August 13, 2009

August 13, 2009

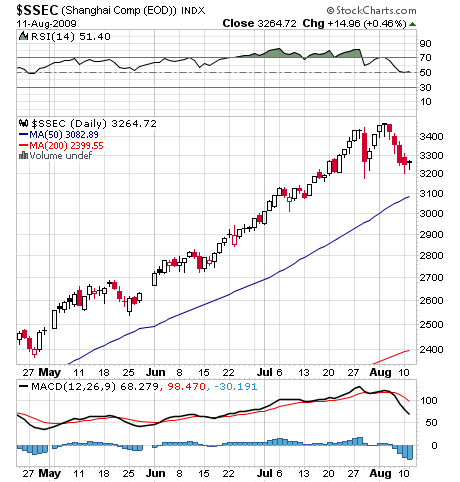

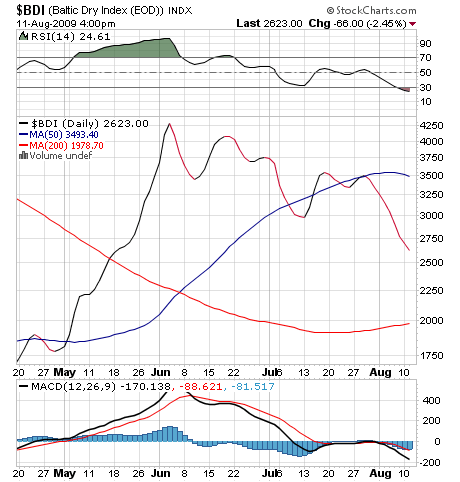

1) Traders are keeping a laser eye focus on two bellwether markets, which are starting to roll over like a cheap date.? The red hot Shanghai stock market has dropped 10% in the past few weeks, putting in an ominous double top on the charts. The Baltic Dry Index, an indicator of? Chinese bulk raw material importing expectations, put in its worst week in a year, off a bone chilling 40% from its recent peak. What are these markets telling us? Best case, the market is going to sleep. Worst case, we are seeing the red skies of a global sell off. Better trim back you?re long exposure of every size, shape, color, taste, and smell. This year?s mini bubble is over.

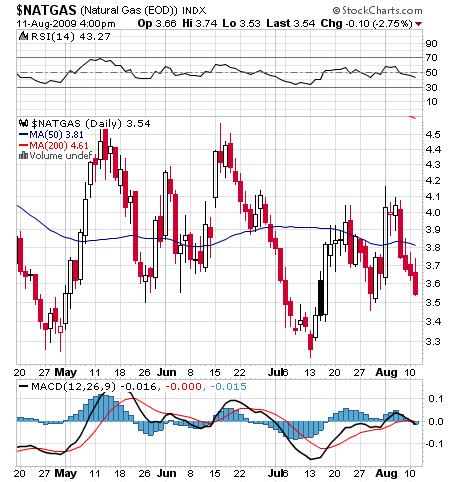

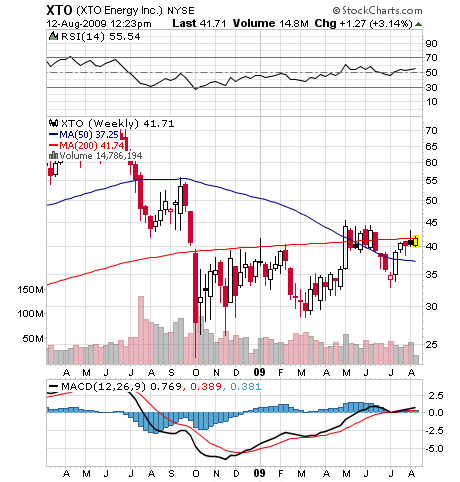

2) XTO Energy (XTO) CEO Bob Simpson sees natural gas bottoming around here and then spiking up to $7 next year (see their website ) . It was a perfect storm of a collapsing economy, huge new discoveries, and the coolest summer on record that took us from $13.50 to $3.10. Since then companies have slashed gas exploration and drilling budgets, taken the rig count down from 1,600 to 700, and that number is still falling at a precipitous rate. Total onshore production is down by 3% and will plunge by 10% by the winter. XTO is one of the largest independent oil and gas producers in the country, and Simpson is one of the savviest players in the space. He hedged all of his firm?s 2009 oil production?? at $96/barrel, and 40% of his gas production at a stunning $9/BTU. NG has sold off 15% in the past week, as I expected, and this could be the beginning of the final wash out if no hurricanes show up. Keep that natural gas ticker (UNG) ticker glued to your desktop. There certainly isn?t much else to buy out there right now.

3) I don?t normally rely on National Geographic magazine for investment advice, but in the June issue the screaming long term bull case for the soft commodities is there in all its glory (see their website ). During the sixties, new dwarf varieties, irrigation, fertilizer, and heavy duty pesticides tripled crop yields, unleashing a green revolution. But guess what? The world population has doubled from 3.5 to 7 billion since then, eating up surpluses, and is expected to rise to 9 billion by 2050. Now we are running out of water in key areas like the American West and Northern India, droughts are hitting Africa and China, soil is exhausted, and global warming is shriveling yields.?? Water supplies are so polluted with toxic pesticide residues that rural cancer rates are soaring. Food reserves are now at 20 year lows. Rising emerging market standards of living are consuming more and better food, with Chinese pork production rising 45% from 1993 to 2005. The problem is that meat is an incredibly inefficient calorie transmission mechanism, creating demand for five times more grain than just eating the grain alone. I won?t even mention the strain the politically inspired ethanol and biofuel programs have placed on the system. It is possible that genetic engineering, sustainable farming, and smart irrigation could lead to a second green revolution, but the burden is on scientists to deliver. The net net of all of this is that food prices are going up, a lot. Entertain core long positions in corn, wheat, and soybeans on the next dip, as well as the second derivative plays like Agrium (AGU), Potash (POT) and Monsanto (MON). You might also look at DB Commodities Tracking Index Fund (DBC). These will all surpass last year?s stratospheric highs at some point.

4) The market has been buzzing about an enormous options position that has been put on by one of the major hedge funds, betting that that the S&P 500 goes out with a swan dive at the end of 2009. The trade involves going long 120,000 S&P 500 December 950 puts, and going short 240,000 December 820 puts, a strategy known by pros?? as a ?bear put ratio.? For newbies to the option world, this means the player would automatically go short $2.85 billion worth of stock if the index goes under 950, then goes long $5.70 billion of stock if the index drops below 820. I don?t think this is a trade someone did while sitting at home in bed with their Imac on their lap watching Lost on TV. The position generates a maximum profit of $390 million on December 18 with the S&P 500 at 820, just in time to jump on your G5 for a ski vacation in Aspen. It can be strapped on today for a cost of only $7.5 million, or $62.50 if you want to deal in only a one lot. But the trade suffers accelerated losses below 820. If you want to see the deep background on this trade, please click here . Looks like it?s time for me to download new bear photos from Google.

QUOTE OF THE DAY

?The risk of a ?W? is high because there are so many structural problems that will take a long time to work out. Commercial real estate is bad, the employment situation is not good and will be high for years, and we have huge policy issues, like high taxes, bigger deficits, big structural change,? said David Kotok of Cumberland Advisors.