When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

When John identifies a strategic exit point, he will send you an alert with specific trade information on what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

May 5, 2025

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD or EXPENSIVE AGAIN),

(SPY), (TSLA), (MSTR), (NVDA), (NFLX), (SPY), (GLD)

We certainly are having to work hard for our crust of bread in the stock market this year. April brought us the fastest downturn in stocks in 16 years, immediately followed by the sharpest upturn in 21 years.

It's like running for a treadmill heart test, but a sadistic doctor keeps raising the angle of incline.

Still, I was able to deliver the best trading profits since December 2023, up 14.57%. The harder I work, the luckier I get. Buying when everyone else is throwing up on their shoes is certainly a winning strategy, proven yet again.

The truly disappointing thing about this rally is that it has made stocks expensive once again. In valuation terms, we are now back at February’s peak earnings multiple of 22X for the S&P 500, up from 18X a month ago. This is happening because the growth rate of earnings is falling while share prices are rising.

We are now facing record-high share prices in an economy going into a recession, DOGE cutting chunks of government spending, with rising unemployment and inflation, and a budget deficit for 2025 that is likely to hit $4-$5 trillion.

It doesn’t sound like a great bargain to me. Maybe that’s why only 26% of investors are currently bullish.

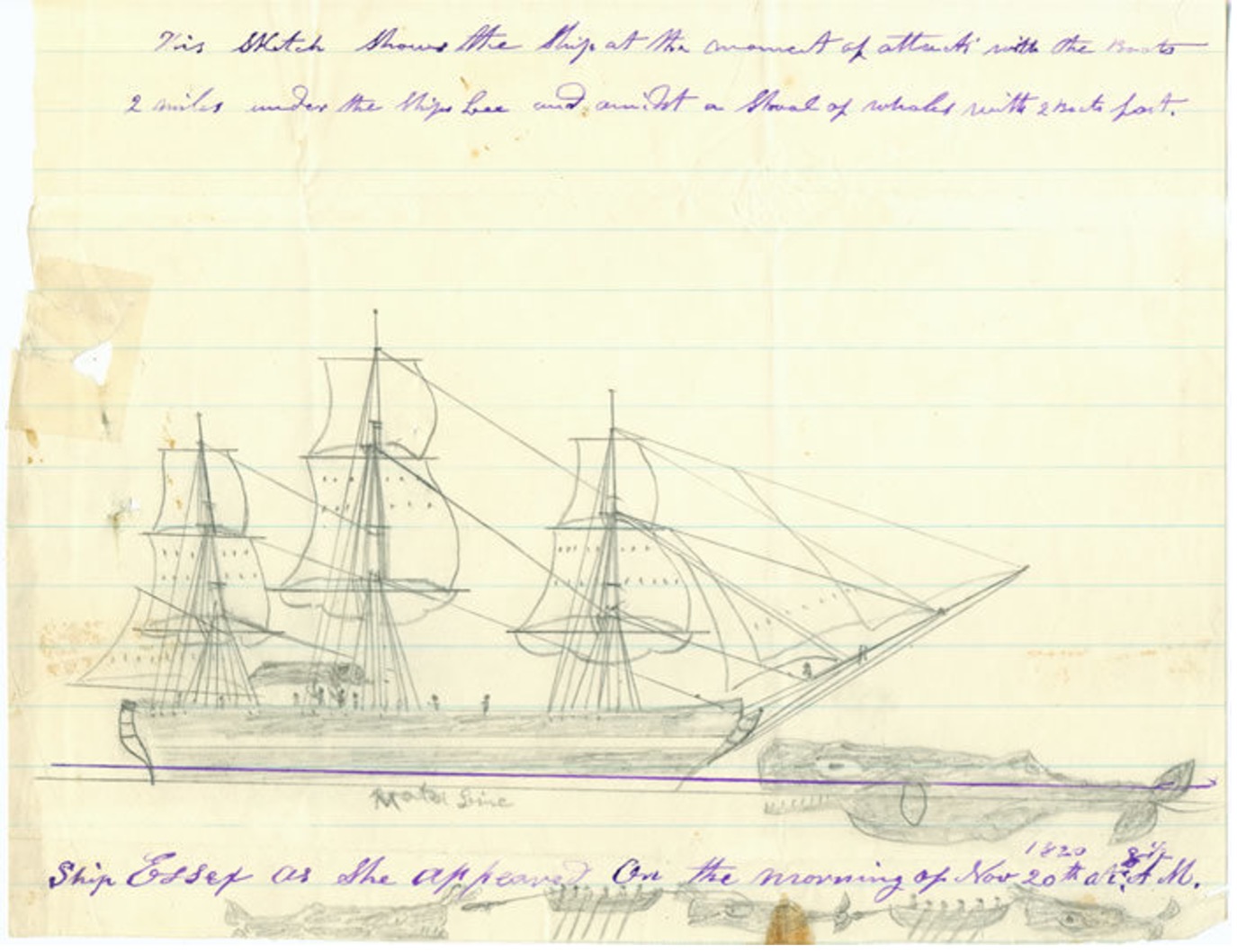

We are in fact now at the top of a $4,800-$5,800 range while also bumping up against a solid ceiling at the 200-day moving average. If this bothers anyone, please raise your hand.

Looking at the grim, almost apocalyptic data that is marching our way, I think we are much more likely to next hit an earnings multiple of 16X than 23X. There are a lot of great shorts out there right now, but being up 28.45% so far this year, I am being very cautious when to pull the trigger.

One of the countless fascinating experiences in my life was spending a summer living with a Nazi family in West Berlin in 1968. There was a huge housing shortage in Berlin at the time, and I had to take what I could get. Besides, the apple strudel for dessert was fantastic.

And even though WWII had been over for 23 years, they never shed their extremist political beliefs. Over many dinner discussions I was exposed to the full Nazi philosophy. However, they loved Americans, as it were, they who saved them from the Bolsheviks in 1945.

You know, whenever you get a shot, the nurse always squeezes a little bit of the liquid out of the needle first before sticking it into your arm? This is to prevent an air bubble from getting into your heart, creating an airlock, and stopping it dead. One of the many torments the German Gestapo used to inflict on prisoners was to inject them with air bubbles. Then it was just a matter of minutes before the prisoner died or had a stroke.

I mention all of this because the US economy has just been injected with a big air bubble. If you’re looking for a recession, you can see it with a good set of binoculars off the California coast.

I’m watching the movement of this air bubble on a daily basis.

First, there were the prices for an eastbound 40-foot container shipped from China to the US, down from $8,000 to as low as $1,500 each. About 60 very large container ships carrying 1.2 million containers have gone missing.

Then there is congestion at the Port of Los Angeles, where 200 ships are stranded offshore, unable to unload. Truck drivers are now getting laid off because importers can’t afford to pay the 145% tariffs and are abandoning them, clogging warehouses. Store shelves will start to go bare from mid-May onward, with discount electronics going first.

Any positive growth we see in Q1 will be the result of a rush of post-election over-ordering to front-run the Trump tariffs. That creates a big air bubble in the system for Q2 and onward, maybe for years, even if the trade war ends tomorrow. That’s because shutting down and then restarting a massively complex international trade network takes at least a year.

It certainly was a confusing week for economic data. We saw a succession of very weak employment reports from the ADP Private Employment Report, JOLTS Jobs Openings, and Weekly Jobless Claims, which one might expect from trade war-induced economic collapse. Then, out of the blue, we got a somewhat respectable April Nonfarm Payroll Report at 177,000. Something in these disparate things does not compute.

We haplessly slogging away in the economic forecasting industry are constantly thwarted by constantly conflicting data. You’re probably all sick of hearing the words “on the one hand” and “on the other hand.” But could the unimaginable be happening? One thing I know for sure. You are definitely not going to see strong employment figures for health care (51,000) and Transportation and Warehousing (29,000) in May that we saw in April, once the trade war really starts to bite.

It’s not just the jobs figures that are going haywire. You can count on ALL economic data to be disrupted for at least the next year as the trade war unfolds, retreats, and does whatever it is going to do. It all makes my job so much harder. But then, I always love a challenge.

You may have noticed that I have started making a lot of money from Bitcoin plays like MicroStrategy (MSTR). This is not because I have suddenly become a died in the wool crypto acolyte, a mindless true believer, a guzzler of the Kool-Aid at every opportunity. I firmly believe that Bitcoin has another 95% decline ahead of it sometime in the future and that it is nothing more than a Ponzi scheme.

As I watch the many crypto “experts” wax lyrical about their $1 million upside targets, I can’t help but notice that most aren’t even old enough to be my grandchildren. The president has recently pardoned several crypto robber barons convicted of looting customer accounts of billions of dollars. Another term for “anti-regulation” is “pro-stealing.” The SEC has morphed from securities regulation to crypto promotion.

Nevertheless, I DO know what a chart is, downside support and upside resistance, and above all, euphoria and momentum. All of these started screaming “BUY” at me three weeks ago, and I started picking up crypto play with both, and if not three. I merely did what Mr. Market was begging me to notice.

Yes, sometimes even I have to trade charts for a living. But it is definitely a position I am only dating, not marrying. I’ll only be in crypto as long as there are more buyers than sellers and the suckers keep being born. I have a feeling that, at the end of the day, all crypto has really done is to pay for some very expensive parties in Miami and Dubai.

As far as I’m concerned, I’m hoping for the stroke and not the heart attack.

My April performance closed out at a spectacular +14.57%. That takes us to a year-to-date profit of +28.40% so far in 2025. My trailing one-year return stands at a spectacular +89.79%. That takes my average annualized return to +50.61% and my performance since inception to +780.29%, a new all-time high.

It has been another wild week in the market, with the stock market up every day. I used a brief $25 dip in (TSLA) to take profits in my short play there. That leaves me 40% long, with a double position in (MSTR), and longs in (NVDA) and (NFLX). I have 20% short in (SPY) and a “risk off” position in (GLD), and 40% cash. I’m just waiting for this rally to burn out before topping up my shorts, not a bad idea in the wake of the biggest run-up in 21 years.

Some 63 of my 70 round trips in 2023, or 90%, were profitable. Some 74 of 94 trades

were profitable in 2024, and several of those losses were really break-even. That is a success rate of +78.72%.

Try beating that anywhere.

100 Years of S&P 500 Earnings Multiples

My Ten-Year View – A Reassessment

We have to substantially downsize our expectations of equity returns in view of the election outcome. My new American Golden Age, or the next Roaring Twenties, is now looking at multiple gale-force headwinds. The economy will completely stop decarbonizing. Technology innovation will slow. Trade wars will exact a high price. Inflation will return. The Dow Average will rise by 600% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old. My Dow 240,000 target has been pushed back to 2035.

On Monday, May 5, at 8:30 AM EST, the S&P Global Composite PMI is announced.

On Tuesday, May 6, at 3:30 AM, the Balance of Trade is released.

On Wednesday, May 7, at 1:00 PM, the Federal Reserve announces its interest rate decision. No move is expected in the face of a rising inflation rate. A press conference follows at 1:30.

On Thursday, May 8, at 8:30 AM, the Weekly Jobless Claims are disclosed.

On Friday, May 9, at 12:00 PM, the Baker Hughes Rig Count is published.

I’m Always Cautious When Pulling the Trigger

Microsoft Goes Ballistic, with the second 10% move in a month. Indications are that AI spending is continuing unabated, taking the entire tech space up with it.

ISM Manufacturing Index Says the Recession is Here. Economic activity in the manufacturing sector contracted in April for the second month in a row, following a two-month expansion preceded by 26 straight months of contraction, say the nation's supply executives in the latest Manufacturing ISM Report On Business®. Manufacturing in high-cost America has been in a structural decline for three years now and is accelerating to the downside.

US Q1 GDP Crashes in Q1, down 0.3%, thanks to the massive front-running of imports to beat the Trump tariffs. This quarter will certainly be worse as almost all international trade has ceased, giving us a second negative quarter that officially constitutes a recession. A three-quarter recession gives us an S&P 500 of 4,500, four quarters, 4,000.

JOLTS Job Openings Report was Weak in March at 7.1 Million, said the U.S. Bureau of Labor Statistics. Over the month, hires held at 5.4 million, and total separations changed little at 5.1 million. Within separations, quits (3.3 million) were unchanged, and layoffs and discharges (1.6 million) edged down.

Consumer Confidence Collapses, hitting a 15-Year Low, according to the Conference Board. The Index fell to 86 on the month, down a hefty 7.9 points from its prior reading and below the Dow Jones estimate for 87.7. The board’s Expectations Index, which measures how respondents look at the next six months, tumbled to 54.4, a decline of 12.5 points and the lowest reading since October 2011.

New Homes are Now Cheaper than Existing Homes, for the first time. A 30% rise in existing inventories has made the difference. New home builders can more easily discount with free upgrades and offer loan buy-downs. Some 40% of homes on the market have seen price drops, and time on the market is growing.

Weekly Jobless Claims Rocket by 18,000. First-time filings for unemployment insurance totaled a seasonally adjusted 241,000 for the week ended April 26, up 18,000 from the prior period and higher than the estimate for 225,000. Continuing claims, which run a week behind and provide a broader view of layoff trends, rose to 1.92 million, up 83,000 to the highest level since Nov. 13, 2021.

General Motors to take $5 Billion Hit on Tariffs. GM on Thursday lowered its 2025 earnings guidance to include a possible $4 billion to $5 billion impact as a result of President Donald Trump’s auto tariffs. GM said its new guidance includes adjusted EBIT of between $10 billion and $12.5 billion, down from $13.7 billion to $15.7 billion. GM released first quarter results Tuesday that beat Wall Street’s expectations but delayed its investor call and updated guidance details amid expected changes to the auto tariffs.

S&P Case-Shiller National Home Price Index Slows to 3.9% YOY, in February, a sharp slowdown. Home prices are increasingly untenable to potential home buyers. Waning consumer confidence, heightened insecurity over economic uncertainties, and the future of household budgets are impacting the consumer housing market. New York (+7.7%), Chicago (+7.0%), and Cleveland (+6.6%) show the biggest gains, while Tampa showed a (-1.4%) loss. Expect real estate to remain a major drag on the US economy, with mortgage rates at 7.0%.

Bitcoin ETF’s Suck in $3.5 Billion Last Week, as the “Sell America” trade expands. Exchange-traded funds tracking Bitcoin and Ether attracted more than $3.2 billion last week, with the iShares Bitcoin Trust ETF (IBIT) alone seeing a nearly $1.5 billion inflow — the most this year.

Crude Oil Drops on Global Recession Fears. Brent crude futures were down $1.09, or 1.63%, at $65.78 a barrel. West Texas Intermediate crude fell $1.15, or 1.82%, to $61.87 a barrel. The U.S.-China trade war is dominating investor sentiment in moving oil prices, superseding nuclear talks between the U.S. and Iran, and discord within the OPEC+ coalition. Markets have been rocked by conflicting signals from the U.S. over what progress was being made to de-escalate a trade war that threatens to sap global growth.

As for me, by the 1980s, my mother was getting on in years. Fluent in Russian, she managed the CIA’s academic journal library from Silicon Valley, putting everything on microfilm.

That meant managing a team that translated over 1,000 monthly publications on topics as obscure as Arctic plankton, deep space phenomena, and advanced mathematics. She often called me to ascertain the value of some of her findings.

But her arthritis was getting to her, and all those trips to Washington, DC were wearing her out. So I offered Mom a job. Write the Thomas family history, no matter how long it took. She worked on it for the rest of her life.

Dad’s side of the family was easy. He was traced to a small village called Monreale above the Sicilian port city of Palermo, famed for its Byzantine church. Employing a local priest, she traced birth and death certificates going all the way back to an orphanage in 1820. It is likely he was a direct illegitimate descendant of Lord Nelson of Trafalgar.

Grandpa fled to the United States when his brother joined the Mafia in 1915. The most interesting thing she learned was that his first job in New York was working for Orville Wright at Wright Aero Engines (click here). That explains my family’s century-long fascination with aviation.

Grandpa became a tail gunner on a biplane in WWI. My dad was a tail gunner on a B-17 flying out of Guadalcanal in WWII. As for me, you’ve all heard plenty of my own flying stories, and there are many more to come.

My Mom’s side of the family was an entirely different story.

Here ancestors first arrived to found Boston, Massachusetts in 1630 during the second Pilgrim wave on a ship called the Pied Cow, steered by Captain Ashley (click here for the link).

I am a direct descendant of two of the Pilgrims executed for witchcraft in the Salem Witch Trials of 1692, Sarah Good and Sarah Osborne, where children’s dreams were accepted as evidence (click here). They were later acquitted.

When the Revolutionary War broke out in 1776, the original Captain John Thomas, whom I am named after, served as George Washington’s quartermaster at Valley Forge, responsible for supplying food to the Continental Army during the winter.

By the time Mom completed her research, she had discovered 17 ancestors who fought in the War for Independence, and she became the West Coast head of the Daughters of the American Revolution. It seems the government still owes us money from that event.

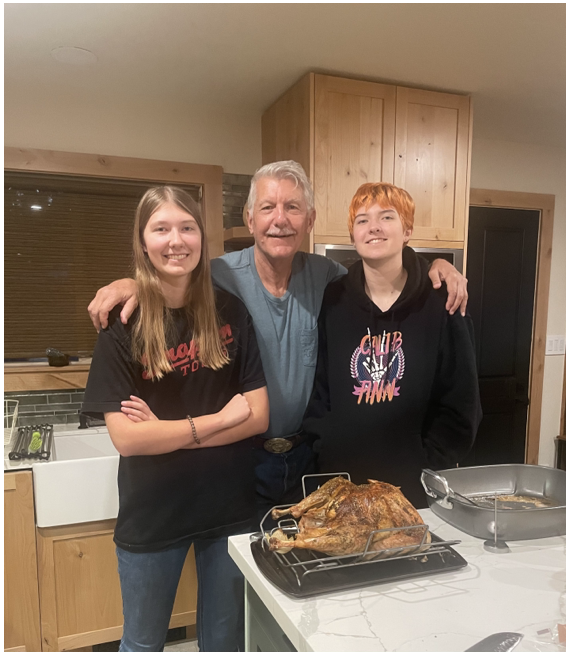

Fast forward to 1820 with the sailing of the whaling ship Essex from Nantucket, Massachusetts, the basis for Herman Melville’s 1851 novel Moby Dick. Our ancestor, a young sailor named Owen Coffin signed on for the two year voyage, and his name “Coffin” appears in Moby Dick seven times.

In the South Pacific, 2,000 miles west of South America, they harpooned a gigantic sperm whale. Enraged, the whale turned around and rammed the ship, sinking it. The men escaped to whale boats. And here is where they made the fatal navigational errors that are taught in many survival courses today.

Captain Pollard could easily have just ridden the westward currents, where they would have ended up in the Marquesas Islands in a few weeks. But these islands were known to be inhabited by cannibals, which the crew greatly feared. They also might have landed in the Pitcairn Islands, where the mutineers from Captain Bligh’s HMS Bounty still lived. So the boats rowed east, exhausting the men.

At day 88, the men were starving and on the edge of death, so they drew lots to see who should live. Owen Coffin drew the black lot and was immediately shot and devoured. The next day, the men were rescued by the HMS Indian within sight of the coast of Chile and returned to Nantucket by the USS Constellation.

Another Thomas ancestor, Lawson Thomas, was on the second whaleboat that was never seen again and presumed lost at sea. For more details about this incredible story, please click here.

When Captain Pollard died in 1870, the neighbors discovered a vast cache of stockpiled food in the attic. He had never recovered from his extended starvation.

Mom eventually traced the family to a French weaver 1,000 years ago. Our name is mentioned in England’s Domesday Book, a listing of all the land ownership in the country published in 1086 (click here for the link). Mom died in 2018 at the age of 88, a very well-educated person.

There are many more stories to tell about my family’s storied past, and I will in future chapters. This week, being Thanksgiving, I thought it appropriate to mention our Pilgrim connection.

I have learned over the years that most Americans have history-making swashbuckling ancestors, but few bother to look.

I did.

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

USS Essex

“I spend more time looking at balance sheets than income statements. Wall Street doesn’t really bother with balance sheets.,” said Oracle of Omaha Warren Buffet.

The marketing landscape is undergoing a seismic shift, driven not by catchy slogans or flashy campaigns alone, but by the silent, powerful force of Artificial Intelligence (AI). Once a futuristic buzzword, AI has firmly established itself as an indispensable tool, transforming how businesses understand, engage, and convert customers. From hyper-personalized experiences to automated content creation and predictive analytics, AI is no longer just an advantage – it's rapidly becoming the baseline for competitive marketing efforts.

Marketing professionals across industries are grappling with an explosion of data and increasingly fragmented customer journeys. AI offers a lifeline, capable of processing vast information streams, identifying subtle patterns, and automating complex tasks at a scale previously unimaginable. As businesses navigate the complexities of the modern digital ecosystem, particularly with the ongoing deprecation of third-party cookies, AI's ability to leverage first-party data and generate actionable insights is proving invaluable.

The Era of Hyper-Personalization at Scale

Perhaps the most profound impact of AI in marketing lies in its ability to deliver true hyper-personalization. Gone are the days of broad demographic targeting. AI algorithms delve deep into individual customer data – analyzing Browse behavior, purchase history, real-time interactions, social media sentiment, and even external factors like seasonality – to understand preferences and predict future needs with startling accuracy.

"AI is moving far beyond basic personalization," notes a report from creative management platform Bannerflow. "Predictive analytics will become the driving force behind hyper-personalized marketing. Rather than reacting to customer actions, AI is set to anticipate their needs before they even realize them."

Streaming giants like Netflix and Spotify exemplify this power. Their AI recommendation engines analyze viewing and listening habits to curate personalized content suggestions – movie artwork might even change based on actors a user prefers – keeping users engaged and significantly boosting retention. Netflix estimates its AI-powered recommendation system saves it $1 billion annually in customer retention costs. Similarly, Starbucks utilizes AI to analyze purchase data, sending personalized offers via its app, driving sales and engagement. Tools like Dynamic Yield, Adobe Target, and OfferFit enable businesses of all sizes to implement real-time adjustments to website experiences, tailor product recommendations, and optimize communication timing based on AI-driven insights. OfferFit even moves beyond traditional A/B testing, using machine learning to continuously refine personalized offers and content variations daily.

AI as a Creative Partner: Content Generation and Optimization

The creative process itself is being reshaped by AI. Generative AI tools, popularized by platforms like OpenAI's ChatGPT and DALL-E, Google's Gemini, and integrated solutions like Jasper, Grammarly, and Buffer's AI Assistant, are empowering marketers to scale content production dramatically. These tools can draft blog posts, generate social media captions, craft email subject lines, write ad copy, create images, develop video scripts, and even compose music.

"Generative AI is expanding beyond text, enabling marketers to create videos, music, 3D visuals, and interactive content effortlessly," explains digital marketing resource WordStream. "With AI tools, marketers can create marketing materials much faster and launch new campaigns with ease."

This isn't about replacing human creativity entirely, but augmenting it. AI handles the heavy lifting – brainstorming ideas based on trends and data, generating initial drafts, repurposing content across platforms, and ensuring SEO optimization – freeing up human marketers to focus on strategy, refining tone, injecting brand voice, and ensuring emotional resonance. A global survey cited by Sprout Social revealed that 42% of marketers used AI tools daily or weekly for content generation in 2024. Furthermore, AI significantly enhances content optimization, analyzing performance data to suggest improvements, A/B testing variations automatically, and ensuring content remains relevant and effective.

However, experts caution against over-reliance. "Relying too heavily on AI-generated content can even foster a sense of inauthenticity amongst your audience," warns Bannerflow, advocating for a hybrid approach that maintains human intuition and emotional connection.

Smarter Segmentation and Targeting in a Cookieless World

AI excels at identifying nuanced customer segments that go far beyond traditional demographics. By analyzing complex behavioral patterns, AI can group customers based on subtle interests, predicted lifetime value, or propensity to churn. This capability is becoming crucial as the digital advertising world grapples with signal loss from the phasing out of third-party cookies.

"With privacy regulations tightening... marketers are turning to first-party data and AI-powered audience segmentation to effectively reach their target audience," notes WordStream. Platforms like HubSpot, Segment, and Klaviyo help manage this first-party data, which AI can then analyze to understand shopping habits, preferred communication channels, and engagement trends without relying on cookies. This allows for more precise targeting and retargeting efforts through platforms like Meta and Google Ads.

Optimizing Ad Spend and Programmatic Power

Programmatic advertising – the automated buying and selling of online ad space – is heavily reliant on AI. AI algorithms drive real-time bidding (RTB), analyze massive datasets to determine the optimal ad placements, and continuously optimize campaigns for better performance and ROI.

"AI allows programmatic advertising to use data to educate itself and measure and optimize ad performance," states Adtelligent, an ad tech company. AI identifies patterns humans might miss, enabling more effective targeting, predicting campaign outcomes, improving budget allocation (with tools like Prescient AI), and enhancing ad fraud detection.

Looking ahead in 2025, industry experts see AI playing an even larger role, particularly in optimizing advertising across expanding channels like Connected TV (CTV), Digital-Out-of-Home (DOOH), programmatic audio (podcasts, streaming music), and in-game advertising. According to Basis Technologies, programmatic video ad spending alone is projected to surpass $110 billion in the US by 2025. Generative AI is also enabling dynamic video ad creation, tailoring commercials in real-time based on viewer data and context.

Enhancing Customer Experience and Service

AI-powered chatbots and virtual assistants are transforming customer service. Available 24/7, they provide instant responses to queries, guide users through processes, qualify leads, and even offer personalized support, as seen with Sephora's AI chatbot on social media. Research firm Gartner predicts chatbots will handle 25% of customer service interactions by 2027.

Beyond direct interaction, AI performs sentiment analysis by monitoring social media channels and online reviews (leveraging tools like Brand24). This allows brands like Coca-Cola to understand public perception in real-time, address concerns quickly, and adapt marketing messages accordingly. By streamlining interactions and providing relevant, timely support, AI significantly enhances the overall customer experience.

Unlocking Insights from Big Data

The sheer volume of data generated by digital marketing activities can be overwhelming. AI provides the analytical power needed to process this data tsunami, uncovering hidden trends, correlations, and actionable insights that would be impossible for human analysts to find alone. AI-powered data visualization tools like Tableau help make these complex insights understandable and actionable for marketing teams. This leads to more accurate measurement of Key Performance Indicators (KPIs), better understanding of campaign effectiveness, and ultimately, improved ROI.

Navigating the Ethical Tightrope and the Human Role

Despite its immense potential, the use of AI in marketing is not without challenges and ethical considerations. Key concerns highlighted by experts at Bird Marketing and contributors on Quora include:

- Data Privacy: AI's reliance on vast amounts of user data raises concerns about consent, potential misuse, data breaches, and compliance with regulations like GDPR and CCPA. Transparency about data collection and usage is paramount.

- Algorithmic Bias: AI models trained on biased data can perpetuate and even amplify societal biases, leading to discriminatory targeting or exclusion of certain groups. Regular audits and diverse training data are crucial mitigations.

- Transparency and Accountability: The "black box" nature of some AI algorithms makes it difficult to understand how decisions are made, raising issues of accountability when errors occur.

- Potential for Manipulation: AI's power to personalize could be used unethically to exploit consumer vulnerabilities or spread misinformation through AI-generated content like deepfakes or fake reviews.

- Human Oversight: While AI automates tasks, human oversight remains critical for strategic direction, ethical judgment, ensuring brand authenticity, and maintaining the "human touch" in customer interactions. Over-automation can lead to impersonal experiences and erode trust.

- Job Displacement: Concerns exist about AI replacing human marketers, highlighting the need for upskilling and focusing on roles that leverage AI as a tool.

Brands prioritizing ethical AI usage, emphasizing transparency, fairness, and data security, are more likely to build long-term customer trust.

The Future is Intelligent and Integrated

The evolution of AI in marketing shows no signs of slowing. Trends shaping the near future include:

- Accelerated Customer Journeys: AI-driven search (like Microsoft's Copilot) and chatbots are creating non-linear paths to purchase, requiring marketers to optimize content for conversational AI experiences.

- Increased Multimodality: AI will become better at understanding and integrating information across different formats simultaneously – text, images, audio, and video – leading to richer insights and interactions.

- Enhanced Search: Optimizing for AI-driven visual search (like Google Lens) and voice search will become increasingly important.

- Smarter Influencer Marketing: AI tools (like CreatorIQ) are helping brands identify ideal influencer partners based on audience data and predict campaign success.

- Focus on Ethical AI: Transparency and responsible AI practices will become larger topics of discussion and crucial differentiators.

Conclusion: Embrace the Algorithm, Wisely

Artificial intelligence is fundamentally rewriting the rules of marketing engagement. It offers unprecedented opportunities for personalization, efficiency, and data-driven decision-making. From anticipating customer needs to crafting compelling content and optimizing ad spend, AI empowers marketers to achieve results previously unattainable.

However, harnessing this power effectively requires more than just adopting new tools. It demands a strategic approach, a commitment to ethical practices, and a recognition that AI works best when augmenting, not replacing, human insight, creativity, and judgment. As AI continues its rapid evolution, marketers who embrace its potential thoughtfully and responsibly will be best positioned to connect with customers, drive growth, and lead the way in this new era of intelligent marketing. The algorithm is ready; the challenge now is for marketers to become skilled co-pilots.

Mad Hedge Technology Letter

May 2, 2025

Fiat Lux

Featured Trade:

(CHINESE CHIP MAKERS CLOSER THAN YOU THINK)

(NVDA), (HUAWEI)

Just the other day, CEO of Nvidia told the media, “China is not behind...This is a country with great capabilities. 50% of the world's best AI researchers are Chinese.”

So it’s not a surprise that Huawei is about to debut a new AI chip and will continue to foray into higher value-added products and stand toe-to-toe with the United States for technological supremacy.

Remember Huawei?

They were brutally banned from installing the best American chip technology, but like a boomerang, they have come back with even more ferocious ambition.

The Huawei chip called the Ascend 910D is still at an early developmental stage, and a series of tests will be needed to assess the chip’s performance.

Huawei hopes that the latest iteration of its Ascend AI processors will be more powerful than Nvidia’s H100.

Huawei has emerged as China’s champion in a technology field where the U.S. remains ahead. The Shenzhen-based company has developed some of the country’s most promising substitutes for Nvidia’s AI chips. It is part of Beijing’s effort to groom a self-sufficient semiconductor industry.

This year, Huawei is poised to ship more than 800,000 Ascend 910B and 910C chips to customers, including state-owned telecommunications carriers and private AI developers such as TikTok parent ByteDance.

Despite manufacturing bottlenecks, Huawei and several Chinese chip firms have already been able to deliver some products comparable to Nvidia chips and are inching closer to Nvidia’s level of expertise.

Old versions of Huawei chips have struggled to live up to their hype. The 910C was marketed to clients as comparable to Nvidia’s H100, but engineers who have used the two chips said Huawei’s performance fell short of its rival.

Huawei faces challenges in producing such chips at a significant scale. It has been cut off from the world’s largest chip foundry, Taiwan Semiconductor Manufacturing. China’s closest alternative, Semiconductor Manufacturing International, is blocked from purchasing the most advanced chip-making equipment.

Even though Chinese chips have been overhyped and fail to deliver, I do believe it is only a matter of time before they reach the same level of Nvidia.

If you remember what the first Chinese smartphones looked like, and compare them to what they are now, and you will understand that once the weight of the government supports these goals, many of them are met.

Just look at another example like EVs, Chinese EVs are some of the top EV products in the world, and they produce them for just a fraction of a Western-made EV.

This trend is here to stay, and with the Chinese government subsidizing the operation to push it over the line, many Western countries will have a hard time beating the Chinese on price and performance.

Silicon Valley innovation has slowed down considerably, and one of the obvious side effects is the Chinese catching up on the latest cutting-edge tech.

Some of this is reflected in the price of Nvidia’s stock, which has zig-zagged sideways for around the year.

Naturally, some of the stock’s weakness has to do with the volatile foreign trade policies, but a big portion of this is Chinese competition in high-end tech products.

There is a chance that we will continue to see this sideways price action in the stock, and at the very minimum, the era of breakaway growth is over for Nvidia.

“Smart people focus on the right things.” – Said CEO of Nvidia Jensen Huang

(SUMMARY OF JOHN’S APRIL 30, 2025 WEBINAR)

May 2, 2025

Hello everyone

TITLE – “The Special Recession Issue”

PERFORMANCE –

MTD = 12.69%

2025 YTD = 26.52%

Since Inception = +776%

Trailing one year return = 84.47%

PORTFOLIO –

Risk On

(MSTR) 5/$220-$230 call spread

(MSTR) 5/$250-$260 call spread

(NFLX) 5/$850-$860 call spread

(JPM) 5/$190-$200 call spread

Risk Off

(SPY) 5/ $570-$580 put spread

(GLD) 5/ $275- $285 call spread

(TSLA) 5/$320-$330 put spread (Profits taken)

METHOD TO MY MADNESS

Market looks through the noise to a trade war solution…

Bonds stabilize after Trump backs off Powell firing.

Markets have entered wide trading ranges with a lot of volatility.

Economic data remains consistently weak, capping any upside in stocks.

Recession call is still on, with China in no hurry to negotiate.

US Dollar hits three-year lows on “Sell America” trade

Oil bounces on Iran war risks.

Gold remains golden at new all-time highs, silver ready to play catch-up.

THE GLOBAL ECONOMY – UNIVERSALLY BAD

Negative 0.3% GDP growth, 4.3% March inflation rate point to stagflation.

Jay Powell hints at no rate cuts this year.

Consumer Confidence dives on tariff fears from 57.0 in March to 52.2 in April.

IMF cuts US GDP forecast for 2025 from 2.8% to 1.8%.

Leading Economic Indicators plunge, down 0.7% to 100.5.

Europe lowers interest rates, down 0.25% to 2.25%.

Unemployment fears hit five year- high.

US Inflation Expectations hits 44 year- high.

STOCKS – ROLLER COASTER

Stock markets suffer worst start to a year in history, but still expensive.

Morgan Stanley marks down (SPX) earnings, from $270 to $257 per share.

The Volatility Index ($VIX) spikes to $54.

All Capital gains of the last 13 months wiped out at market lows.

Chaos reigns supreme, with the (SPX) dropping 20% at the lows.

Hedge Funds are still dumping technology stocks, as they still command big premiums to the main market.

Tech leads the downturn on every selloff.

All long-term technical indicators have rolled over, meaning that the bear market could continue until summer at the earliest and next year at the latest.

2025 will be a down year for stocks.

John is looking to buy gold and banking stocks.

Vistra (VST) long term hold.

BONDS – STABILIZING

Foreign Central Banks selling US Treasury Bonds and buying Treasury bills.

Treasury discussed banning sales of bonds by foreign investors or hitting T-bills with withholding taxes.

With Bonds suffering their worst selloff in 25 years no one is rushing back in.

Continuing collapse of the US dollar is keeping away bond investors.

Bond Credit Quality is crashing, as recessions lead to more defaults.

Avoid (TLT), (JNK), (NLY), (SLRN) and REITS.

FOREIGN CURRENCIES

US dollar hits three year low, as the flight from America trade accelerates.

Rising rates didn’t provide any help, meaning the weakness is structural.

15 years of long dollar positions are unwinding.

The Trump economy is forcing investors to flee all US assets, including stocks and currency.

Massive cash flight is running away from the US and into Europe and China.

Buy (FXA), (FXE), (FXB), (FXC), and (FXY).

ENERGY & COMMODITIES – Crash!

Oil crashes down an amazing $13 or down 18% in a week, from $72 to $59.

High dividend paying (XOM) has collapsed by 18%.

It is the sharpest fall in Texas tea prices since the 1991 Gulf War.

Recession fears are running rampant, and no one wants to pay for storage until a recovery which may be years off.

Sell all energy rallies.

A global recession is looming large.

Avoid all energy plays like the plague.

PRECIOUS METALS – Taking a Break

JP Morgan targets Gold at $4000 in Q2, as the “Sell America” trade gathers steam.

Gold tops $3,424, the 1980 inflation adjusted all-time high.

Interest rates seem to be no longer a factor in the gold trading, losing the opportunity cost.

Gold sees first $100 up day in history.

Natural profit taking takes gold back 5%.

Central bank buying and Chinese savings demand continues unabated with China devaluing its currency.

Keep buying all (GLD) metal dips.

REAL ESTATE – Gone Quiet

New Home Sales Jump in March. The median price of a new home sold is down 7.5% YOY thanks to greater demand for lower priced homes. Interest rates delivered a short-term dip in March which they gave back in April.

Existing Homes Sales hit 16 year low.

Sales of previously owned U.S. homes fell 5.9% in March to an annualized rate of 4.02 million, the weakest March since 2009.

The median sales price increased 2.7% from a year ago to $403,700, a record for the month of March and extending a run of year-over-year price gains dating back to mid-2020.

Weekly mortgage demand has plunged 13%.

THE WRAP

Stocks – sell rallies

Bonds – stand aside

Commodities – stand aside

Currencies – buy dips

Precious Metals – buy dips

Energy – stand aside

Volatility – sell over $50

Real Estate – stand aside

NEXT STRATEGY WEBINAR

12:00 EST Wednesday, May 14, 2025

From Incline Village, NV.

Cheers

Jacquie

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.