Mad Hedge Biotech & Healthcare Letter

February 20, 2020

Fiat Lux

Featured Trade:

(A NEW CURE FOR CANCER)

Mad Hedge Biotech & Healthcare Letter

February 20, 2020

Fiat Lux

Featured Trade:

(A NEW CURE FOR CANCER)

Cancer is a cunning enemy.

I’m writing about this subject today because there is an immediate trading opportunity. I’m writing it because you personally may have to bet your life on using this advanced technology someday.

Solid tumor cancers, like those affecting the breast and the lungs, require stringent treatments including chemotherapy, radiation, and surgery. When the tumors are not completely eliminated, there’s a high risk of cancer coming back to haunt the patient once again.

In fact, around 20% to 40% of women in the US who go through partial mastectomy still go back for surgery. This is because there are marginal tumors that remained -- the ones that the surgeons failed to spot the first time around.

This is where a groundbreaking technology comes in.

In 2019, the US Food and Drug Administration approved the first-ever cold atmospheric plasma technology to remove microscopic cancer tumors that linger even after surgery. Recently, we learned from one of our subscribers that the first approved clinical trial was a success.

The procedure was done by a surgical team in Israel in cooperation with an American company, US Medical Innovations LLC. The two teams utilized USMI’s patented Canady Helios Cold Plasma Scalpel (CHCPS) to help a patient suffering from a rare advanced reoccurring inoperable retroperitoneal sarcoma.

The 33-year-old patient was first diagnosed at age 20. Since then, he had to undergo surgery twice because his tumors kept reoccurring.

Here’s a bit of context on the complexity of the patient’s condition and possibly the reason why the surgeons couldn’t get to all the tumors the first two times.

The retroperitoneal space, which is where they detected the sarcoma, covers sections of the abdominal cavity, the duodenum, the kidneys, adrenal glands, both ascending and descending colons, parts of the rectum, and the pancreas. Needless to say, the affected area extends over a huge part of the patient’s body.

The surgery in Israel, which was performed on August 20, 2019, aimed to completely eliminate all the tumors. To do this, the surgeons used the cold plasma scalpel to selectively kill cancerous tissue.

To be specific, the surgical team first removed the tumor along with its attachment located in an adjacent tissue in the abdomen. Then, the patient underwent radiation therapy. After those, cold plasma was sprayed over the surgical site. The entire process was successful, and the patient went home to the US in September 2019.

Here’s a brief discussion of this groundbreaking technology.

Plasma, albeit the state of matter we’re least familiar with, is said to be the most common form found in the universe. Generally, plasma is hot and runs on high temperatures like the stars.

However, it can be manufactured at a low temperature by partially ionizing a gas such as helium. Doing so produces cold plasma.

In the past years, cold plasma has seen various applications including killing bacteria on medical equipment, human skin, and wounds. It has even been used to get rid of the smell of deep fryers.

However, the most exciting application that has been in the works for quite some time now is cancer treatment.

Through various trials done on animals and cultured cells, researchers found that cold plasma is a productive and selective cancer killer.

This particular form of matter can create toxic molecules called reactive oxygen species (ROS). These molecules can damage tumors while keeping healthy cells safe.

It’s a brilliant way to kill the cancer cells since the tumors are already highly oxidized, leaving a fairly simple job for the toxic molecules.

When the ROS comes in contact with the highly oxidized cancer cells, the latter’s oxidization levels are pushed through the roof, effectively killing them.

To harness the power of this form of matter, USMI created the cold plasma scalpel.

The CHPCS is a pen-like electrosurgical scalpel. It sprays a blue jet of cold plasma on the surgical site for roughly two to seven minutes, which means that all the remaining cancerous tissue or cells are in the blast zone.

As demonstrated in the successful clinical trial, the procedure only affected the remaining tumors and left healthy tissues safe.

Although this is definitely amazing work, it should be remembered that cold plasma technology is not a substitute for other cancer treatments like chemotherapy, radiation, and surgery.

Rather, think of cold plasma technology as “Pulp Fiction’s” infamous Winston 'The Wolf' Wolfe. Its role is to “clean up” the residual cells after surgery and eliminate any possibility of a tumor returning with a vengeance.

Mad Hedge Biotech & Healthcare Letter

February 13, 2020

Fiat Lux

Featured Trade:

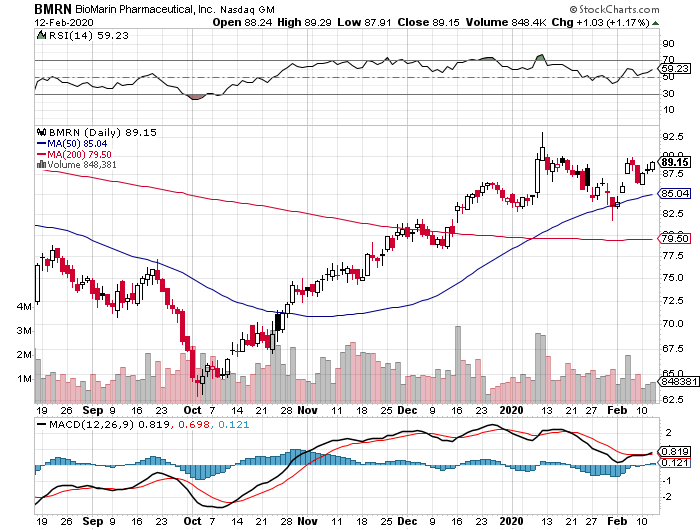

(THE REDEMPTION OF BIOMARIN PHARMACEUTICAL)

(BMRN)

BioMarin Pharmaceutical (BMRN) has been in the doghouse in the past years, but the company is heralding 2020 as its redemption year.

This California-based biotechnology innovator has been watching its stock plummet since 2014, with the downward trend starting with BioMarin’s grand plan to find the cure for Duchenne muscular dystrophy.

This vision led to a $680 million gamble on an experimental treatment, Kydrisa. Even before the deal was finalized, however, industry experts opposed the idea like bats out of hell but BioMarin decided to go through with the ill-fated deal.

Unfortunately, the naysayers were proven right all along when the FDA rejected Kydria in 2016.

Four years after, BioMarin has come back swinging.

At the center of its redemption story are two high-value clinical assets: hemophilia gene therapy Valrox and dwarfism treatment Vosoritide.

Valrox is expected to become the most expensive drug in existence with a price tag somewhere between $2 million and $3 million. In comparison, Roche Holdings’ (RHHBY) own hemophilia A treatment, Hemlibra, costs roughly $500,000 annually.

If it receives the go-ahead from the FDA, BioMarin’s treatment will be the first-ever gene therapy available in the United States, with the company planning to target the most common types of hemophilia.

Based on the clinical trials, the patients exhibited significant improvements after the treatment. In fact, some patients had reported zero bleeding incidents for years following their first Valrox injection.

Hemophilia, which hinders a patient’s blood from clotting and causes nonstop bleeding, is known as one of the most expensive diseases to manage. At the moment, the average annual cost of hemophilia medications is $270,000 per patient. If approved, Valrox will actually be able to cut down the costs in the long run.

Barring any unforeseen roadblock, BioMarin’s hemophilia gene therapy will get the FDA green light by the third quarter of 2020.

Meanwhile, dwarfism treatment Vosoritide is now in Phase 3.

This drug is intended for children suffering from achondroplasia, which is the most widely known form of dwarfism and affects 1 in 25,000 infants. Basically, this condition is caused by an error in the patient’s gene that’s supposed to regulate bone growth, particularly in the arms and legs.

So far, BioMarin’s Vosoritide has induced faster bone growth in the patient’s bones compared to a placebo after a year of treatment.

The company plans to discuss the marketing strategy for Vosoritide in early 2021, which means the treatment will be launched in the same year.

Vosoritide is expected to rake in $700 million in peak sales.

If this also gains an FDA nod, Vosoritide will be the first-ever therapy focused on treating the underlying cause of this type of dwarfism.

In and of itself, Valrox is estimated to generate over $1.4 billion in peak sales. Vosoritide has the potential to achieve that level of blockbuster status as well simply because it will be the only approved therapy available in the market for this particular type of disease.

Taken together, both Valrox and Vosoritide have the capacity to more than double the annual revenue of BioMarin as early as 2024.

Given these expectations, the success of both drugs would catapult BioMarin to the top of the biotechnology industry and transform it into the most sought-after stock over the next decade.

So, although the company’s shares don’t exactly come cheap, this rare-disease biotech stock can still post substantial gains in 2020. After all, the primary force behind BioMarin’s growth this year is the company’s decision to create a pipeline focused on finding cures for rare, genetic conditions.

If you carefully think about it, BioMarin is actually undervalued when you consider the progress achieved by its direct competitors and the company’s near-term growth prospects.

Needless to say, BioMarin stock will be one of the red-hot commodities in a few short years.

Mad Hedge Biotech & Healthcare Letter

February 11, 2020

Fiat Lux

Featured Trade:

(NOVO NORDISK IS MINING GOLD WITH DIABETES)

(NVO), (LLY)

Diabetes is one of the fastest-growing and serious health conditions that affect the lives of over 50% of Americans, with 60 million more categorized as pre-diabetics. As expected, the market for diabetes treatments is saturated.

However, this biotechnology company has been hailed as one of the leaders in this sector: Novo Nordisk (NVO).

Novo Nordisk has long established itself as a major player in this lucrative market, with diabetes treatments in its portfolio primarily responsible for the 24% jump of the stock’s performance in 2019 -- an increase that has been sustained up until today.

The company’s lineup includes a number of insulin products such as Tresiba and NovoRapid, with Novo Nordisk supplying roughly 50% of the insulin distributed globally.

Meanwhile, its top-selling Type 2 diabetes drug Ozempic ranked first among all the drugs launched in 2018.

Capitalizing on the success of Ozempic as a blockbuster insulin injectable, Novo Nordisk has gained FDA approval to market this bestselling drug as a treatment to reduce the risk of major adverse cardiovascular (CV) condition among patients of Type 2 diabetes.

This is actually an impressive move since diabetics are more often than not also suffering from other comorbidities like kidney problems, obesity, and CV disease.

With this expanded indication involving CV risk reduction, Novo Nordisk’s cash cow will be on par with heavyweights like Bristol-Myers Squibb (BMY) and AstraZeneca’s (AZN) Farxiga as well as Boehringer Ingelheim Pharmaceuticals, Inc. (BIPI) and Eli Lilly’s (LLY) Jardiance.

Ozempic, which was first approved way back in December 2017 as a diabetes medication and launched in the market by 2018, has long been considered the company’s strongest moneymaker.

In fact, the first nine months of 2019 saw Ozempic bring in roughly $1 billion in sales worldwide.

Still riding the momentum of its diabetes treatments, Novo Nordisk also recently received another label upgrade that classifies its recently approved oral tablet Rybelsus as CV safe as well. Projected sales for this drug now lands somewhere between $2 billion and $5 billion.

In addition to CV diseases, Novo Nordisk has also enjoyed success on other fronts like obesity.

For instance, the company’s prescription weight loss shot Saxenda has been gaining sales momentum since its release in 2014.

The fact that Saxenda can also help improve blood sugar levels for pre-diabetic patients has made it the first of its kind across the globe.

Earning $540 million in 2018, which represented a 50% jump from its 2017 sales, Saxenda is estimated to own a 68% share of the obesity market.

Saxenda’s dominance was once again proven in its third-quarter earnings report in 2019 when the drug gained an impressive 56% increase compared to the same period in the previous year.

Novo Nordisk shares come with a bit of a steep price though, and investors are hesitant over the strong reliance of the company on its diabetes lineup. After all, 84% of its sales in the third quarter of 2019 came from this line of business alone.

However, the recent approval and expanded indication of Rybelsus as another groundbreaking Type 2 diabetes treatment both in the US and abroad makes Novo Nordisk a highly coveted investment.

Keep in mind that over 90% of diabetes cases fall under that type, so the company is poised to dominate not only a lucrative sector but also an addressable target market.

Apart from that, the early and mid-stage pipeline of Novo Nordisk offers a promising lineup.

The company has been consistent with its strategy, and that is focusing on its strengths then building on them. Right now, Novo Nordisk has a lot of up and coming candidates not only for its tried and tested diabetes market but for rare diseases as well.

Thus, Novo Nordisk sales are expected to continue its upward trajectory in 2020. If this trend continues, the company can double its earnings practically every five years.

Mad Hedge Biotech & Healthcare Letter

February 6, 2020

Fiat Lux

Featured Trade:

(JOHNSON & JOHNSON JOINS THE CORONAVIRUS BATTLE)

(JNJ), (PRVB)

It looks like Johnson & Johnson isn’t walking away from the biotechnology sector anytime soon.

News of a potential exit came following the company’s move to cut down on its investment on Proventio Bio (PRVB) from 6.4%, which is around 2.4 million shares, to a 2.4% stake or 1.2 million. Further reports revealed that JNJ might sell its remaining shares soon.

JNJ’s reemergence on the front page of the biotechnology sector comes in the wake of the overwhelming fear courtesy of the coronavirus, which has already taken the lives of nearly 500 people and placed more than 24,000 patients in hospitals worldwide.

In the company’s recent announcement, JNJ executives disclosed that they are also throwing their hat in the ring in the search for a speedy vaccine to combat the deadly coronavirus.

This means that JNJ is joining Gilead Sciences (GILD), AbbVie (ABBV), and Moderna (MRNA) in the very short list of companies aiming to achieve that.

Taking a page off its success in creating a vaccine for the Ebola outbreak, JNJ is confident that it can not only come up with a coronavirus vaccine but also be able to scale it up the moment they receive FDA approval.

For context, JNJ took roughly six months to come up with an Ebola vaccine, scale the treatment, and deliver it to the public. The company spent around the same time in its efforts to produce a Zika virus vaccine.

As for the coronavirus vaccine, JNJ expects to shave off two to three months from the Ebola and Zika timelines.

While no concrete report on the progress of this initiative has been released, reports point to JNJ working with Chinese researchers to use HIV drugs to treat the widely spreading respiratory disease.

How will this impact JNJ’s performance in 2020?

For one, success on this front would definitely increase the earnings estimate for this year especially since JNJ’s fourth-quarter results failed to meet expectations on the top line. Meanwhile, the company beat the bottom line by one penny, recording $1.88 per share.

As expected, the talcum powder lawsuits continued to exert pressure on the company’s consumer goods segment.

Sales of the baby care products amounted to $421 million, exhibiting an 11% decline compared to the previous performance during the same period in 2018.

Blockbuster prostate cancer drug Zytiga has been struggling with the rise of generic rivals since 2018, slashing 13.8% off its fourth-quarter sales to $677 million.

Meanwhile, the declining sales of psoriasis moneymaker Remicade didn’t cause any major decline in the total revenue of JNJ’s pharmaceutical segment. This comes as a surprise since biosimilar competition has been gaining on the drug, cutting its fourth-quarter sales by 16.4% year over year to record $1 billion.

Despite the so-so results, the report still provided glimmers of hope that all but guarantees that JNJ shares won’t plummet in the future.

In fact, JNJ’s total fourth-quarter revenue increased by 1.7% thanks to the new products released as precautionary measures to pick up the slack from the sales decline of both Zytiga and Remicade.

For instance, psoriasis treatment Stelara managed to impress with a 17.7% increase year over year to hit $1.7 billion.

Another recently launched psoriasis injection, Tremfya, demonstrated a whopping 53.9% jump to contribute $270 million in the total revenue in the fourth quarter.

Meanwhile, younger drugs like blood cancer treatments Darzalex and Imbruvica pitched in $1.7 billion, showing off a 32.5% improvement in sales.

So although it’s unlikely that the stock will be able to produce top-line growth in the double digits as often as we’d like, JNJ remains an attractive investment.

One of its most alluring features is its diversified portfolio, which reaches across numerous business lines in the healthcare and biotechnology sectors.

This diversification has become a pillar of the company, ensuring that it doesn’t topple even in times of economic downturns.

The fact that it offers a 2.6% dividend yield makes JNJ a dream come true among income-seeking investors. It also doesn’t hurt that JNJ has consistently raised its dividends annually for the past 57 years, making it the most stable and secure out there today.

Even its lawsuits don’t seem to have any severe impact on the company’s performance since JNJ managed scores of legal cases in the past and constantly managed to come out in one piece. Taking its history as an indication, JNJ should remain as one of the top stocks in the years to come.

Mad Hedge Biotech & Healthcare Letter

February 4, 2020

Fiat Lux

Featured Trade:

(ABBVIE’S BIG CORONA VIRUS PLAY)

(ABBV), (RHHBY), (GILD)

Two major issues are in the root of the panic caused by every new infectious disease.

The first is because of the uncontrollable spread of the virus, affecting thousands of people in a short span of time. This consequently pushes the public to question the capacity of their government to provide the proper healthcare to every patient, causing further confusion, alarm, and eventually, economic upheaval.

The second is the overpowering uncertainty that looms over not only the people directly affected by the disease but also the rest of the world as we feel like sitting ducks, wondering who the virus will infect next.

Both effects have become apparent with the news of a new coronavirus, known as 2019-nCoV, which originated in Wuhan, China.

The public’s reaction has come so close to mass hysteria, especially since the virus has already taken over 400 lives and infected more than 20,000 people worldwide.

The speed by which the disease is spreading is also alarming. The 2019-nCoV getting transmitted from one person to another almost as fast as the highly transmissible flu, which was not the case for its slower-moving cousins Severe Acute Respiratory Syndrome (SARS) and Middle East Respiratory Syndrome (MERS).

In response to this alarming situation, the Chinese government along with the medical community has turned to unconventional means to find a cure — and giant biotechnology company AbbVie (ABBV) is at the forefront of these efforts today.

One measure taken by the health experts is using AbbVie’s off-label HIV drug, called Kaletra (aka Aluvia), to treat 2019-nCoV patients.

Kaletra has two components valuable in battling the coronavirus: lopinavir and ritonavir. Both have the capacity to block HIV viral replication.

The twice-a-day Kaletra regimen comprises taking the HIV drug and undergoing infusions of interferon, a protein that triggers the immune system.

Although the AbbVie drug has yet to be officially declared as an approved cure for the 2019-nCoV, more and more health experts in China are already using it.

The belief on this treatment’s efficacy stemmed from the statement of the head at Peking University First Hospital, who shared that he contracted 2019-nCoV but cured himself by taking Kaletra.

This Chinese doctor is currently part of the national team of experts sent by the Chinese government to tend to those in Wuhan. Aside from him, Shanghai authorities disclosed that they have already adopted the HIV treatment in handling their own patients.

However, this isn’t the first time that Kaletra was deployed as a treatment against a coronavirus.

In 2004, Kaletra was used to cure the patients of SARS-CoV. This is promising since SARS, which is also caused by a coronavirus, bears a close resemblance to the 2019-nCoV. Experts tested the drug to help treat MERS patients as well.

A roadblock for the Kaletra cure is the scarcity of the drug in China.

A lot of health professionals disclosed that they have been struggling to get their hands on the AbbVie off-patent product. In response, AbbVie donated approximately $1.5 million worth of Kaletra to help contain the 2019-nCoV.

Other biotechnology behemoths have followed AbbVie’s lead of donating funds to help with the research in China. The list includes Roche Holding (RHHBY) and Gilead Sciences (GILD).

Meanwhile, this piece of promising news is not lost in the market. In fact, AbbVie shares pushed higher the moment Kaletra’s efficacy against the 2019-nCoV was revealed.

Apart from that, this development has reminded investors of AbbVie’s promising growth lately.

Unfortunately, most of the company’s growth came from acquisitions — a path where AbbVie has an abysmal track record. More often than not, investors fear that the company overpays in deals that fail to reap the promised rewards.

Case in point: AbbVie’s hefty $63 billion acquisition of Botox maker Allergan, which is due to be finalized early 2020.

In moving to acquire a company that only has one consistent blockbuster product, experts believe that AbbVie might have pulled the trigger too soon without considering other options.

While this high-profile agreement has been such a hot topic in the investing community, I think it’s a good move towards diversifying AbbVie’s sales and injecting additional growth.

Remember, AbbVie is in desperate need for a new outlet in light of the dwindling Humira sales. Adding a high-selling and established industry leader like Botox to the mix would make AbbVie more diversified than ever, making it safer.

More importantly, AbbVie ensured that the $63 billion acquisition doesn’t run the company to the ground — and its precautionary measures showed.

The company has been consistent in its net income, reporting over $5 billion annually in the past three years. It also raked in $12.8 billion in free cash flow in 2018, proving that AbbVie is well-positioned to acquire more companies and be more creative in looking for growth targets.

Hence, I view this biotechnology stock as an underrated buy that would appeal to bargain hunters willing to hang onto it for the years to come.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.