(THE ERA OF FRACTURED AND COMMODIFIED ATTENTION)

June 6, 2025

Hello everyone

OUR FULL ATTENTION IS BEING FRACTURED AND THEN COMMODIFIED TO REGAIN IT

The information age has been a good thing.

Would you agree?

We now have access to all sorts of information that once were unavailable to the masses.

And that information is filling our email inbox, our social media, and every other media you can think of.

“Experts” are constantly telling/advising us what to eat, how much to eat, when to eat, or not to eat.

We are also told what exercise to do or not to do depending on our age.

And we are now deep in the age of spirituality, mindset, meditation, and consciousness awareness.

We are urged to reawaken ourselves, meditate, and shut out the noise, understand our energy and how it and the mind work.

Add to that the daily news we get – usually all bad – that we take in, if we choose to watch or listen or read the news.

And then on top of that, we live our lives with constant reminders of things to get done, don’t forget post-it notes or notes in the iPhone, which are constantly pinging – all of this becomes a juggling act of sorts.

To say we are overloaded with information would be an understatement.

I start my morning with a glass of water and a cup of tea. I go outside, feed the birds, enjoy the sunshine, and gaze over the mountains and the ocean in the distance. It clears my head and empties out the noise and allows me to focus on my priorities.

I think many of us have lost the ability to really pay attention. We are being pulled in so many directions all at once that many of us walk around in a fog, unable to discern what is important and what is not important. It seems our iPhone has taken away our control over our lives.

There is a coercion that is drawing us towards this noise. Our constant need to check our iPhones is draining our ability to really be present here and now, and to really be ourselves. We are what we notice, and we are noticing less due to the myriad bits of pings, media shots, and psychological pull of 24-hour info technology.

Research tells us that we are whittling away how long we can focus. In 2003, before smartphones were really on the scene, the average time a person spent on any one computer-related task before switching screens was two and a half minutes. Between 2016 and 2020, that interval fell to 47 seconds. How low can it go?

The aimless motion of scrolling. It’s mind-less, not mind-full.

With art reflecting our culture, we could eventually see pictures of mist representative of people’s mind space, or our eyes covered with tiny dots to show the number of times we have checked our iPhone during the day.

As William James put it in 1890: “My experience is what I agree to attend to. Only those items which I notice shape my mind – without selective interest, experience is an utter chaos.”

How many of you have checked your emails when sitting at the traffic lights? I have seen Uber drivers do this when I have been travelling with them.

Those emails can wait.

A Backlash May be Starting

Many people are now starting to bristle against the unwanted impositions of the pings, rings, notices, newsfeeds, and so on of 21st century technology.

We are now seeing apps commodifying our need for calm. Sidekick, Stay Focused, and Freedom, among others, have popped up.

Do you really need an app to detach yourself from the noise?

How about going for a walk or a bike ride and leaving your iPhone at home? (If you must take it with you, turn it off.)

Playing tennis, swimming, surfing, and golf takes you away from technology. You can’t scroll while swimming or playing tennis – please correct me if I’m wrong here.

What about hobbies like gardening, painting, or handicrafts like sewing, knitting, or tapestry? These take you into a world where you can lose track of time and engage completely with the present and the action you are doing.

Time slips away when I’m in the garden. It is a similar story when I’m doing handicrafts.

And what about just reading a book?

You don’t need an app to calm your mind. Just go outside and leave tech at home. It can all wait.

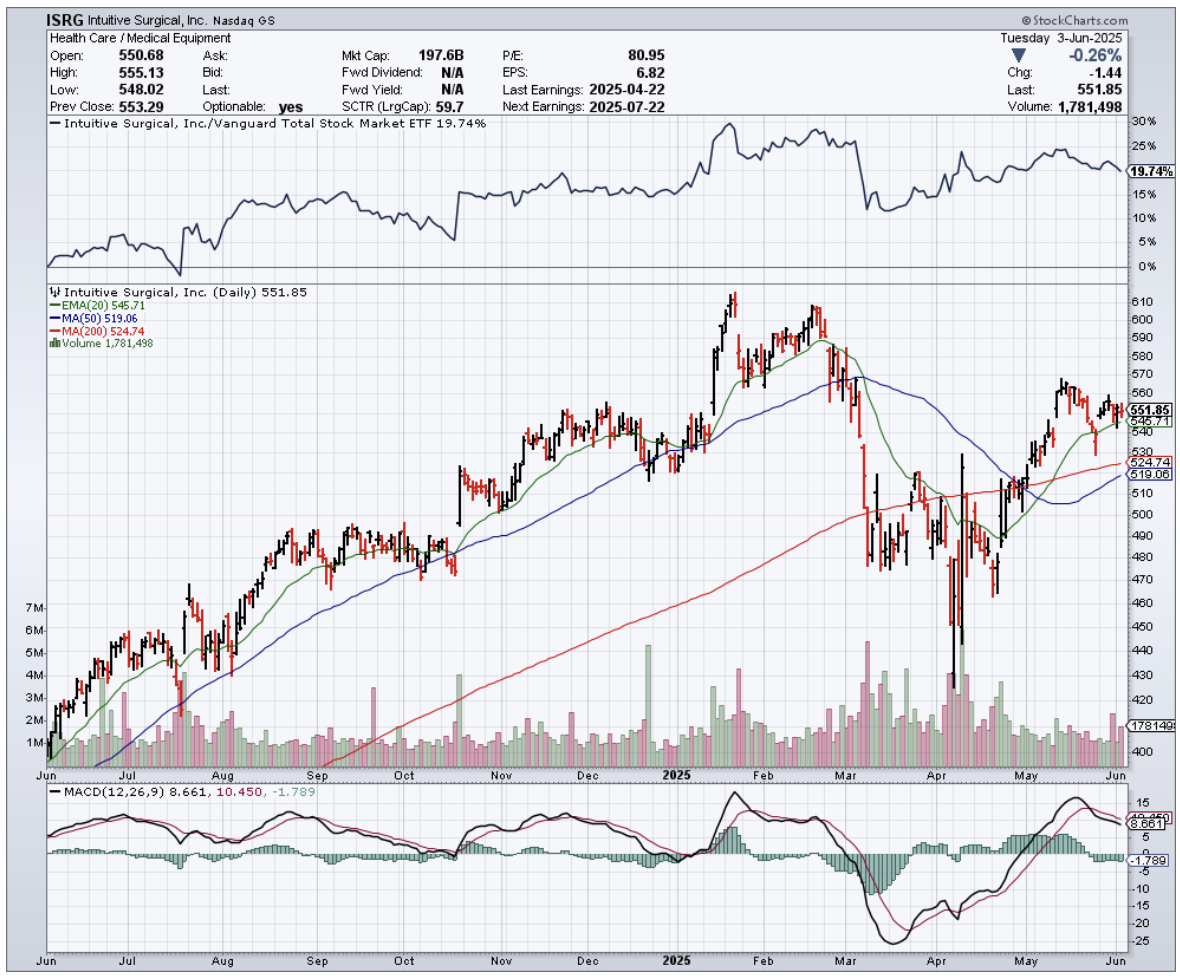

Let’s bring our attention back to the market, just before I close for the weekend break.

As I said in the Monday newsletter, we are in a market seemingly controlled by a handful of people.

The bromance between Musk and Trump seems to have cooled markedly. The to and fro of comments between these two personalities has given the market indigestion, and Tesla a case of the glums. Choppiness and sharp moves have become the norm lately. And we could continue to see volatile moves. It’s the market we have now, so we just must deal with it.

This is a weekly chart of the S&P 500. This is how the price action could play out. No guarantees. However, as I’ve shown on the monthly chart below, I do expect we may see another down move, just when everybody gets comfortable and complacent from seeing the market moving to the upside. As we move towards the end of the year, we should get a clearer picture.

Monthly S&P500 chart

QI CORNER

Pieter Borsje (Founder of Eona/AML Specialist)

SOMETHING TO THINK ABOUT

Cheers

Jacquie