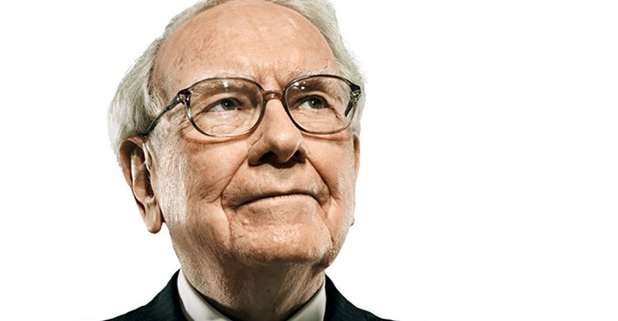

“Truly good businesses are exceptionally hard to find. Selling any you are lucky enough to own makes no sense at all,” said Oracle of Omaha Warren Buffet.

Global Market Comments

March 4, 2019

Fiat Lux

Featured Trade:

(THE MARKET FOR THE WEEK AHEAD, or THE RECESSION HAS BEGUN),

(SPY), (TLT), (GLD), (AAPL)

I hate to be the one to fart in church here, but the long-feared recession has already started.

It’s not a conventional recession defined by two back to back quarters of negative GDP growth, although you have a tough time convincing anyone in the besieged auto, real estate, or agricultural sectors of that.

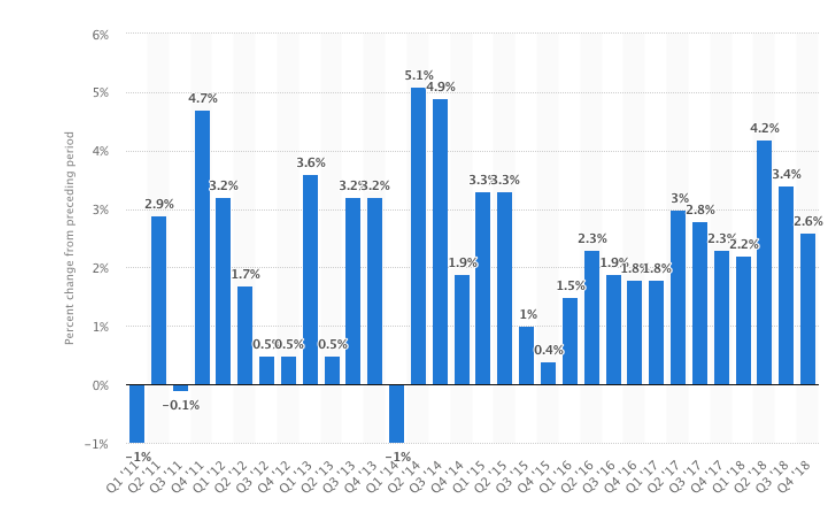

No, this is more of a growth recession. US GDP growth peaked at a 4.4% annualized rate during the second quarter of 2018. The third quarter came in at 3.4% and the four quarter at only 2.6%. Consensus forecasts for Q1 2019 are well below 1%, thanks to the government shutdown.

That means the growth rate has fallen by an eye-popping 76% in nine months! By the way, the government has told us that economic growth has been rising this entire time. But want the stimulus from the 2017 tax bill were spent, there were no more bullets left.

If it were just the GDP data that was falling off a cliff, I wouldn’t be so worried. However, the weakness is confirmed by a raft of other data. The ten year US Treasury bond (TLT) remains stuck around 2.75%, an incredibly low figure given that we are ten years into an economic recovery.

Corporate earnings growth forecasts going forward are now at zero. To see a market multiple of 18X for stocks with no growth and prices that are just short of all-time highs defies belief. This will all lead us to a REAL recession sometime in the near future.

What we are left with is a market of very low return, high-risk trades, not the kind you want to pursue, let alone bet the ranch on.

I believe that when the BIG ONE finally arrives, it won’t be all that bad. I’m looking for a short, sharp recession of maybe six months in duration. There really isn’t that much leverage in the system that can blow up. It might even not be worth selling out all your stocks to avoid it, especially if it results in a giant tax bill.

You would also be selling in front of my coming Golden Age for the United States when a huge demographic tailwind brings a new era of prosperity. If you are smart enough to get out at the top now, will you also be clever enough to get back in at the bottom? Or will you sell more instead, like you did in December?

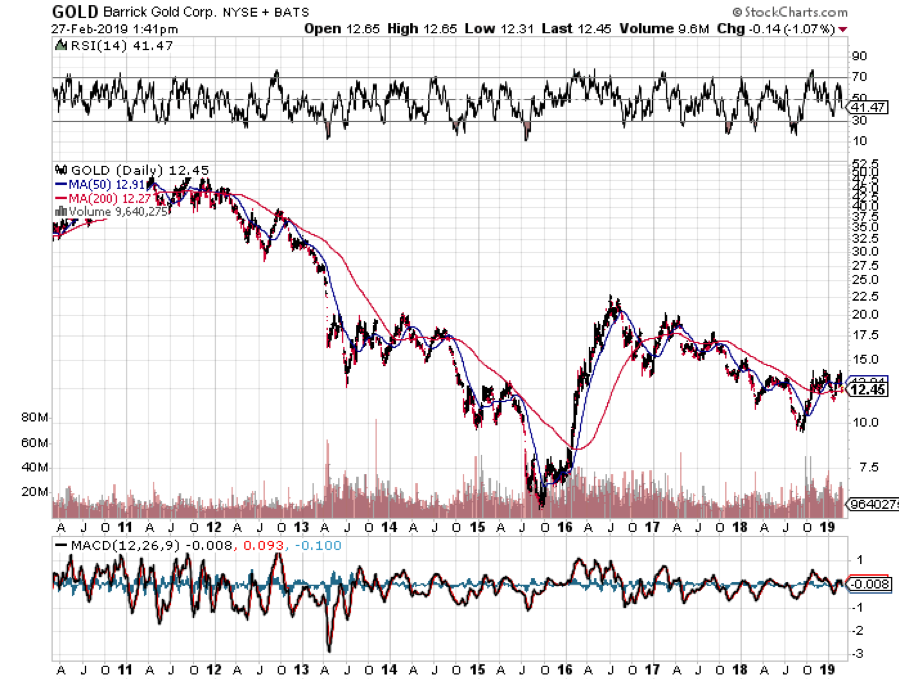

Merger fever hit the gold industry with Barrick Gold (GOLD) taking a run at Newmont Mining (NEM), the world’s first and second largest producers. It’s all about efficiencies of scale. Take this as a long-term bottom in gold prices.

The China tariff hike was postponed indefinitely, and Chinese stocks love it. Import duties will stay at 10%, instead of rising by 25% starting last Friday. We knew it was never going to happen.

Some 95% of the China trade deal is now already priced into the market. If a deal DOESN’T get done and goes the way of the North Korean negotiations, the market will very quickly back out that 95%.

Poor economic data was to be found everywhere you looked. Wholesale Inventories rose sharply, up 1.1% in another recession indicator. US Factory Orders came in incredibly weak at 0.1% in December when 0.6% was expected. Recession indicator number one million. Limit your risk.

Our friend Jay stayed dovish again, but markets yawned this time. How much mileage can you get from the same vague assertion? Shorts are about to swarm the market. Take profits on all longs.

The US Dollar hit a three-week low. The Fed’s dovish leanings are hammering the buck. Keep loading the boat with weak dollar plays, like emerging markets (EEM).

Bonds got crushed delivering their worst week in five months, down three points as the great “crowding out” begins. Massive corporate borrowing can’t compete with government borrowing, so rates are rising sharply. This is the beginning of the end. Sell short the (TLT).

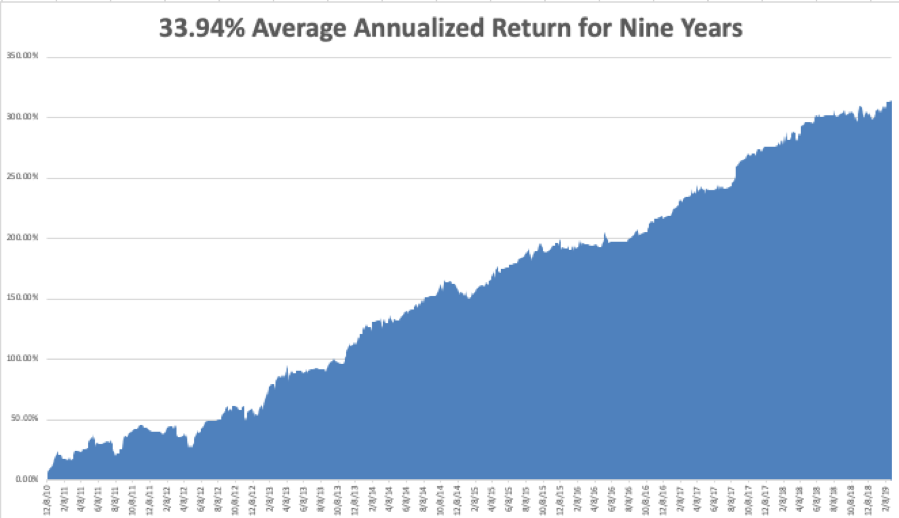

February came in at a hot +4.16% for the Mad Hedge Fund Trader. My 2019 year-to-date return ratcheted up to +13.64%, a new all-time high and boosting my trailing one-year return back up to +31.90%.

My nine-year return clawed its way up to +313.78%, another new high. The average annualized return appreciated to +33.94%.

I am now 80% in cash, 10% long gold (GLD), and 10% short bonds (TLT). We have managed to catch every major market trend this year, loading the boat with technology stocks at the beginning of January, selling short bonds, and buying gold (GLD). I am trying to avoid stocks until the China situation resolves itself one way or the other.

As for the Mad Hedge Technology Letter, it is short Apple (AAPL).

Q4 earnings reports are pretty much done, so the coming week will be all about jobs, jobs, jobs.

On Monday, March 4, at 10:00 AM EST, December Construction Spending is published.

On Tuesday, March 5, 10:00 AM EST, December New Home Sales are out.

On Wednesday, March 6 at 10:00 AM EST, the February ADP Employment Report is out, a measure of private sector hiring.

Thursday, March 7 at 8:30 AM EST, we get Weekly Jobless Claims.

On Friday, March 8 at 8:30 AM EST, we get the February Nonfarm Payroll Report is released. The Baker-Hughes Rig Count follows at 1:00 PM.

As for me, I’m taking the kids to see Hello Dolly in San Francisco. This was one of my parents’ favorite Broadway musicals, and they used to sing the songs around the house all day long. However, it won’t be the same without the late Carol Channing.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

March 1, 2019

Fiat Lux

Featured Trade:

(OH, HOW THE MIGHTY HAVE FALLEN),

(BRK/A), (AXP), (AAPL), (BAC), (KO), (WFC), (KHT),

(AMGEN’S BIG WIN), (AMGN), (SNY), (REGN)

Going through Warren Buffet’s letter to the shareholders of Berkshire Hathaway (BRK/A) you can’t help but notice that his performance nosedived from a breathtaking 21.9% in 2017 to a much more sedentary 2.8% last year. That is with an S&P 500 down -4.4%, including dividends.

That compares to my own 23.67% profit for 2018. But Warren has a much higher bar to reach. He does this with a staggering market capitalization that was pegged at $496 billion as of today. At best, the combined buying power of my Trade Alerts is only about a billion dollars.

And here is the stunning piece of information that should have been the headline. Warren has $112 billion in cash and equivalents, some 22.58% of the total, and an all-time high. That means buying stocks at these levels is the least attractive in the fund’s 57-year history.

Buffet would much rather buy back his own stock. He is willing to pay a premium to book value but only when it trades at a discount to intrinsic value, as he did in size during the fourth quarter of 2018.

Which raises one screaming great question. If Warren Buffet isn’t buying stocks, why should you?

Buffet isn’t even buying Apple, which he only started soaking up in 2017. It now is his second largest holding, with an average cost of $140. I’m amazed that the stock didn’t get crushed on this news, but then we live in a constantly amazing world these days.

The big change in Berkshire Hathaway over the years is that it is becoming more of an operating company and less of an investing one. That is because Buffet is increasingly buying entire companies, rather than exchange-traded stocks. One of the reasons for his cash hoard that an effort to buy a company for high double-digit billions of dollars fell through last year.

Still, Warren bought $43 billion worth of public stocks in 2018 and only sold $19 billion worth. These are his five largest public shareholdings and his percentage of outstanding shares:

American Express (AXP) – 17.9%

Apple (AAPL) – 5.4%

Bank of America (BAC) – 9.5%

Coca-Cola (KO) – 9.4%

Wells Fargo (WFC) – 9.8%

Warren likes to break up his entire holdings into five “groves”, as there are too many companies to follow individually.

1) Wholly owned companies where Berkshire has 80%-100% stakes, such as the BNSF railroad and Berkshire Hathaway Energy.

2) Publicly listed equities like those listed above

3) Companies controlled with third parties, like Kraft Heinz (KHT)

4) US Treasury bills

5) Property/Casualty Insurance operations like GEICO that generate an enormous free cash float

Buffet described the enormous tax benefits his company received from the 2017 tax bill. It amounted to the government’s indirect ownership of Berkshire shares falling, which he humorously calls “AA” shares, from 35% to 21% at no cost whatsoever. That greatly increased the value of the remaining shares.

Warren spent the rest of his letter talking about the Great American Tailwind. Since he started investing on March 11, 1942, one dollar invested in the S&P 500 has grown to an eye-popping $5,288! That works out to an average annualized compound return of 11.8% a year.

The end result has been the greatest creation of wealth and rise in standards of living in human history.

That is a tough record to beat.

Amgen Inc. (AMGN) won big in its patent case against Sanofi SA (SAN) and Regeneron Pharmaceuticals Inc. (REGN). The battle was over Repatha, a cholesterol-lowering drug said to be more potent than Pfizer’s Lipitor.

Billions of dollars in projected sales are anticipated to be at stake, with the court still in the process of determining how much the opposing companies owe Amgen in royalties.

A U.S. jury in Wilmington Delaware confirmed the validity of Amgen's patents on Repatha, rejecting the joint arguments of Sanofi and Regeneron that the documents failed to adequately describe the drug invention or explain the process of creating the antibodies the patents claim to cover.

This ruling confirms that the creation of Praluent, the competing cholesterol drug jointly created by Sanofi and Regeneron, infringed upon Amgen's patents.

The affirmation of these two patents validates three of Amgen's five claims against the opposing drug companies. However, the decision currently does not affect the U.S. availability of Regeneron and Sanofi's drug Praluent.

Praluent and Repatha are drugs categorized as “PCSK9 inhibitors.” These are designed for patients with ultra-high LDL or “bad” cholesterol whose condition cannot be regulated by commonly prescribed medications like Pfizer's Lipitor. These drugs claim to be able to lower a patient's cholesterol level to a "safe" point as opposed to allowing it to plummet to fatal levels.

Both Praluent and Repatha are anticipated to become blockbuster drugs for the biotech companies, with Sanofi and Amgen competing neck and neck in relative positioning.

Amgen's Repatha is projected to rake in an estimated $2.21 billion in sales by 2022, while Sanofi's Praluent is expected to reach roughly $800 million.

The legal battle between these biotech firms started in 2014, with Amgen winning a similar verdict in 2016 which resulted in a court order blocking the sales of Praluent. In October 2017 though, a U.S. Court of Appeals for the Federal Circuit vacated the district court's ruling to ban the sales of the embattled Sanofi cholesterol drug.

Although Amgen triumphed in this latest round, the fight is far from over as Sanofi and Regeneron announced their intention to challenge the ruling. The latter companies plan to file for post-trial motions in the succeeding months with the goal of overturning the verdict. They intend to demand a new trial as well.

Ironically, (REGN) has been the better performing stock since the Christmas Eve Massacre, rising by an eye-popping 27%, compared to (AMGN)’s almost 5.5% gain and (SNY)’s pocket change pick up of 2.1%.

BUY AMGEN ON THE DIP.

Global Market Comments

February 28, 2019

Fiat Lux

Featured Trade:

(GOLD IS BREAKING OUT ALL OVER),

(GLD), (GDX), (NEM),

(THE STEM CELLS IN YOUR INVESTMENT FUTURE)

(CELG), (TMO), (REGN)

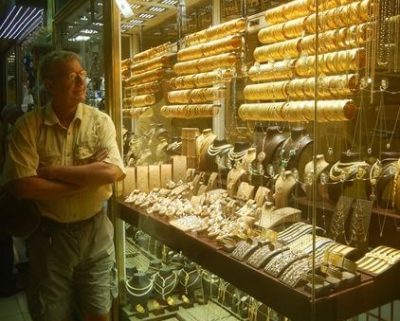

Longtime readers of this letter are well aware that I have been bullish on gold since August. However, this week, the barbarous relic really got the bit between its teeth and is now poised to break out to a new five year high.

All of a sudden, the sun, moon, and stars have aligned in favor of a new leg of the bull market for gold. We could even see a bitcoin-style melt up over the next 18 months to its previous all-time high of $1,927 an ounce.

Gold is not seeing this in isolation. With the primary focus of all financial markets now exploding US deficits, inflation plays everywhere have found new vigor. These would include, other precious metals, commodities, energy, and any security that shorts the bond market.

The really great news here is that your investment life has suddenly gotten very easy. We are probably only months into a megatrend that could last for another decade.

If you look carefully at the long-term charts you will see that gold has in fact been in a new bull market for three years now. But the rate of appreciation was at a snail’s pace, with the yellow metal averaging only 14% a year since then.

For a while, bitcoin and other cryptocurrencies were stealing gold’s thunder and sucking up gold’s volatility. Inflation, the traditional driver of gold prices, was nowhere to be seen.

It is no accident that the recent strength in gold has been matched with the decimation of Bitcoin, down 80% from its high. Investors are finally seeing the light of day.

Other factors have been assisting in gold’s resurgence. Chinese dumping of US treasury bonds is freeing up lots of cash in the middle Kingdom to buy gold.

The run-up to the Chinese New Year on February 16, when Chinese traditionally settle debts with gold coin purchases, has thrown some exploding firecrackers on the move.

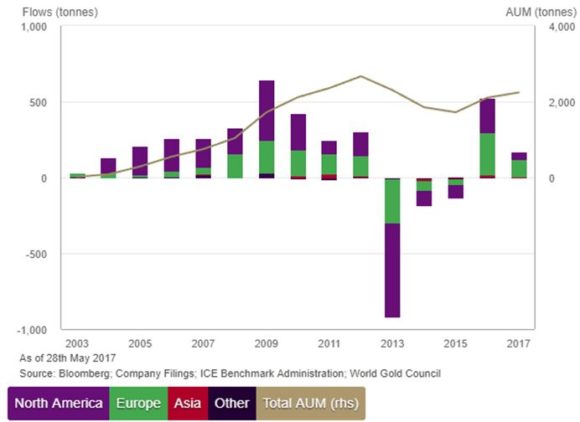

The Europeans saw the inflation boogeyman before we did. Look at the chart below showing global gold ETF purchases, which helped market the 2015 bottom. Some 75% of global flows into gold ETF’s were for Europe based funds.

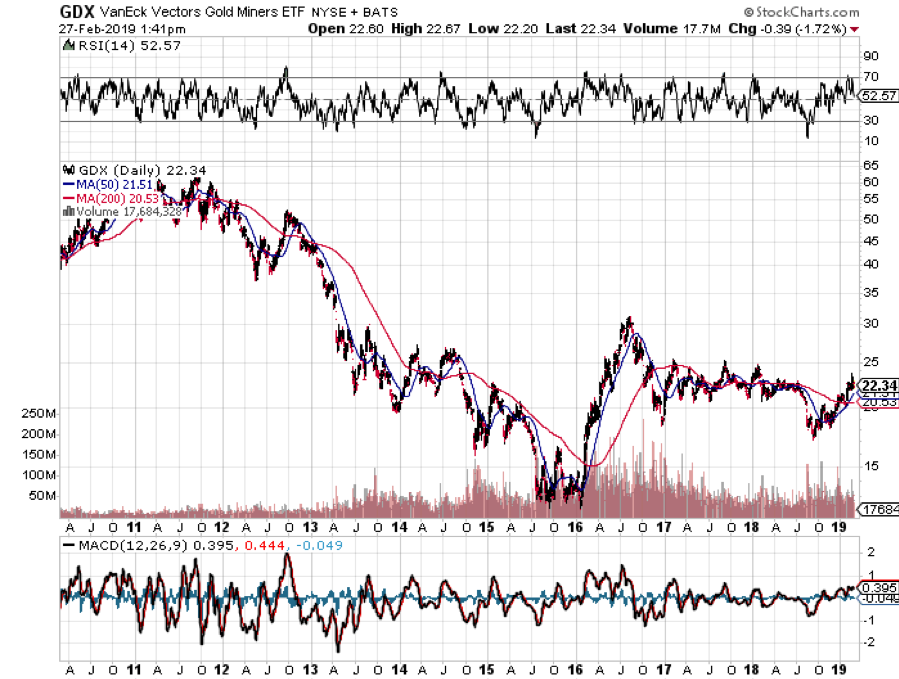

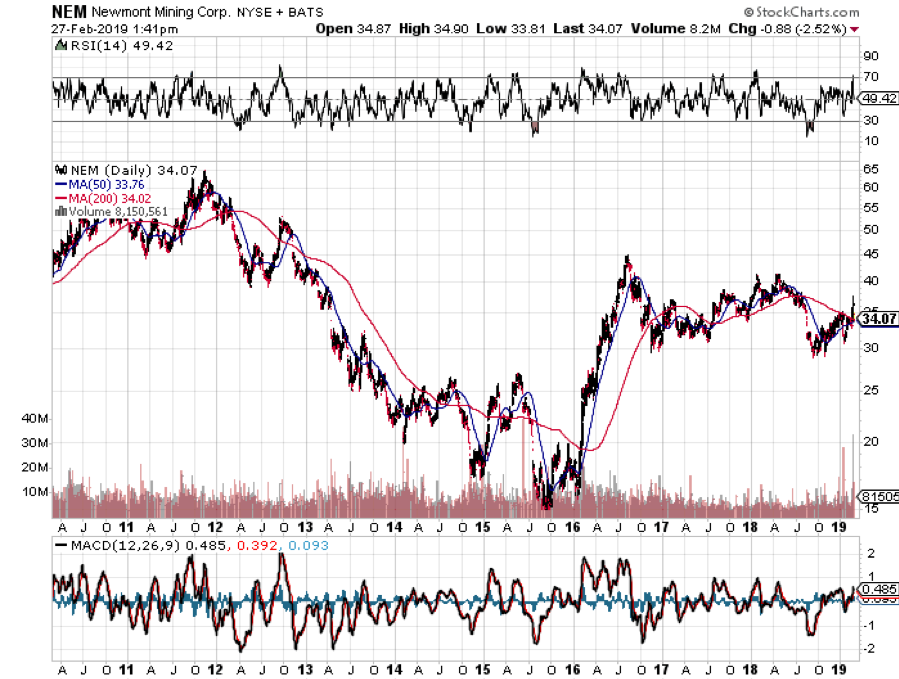

The buying has spread into the entire precious metals space. The Van Eck Vectors Gold Miners ETF (GDX) is off to the races. So is Newmont Mining (NEM), Canada’s largest miner and one of my long-time favorites. (NEM) by the way, is considering a takeover offer from Barrick Gold (GOLD).

Look to buy dips in gold whenever you get them. Remember those black swans? They are still out there in a holding pattern awaiting landing instructions.

When they finally return, you’ll be happy you have a nice position in gold to hedge your other risk positions.

All That Glitters

“We live in a world that is not described by classical economics,” said Oracle of Omaha Warren Buffet.

Global Market Comments

February 27, 2019

Fiat Lux

Featured Trade:

(WHY CHINA’S US TREASURY DUMP WILL CRUSH THE BOND MARKET),

(TLT), (TBT), ($TNX), (FCX), (FXE), (FXY), (FXA),

(USO), (OXY), (ITB), (LEN), (HD), (GLD), (SLV), (CU),

(THE 13 NEW TRADING RULES FOR 2019)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.