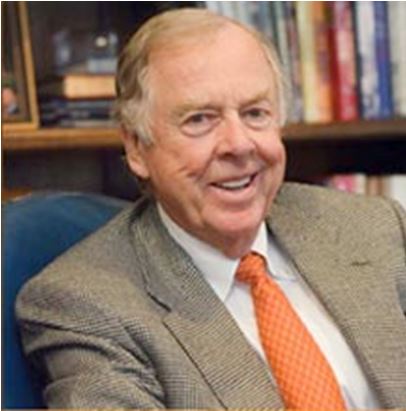

Breakfast with Boone Pickens

It was with a heavy heart that I learned of the passing last night of the legendary Boone Pickens who has dominated oil markets for the past 50 years. I owe him much of my understanding of the energy markets, which I picked up in crumbs that fell off his table over the past 40 years.

Below, I am rerunning my last meeting with him, which took place six years ago.

Reformed oilman, repenting sinner, and born-again environmentalist, T. Boone Pickens, Jr. says that “When we turn the US green, it will have the best economy ever.”

I met the spry, homespun billionaire at San Francisco’s Mark Hopkins on a leg of his self-financed national campaign to get America to kick its dangerous dependence on foreign oil imports. For the past 30 years, the US has had no energy policy because “no one wanted to kick a sleeping dog.”

Production at Mexico’s main Cantrell field is collapsing and will force that country to become a net importer in five years. Venezuela is shifting the exports of its sulfur-laden crude to China for political reasons once refineries in the Middle Kingdom are completed to handle it.

Unfortunately, stable energy prices have put urgent alternative energy development on a back burner, with his preferred natural gas (UNG) taking the biggest hit. If the US doesn’t make the right investments now, our energy dependence will simply shift from one self-interested foreign supplier (Saudi Arabia) to another (China).

Wind and solar alone won’t work on still nights and can’t power an 18-wheeler. Don’t count on the help of the big oil companies because they get 81% of their earnings from selling imported oil. The answer is in a diverse blend of multiple alternative energy supplies from American only sources.

Boone says he had donated $700 million to charity and argues that the 20,000 trees he has planted should offset the carbon footprint of his Gulfstream V private jet.

I worked with Boone to organize financing for a Mesa Petroleum Pac Man oil company takeover in the early eighties when it was cheaper to drill for oil on the floor of the New York Stock Exchange than in the field. Back then at 85, he had not slowed down a nanosecond.

As Boone walked out the door, I shook hands with him and said, “I want to be like you when I grow up.” He smiled. When you meet a friend who is 85, you never know if you are going to see him again.

To learn more about the details of his passing, please click here.

Boone’s Ranch Went on the Market for $250 Million in 2017