Avoid the Housing Database Landmines

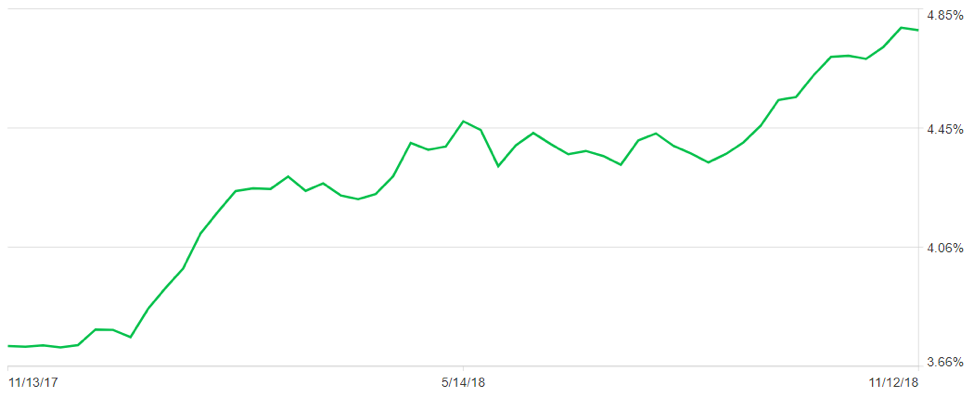

Stocks that negatively correlate with higher trending interest rates are on a suicide mission as the Fed gradually raises interest rates because of the robust domestic economy hitting on all cylinders.

That is why I am unequivocally bearish on online real estate database companies Zillow (Z) and Redfin (RDFN).

Invest in these stocks at your peril because the short-term path to accelerated EPS growth and higher revenue growth looks treacherous at best.

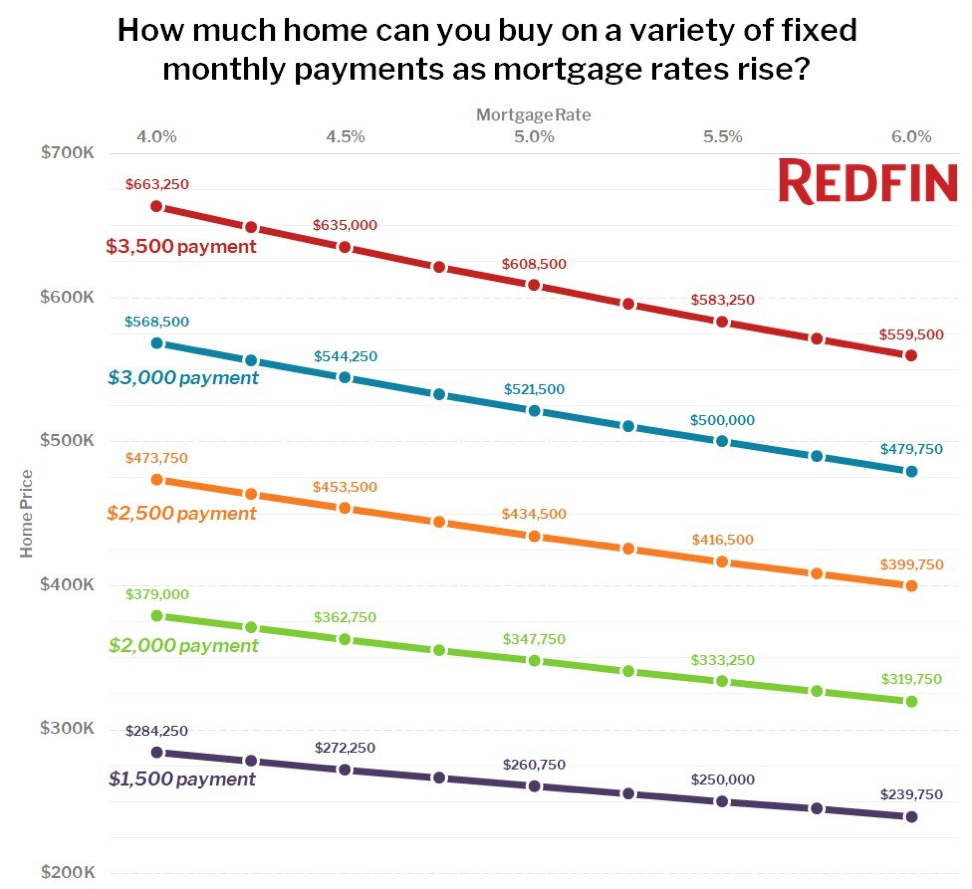

The last few months has brought forth a massive contraction in mortgage applications as a lack of affordability cripples home buyers around the country.

Buyers are simply waiving the white flag and giving up home searches unable to digest the potential monthly mortgage payments.

As recent as last week, mortgage applications dropped 4% from the previous week and this is only the tip of the iceberg.

Buyers are holding off pulling the trigger and have concluded that housing is about to peak, or the peak is in view.

Why splurge on a big investment when you can buy a house cheap on the next dip?

The supposed silver lining is that inventory is slightly up but that is largely irrelevant because the inching up stems from a dire shortage of inventory that incited vicious bidding wars in the most sought-after metropolitan areas mainly around the east and west coasts.

This is all bad news for Zillow and Redfin who are the main real estate database firms buyers use to do research on the properties and sellers use to advertise housing-related products.

The more buyers drop out of the market altogether, the fewer eyeballs gravitate towards these platforms creating less traffic volume.

Aptly aware of the pitfalls around this business model, both Redfin and Zillow desperately attempted to evolve and fortify their business model.

They decided to get into the business of selling houses and originating mortgage loans when real estate specialists view short-term housing prices in a precarious situation at best.

Zillow preceded this up by purchasing online mortgage lender, Mortgage Lenders of America, which is a dangerous short-term bet as the loan book could sour if the real estate market is crushed by rising rates.

Buy low and sell high, it seems Zillow understood this the other way around.

One bright note was that Zillow shouldn’t face liquidity problems because the purchase was made in cash for $65 million.

Attempts to corner the real estate advertising market was Zillow’s cash cow, and careening into a high-risk part of the real estate market at the wrong time could turn into a painful write-off.

Both of these companies are chronic loss-markers and if the recession graces our shores earlier than expected, it could stick Zillow and Redfin with a hefty inventory of housing units in a downtrodden market.

Pouring fuel on the flames, turning into a mortgage lender could cannibalize 3rd party agent business who could decide to pull the plug on their listings and ads from the database completely.

This could be dreadful for Zillow because the main source of revenue is the advertising revenue they rely on from its platform.

In one fell swoop, Zillow effectively damaged both businesses failing to recognize the disconnection of the synergies between them.

I would argue that this could have been a sublime idea if there was no competition and a monopolistic moat would force customers to search on a single platform.

However, these two companies have minimal product differentiation and the risk of starting a pricing war to zero could be in the fold as shoppers will cherry-pick for the best deal depending on the platform since the products are the same.

Fast food outlets have faced this problem in the last few years as their products have been commoditized.

Prematurely rolling out this new strategy could emasculate these companies.

The time is ripe for an outsider with access to cheap capital to easily roll into town and play nice with the independent broker industry promising to protect future broker’s commission and not step onto their turf.

3rd party brokers would migrate towards this peaceful platform in an instant if they sensed cooperating with Redfin and Zillow hampered business, and it would be game over for Zillow and Redfin in a jiffy.

It would make sense for outliers like Homesnap, Neighborhood Scout, and Realtor.com to summon a batch of capital and surgically target the weakness left gaping open by Zillow and Redfin.

Naturally, investors voted with their wallets and each of these “transformational” moves was met by a cascade of torrential selling in the shares.

As interest rates trend higher, it will automatically ratchet up pressure on these marginal business models.

The coming potential lack of mortgage originations from fewer buying candidates and a slide in internet traffic disrupting ad revenue will quickly erode sales revenue growth.

Zillow is already buying houses from sellers in Denver, Atlanta, Las Vegas and Phoenix with their own capital.

If buyers dry up, Zillow will be on the hook for these houses saddled with a growing inventory of units with a return rate of zero while dealing with a high cost of carry.

All of this shouts lower growth and decelerating revenue.

Management has effectively offered shareholders a difficult path to profits beset by landmines that could potentially blow up a limb or two along the way.

If management stuck with the ad business, they could revisit this risky business at the start of the new cycle with the tailwind of low-interest rates and lower house prices.

Patience is a virtue, and nobody told Zillow’s and Redfin’s management.

That is exactly the type of tech company not to invest in even though Zillow’s 22% sales revenue growth is not bad.

I commend management for seeking fresh levers to stoke growth, but this was a badly calibrated commitment that will cast a pall over its operations for the next few years.

As predicted, these companies blew up its future guidance which is a sign of things to come.

Redfin reduced guidance for profits on the home selling unit by 80%.

Not only did they pull back guidance for the new division, but the core advertising unit was hit with a mild reset in guidance.

Elevated execution risk effectively moving forward to this back end of the economic cycle could turn out to be a genius move. But until management can prove this move could gain traction, investors need to abstain from taking risks with this potential catastrophe.

My bet is that this will end in tears.

Zillow is a far stronger company than Redfin with stronger revenue accumulation while boasting higher revenue growth. But when the industry fundamentals are dictating the weak price action, it’s a great time to sit on the sidelines.

Avoid Zillow and Redfin, the boat is sinking and unfortunately this time, the tide won’t raise all boats and say hello to margin capitulation while you’re at it.