Why You are About to Lose Your Job

The hammer has been brought down on the financial industry.

Robots are here and here to stay - automation is taking place at a breakneck speed displacing worker from all industries.

In a recent report by Wells Fargo, the U.S. financial industry will supposedly fire 200,000 workers in the next decade because of the advancements of automating processes.

Yes, humans are going obsolete and banking will effectively become algorithms working for a handful of executives and engineers controlling the algorithms.

The catalyst in this equation is the direct capital of $150 billion annually that banks spend on technological development in-house which is higher than any other industry.

Private businesses aren’t charities and banks are doing this all in the name of lower cost, shedding employee wage packets, and boosting efficiency rates.

We forget to realize that employee compensation absorbs up to 50% of bank’s expenses.

The 200,000 job trimmings would result in 10% of the U.S. bank jobs axed for the hyped-up “golden age of banking” that should deliver extraordinary savings and extra services to the customer.

I would argue that cost savings due to technological enhancements have already had an outsized surge in available services to the client as mobile and online banking has increased functionality allowing U.S. customers to maintain tight internet control over their bank account from anywhere that has an internet connection.

The most gutted part of banking jobs will be in the call centers because they will be substituted by chatbots.

A few years ago, chatbots were awful, even spewing out arbitrary profanity, but they have slowly crawled up in performance metrics to the point where some customers do not even know they are communicating with an artificial engineered algorithm.

The wholesale adoption of automating the back-office staff isn’t the end of it, the front office will experience a 30% drop in numbers sullying the predated ideology that front office staff is irreplaceable heavy hitters.

As it is, front-office staff is in the midst of getting purged with 2018 representing a fifth year of decline.

Front-office traders are being replaced by software engineers as banks follow the wider trend of every company migrating into a tech company.

Efficiencies do not stop there; the adoption of artificial intelligence will lower mortgage processing costs by 20% and the accumulation of hordes of data will advance the marketing effort into a smart, hybrid cloud-based and hyper-targeted strategy.

You would think that less workers mean higher pay for the employees - you thought wrong.

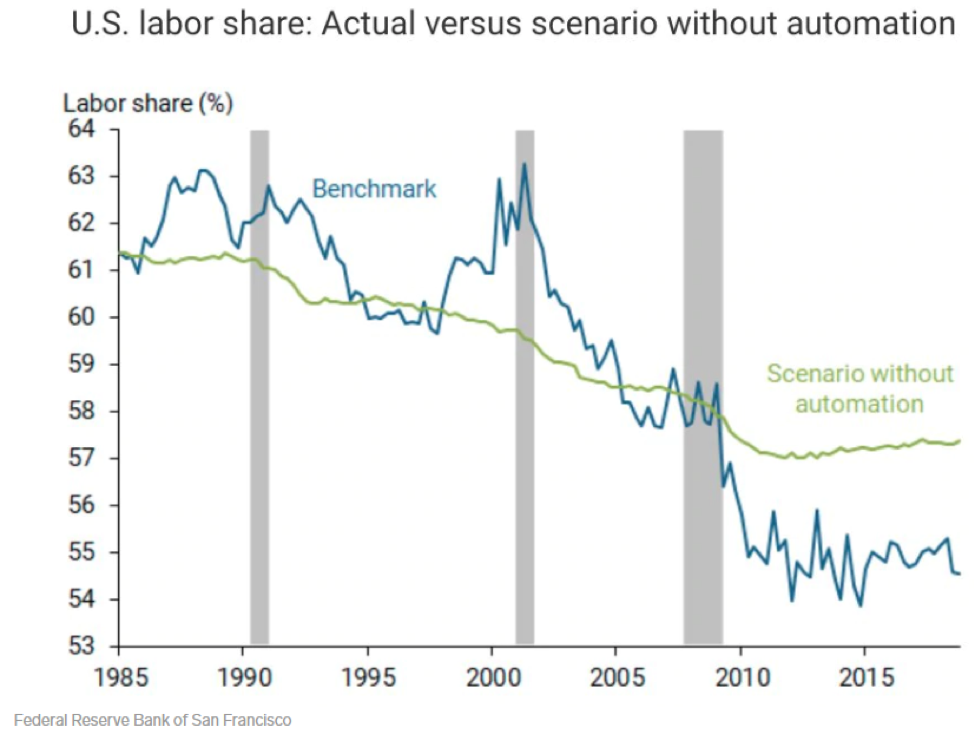

Historically, a strong labor market and low unemployment boosts wage growth, but national income going to workers has dipped from about 63% in 2000 to 56% in 2018.

Causes stem from the deceleration in union membership and outsourcing has snatched away bargaining power amongst workers on top of the mass automation being implemented.

I was recently in Budapest, Hungary and on a main thoroughfare, a J.P. Morgan and Blackrock office stood a stone’s throw away from each other employing an army of local English proficient Hungarians for 30% of the cost of American bankers.

Banks simply possess wider optionality to outsource to an emerging nation or to automate hard-to-fill positions now.

In this game of cat and mouse, companies can easily rebuff workers' attempts to ask for salary raises and if they threaten to walk off the job, a robot can just pick up the slack.

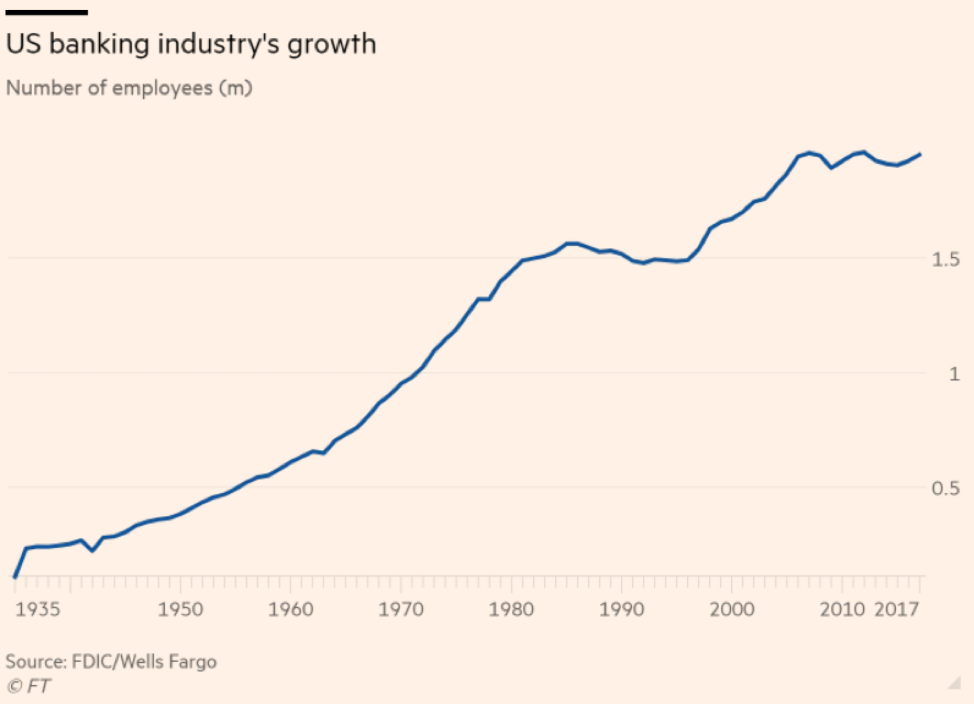

The last two human bank hiring waves are a distant memory.

The most recent spike came in the 7 years after the dot com crash until the sub-prime crisis of 2008 adding around half a million jobs on top of the 1.5 million that existed then.

The longest and most dramatic rise in human bankers was from 1935 to 1985, a 50-year boom that delivered over 1.2 million bankers to the U.S. workforce.

Recomposing banks through automation is crucial to surviving as fintech companies are chomping at the bit and even tech companies like Amazon and Apple have started tinkering with new financial products.