August 6, 2009

August 6, 2009 Featured Trades: (UNG), (NATURAL GAS), (DVN), (CHK)

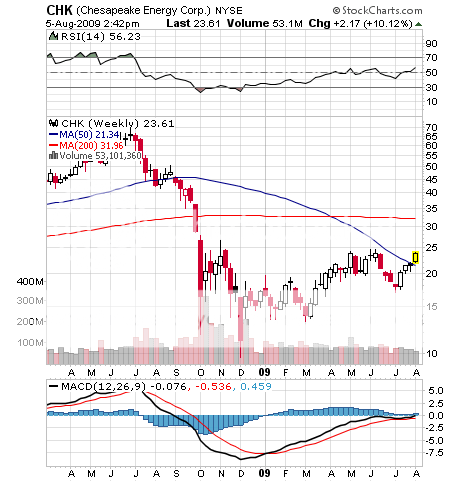

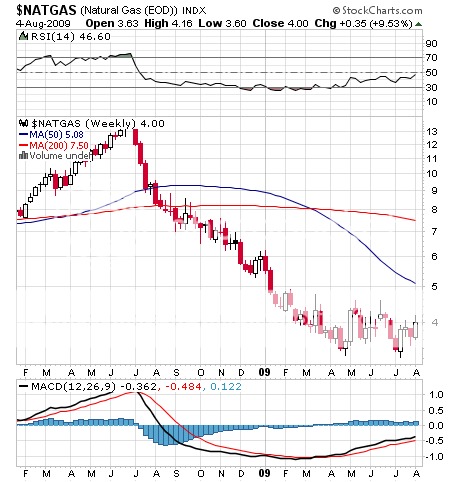

1)I have been a growling, obnoxious, and highly unpopular bear on natural gas since I put out my sell recommendation on June 2 , just before the crash from $4.30 to $3.10. Since then it has been bouncing around like a ball bearing in a boxcar on the Durango & Silverton Railway. Devon Energy?s (DVN) CEO Larry Nichols has me wondering how long this exasperating action will continue, and when a recovery will begin, if ever. NG has been a screaming chart buy for months, but with terrible fundamentals. Thanks to advanced fracting technologies, hardly a week goes by without a major new find somewhere in North America, taking our reserves from nine years to 100 years in a New York minute.?? So the US is sitting on a gigantic untapped gas formation? Who knew? DVN, one of the best managed companies in the industry, has a balanced oil/gas portfolio. Fortunately, windfall profits in oil have offset wrenching losses in gas. By chopping NG exploration to nothing, it has halved its drilling budget, and that money has dropped straight to the bottom line, enabling it to announce great earnings. See my call to buy competitor Chesapeake Energy (CHK) before its unbelievable 250% run . Despite the prices not seen in a decade, gas demand from industry remains moribund. But Nichols thinks continued production cuts will bring the gas market into balance sometime this winter, making those charts a lot more interesting. Maybe you should be picking up some of the NG ETF (UNG) on its next dive down to $12.50.

2) Reformed oil man, repenting sinner, and borne again environmentalist T. Boone Pickens says that ?when we turn the US green, it will have the best economy ever.? I met the spry, homespun billionaire at San Francisco?s Mark Hopkins on a leg of his self financed national campaign to get America to kick its dangerous dependence on foreign oil imports. For the past 30 years, the US has had no energy policy because ?no one wanted to kick a sleeping dog.? Production at Mexico?s main Cantarell field is collapsing, and will force that country to become a net importer in five years. Venezuela is shifting its exports of its sulfur laden crude to China for political reasons, once refineries in the Middle Kingdom are completed to handle it. Unfortunately, the collapse of energy prices since June and the disappearance of credit have put urgent alternative energy development on a back burner, with his preferred natural gas (NG) taking the biggest hit. If the US doesn?t make the right investments now, our energy dependence will simply shift from one self interested foreign supplier (Saudi Arabia) to another (China). Wind and solar alone won?t work on still nights, and can?t power an 18 wheeler. Don?t count on the help of the big oil companies because they get 81% of their earnings from selling imported oil. The answer is in a diverse blend of multiple alternative energy supplies from American only sources.?? Although Boone now has Obama?s ear, it?s a long learning process. Boone has donated $700 million to charity, and says the 20,000 trees has planted should offset the carbon footprint of his Gulfstream V. I worked with Boone to organize financing for a Mesa Petroleum Pac Man oil company takeover in the early eighties, when it was cheaper to drill for oil on the floor of the New York Stock Exchange than in the field. Now 80, he has not slowed down a nanosecond.

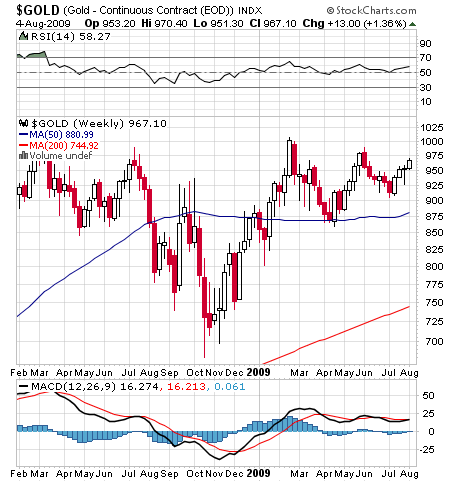

3) President Obama has a tough hand to play here. If the economy stagnates, the 2010 midterm elections are going to be an uphill battle. Only 7.7% of his $787 billion package has been spent so far, and when the rest hits, it will be like pouring gasoline on the flames. On top of that, add the cost of the new health care plan, still an unknown, but big. Perhaps this is why gold is now taking its fifth run at $1,000 in the past year? If his gargantuan stimulus takes hold, then it?s off to the races with inflation. For more on this, read the piece by William Patalon III by clicking here .

QUOTE OF THE DAY

?If you want a friend in Washington, get a dog,? said Harry S. Truman, the 33rd president of the United States.