A Solid Biotech That Can Survive the Crash

In years filled with virtually never-ending market volatility fears, the third quarter of 2022 seems to be one for the books.

We’ve gone through wild currency fluctuation, with the British pound practically free-falling to a record low against the US dollar.

The US Treasury yields rose to their peak since April 2011, while the S&P 500 is going into its third-consecutive quarter marked with losses for the first time since we experienced the 2008 financial crisis.

On top of these, the Federal Reserve disclosed that rates would climb even higher than expected as the previous month’s inflation data came in scorching.

The situation across the globe isn’t exactly showing any indications of improvement. Sanctions on Russia are becoming more severe following the Kremlin’s decision to annex certain areas of Ukraine formally. Meanwhile, emerging markets look to be down in the dumps as well.

Amid the market turmoil, some stocks managed to weather the storm and still hold the potential to deliver good results.

One of them is Gilead Sciences (GILD).

Gilead rose to fame when it launched an effective treatment for HCV, which came after its excellently timed (or lucky) acquisition of Pharmasset for $11 billion. This created a massive boost to the company’s business, with shares peaking at more than $100 per share in 2015.

With HCV finally having a solution, the boom did not last. Obviously, sales from the drug were not recurring since the patients were already getting cured.

At that time, Gilead bolstered its pipeline with a flourishing HIV business. However, the company’s revenues and earnings eventually became flat.

In the meantime, Gilead went after more expensive deals, including a $21 billion acquisition of Immunomedics to gain access to Trodelvy, a $12 billion contract with Kite Pharma to get their hands on Yescarta, and multi-billion deals involving Forty-Seven and Galapagos. Unfortunately, none of them delivered the same pay-off as the Pharmasset deal.

However, Gilead has been gaining traction recently.

Wall Street has been desperately looking for businesses that could help investors regain their losses, and it looks like Gilead is part of the very short list of companies that made the cut.

While it hasn’t exactly done anything groundbreaking as of late, the company’s consistency and foreseeable growth are boosting its attractiveness to investors.

Right now, Gilead’s HIV franchise is singlehandedly supporting the entire market cap of the stock. That’s impressive and promising, considering the company also has a burgeoning oncology sector.

For context, Gilead’s oncology franchise is estimated to hit roughly $5 billion in sales by 2030.

Meanwhile, Gilead has another HIV blockbuster making waves in Lenacapavir. Earlier in 2022, the company managed to expand the covered distribution channels of this HIV treatment and gained marketing authorization in the EU.

Given the current performance of its HIV franchise and the promise of expansion for Lenacapavir, this particular segment can be conservatively estimated to report at least single-digit growth through the early 2030s.

Overall, Gilead has been recording solid results for this year. In the first quarter, sales climbed 3% to $6.6 billion, partly thanks to its Veklury sales and the gaining momentum of its cell therapy business.

While growth was not as impressive, the 10% earnings yield, stability, and, of course, 5% dividend yield make Gilead a compelling choice. Admittedly, we’ve witnessed how interest rates climb higher, which results in additional competition for the 5% dividend yield, but the company appears to be holding up nicely in this aspect.

Gilead’s apparent independence from its COVID-centered product shows a highly encouraging trend. In August, Gilead shared its second quarter report showing revenues rising 1% to $6.3 billion. The “positive” note is that Veklury, a COVID-19 treatment, fell 46% while other products jumped 7% to contribute $5.7 billion.

Riding this momentum, Gilead shared another bolt-on deal worth $405 million to acquire MiroBio, a biotechnology company based in the UK. MiroBio develops treatments that aim to restore immune balance.

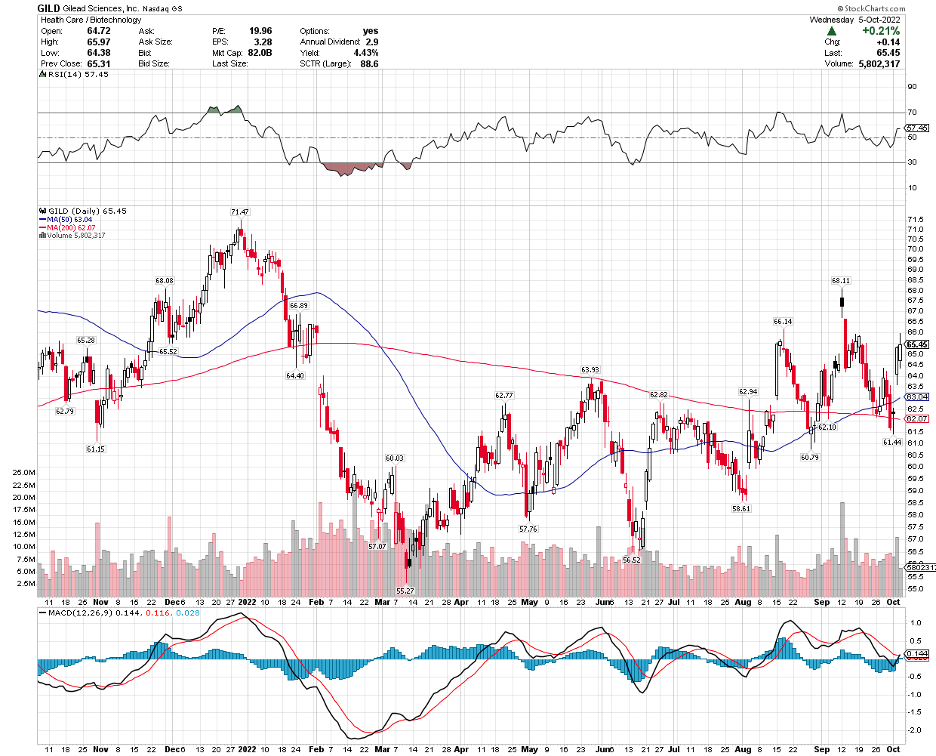

In summary, Gilead remains a solid bet in these trying times. It has established programs, which are expected to rake in higher earnings in the years to come, and an ability to execute great deals to bolster its pipeline—all while keeping its debts and costs well under control. I suggest you buy the dip.