Bullish Tailwinds Defend the Nasdaq

The 6.5% reversal in the Nasdaq has been as V-shaped as can be.

Let me remind readers that this Ukraine war is just only one external factor the market is trying to stomach.

It’s not the only show in town.

As we zero in on the March Fed Meeting that comes into focus, I would argue unless new developments rear their ugly head, the Ukraine-Russia hot war is what it is which is mostly quantified.

The Nasdaq index was cheering the light sanctions as the West chose to avoid the nuclear option of removing Russia from accessing the SWIFT system of global bank payments.

Germany refuses to support this option as it would make it harder to pay the Russians for their oil and natural gas.

America also doesn’t support this because we have concerns that it would undermine the status of the U.S. dollar as the global reserve currency.

On more of a micro level, the Ukraine-Russia situation mostly affects energy and food prices which is a relative win for the Nasdaq index that is comprised of technology.

The Nasdaq has outperformed the Dow and S&P in this short quick spike to the upside contributing to my thesis of investors feeling more comfortable dollar-cost averaging into the best breed of tech than reaching for something more inferior.

And yes, I am saying the best companies currently listed in America are tech companies.

The geopolitical turmoil overshooting means that the Nasdaq index is now pricing in a 25-basis point cut instead of a 50-basis point cut.

Either case is still highly stimulatory, and the Fed is way behind the curve on inflation, and this does mean that inflation will stick around a lot longer than first anticipated.

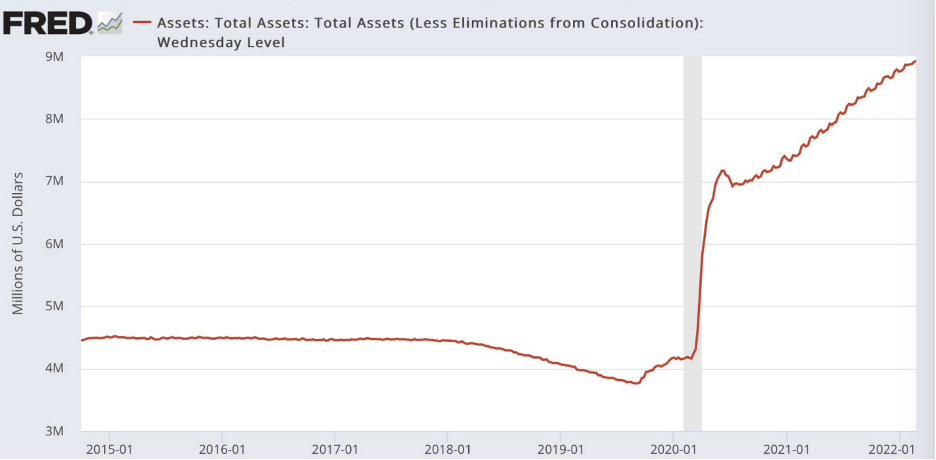

According to the Federal Reserve Economic Data (FRED), the US Central Bank has actually been increasing asset purchases to their balance sheet most likely because they are becoming nervous about the transition from dovish to hawkish policy.

To add an inflationary pillow to the interest rate dilemma is irresponsible, but it shows investors how much pressure is on the Fed to get this right after waiting way too long to raise rates.

Ultimately, I believe the Fed is also concerned about the recent selloff and these asset purchases will ensure the market does not dip to painful levels.

Traders got wind of the green lighting of saving the stock market and piled into risk-on assets and this reversal does a lot to draw a line in the sand as to what level of volatility the Fed is able or willing to tolerate.

Boosting the balance sheet to new all-time highs means that the Fed will need to be careful because nobody really knows how much they can push the hawkishness with a $9 trillion debt load.

It seems counterintuitive to initiate new asset purchases at these levels, and this behavior implicitly admits that the Fed cares more about saving the stock market by reducing volatility than putting a kibosh on hyperinflation.

Basically, high inflation is here to stay.

The $9 trillion Central Bank balance sheet is 43% of the United States’ GDP and it appears that the Fed is taking the Japan approach to their balance sheet.

Of course, there is nothing illegal about government asset purchases, just look at Japan whose Central Bank owns about 15% of the Japanese stock market and the US Fed is using their playbook as they look to future decisions on monetary policy.

Will it get to that point of a Japanese monetary policy?

Desperate times call for desperate measures.

If the Fed governor Jerome Powell does go insane with liberal infusions of asset purchases, then readers can bet that tech stocks will be the first to benefit from fresh liquidity.

Does it appear that the U.S. Central Bank is trigger happy when any crisis comes along?

There are elements of truth to that, but we aren’t the ones making the decisions, and on the next mini dip, I would use that as a new entry point into the best American tech stocks on the planet such as the likes of Alphabet (GOOLG), Adobe (ADBE), Microsoft (MSFT), and Apple (AAPL).

Lastly, we are exploding from the embers of the omicron virus and that hasn’t gotten much play because of the war reports.

Once these pandemic headwinds are thrown to the side, the U.S. economy and technology companies will accelerate into the summer.