June 23, 2009

June 23, 2009

Featured Trades: (SPX), (GXM)

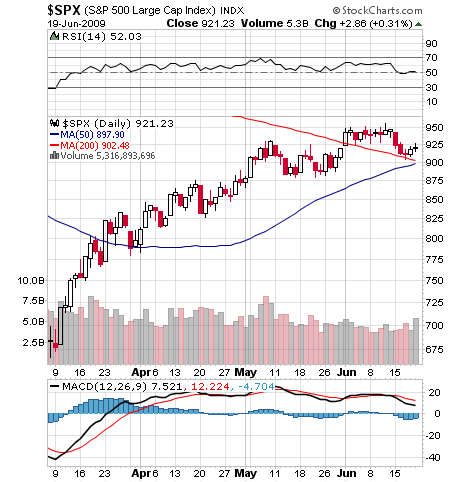

1) Ok, people, the sucker's rally is now over. If you had any doubt, take a look at the insider selling figures for April and May. Corporate selling of stock has soared from $10 billion in April to $63 billion in May.?? Insider selling jumped from $1.9 billion to $2.2 billion, an enormous amount. Who were the suckers? Inflows to mutual funds and ETF's ballooned from $7.0 billion to $10.3 billion. Retail investors are always the ones who ring the bell at the top of a move. That explains why dozens of technical indicators are rolling over. They're are not signaling a crash, but they are not saying we are going up any time soon, either. If for whatever reason you can't get out, sell short dated calls against all of your positions.

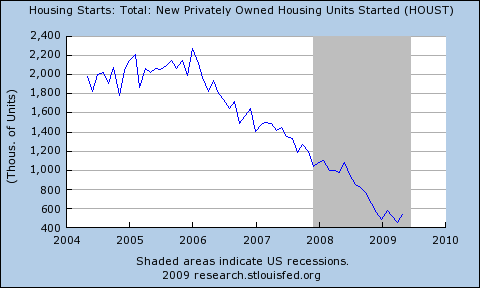

2) Paul Krugman made an insightful point on his New York Times blog (see http://krugman.blogs.nytimes.com/). The surprise 17% improvement in new housing starts for May, which many heralded as a bonafide green shoot, is not what it seems. Sure, 17% is a nice number, but we're coming off such a low base the number is meaningless. 17% ain't what it used to be. It's like General Motors (GXM) (note new ticker symbol) going from $2 to $3. Sure, it's a 50% move, but it doesn't mean the bankrupt company is back in the pink of health. You could use the same argument for the 40% move in the S&P500. Since virtually all of our economic data is recovering from once a century extremes, they will have to be viewed with many grains of salt. When you meet Paul in person he is a pussycat, but in print is he Freddy Kruger meets Jack the Ripper.

3) One of the joys of having small children is that you get to know the guy at the local plumbing supply shop really well. It's amazing what will fit down a toilet these days. He once told me that when Troll Dolls hit the market, every plumber in the country was guaranteed a job for life. When I went there yesterday I thought I'd pick up some leading economic indicators as well. After a deadly winter, business is picking up a bit. Sure, it is still down a third from two years ago, but there is a definite improvement going on. The Eureka moment! His comments confirm the sort of 'L' shaped recovery I have been expecting. We aren't going to zero anymore, but it is not exactly off to the races either. Throughout the nineties, a salesman at Circuit City (RIP) walked me through every generation of technology, and he was worth his weight in gold. All I had to do was buy a new TV from him every year, and they kept getting bigger and more expensive. Sometimes figuring out the direction of the economy is as simple as going down to the local butcher, baker, or candlestick maker and asking. They are on the front lines of economic activity, and they will see any changes months before those of us glued to computer screens.

4) Since I have been pelted daily with predictions that residential real estate has bottomed for the last 18 months, like hail in a Midwestern summer thunderstorm, I feel a public duty to tell you that is just not the case. Now that the state and federal moratoriums are off, foreclosures are accelerating. There are over a million Option ARM and Alt-A loan resets about to hit the fan. Since many owners will not see positive equity in their homes in their lifetimes, banks are seeing more walk always. The run up in mortgage rates from 4.5% to 5.5% has yet to hit the market. Some 18 million homeowners divert 50% of their incomes to pay for housing, double the 25% that is considered healthy, and many of them are losing jobs. While the volume of units sold has rebounded, the action is dominated by speculators, flippers, and bottom feeders bidding for properties at 10-40 cents on the dollar, not exactly a sign of health. Call me when Ozzie & Harriet Nelson come back to the market. I listen to industry insiders call the bottom of the Japanese real estate market for 15 years, until they finally died, and the market is still a fraction of its 1990 high. I thing we are closer to the bottom than the top in terms of price, but closer to the top than the bottom in terms of time. You can take that to the bank.

QUOTE OF THE DAY

'We won't see a 'V' shaped recovery, but a recovery nonetheless,' Said Abbey Joseph Cohen, senior strategist at Goldman Sachs.