Bet the Ranch on Square

Square (SQ) is one of those fintech companies that you buy and never sell.

The company’s recent stock performance has eclipsed many of the other cloud stocks that have done almost as well.

Shares of Square are up from the March lows of $36 and now trading a smidgeon below $100.

It is just a matter of time before the stock breaks $100 and this company is easily a $200 stock in the future.

Let us look at the reasons why shares have rebounded with extra zeal from the nadir.

First, they are an overwhelming recipient of the “re-opening” trade which is in full effect even with a reboot of coronavirus cases in the U.S.

The government has been adamant that there is only a way forward and not backwards - shutting down the economy again is not an option.

With people out of their houses, data points are up from zero like May’s retail sales numbers showing a sharp rise of 18% month on month. The SPDR S&P Retail ETF (XRT) is up 2.4%.

Square is a fintech payment service provider among other things and their addressable market worth $160 billion is expanding and they are perfectly positioned for sustained expansion in the years ahead.

The digitization of the economy has played into Square's hands and the pandemic has acted like a supercharger to a trend: the steady migration of most everyday banking activities to mobile apps and online portals.

Why is Square a legitimate long-term threat to the traditional banking system?

Square has siphoned accounts from banks and add up to 14 million in total including customers who direct deposited their stimulus checks and/or tax refunds and not necessarily their paychecks.

Square Capital’s 75,000 PPP borrowers give Square real skin in the game and combined with a growing base of larger merchants, intimate knowledge of their revenue flows, Square will win a good amount of new small business loan activity.

Its small business loan portfolio is already approximately 75,000 loans and were facilitated during the quarter with a total value of $548 million - an increase of 8% year-over-year.

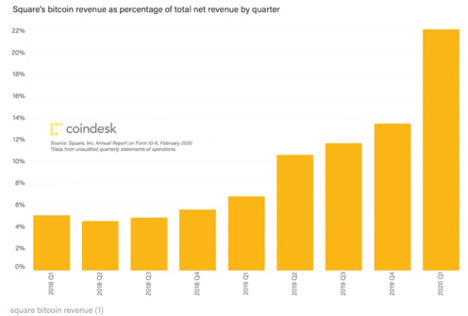

One of Square’s massive growth drivers is its accessibility to buying bitcoin and the commission of payments on the Cash app.

Square’s bitcoin revenue now accounts for 22% of total quarterly revenue.

In Q1, Cash App gross profit grew 115% year over year and gross profit on Cash App is dominated by Square’s $222 million in non-bitcoin revenue, $178 million of that was profit.

The bad news is already behind the fintech companies with the post-pandemic which saw Square’s payment volume crater 39% last month.

Even with such terrible data, Square still posted a positive earnings report with revenue for the quarter up 44% year-over-year. Gross Payment Value (GPV) was up 14% year-over-year. Gross profit was up 36% year-over-year.

Square also offers an online retail capability with Square Online Store, which competes with Shopify.

The company is a hotbed of new fintech innovation rolling out new products every quarter.

If a new product fails, management is quick to put out the flames and try something new.

They are not just a one-trick pony like Facebook and are one of Silicon Valley’s true innovation firms.

It is refreshing to see a company led with a bold CEO in Jack Dorsey who isn’t 99% marketing and 1% substance like many who make the decisions at these ultra-powerful firms.

Volatility in this stock makes this a terrible stock to trade – 6% down days are common.

Buy this stock and it will no doubt cross $200 in the next 3 years.