When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

May 2, 2025

Fiat Lux

Featured Trade:

(APRIL 30 BIWEEKLY STRATEGY WEBINAR Q&A),

(FXI), (AGQ), (NVDA), (SH), (UNG), (USO),

(TSLA), (SPX), (CCJ), (USO), (GLD), (SLV)

Below, please find subscribers’ Q&A for the April 30 Mad Hedge Fund Trader Global Strategy Webinar, broadcast from Incline Village, NV.

Q: Why is the Australian dollar not moving against the US dollar as much as the other currencies?

A: Australia is too closely tied to the Chinese economy (FXI), which is now weak. When the Chinese economy slows, Australia slows. Australia is basically a call option on the Chinese economy. So they're not getting the ballistic moves that we've seen in, say, the Euro and the British pound, which are up about 20%. Live by the sword, die by the sword. If you rely on China as your largest customer for your export commodities, you have to take the good and the bad.

Q: I see we had a terrible GDP print on the economy this morning, down 0.3%. When are we officially in a recession?

A: Well, the classical definition of a recession is two back-to-back quarters of negative GDP growth. We now have one in the bank. One to go. And this quarter is almost certain to be much worse than the last quarter, because the tariffs basically brought all international trade to a complete halt. On top of that, you have all of the damage to the economy done by the DOGE cuts in government spending. Approximately 80% of the US states, mostly in the Midwest and South, are very highly dependent on Washington spending for a healthy economy, and they are going to really get hit hard. So the question now is not “do we get a recession?”, but “how long and how deep will it be?” Two quarters, three quarters, four quarters? We have no idea. Even if trade deals do get negotiated, those usually take years to complete and even longer to implement. It just leaves a giant question mark over the economy in the meantime.

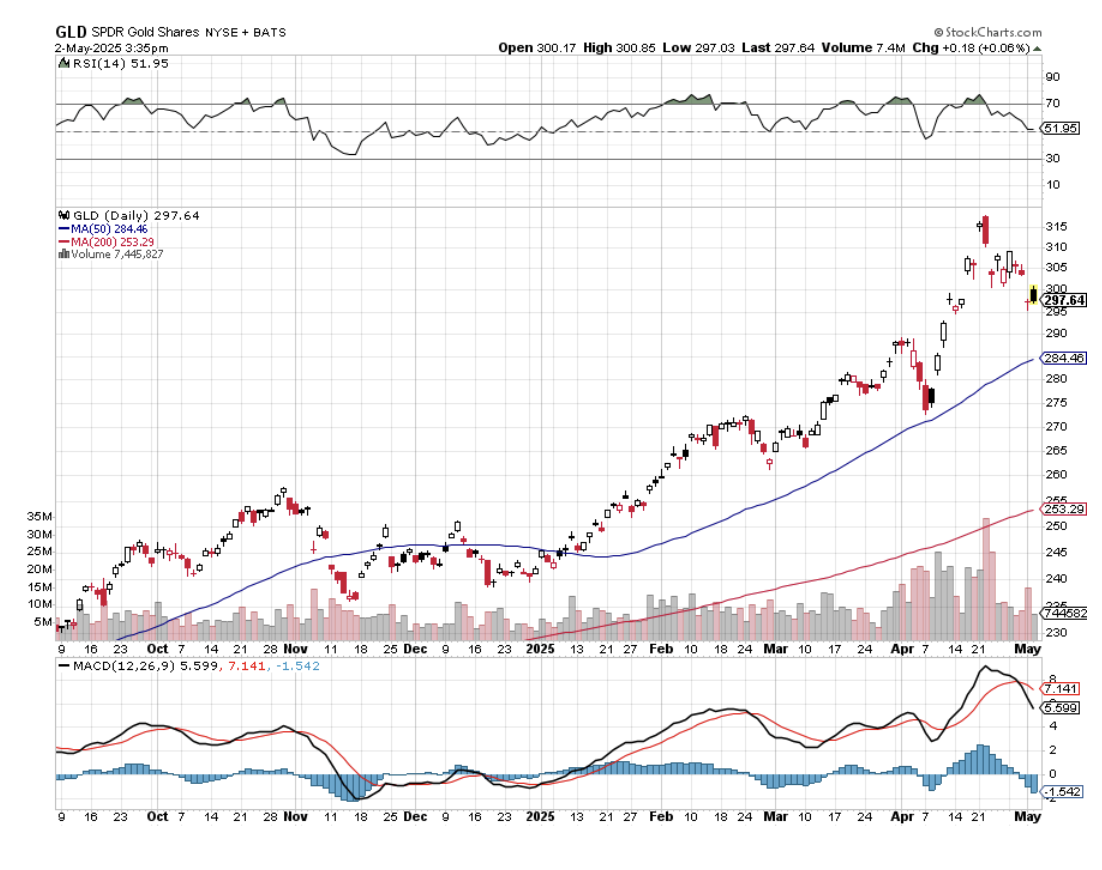

Q: Is SPDR Gold Trust (GLD) the best way to play gold, or is physical better?

A: I always go for the (GLD) because you get 24-hour settlement and free custody. With physical gold, you have to take delivery, shipping is expensive, and insurance is more expensive. Plus, then you have to put it in a vault. Private vaults have a bad habit of going bankrupt and disappearing with your gold. You keep it in the house, and then if the house burns down, all your gold is gone there. Plus, it can get stolen. There's also a very wide dealing spread between bid and offer on physical gold coins or bars; usually it's at least 10%, often more. So I often prefer the ease of trading with the GLD, which owns futures on physical gold, which is held in London, England. So that is my call on that.

Q: Is ProShares Ultra Silver (AGQ) the leveraged silver play?

A: It absolutely is, but beware: (AGQ) is only good for short, sharp rises because the contango and the storage operating costs of any 2x are very, very high—like 10% a year. So, good if you're doing a day trade, not good for a one-year hold. Then you're just better off buying silver (SLV).

Q: What is more important with the Fed's mandate—unemployment or fear of inflation?

A: That's an easy one. Historically, the number one priority at the Fed has been inflation. That is their job to maintain the full faith and credit of the U.S. Dollar, and inflation erodes the value, or at least the purchasing power of the US dollar, so that has always historically been the priority. Until we see inflation figures fall, I think the chance of them cutting interest rates is zero, and we may not see actual falls until the end of the year, because the next influence on prices is up because of the trade war. The trade war is raising prices everywhere, all at the same time. So that will at least add 1 or 2% to inflation first before it starts to fall. You can imagine how if we get a 6% inflation rate, there's no way in the world the Fed can cut rates, at least for a year, until we get a new Fed governor. So that has always historically been the priority.

Q: Do you think the 10-year yield is going down to 5%?

A: You know, we're really in a no-man's-land here. Recession fears will drive rates down as they did yesterday. I haven't even had a chance to see where the bond market is this morning because. So, rates are rising on a recessionary GDP, which is the worst possible outcome. Rates should be falling on a recessionary GDP print. Of course, Washington’s efforts to undermine the U.S. dollar aren't helping. Threatening to withhold taxes on interest payments to foreign owners is what caused the 10% down move in bonds in one week—the worst move in the bond market in 25 years. So, the mere fact that they're even thinking about doing something like that scares foreign investors, not only from the bond market, but all US investments period. And certainly, we've seen some absolutely massive stock selling from them.

Q: Why won't the market go down to 4,000 in the S&P 500?

A: Absolutely, it could; that is definitely within range. That would put us down 30% from the February highs, it just depends on how long the recession lasts. If you just get a two-quarter shallow recession, we could bounce off 4800 for the (SPX) until we come out. If the recession continues for several quarters, and it's looking like it will, then 4,000 is definitely within range. So, it's all about the economy. And remember, stocks are expensive. They don't get cheap until we get a PE multiple of 16, and even then, that alone, just a multiple shrinkage would take us down to 4,000.

Q: Would it be a good idea to buy the S&P 500 (SPY) as it falls?

A: I'm getting emails from readers asking if it's time to buy Nvidia (NVDA) or time to buy Tesla (TSLA). What I've noticed is that investors are constantly fighting the last battle. They're always looking for what worked last time, and that does not succeed as an investment strategy. As long as I'm selling rallies, I'm not even thinking about what to buy on the bottom. The world could look completely different on the other side. The MAG-7 may not be the leadership in the future, especially with the Trump administration trying to dismantle four out of seven companies through antitrust, and the rest are tied up in the trade wars. So, tech is still expensive relative to the main market, and we're going to need to look for new leaders. My picks are going to be mining shares, gold, and banking. Those are the ones I'm looking to buy on dips, but right now, cash is king unless you want to play on the short side. Being paid 4.3% to stay away sounds pretty good to me, especially when your neighbors have 30% losses. You know, I've heard of people having all of their retirement funds in just two stocks: Nvidia and Tesla, and they're getting wiped out. So, you don't want to become one of them.

Q: After a tremendous run in Gold, is Silver a better risk-reward right now?

A: I would say yes, it is. Silver has been lagging gold all year because central banks, the most consistent buyers for the past decade, buy gold—they don't buy silver. But what we may be in store for here now is a prolonged sideways move in gold while the technicals catch up with it. And in the meantime, the money goes elsewhere into silver and Bitcoin. That's my bet.

Q: Is Apple (APPL) a no-touch now?

A: I’d say yes. The trade war is changing by the day, and Apple probably does more international trade than any other company in the world. Also, Apple gets hit with recessions like everybody else. There was a big front run to buy Apple products ahead of tariffs—my company bought all its computer and telephone needs for the whole year ahead of the tariffs. We're not buying anything else this year. And I would imagine millions more are planning to do the same, so you could get some really big hits in Apple earnings going forward.

Q: Should I sell my August Proshares Short S&P 500 (SH) LEAPS?

A: No, I would keep them. If the (SPX) IS trading between 5,000 to 5,800, your $4-$42 SH LEAPS should expire at max profit in August, so I'm hanging on to mine. Next time we take a run at 5,000, you should be able to get out of your SH LEAPS at 80% to 90% of the max profit.

Q: What car company stock will do the best in a high-tariff global economy?

A: Tesla (TSLA), because 100% of their cars are made in the US with 90% US parts (the screens come from Panasonic in Japan). Their foreign components are only about 10%, so they can eat that. For General Motors (GM), it's more like 30% of all components are made abroad, and they can't eat that; their profit margins are too low. (GM) expects to lose $5 billion because of tariffs. By the way, the profit margins on Tesla have fallen dramatically from 30% down to 10% in two years, so it's not like they're in great shape either. Also, Tesla hasn’t had a CEO for ten months, which is why the board is looking for a replacement.

Q: Is it a good time to buy the dip in oil (USO)?

A: Absolutely not. Oil is the most sensitive sector to recessions, because if you can't sell oil, you have to store it, very expensively. It costs 30 to 40% a year to store oil—that's the contango; and once all the storage is full, then you have to cap wells, which then damages the long-term production of the wells. I think at some point you will expect an announcement from Washington to refill the Strategic Petroleum Reserve, which was basically sold by Biden at $100 a barrel. You can now get it back for $60. That may not be a bad idea if you're going to have a strategic petroleum reserve. What's better is just to quit using oil completely, which we were on trend to do.

Q: Will interest rates drop by year-end?

A: They may drop by year-end once unemployment runs up to 5% or 6% —which is likely to happen in a recession—and inflation starts to decline, even if it declines from a higher level. Even if they don't cut by year end, they'll still cut in a year when the president can appoint a new Fed governor. What the Trump really needs to do is appoint Janet Yellen as the Fed governor. She kept interest rates near zero for practically all of her term. We need another Yellen monetary policy.

Q: The job market here seems to be slowing quite fast. Is there any way this will rebound and stave off recession?

A: No, there is not. Companies are going to be looking to cut costs as fast as they can to offset the shrinkage in sales, but also to help cope with tariffs. So no, the job market is actually surprisingly strong now. That means future data releases are probably going to get a lot worse. In April, we saw job gains in Health care, adding 51,000 jobs. Other sectors posting gains included transportation and warehousing (29,000), financial activities (14,000), and social assistance. I highly doubt any of these sectors will show gains next month.

Q: What about nuclear energy plays?

A: I like them, partly because people are buying stocks like Cameco Corp (CCJ) as a flight to safety commodity play, like they're buying gold, silver, and copper. But also, this administration is supposed to be deregulation-friendly, and the only thing holding back nuclear (at least new modular reactors) is regulation. That and the fact that no one wants to live next door to a nuclear power plant, for some strange reason.

Q: What do I think about natural gas (UNG)?

A: Don't touch. Don't buy the dip. All energy plays look terrible right here, going into recession.

Q: What are your thoughts on manufacturing returning to the U.S? And how will that affect the stock market?

A: I think there's zero chance that any manufacturing returns to the U.S. Companies would rather just shut down than operate money-losing businesses. You know, if your labor cost goes from $5 to $75 an hour, there's no chance anyone can make money doing that, and no shareholders are going to want to touch that stock. That is the basic flaw in having a government where no one is actually running a manufacturing business anywhere in the government. They don't know how things are actually made. They're all real estate or financial people.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com , go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Mad Hedge Biotech and Healthcare Letter

May 1, 2025

Fiat Lux

Featured Trade:

(TELEHEALTH'S NEW WEIGHT CLASS)

(HIMS), (NVO)

Clinging to Mount Everest at 20,000 feet, fingers numb and oxygen tank hissing like an annoyed cobra, I had an epiphany that would later serve me well on Wall Street: the most promising paths aren't always the obvious ones — they're the routes that quietly keep you alive while everyone else is busy with their cameras and guided tours.

That same principle is quietly guiding Hims & Hers Health (HIMS) right now.

While the market obsesses over their new Wegovy partnership with Novo Nordisk (NVO), sending HIMS stock jumping 25% to $35, savvy investors should look deeper.

The company isn't suddenly becoming a weight-loss play — they're eliminating doubt and positioning themselves at the center of healthcare's digital transformation.

This reminds me of a pattern I've observed across decades of tracking successful businesses and leaders. The most effective ones don't chase trends. Instead, they position themselves to win regardless of which way the wind blows.

I witnessed this firsthand during a memorable interview with Deng Xiaoping back in the late 70s. Despite the chaotic economic landscape he inherited, his focus remained steadfastly on fundamentals rather than fleeting opportunities.

That's precisely the Hims playbook with these GLP-1 partnerships.

Fascinatingly, they're charging $599 monthly for Wegovy — $100 more than Novo's direct offering.

In my decades managing hedge fund portfolios, I've learned that pricing power is the ultimate business aphrodisiac. It signals you have something people genuinely value enough to pay a premium for.

Wall Street, in its infinite wisdom, is once again squinting at the wrong spreadsheet.

Hims projects $2.35 billion in 2025 revenue, with $725 million from weight management alone — a forecast that completely excluded branded GLP-1s. Their core business in sexual health, dermatology, and mental wellness already generates $1.2 billion annually.

That's 83% of revenue from decidedly non-injectable sources!

Their growth figures are impressive, too: 60% projected sales growth and 70% adjusted EBITDA growth. Yet HIMS trades at just 3.5x 2025 revenue estimates.

If I pitched you a company growing this fast in any other sector at that multiple, you'd think I was selling oceanfront property in Nebraska.

But what truly separates Hims from competitors is retention. Their internal data shows 70% patient retention after 12 weeks, compared to 42% in standard clinical settings. Their users interact with providers three times more frequently in the first month and five times more over three months.

That's not marginally better — it's an entirely different universe of care.

Like those guerrilla fighters I once interviewed in Southeast Asia, who held territory against superior forces by knowing the terrain better — Hims isn’t just in the healthcare war, they know exactly where to strike.

The stock previously touched $70 after posting 95% year-over-year growth in Q4. It retreated on fears about GLP-1 access that were largely imaginary.

Now it's climbing again on news that merely confirms what company executives already knew: their business model doesn't hinge on any single medication.

This situation reminds me of trading Japanese equities in the late '80s—watching rational people make irrational decisions based on incomplete information. The market is simultaneously overvaluing the importance of GLP-1s while undervaluing Hims' overall growth trajectory.

With $300 million in projected 2025 adjusted EBITDA (13% margins), expanding to 20% as they scale, HIMS at 27x EBITDA represents the kind of opportunity that makes me sit up straighter in my ergonomic chair. That multiple would make perfect sense for a company growing at half this rate.

What's more telling than spreadsheets, though, is customer loyalty. During my years managing portfolios worth more than some small nations' GDPs, I developed a simple litmus test: if a company disappeared tomorrow, would its customers feel inconvenienced or devastated?

Hims has clearly crossed into "devastated" territory for its growing user base - the kind of emotional moat that Warren Buffett probably dreams about between bites of his McDonald's breakfast.

For those hunting increasingly endangered species - growth with reasonable valuation, momentum with sustainable model, actual substance beneath the hype - HIMS offers a compelling specimen. These GLP-1 deals aren't the main story; they're just the latest chapter in a much longer narrative about healthcare's digital transformation.

And if there’s one thing I’ve learned from diving shipwrecks in Truk Lagoon to decoding market trends from Tokyo to New York — it’s that the journey tells you more than any single milestone ever could.

This one looks increasingly profitable for those with the patience to stay the course.

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline. Read more

Global Market Comments

May 1, 2025

Fiat Lux

Featured Trade:

(THE SEVEN WORST FINANCIAL MISTAKES THAT RETIREES MAKE)

A significant proportion of my Mad Hedge subscribers are either retired or are about to do so. I have therefore gained from them a lot of valuable information about how retirees can best manage their financial resources, as well as the worst mistakes they commit, which I thought I might pass on.

I have also learned a lot by researching my own retirement, not that it will ever happen, but it’s nice to know what choices are out there. So, let me get on with the show.

1) Spend Like There’s No Tomorrow

Because there might not be a tomorrow. We all had parents who suffered through the Great Depression, so Baby Boomers (Those born between 1946 and 1962) are inveterate savers. They continue saving well after they retire, beyond any need to do so.

The cruel fact is that after the age of 80, it becomes physically impossible to do any expensive international travel. If you don’t believe me, try slinging some 50-pound suitcases onto a train in the three-minute window you’re allowed in Europe to board in the midst of a teeming mass of other passengers.

This is where the “4% Rule” kicks in. You should be spending, not saving 4% of your assets every year to support your lifestyle. If you don’t retire until the mandatory Social Security payout year of 72, that’s enough to last until you’re 97. After that, you become the responsibility of your children, your grandchildren, your great-grandchildren, or the state. Note: You have only a 2.68% actuarial chance of making it to 97.

I had four aunts who lived to over 105. Believe me, it’s no fun. You can’t see or hear, taste your food, or have sex. You need full-time care. And your kids start to die off. That’s not for me. I have told my own kids that if I ever reach that stage, take me on a long walk on a short pier and then pour my ashes into Lake Tahoe.

2) Invest Like a Retiree, not a 25-Year-Old

I have seen a number of my friends and clients completely change their investment styles once they quit work. When they have all the time in the world to trade, they become more aggressive and overtrade. They take on more risk than they can handle.

They also subscribe to other newsletters that lead them into disastrous strategies, like naked put selling at market tops. As a result, they morph from money makers to money losers, right when they can least afford to do so.

3) Not Claiming Social Security

Incredible as it may seem, some retirees don’t claim the Social Security benefits they deserve. This happens because they think that the amounts will be too small to be worth the trouble, they forget, or they think Social Security is already bankrupt, a common Internet conspiracy theory.

Social Security will allow you your senior moment and let you apply for benefits up to the age of 72 ½ and still get your full benefits. In my case, I applied at the last possible moment, and the Feds promptly sent me a check for $18,000. After that, you will lose them. Assuming you paid the maximum amount in Social Security taxes during your life, you should receive around $36,000 a year. This is indexed for inflation, with the 2023 payout rising by a generous 8.7%. Add this up over 20 years of compounding, and the total benefits can reach millions of dollars. As I tell my friends, you paid for it and deserve it, so take it.

4) Borrowing

One of the dumbest things I have seen retirees do is take out high-interest loans when they don’t need to. They do this by running up big credit card balances at 27% a year, coddling the above errant kids, buying the above-mentioned boat or plane, or picking up a second home where the fire or flood insurance is higher than the mortgage payment.

The best investment you can make is to pay off your own debt, reduce your leverage, and eliminate nontax-deductible interest payments. As a retiree, your life is about getting simpler, not more complex. My sole exception to this rule is if you are one of the millions who received a Covid-era 30-year government-subsidized loan with an interest rate near the long-term average inflation rate of 3%. I don’t mind going to the grave (or the lake) owing the government a few bucks.

5) Don’t Coddle Your Children

While I was in New York working for Morgan Stanley during the 1980s, I had a lot of free time on my hands during the day because the Tokyo market didn’t open until 8:00 PM local time. So, the higher-ups handed me a lot of odd jobs to make me look busy. I taught an international economics course at Princeton, where I met Game Theory Nobel Prize winner John Nash. I took clients from obscure places like Kansas and Arkansas (The Walls of Wal-Mart fame) to lunch at Windows of the World at the top of the old World Trade Center.

I was also called in to help out the kids of our largest clients. It seems becoming a billionaire takes a lot of time, and there is certainly no time to raise your own kids. They tried to atone for this lapse by giving their kids anything they wanted when they attained adulthood.

I ended up arranging cushy jobs, setting up meetings with politicians in Washington DC, scouting out Manhattan penthouse apartments, obtaining the best theater tickets, and even bailing some out of jail. I drew the line at buying drugs.

Over time, I observed that this excess coddling ruined these kids’ lives. They never developed careers, at best picking up expensive hobbies (like racing cars or falconry). They never learned financial responsibility, often investing in the failing startups of college buddies. Not a few died of drug overdoses.

The best favor you can do your kids is to train them well, invest in their education, provide a good role model, and let them stand on their own two feet. I have told my own kids that I plan to spend every penny I have and hope that the check to the undertaker bounces. If there’s any money left over, it’s an accident.

6) Dial Back Your Lifestyle

Remember that you are not Jeff Bezos or Elon Musk, the richest men in the world. Match your lifestyle to your income. A friend of mine once told me that when he retired, suddenly everything became expensive. Writing this from Florida, I can’t help but notice the vast number of boats, which a friend described as “A hole in the water you throw money into.” Many of these are parked in long-term moorings with barnacle-encrusted hulls because the owners can’t afford to sail them. I was a victim for many years of aircraft ownership, a “Hole in the sky you throw money into.” At least I could write these off as unreimbursed business expenses and claim the accelerated depreciation. The best case is to have a rich friend and borrow his boat. They’re usually unused.

7) How much is Enough?

I have surveyed many of my hedge fund friends as to the minimal amount of money needed to retire comfortably, and the number of $10 million keeps coming up. That covers 20% of any surprise medical expenses that Medicare won’t pay, $50,000 in the case of open-heart surgery. Sure, you could go to Mexico or Belize for much cheaper health care, as I have seen many do, but that wouldn’t be MY first choice.

Other surveys put the minimum retirement number at $1.46 million, and 40% more if you live in California. But remember, even if you own your home outright, home ownership costs are skyrocketing, such as for insurance, association fees, utilities, amenity associations, and repairs. The world is changing, and you need to bank for the unexpected.

Send me Your Suggestions

I have great confidence in the ability of my subscribers to make mistakes and blow money. After all, I make them, so why shouldn’t they? So, if you have any additional suggestions for the above, I’m all ears. Please email them in. I can make this a recurring piece that I update for the next 25 years.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

A Friend’s Boat

“We are one budget deal away from being the hot spot of the world. Europe is in the toilet, China’s growth has fallen down, and the Middle East is going backwards. We have a lot of potential for fracking and innovation. If we can prove our nation is governable, we will be the golden spot in the world,” said David Brooks, a conservative columnist for the New York Times.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.