The seismic shift to hybrid work, once a reactive response to global upheaval, has solidified into a fundamental pillar of the modern professional landscape. No longer a passing trend, this blend of in-office and remote presence offers unparalleled flexibility and cost efficiencies. Yet, as organizations grapple with the complexities of managing dispersed teams, a new, even more disruptive force is emerging: Artificial Intelligence (AI). Far from being a mere tool, AI is rapidly becoming the algorithmic architect of the hybrid workplace, promising to optimize productivity, revolutionize collaboration, and redefine the very nature of work itself.

The initial transition to hybrid models presented a unique set of challenges. Bridging communication gaps, fostering a cohesive culture across physical and digital divides, ensuring equitable opportunities for all employees, and maintaining robust security in a decentralized environment became paramount concerns. Traditional tools often fell short, struggling to create truly inclusive virtual meetings, manage complex schedules, or prevent information silos. Enter AI, a catalyst poised to address these pain points and unlock unprecedented levels of efficiency and innovation.

Enhancing Productivity and Efficiency: The AI Advantage

One of the most immediate and impactful ways AI is disrupting hybrid work is through its ability to supercharge productivity and efficiency. Repetitive, time-consuming administrative tasks are ripe for automation, freeing up human capital for more strategic, creative, and empathetic endeavors.

AI-powered scheduling tools, for instance, are revolutionizing meeting coordination. No longer do teams need to navigate a labyrinth of calendars and time zones to find a mutually agreeable slot. AI can analyze team availability, consider personal preferences, and even account for peak productivity times, suggesting optimal meeting schedules that ensure seamless coordination between in-office and remote employees. This intelligent automation extends to task management, where AI streamlines workflows by suggesting efficient approaches and flagging potential bottlenecks, allowing hybrid teams to collaborate effortlessly.

Beyond scheduling, AI excels at automating mundane activities like data entry, email filtering, and document management. AI chatbots provide instant answers to common queries, technical issues, or HR-related questions, offering round-the-clock assistance and reducing the burden on support staff. Virtual assistants manage task lists, set reminders, and help employees stay organized, irrespective of their physical location.

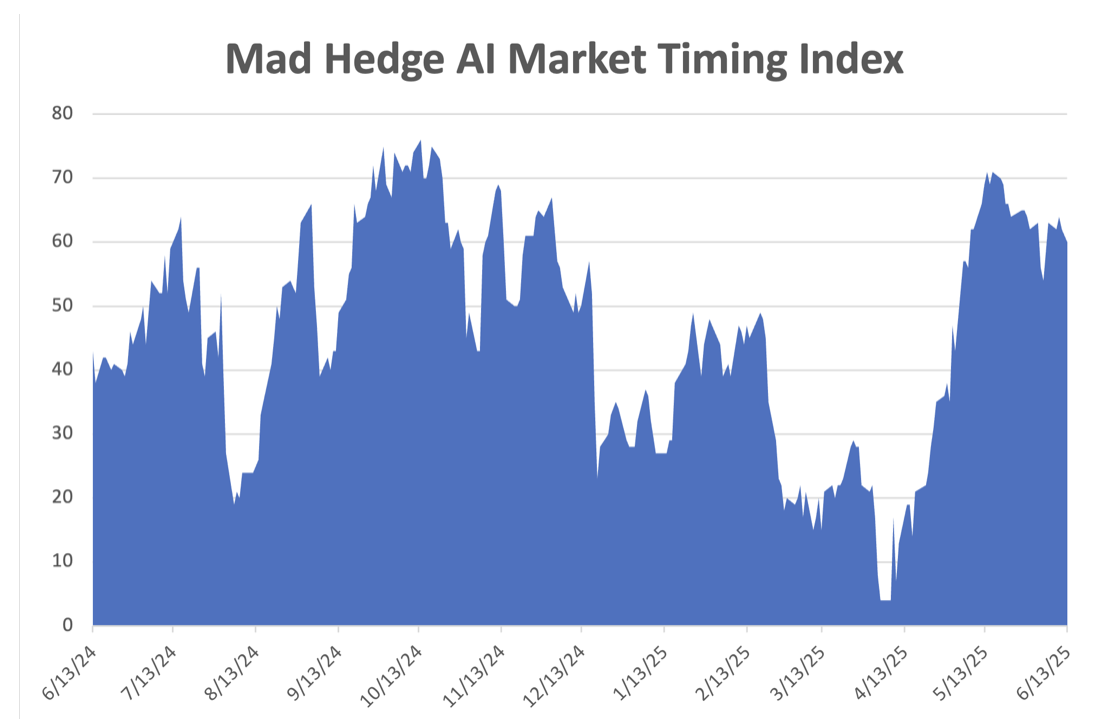

Furthermore, AI-driven analytics are providing unprecedented insights into productivity patterns. By analyzing work output and identifying trends, AI can help both employees and managers understand when individuals are most productive, allowing for optimized scheduling of demanding tasks. This data-driven approach empowers managers to make informed decisions that streamline operations and enhance overall team efficiency. Companies like Microsoft, for example, have reported significant gains in productivity and work quality among users of their AI-powered tools, with many expressing a strong reluctance to work without them once adopted.

Revolutionizing Communication and Collaboration: Breaking Down Barriers

The hybrid model, by its very nature, can introduce communication friction and the risk of siloed teams. AI is proving instrumental in bridging these gaps, fostering more seamless and inclusive collaboration.

Video conferencing, a cornerstone of hybrid work, is being transformed by AI. Real-time transcription, translation, and captioning features are becoming standard, breaking down language barriers for global teams and ensuring all participants, including those with hearing impairments, can fully engage. AI-powered meeting assistants go a step further, automatically taking notes, highlighting key discussion points, and assigning action items, ensuring clarity and accountability even for those unable to attend live. This intelligent note-taking frees up employees to give their full attention to the conversation, fostering more meaningful interactions.

Beyond meetings, AI is enhancing overall communication flows. Intelligent platforms can analyze conversation patterns to gauge employee sentiment, proactively identify potential issues, and route information effectively across various channels. This proactive approach helps prevent miscommunication and misunderstandings, strengthening team dynamics.

The promise of real-time language translation is particularly transformative for international businesses. Imagine a virtual meeting where participants can speak in their native languages, with AI algorithms providing instantaneous translations for everyone. This capability not only fosters inclusivity but also unlocks innovation by enabling diverse perspectives and insights to be shared and understood effortlessly, regardless of geographical or linguistic boundaries.

Personalization and Employee Experience: A Human-Centered Approach

AI’s disruptive power in hybrid work extends to creating a more personalized and human-centered employee experience. By analyzing individual work habits and preferences, AI can tailor digital workspaces, optimize workflows, and even recommend personalized learning and development paths.

AI-driven platforms can identify skill gaps and suggest customized training programs, enabling employees to continuously grow and align their development with organizational goals. This personalized approach to learning ensures that distributed teams have access to relevant training regardless of their location, allowing them to progress at their own pace.

Moreover, AI can help combat the feeling of isolation that some remote workers may experience. By analyzing communication patterns and productivity metrics, AI algorithms can proactively identify employees at risk of burnout or disengagement, prompting managers to offer timely support and intervention. This empathetic application of AI can significantly boost morale and job satisfaction.

Case studies, such as those from HR Future, a global HR consultancy, demonstrate the positive impact of such personalized approaches. By blending structured communication with informal virtual meetups and leveraging feedback loops, they observed a significant increase in engagement scores and a reduction in voluntary turnover, highlighting that hybrid success is as much about human connection as it is about digital tools.

Addressing the Challenges and Ensuring Ethical Implementation

While the opportunities presented by AI in hybrid work are immense, it’s crucial to acknowledge and address the associated challenges. Concerns around privacy, data security, and algorithmic bias are paramount. Organizations must establish clear guidelines and ethical frameworks for AI implementation, ensuring transparency in data collection and usage, and prioritizing the protection of sensitive employee information.

The potential for AI to enhance productivity tracking also raises questions about surveillance and trust. While AI can provide nuanced insights into work patterns, it’s essential that these tools are used to empower and support employees, rather than to micromanage or foster a culture of suspicion. The focus should remain on optimizing workflows and identifying areas for improvement, with a strong emphasis on employee well-being and autonomy.

Furthermore, the “human in the loop” remains critical. While AI can automate many tasks, human oversight is essential, particularly for creative tasks, complex problem-solving, and client interactions. Experts emphasize that AI won’t replace humans, but rather, humans with AI will replace humans without AI. This underscores the need for continuous learning and skill development, with a growing emphasis on uniquely human capabilities such as critical thinking, creativity, emotional intelligence, and adaptability.

The effective integration of AI also requires a robust IT infrastructure capable of supporting high computing demands. Organizations need to invest in the right technologies and ensure their networks are ready for AI-driven transformations.

The Future is Algorithmic and Human-Centered

The disruption brought by AI to hybrid work is not a fleeting phenomenon but a fundamental transformation. As AI becomes more sophisticated, its role in shaping the “where” and “when” of work will become even more pronounced. From intelligently optimizing space utilization in physical offices to creating hyper-personalized learning experiences for remote teams, AI will continue to refine and elevate the hybrid model.

Ultimately, the successful integration of AI into hybrid work environments will hinge on a balanced approach. Organizations that prioritize ethical AI implementation, invest in upskilling their workforce, and foster a culture of continuous learning and adaptation will be best positioned to harness the full potential of this transformative technology. The future of hybrid work is not just about technology; it’s about leveraging AI to create a more efficient, collaborative, and human-centered workplace where employees feel empowered, engaged, and supported, regardless of their location. The algorithmic architect is here, and its blueprint is shaping a new era of work.