Why Solid-State Batteries are the “Next Big Thing”

Tesla shares have recently gotten their mojo back, exploding by an incredible 60% in the past month, and that can only mean one thing: mass production of solid-state batteries is fast approaching.

For the last 30 years, the cutting edge of battery design has been trapped in lithium-ion liquid or gel states. This originally Japanese technology took us from the first generation of smartphones in the early 1990s to the 1,200-pound, 405-mile range behemoths of today.

Now it’s time for the next big thing.

Solid-state batteries, made of oxide, sulfide, and phosphate ceramics, have existed in labs for decades and are currently used in pacemakers and other small devices. But economic mass production has remained elusive.

That may be about to change.

Bill Gates-backed QuantumScape gained a listing on the New York Stock Exchange via a SPAC (special purpose acquisition corporation) with Kensington Capital Acquisition Corp. (click here for the link). The deal valued the company at $3.3 billion, a high figure for a firm with no salable product.

QuantumScape is a decade-old San Jose, CA-based startup which has been pioneering solid-state battery technology. It obtained a $100 million investment from Volkswagen in 2018. QuantumScape’s goal is to supply the batteries for an all-electric VW Golf by 2025.

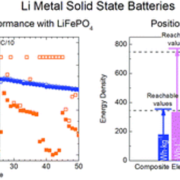

And here is the big deal about solid state. It offers energy densities 2.5 greater than existing lithium-ion batteries. It also presents far less risk of catching fire when punctured, as we have seen dramatically on TV a few times over the last couple of years with unfortunate Teslas.

With such technology, Tesla can cut battery sizes from 1,200 pounds to 500 pounds, chop $6,000 off the cost of production of each car, and further extend ranges because of less weight.

That would enable Tesla to enter the mass market with a $36,000 entry-level Tesla 3 or small SUV Model Y with minimal fuel cost and maintenance for the life of the car. This is how Tesla boosts production from last year’s 500,000 units to 5 million units annually by 2025. This is what the recent $700 Tesla share price is all about.

There are even more advanced battery technologies on the horizon. Samsung is working on graphene technology for its smartphones. The University of Chicago has developed a lithium dioxide battery seven times more powerful than those currently available. Silicon nanowire technology will become viable in three years that offer a further multiplication of ranges.

In the end, Elon Musk may surprise us all. In 2019, Tesla bought Maywell Technologies and their dry battery technology which can produce batteries at 16 times greater energy density at 20% less cost, giving a 20-fold improvement in battery performance.

That is a greater leap in energy densities than we have seen over the past decade when costs dropped by 80%.

As a long-time Tesla owner (chassis no. 125 of the assembly line), I can tell you that it has been a battle to keep up with Tesla’s rapidly emerging technology. As soon as I bought a Model X three years ago with a 275-mile range, a new 351-mile range was announced. I did get a great deal on the car though and I’ll never drive another vehicle.

As an old venture capitalist once told me, “When you’re in tech, you’re in the bakery business. You have to sell whatever you have in three days before it goes stale.”

For a YouTube video of Bill Gates explaining his involvement in QuantumScape, please click here.