Buyer Strike Has Legs

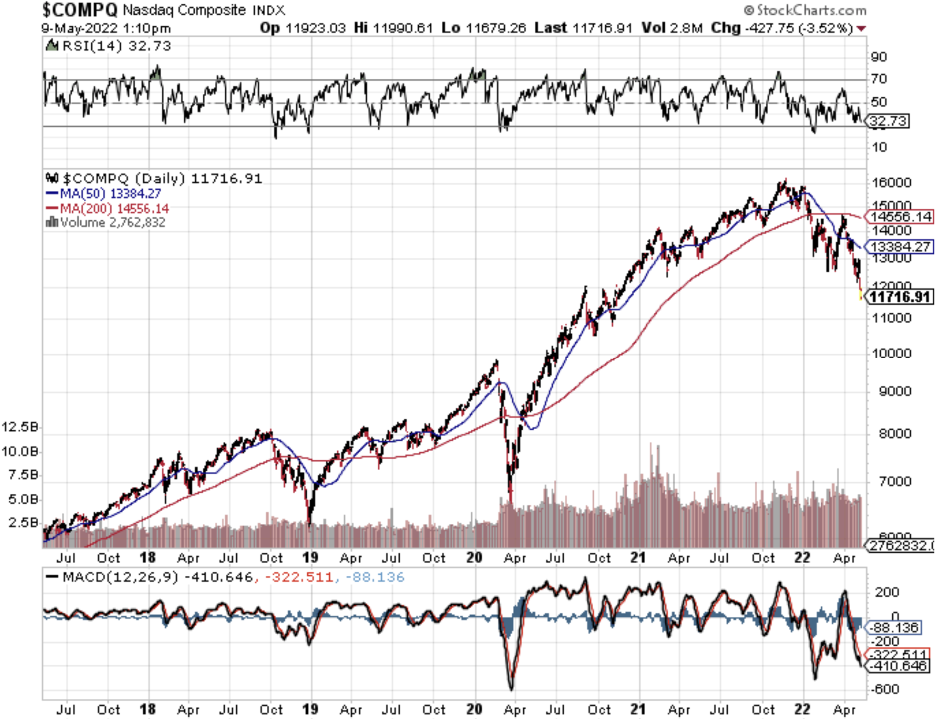

The buyer strike roars ahead as the 10-year U.S. treasure accelerates its rate of decline touching 3.2%.

We are dealing with a major deleveraging of the tech sector as a massive rotation flood into commodity-linked assets, the US dollar, and shorting bonds.

Sadly, we got another kick up the rear side when US Central Bank governor Jerome Powell committed yet another policy mistake by attempting to save the stock market.

Things could get ugly from here.

Many investors believed the Fed would self-correct after the “transitory” inflation nonsense.

It’s not so much the actual 3.2% rate today, but the velocity of the move which is creating many air pockets that are not being filled.

Why?

Investors are betting that Powell will most likely make a third policy mistake which could create another suicidal spiral downwards.

Investors have no incentive to buy stocks when the Fed has not only lost credibility but appears to not understand what is going on with real inflation tearing apart economic health.

This looks a lot like the 1970s just before former US Fed Chair Paul Volcker was brought in to slam the economy and raise interest rates to 18%.

Powell doesn’t seem like he has the guts to do that which is why the prolonging of this failed interest rate policy will mean a longer and more painful economic recession in the future.

I see many pundits going on record saying that the “risk reward has improved.”

Besides stating the obvious, this analysis doesn’t take into consideration that yields could go higher which would cause tech stocks to plummet further.

So yes, the risk reward has improved, but it can improve even more from here.

That doesn’t tell us much about anything.

All signs are now pointing to a souring paradigm shift among tech firms and dramatic changes under the hood.

Facebook (FB) is pausing hiring, a previously unthinkable prospect.

The company blamed macroeconomic challenges and Apple’s privacy changes for its slowest revenue growth in 10 years last quarter.

Almost 12 months after Apple launched App Tracking Transparency, a new analysis predicts its second year will still see big losses to advertisers on FB and YouTube and more collectively losing around $16 billion.

In total, FB will sink $10 billion into its new business with no revenue in 2022.

In February, Amazon (AMZN) announced it would raise its base pay cap from a maximum of $160,000 for most roles to $350,000.

The news comes after employees listed insufficient base pay as the second-most common reason they're looking to leave Amazon in an internal survey conducted last year.

I don’t have an issue with raising salaries, but AMZN had to boost it by far more than double showing readers the intense pressures on current expenses.

Even more problematic now is that new recruits won’t want to accept restricted stock options because of the tech selloff making their stock options less valuable.

Nobody wants to catch a falling knife, me included.

This will put more cash flow pressure on tech companies as new employees will reject stock options and demand a higher net cash salary.

The incremental micro negatives are causing tech companies to miss earnings and guide lower adding yet another negative layer to the grim outlook.

I would argue that even with earnings beats and positive guidance, the tech sector losses would be less.

However, we are experiencing a perfect storm of poor macro events and bad operational data.

Even though the risk reward has improved, it could improve more as the Fed will be forced to ratchet up rates more than expected to compensate for the latest policy mistake.

The market has sniffed this out and is unwilling to buy the dip until the Fed does what is necessary to seriously fight inflation.

The nonsense needs to stop.