I like to start out my day by calling readers on the US East Coast and Europe, asking how they like the service, are there any ways I can improve the service, and what topics they would like me to write about.

After all, at 5:00 AM Pacific time, they are the only ones around.

You’d be amazed at how many great ideas I pick up this way, especially when I speak to industry specialists or other hedge fund managers.

Even the 25-year-old day trader operating out of his mother’s garage has been known to educate me about something.

So when I talked with a gentleman from Tennessee this morning, I heard a common complaint. Naturally, I was reminded of my former girlfriend, Cybil, who owns a mansion on top of the levee in nearby Memphis overlooking the great Mississippi River.

As much as he loved the service, he didn’t have the time or the inclination to execute my market-beating Trade Alerts.

I said, “Don’t worry. There is an easier way to do this.”

Only about a quarter of my followers actually execute my Trade Alerts. The rest rely on my research to correctly guide them in the management of the IRAs, 401(k) s, pension funds, or other retirement assets.

There is also another, easier way to use the Trade Alert service. Think of it as “Trade Alert light.” Do the following.

1) Only focus on the four best of the S&P 500’s 101 sectors. I have listed the ticker symbols below.

2) Wait for the chart technicals to line up. Bullish long-term “Golden crosses” are setting up for several sectors.

3) Use a macroeconomic tailwind, like the ramp up from a -31% GDP growth rate to +31% we are currently seeing.

4) Shoot for a microeconomic sweet spot, companies, and sectors that enjoy special attention.

5) Increase risk when the calendar is in your favor, such as from November to May.

6) Use a modest amount of leverage in the lowest risk bets, but not much. 2:1 will do.

7) Scale in, buying a few shares every day on down days. Don’t hold out for an absolute bottom. You will never get it.

The goal of this exercise is to focus your exposure on a small part of the market with the greatest probability of earning a profit at the best time of the year. This is what grown-up hedge funds do all day long.

Sounds like a plan. Now, what do we buy?

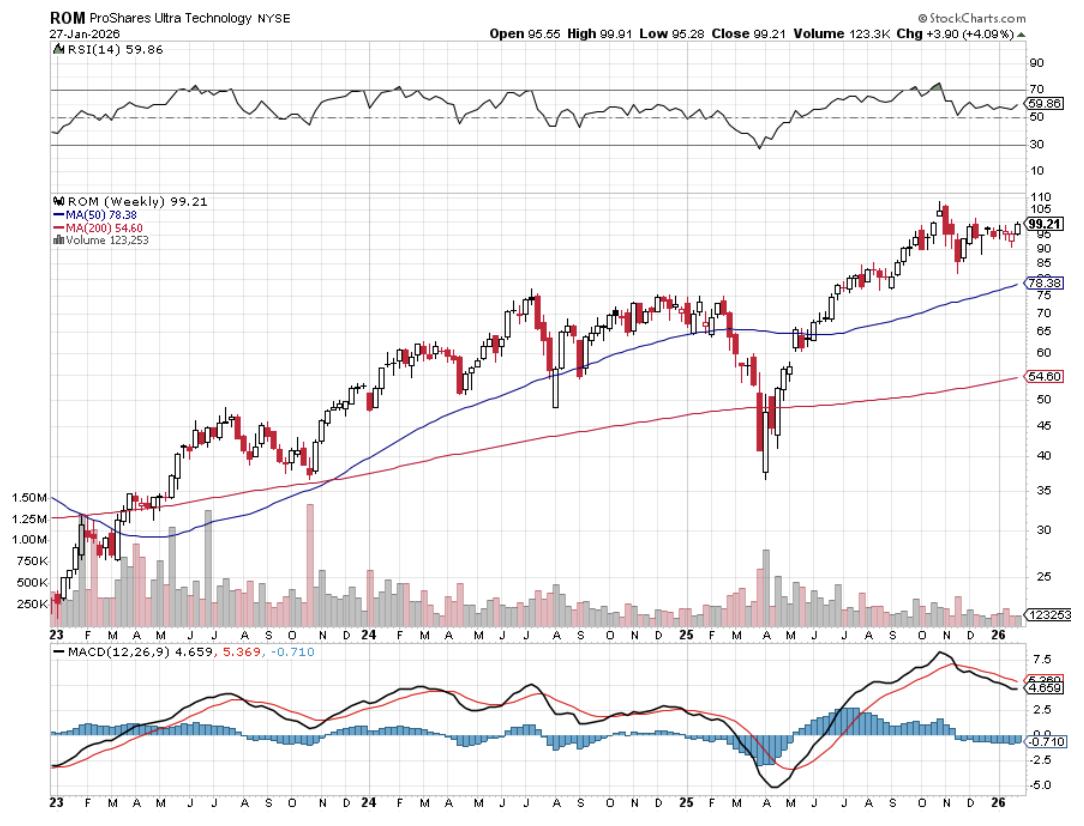

(ROM) – ProShares Ultra Technology 2X Fund – Gives you a double exposure to what will be the top-performing sector of the market for the next six months, and probably the rest of your life. Click here for details and the largest holdings.

(UXI) – ProShares Ultra Industrial Fund 2X – Is finally rebounding off the back of a dollar that will slow down its ascent once the first interest rate hike is behind us. Onshoring and incredibly cheap valuations are other big tailwinds here. For details and largest holdings, click here.

(UCC) – ProShares Ultra Consumer Services 2X Fund – Is a sweet spot for the economy, as tight-fisted consumers finally start to spend their gasoline savings now that it no longer appears to be a temporary windfall. This is also a great play on a housing market that is on fire. It contains favorites like Home Depot (HD) and Walt Disney (DIS), which we know and love. For details and largest holdings, click here.

(UYG) – ProShares Ultra Financials 2X Fund – Yes, after six years of false starts, interest rates are finally going up, with a December rate hike by the Fed a certainty. My friend, Janet, is handing out her Christmas presents early this year. This instantly feeds into wider profit margins for financials of every stripe. For details and largest holdings, click here.

Of course, you’ll need to keep reading my letter to confirm that the financial markets are proceeding according to the script. You will also have to read the Trade Alerts, as we include a ton of deep research in the Updates.

You can then unload your quasi-trading book with hefty profits in the spring, just when markets are peaking out. “Sell in May and Go Away?” I bet it works better than ever in 2021.

For Those Who Invest at Their Leisure