of our Mad Hedge Concierge service is exactly this kind of real-time market guidance—though most questions don't catch me mid-takeoff.

Sometimes the best investment ideas aren't the most exotic or revolutionary. Sometimes they're just exceptionally well-run businesses selling products people need, returning value to shareholders, and positioned in growing markets.

AbbVie checks all of these boxes with room to spare.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

March 4, 2025

Fiat Lux

Featured Trade:

(A BUY WRITE PRIMER),

(AAPL), (AMZN), (GOOGL)

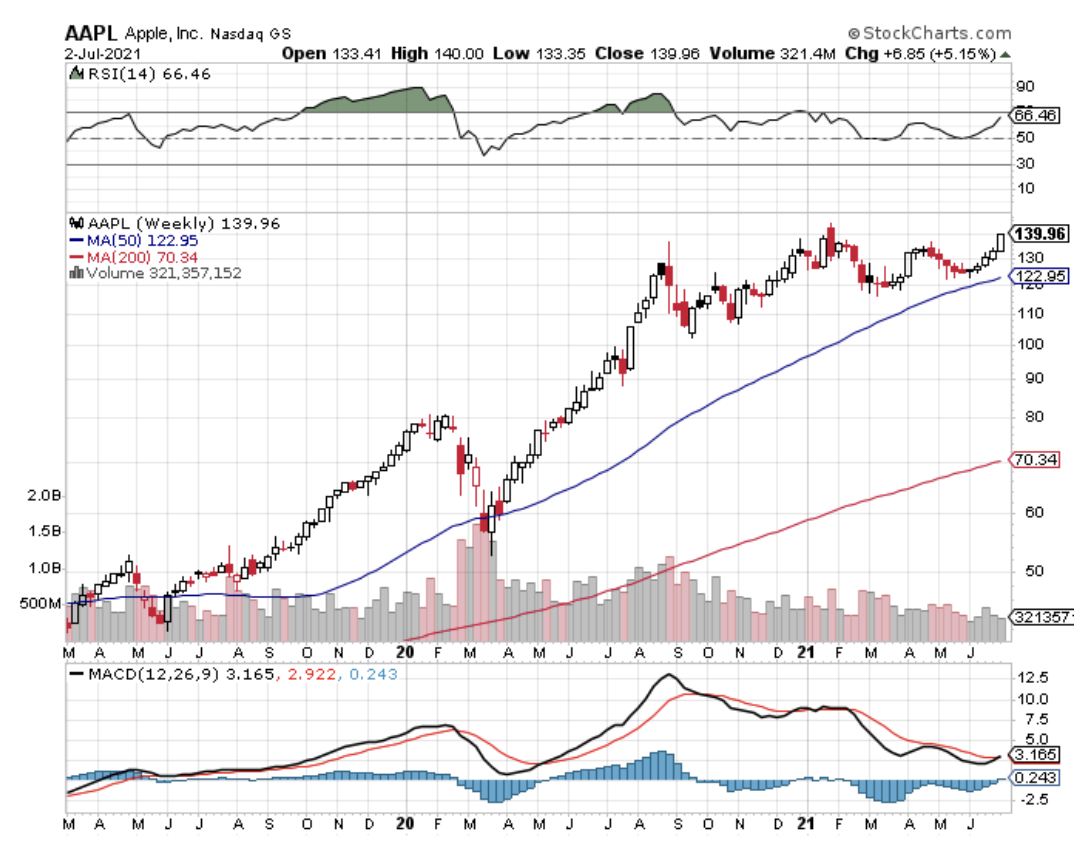

With both market technical and fundamentals going to hell in a handbasket, it’s time to take a refresher course on “Buy Writes.”

I have advised followers to dump the positions they are dating and only keep the ones they are married to. It’s worth enduring a 30% drawdown in a high-quality name to capture a 300% profit over the long term.

If you sell an Amazon (AMZN) or Alphabet (GOOGL) now, I guarantee you that you’re not going to be able to buy them back at the bottom. For a start, when these do bottom out, the universal advice is to sell them because the world is ending….again.

There is always a way to make money in the stock market. Get the direction right, and the rest is a piece of cake.

But what if the market is going nowhere, trapped in a range, with falling volatility? Yes, there is even a low risk, high return way to make money into this kind of market, a lot like the one we have now.

And that’s the way markets work. It’s like watching a bouncing ball, with each successive bounce shorter than the previous one. Thank Leonardo Fibonacci for this discovery (click here for details).

Which means a change in trading strategy is in order. The free lunch is over. It’s finally time to start working for your money.

When you’re trading off a decade low its pedal to the metal, full firewall forward, full speed ahead, damn the torpedoes. Your positions are so aggressive and leveraged that you can’t sleep at night.

Some four years into the bull market, not so much. It’s time to adjust your trades for a new type of market that continues to appreciate, but at a slower rate and not as much.

Enter the Buy Write.

A buy write is a combination of positions where you buy a stock and also sell short options on the same stock against the shares at a higher price, usually on a one-to-one basis.

“Writing” is another term for selling short in the options world because you are, in effect, entering into a binding contract. When you sell short option, you are paid the premium and the buyer pays, and the cash sits in your brokerage account, accruing interest.

If the stock rallies, remains the same price, or rises just short of the strike price you sold short, you get to keep the entire premium.

Most buy writes take place in front month options, and the strike prices are 5% or 10% above the current share price. I’ll give you an example.

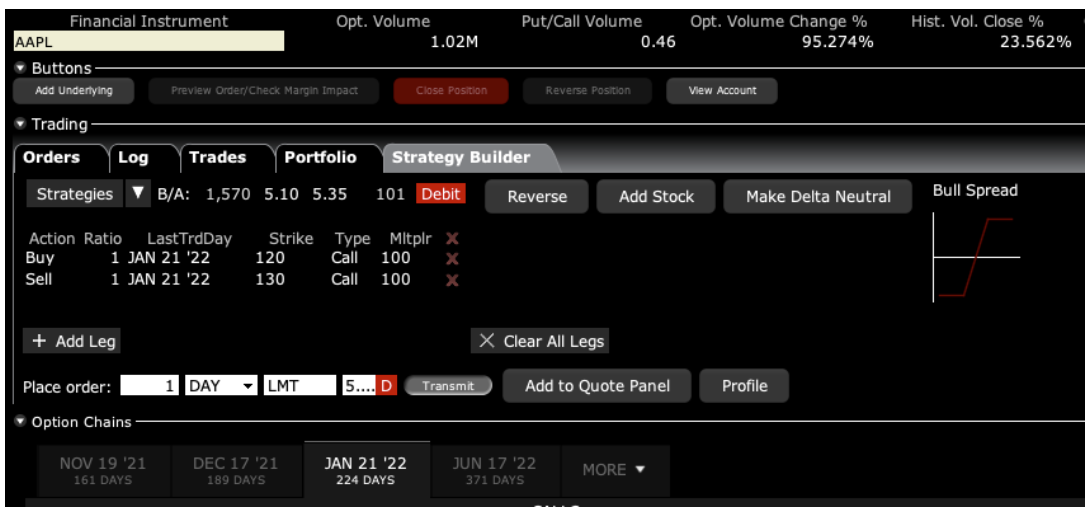

Let’s say you own 100 shares of Apple (AAPL) at $140. You can sell short one August 2021 $150 call for $1.47. You will receive the premium of $147.00 ($1.47 X 100 shares per option). Remember, one option contract is exercisable into 100 shares.

As long as Apple shares close under $150 at the August 20 option expiration, you get to keep the entire premium. If Apple closes over $150, you automatically become short 100 Apple shares. Then, you simply instruct your broker to cover your short in the shares with the 100 Apple shares you already have in your account.

Buy writes accomplish several things. They reduce your risk, pare back the volatility of your portfolio, and bring in extra income. Do these write, and it will enhance the overall performance of your portfolio.

Knowing when to strap these babies on is key. If the market is going straight up, you don’t want to touch buy writes with a ten-foot pole as your stock will be called away, and you will miss substantial upside.

It’s preferable to skip dividend-paying months, usually March, June, September, and December, to avoid your short option getting called away mid-month by a hedge fund trying to get the dividend on the cheap.

You don’t want to engage in buy writes in bear markets. Whatever you take in with option premium, it will be more than offset by losses on your long stock position. You’re better off just dumping the stock instead.

Now comes the fun part. As usual, there are many ways to skin a cat.

Let’s say that you are a cautious sort. Instead of selling short the $150 strike, you can sell the $155 strike for less money. That would bring in $79 per option. But your risk of a call away drops, too.

You can also go much further out in your expiration date to bring in more money. If you go out to the January 18, 2022, expiration, you will take in a hefty $6.67 in option premium, or $667 per option. However, the likelihood of Apple rising above $150 and triggering a call away by then is far greater.

Let’s say you are a particularly aggressive trader. You can double your buy-write income by doubling your option short sales at the ratio of 2:1. However, if Apple closes above $150 by expiration day, you will be naked short 100 shares of Apple.

It is likely you won’t have enough cash in your account to meet the margin call for selling short 100 shares of Apple, so you will have to buy the shares in the market immediately. It is something better left to professionals.

How about if you are a hedge fund trader with a 24-hour trading desk, a good in-house research department, and serious risk control? Then you can entertain “at-the-money buy writes.”

In the case of Apple, you could buy shares and sell short the August 20 $140 calls against them for $4.45 and potentially take in $4.45 for each 100 Apple shares you own. Then, you make a decent profit if Apple remains unchanged or goes up less than $4.45.

That amounts to a $3.18% return in 34 trading days and annualizes out at 26%. In bull markets, hedge funds execute these all day long, but they have the infrastructure to manage the position. It’s better than a poke in the eye with a sharp stick.

There are other ways to set up buy wrights.

Instead of buying stock, you can establish your long position with another call option. These are called “vertical bull call debit spreads” and are a regular feature of the Mad Hedge Trade Alert Service. “The “vertical” refers to strike prices lined up above each other. The “debit” means you have to pay cash for the position instead of getting paid for it.

How about if you are a cheapskate and want to get into a position for free? Buy one call option and sell short two call options against it for no cost. The downside is that you go naked short if the strike rises above the short strike price, again triggering a margin call.

Here is my favorite, which I regularly execute in my own personal trading account. Buy long-term LEAPS (Long Term Equity Anticipation Securities) spreads like I recommended three weeks ago with the (AAPL) January 21 $120-$130 vertical bull call spread for $5.20.

On Friday, it closed at $7.21, up 38.65%.

This is a bet that one of the world’s fastest-growing companies will see its share unchanged or higher in seven months. In Q1, Apple’s earnings grew by an astonishing 35% to $23.6 billion. Sounds like a total no-brainer, right?

If I run this position all the way to expiration, and I probably will, the total return will be ($10.00 - $5.20 = $4.80), or ($4.80/$5.20 = 92.31%) by the January 21, 2022, option expiration. This particular expiration benefits from the year-end window dressing surge and the New Year asset allocation into equities.

Whenever we have a big up month in the market, I sell short front-month options against it. In this case, that is the August 20 $150 calls. This takes advantage of the accelerated time decay you get in the final month of the life of an option, while the time decay on your long-dated long position is minimal.

Keep in mind that the deltas on LEAPS are very low, usually around 10%, because they are so long-dated. That means your front month short should only be 10% of the number of shares owned through your LEAPS in order to stay delta-neutral. Otherwise, you might get hit with a margin call you can’t meet.

After doing this for 53 years, it is my experience that this is the best risk/reward options positions available in the market.

To make more than 92.31% in seven months, you have to take insane amounts of risk or engage in another profession, like becoming a rock star, drug dealer, or Bitcoin miner.

I’m sure you’d rather stick to options trading, so good luck with LEAPS.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.