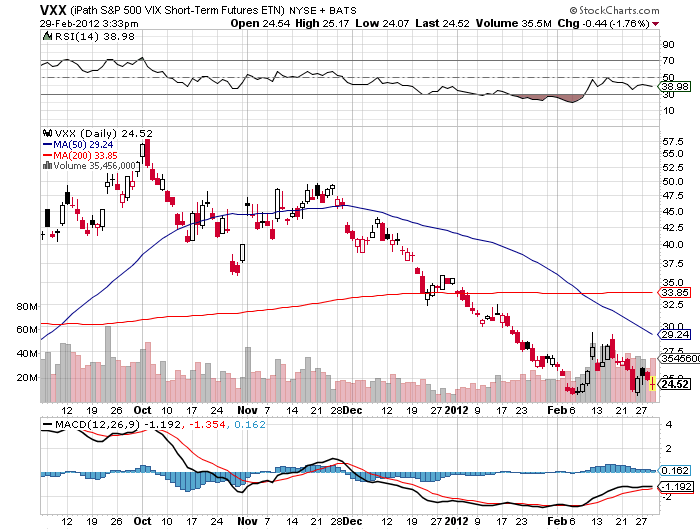

Buy Christmas Ornaments in January With the (VXX)

I am a notorious seeker of great bargains. I buy sun hats in the winter, umbrellas in the summer, and Christmas ornaments in January when Costco sells them for ten cents on the dollar. I even go into the barrio to buy Japanese sake where no one knows what it is, and it is sometimes ordered by accident.

I?ll tell you what I like about the (VXX). It is a bet that someday, somewhere, something bad happens. Since it is not an option, it doesn?t suffer from time decay, and the cost of carry is low. The contango costs are modest. It can be used to hedge the downside risk for a whole range of ?RISK ON? assets, including those garden variety shares in your plain vanilla IRA?s and 401k?s.

If you have a PhD in math from MIT, then you?ll already know that The IPath S&P 500 Vix Short Term Futures ETN (VXX) offers exposure to a daily rolling long position in the first and second month (VIX) futures contracts and reflects the implied volatility (Black Scholes method) of the S&P 500 index at various points along the volatility forward curve. The index futures roll continuously throughout each month from the first month VIX futures contract into the second month VIX futures contract.

If you don?t have such a degree, then this is all you need to know. If the stock market goes up, then the (VXX) goes down. If the stock market goes down, then the (VXX) goes up. The beauty of the (VXX) is that it doesn?t care where the down move starts from, whether it is with the (SPX) here at 1,340, at 1,400, or 1,450. Until then, it will just grind around these levels or go slightly lower.

So if the (SPX) continues to go up, you might lose 10% on the position. If we get the long predicted 5% correction, then it should rise 30% to $32, or back to where it was in January. If we get the summer swoon that I expect, then it will nearly triple to $58, its October high. It is the classic ?heads you win $1, tails, I win $3 type of bet that hedge funds are always looking for.

A direct investment in (VIX) is not possible. The S&P 500 (VIX) Short-Term Futures Index holds (VIX) futures contracts, which could involve roll costs and exhibit different risk and return characteristics. And if your timing is off just a bit, then the time decay will eat you alive if the arbs don?t get to you first.

If you want to learn more about the (VXX), the go to iPath?s page for it at http://www.ipathetn.com/product/VXX/.

Learn to Love Volatility