Are 8% Rates Good For Tech?

Although much of the mass media ignores some of these dire reports issued by some prominent finance guys, I have taken notice.

I’m not here to scare you.

Everything will work out fine.

It was only just lately that one of the most public-facing US bankers, Jamie Dimon, delivered us a future warning that could mean bad results for many tech companies.

I won’t say that every tech company will be ripped to shreds, there are still a few that are head and shoulders above the rest and could withstand heavy shelling.

But 8% rates is a world that could spook tech investors.

It just goes to show that some numbers floating around are starting to come into the realm of possibility even if the probabilities are quite low.

Dimon’s thesis centered on “persistent inflationary pressures” and unless you’re an ostrich with your head in the ground, prices haven’t come down for most stuff that we buy including software and tech gadgets.

Rates close to 10% would kill many golden gooses in various industries and I do believe a world of rates that high would really put the sword to the throat of many tech companies.

If that happened, kiss the tech IPO market goodbye and just be happy that we squeezed into Reddit this year.

More often than not, American tech companies are gut-punched when there is a global growth slowdown because many of these companies extract revenue from everywhere.

They are so big that they have to unearth every stone in far-flung places to keep the growth narrative chugging along.

The unemployment rate remains below 4% and businesses, but a world of 8% interest rates would mean another 50% downsizing of tech staff and a rockier path to profits.

Amidst heightened global uncertainty, what has the technology sector delivered to us lately?

Shareholder returns.

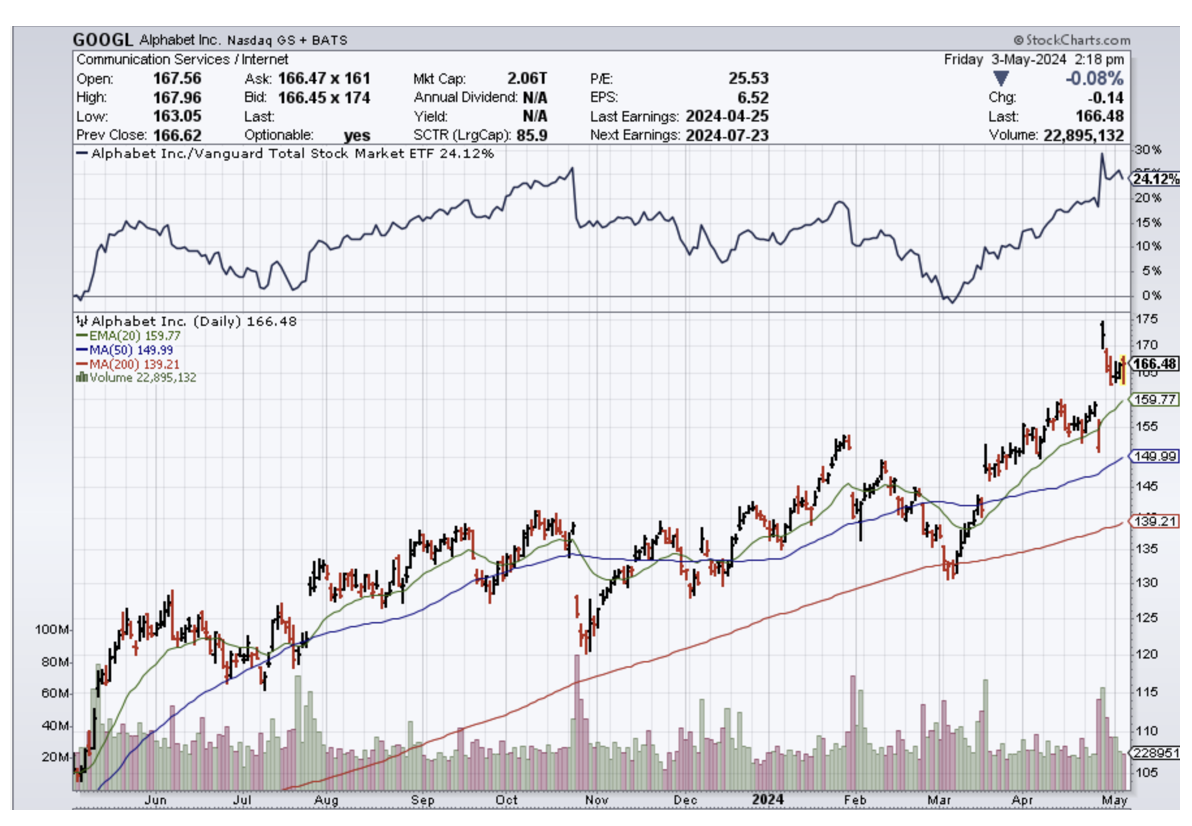

Google rolled out the carpet for its first-ever dividend.

Apple increased its dividend by announcing a new $110 billion share repurchase plan.

What is my takeaway here?

Has Apple run out of bullets here so much so that a share buyback is better to do than give its clients a new product?

They do this also because they can afford to and many tech companies would view this as a luxury.

However, there will come a time where the market will demand a new killer product and that day is inching forward.

How do I know that?

iPhone sales are down 10% in the first 3 months of 2024 and that is absolutely awful.

Even if the market looks through these terrible numbers, the day of reckoning inches up, and when it comes, not even a shareholder buyback will massage the stock higher.

Like a magician, this earnings season was a great escape for tech, and I question how many more earnings seasons will they get a pass for.

In a scenario of 8% interest rates, 95% of tech stocks would drop and a few heavyweights would be forced to carry the load. Psychologically, it would scare off the incremental tech investor and that is the bigger problem.

There is only so far the can is able to get kicked down the road.

In the short term, I would be inclined to buy on the dip after we can digest this mediocre earnings season, but at some point, this “bad news is good news” will disappear with the wind.