CPI Acts as Launching Pad for Tech Stocks

Everyone has been on pins and needles waiting for the U.S. CPI inflation report every month because of the volatile reaction to tech stocks.

Lately, it’s panned out well for tech.

It’s been almost like an ancient Incan ritual ever since Congress and the Fed pushed quantitative easing and stimuli to the moon resulting in spiking inflation over the past few years.

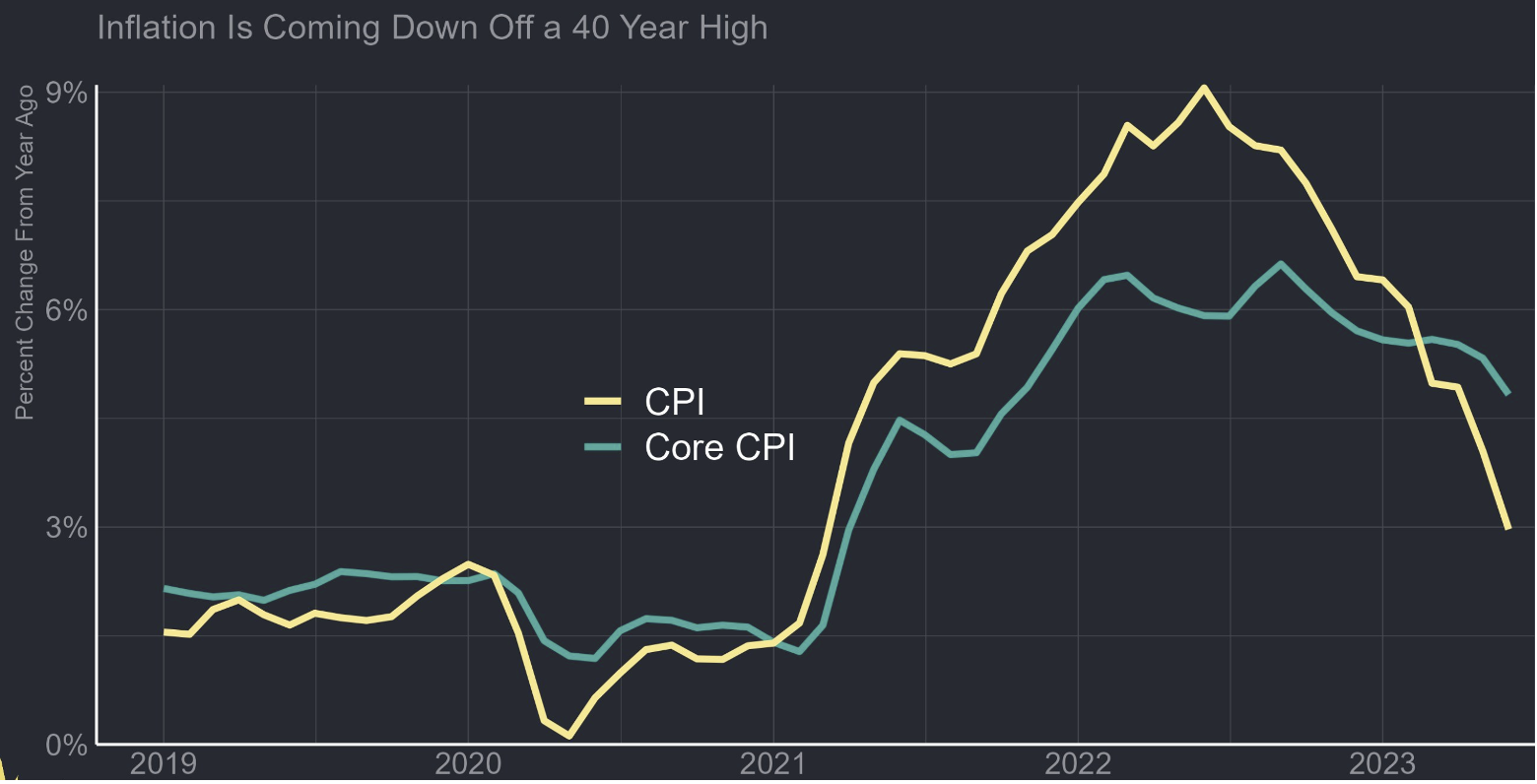

It appears as if we have finally turned the corner with the inflation rate dropping down to 3.0% YoY which was in line with expectations.

Coming down from 4%, the rolodex of normal asset reactions occurred such as higher tech stocks, higher spot gold price, lower US dollar, and spiking oil prices.

Ironically enough, the coming down from 4% could set the seeds for the next inflation reversal as Americans still have jobs and are likely to spend, spend, and spend more at these lower price points excluding oil.

In sum, the numbers could give the Federal Reserve some breathing room as it looks to bring down inflation that was running around a 9% annual rate at this time in 2022, the highest since November 1981.

The Fed will embrace this report as validation that their policies aren’t finally stinking up the joint – inflation has fallen while growth has not yet stalled.

However, central bank policymakers tend to look more at core inflation, which is still running well above the Fed’s 2% annual target. The report is unlikely to stop the central bank from raising rates again later this month.

When inflation first began to accelerate in 2021, Fed officials and most Wall Street economists thought it would be “transitory.”

They included surging demand for goods over services and supply chain clogs that created scarcity for vital items such as semiconductors.

However, when inflation proved more resilient than anticipated, the Fed began tightening.

During the inflation surge that peaked last June, worker wages had run consistently behind the cost-of-living increases.

Traders are still pricing in a strong possibility that the Fed will enact a quarter percentage point rate hike when it meets July 25-26. However, market pricing is pointing toward that being the last increase as officials pause to allow the series of hikes to work their way through the economy.

What does this mean for tech stocks?

Buy on the dip. Don’t need to make it more complicated than that.

Big tech such as Microsoft, Meta, Apple, and Google are up big this morning suggesting that consumers who have more purchasing power and higher real incomes will buy their products.

The lower inflation number also suggests that the Fed could be right about the “soft landing” which is also demonstrably positive for tech stocks.

Tech stocks don’t need any exogenous shocks to the system and in the short term, this effectively cancels out spiking inflation as a legitimate market risk to tech stocks.

It will be hard to topple tech stocks in the short-term and I’m not talking about orderly technical pullbacks.

Workers might start to be able to get ahead of the cost-of-living increases with slower price hikes.

The even larger challenge is getting from 3% to 2% because we now cross the point of when comparable prior data turns from tailwind to headwind.

If the Fed continues with these little 25 basis point hikes until the end of the year, nobody cares because most people are sitting on their sub-3% fixed 30-year mortgages and pouring their paycheck into tech stocks.

Ultimately, today’s report sets up for a positive last 5 months for tech even if we are technically stretched in the short term.

Buy tech on the dip.