A Gem to Scoop Up on the Cheap

I know everyone's gotten into a tizzy because of tech stocks falling off the proverbial cliff.

It won’t always be like this.

Tech stocks won’t plunge this dramatically simply because their growth stories are mainly intact.

External events sometimes do this to our sector, and we must brace for the impact, but readers should look forward to a rosier future.

That is why readers must start to plan for which stocks to scoop up on the cheap after the selling subsides.

One ironclad name that readers must dip into is software company Adobe (ADBE).

This stock has been historically hard to find entry points and we are on the way to getting an optimal one.

Creativity has always played a central role in the human experience.

Over the last year, we have all witnessed the way creativity has sustained us.

We've shared photographs with loved ones on different continents, taught art classes to students at their kitchen tables, and launched entirely new businesses online.

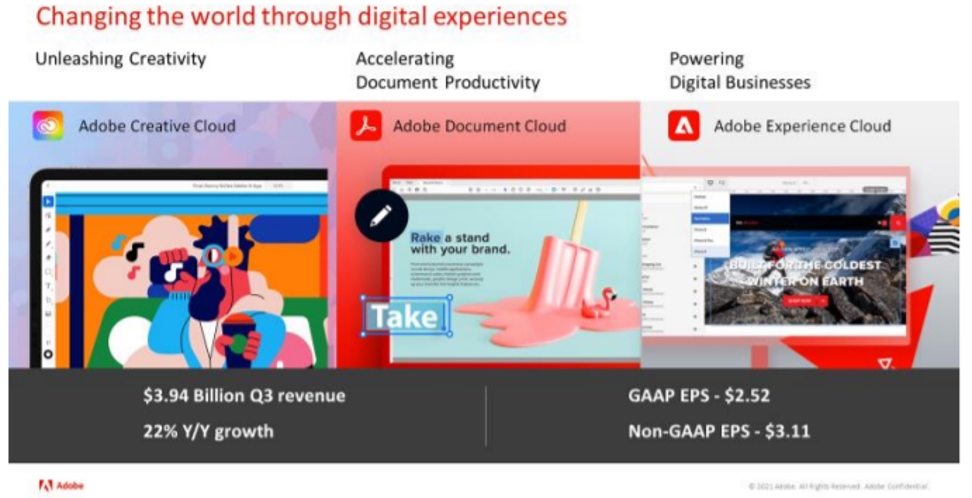

Building on decades of leadership, Adobe continues to pave the way in core creative categories, including digital photography and design, while pushing the boundaries across a wide range of emerging categories such as AR and 3D.

Whether it's the latest binge-worthy streaming plus series, a social media video that sparks a movement, or a corporate video, creation and consumption of video is experiencing explosive growth while Adobe is core to these businesses.

In August, they announced an agreement to acquire Frame.io, a leading cloud-based video collaboration platform. Video editing is rarely a solo activity and it's traditionally been highly inefficient. Frame.io streamlines the video production process by enabling editors and key project stakeholders to seamlessly collaborate using cloud-first workflows.

In the digital economy, companies are relying on digital presence and commerce as the dominant channels to drive business growth.

According to the Adobe Digital Economy Index, U.S. consumers spent over $541 billion in e-commerce from January through August, 58% more than what we saw two years ago.

As a result, in Q3, Adobe achieved record revenue of $3.94 billion, which represents 22% year-over-year growth.

The company isn’t just performing in terms of raw revenue, but the 3-Year EPS Growth Rate has stayed in the mid-20% and snowballing in terms of dollars accumulated.

Just to validate what I just said, in 2017, annual earnings were $1.7 billion and fast forward to 2020 and earnings surged to $5.26 billion.

Adobe’s consistency is also the talk of the town with their 3-year revenue growth rate in the mid-20%.

Adobe is really at the sweet spot of their earnings profile, and I can easily see this company growing from a $270 billion market cap today into half a trillion-dollar stock within 4 years with earnings of $8 billion per year.

Naturally, the bread and butter to Adobe is the small and medium-sized businesses (SMB).

The SMB’s scoop-up products like imaging and video continue to do well — the Acrobat business, which is reflected both in the Creative Cloud and the Document Cloud, is doing well.

Net-net, I would say that the growth prospects for these particular businesses are running smoothly as can be and this is how positive the feedback is from these creative products.

At the end of the day, I think the macro trend that everybody is finding is that a digital presence in commerce, data and insights, and analytics is an x-factor now for anybody doing business.

The behavioral data that Adobe collects in real-time for the productivity division correlates with the marketing message associated with telling creators that they really need to focus on getting their first-party data to be an asset.

Then you add that to the creative products and wow — what a stellar company.

These are seminal trends Adobe is flying on the coattails of, and the robustness of Adobe’s tools significantly differentiates itself relative to competition.

I am bullish Adobe in the long term.