August 4, 2009

August 4, 2009Featured Trades: (EURO), ($CAD), ($AUS), ($NZD), (JNK), (PHB), (HYG), (EWY)

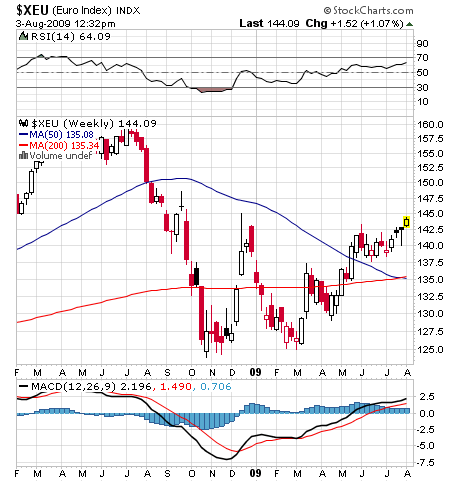

1) The chickens are finally coming home to roost for the dollar, which has gapped since Thursday from $1.40 down to $1.4450 against the euro, and done even worse again the Australian, Canadian, and New Zealand currencies. Crude traders tell me that the weak buck is making oil go up, while currency traders inform me that it is strong crude that is causing the dollar collapse. It?s like an Agatha Christie murder mystery where all of the suspects are guilty. If we are on the eve of an economic recovery, many fear that the US will return to its old, evil, high consuming, high importing ways, and that the trade deficit will skyrocket. If is doesn?t, then you can count on burgeoning government borrowing to knock the stuffing out of the greenback. It sounds like a heads I will, tails you lose bet. This is not exactly a new trend. The chart below shows the purchasing power of the dollar since the Revolutionary War, and it has been mostly downhill since 1929. No, I have not been trading the market that long. Better to take your pay in Euros, American double Eagle gold coins, bushels of wheat, or barrels of crude.

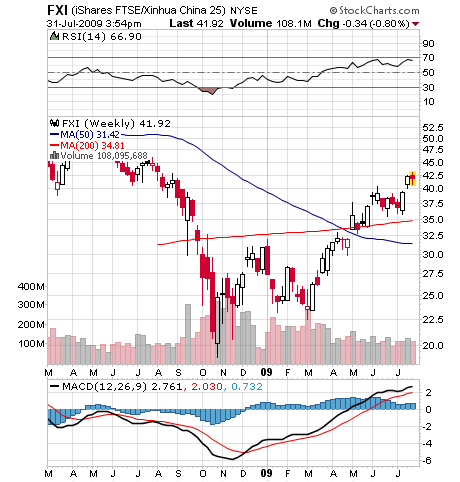

2) Legendary investor and former George Soros partner Jim Rogers gave a great interview to Bloomberg TV over the weekend. Although he is a long term bull on China, he wouldn?t be adding to positions here, because having doubled in six months you?d be jumping on a moving train. China?s stimulus program is 2.5 times larger than ours on a GDP basis, and is generating more immediate results, as it is being entirely domestically spent. No generous subsidies for foreign car imports. Many industries are booming, and real estate is going crazy again. The better play here is commodities, which the Chinese absolutely have to buy, especially the grains (see my call to buy wheat). Jim is so wedded to his China play that he has moved to Singapore to get closer to his investments. He has always been very public with his ideas, getting people to buy what he already owns, and widely propagates YouTube with his interviews. Take a look at his personal investment website at http://www.allthingsjimrogers.com/.

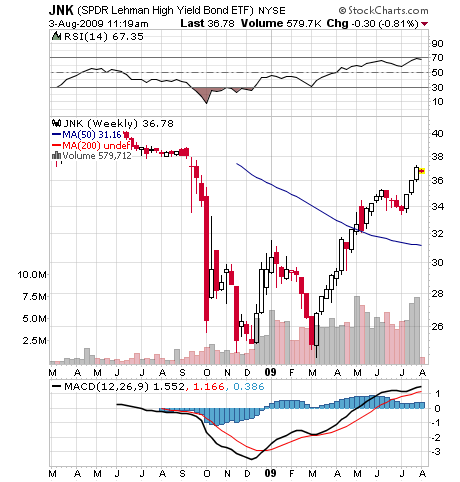

3) At the beginning of the year I was wildly bullish about junk bonds, and recommended a covey of ETF?s, including the Lehman High Yield Bond Fund (JNK), the PS Corporate High Yield Bond Fund (PHB), and the iShares iBoxx Fund (HYG) (see my report ).? At the time, fears about The End of The World triggered cascading margin calls and distress liquidation that saw tidal waves of paper dumped into a no bid market. Some lesser credits traded with yields at 2,500 basis points over Treasuries. JNK is now 54% up from the March lows, and the others have done as well. Once the Great Depression II was taken off the table, the scramble for yield by hedge funds couldn?t have been more awesome. The average spread over Treasuries has been cut from 1,800 basis points to a mere 1,000, which was where spreads maxed out in the 1990 and 2002 recessions, and could be the new ?normal.? This is against a 20 year average junk spread of 600 basis points, and only 100 basis points seen at the ultra frothy 2007 peak. The good news is that falling junk yields may eventually force tight fisted commercial banks to ease up on the supply of conventional loans, which is restraining a real economic recovery. Gains on junk from here may be limited. Emerging market corporate issuers inundated this market in Q2, some dubious borrowers are starting to sneak back in, and the rollover calendar going forward is truly enormous. There are too many better fish to fry. I?d take the money and run.

4) I have long advocated that the term ?BRIC? should be expanded to ?BRICK? with the inclusion of South Korea (maybe BRISK??) (see my last last report ). The Hermit Kingdom?s exporters are super competitive, with Hyundai forging ahead in terms of both market share and quality in the US. South Korea is carving out a quality niche, where China can?t compete. The Won is undervalued, unemployment is relatively low, and the economy is now poised for an early recovery. The iShares MSCI South Korea Index ETF (EWY) has soared by 115% this year, tacking on 30% in the last three weeks alone. Better add some kimchee and bulgolgi to your diet. They?re delicious, but don?t try it before a date if you?re hoping for a return engagement.

QUOTE OF THE DAY

?The Chinese consumer is consuming,? said legendary investor Jim Rogers, about the Middle Kingdom?s successful stimulus program.