The Best Cloud Security Growth Stock Today

Today’s sophisticated hackers are going “beyond malware” to breach organizations.

These hackers are increasingly relying on hard-to-detect methods such as credential theft and tools that are already part of the victim’s environment.

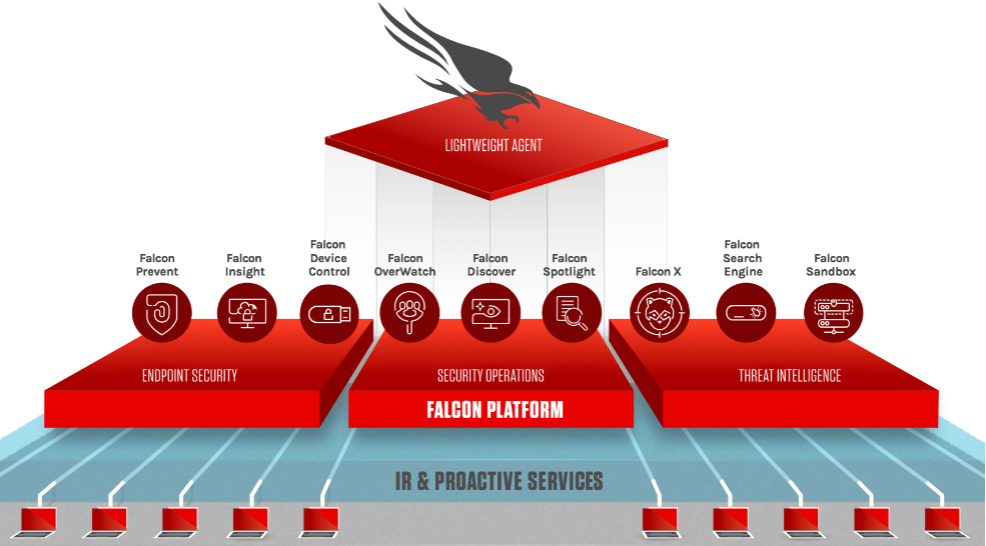

Falcon is the preeminent security platform built by CrowdStrike (CRWD) to stop breaches via a unified set of cloud-delivered technologies that prevent all types of attacks.

Falcon is the major reason why this tech stock is growing so rapidly and why many investors are jumping on the bandwagon.

The stock is up over 400% in the past 5 years, and this is just the beginning of its growth.

CrowdStrike Falcon responds to malicious challenges with a powerful yet lightweight solution.

It unifies next-generation antivirus, endpoint detection and response, cyber threat intelligence, and managed threat hunting capabilities.

Management’s approach to stopping breaches with the Falcon platform is foundational to CrowdStrike's leadership position and maintaining the overperformance which many investors have been impressed with.

Using AI, machine learning, and an intelligent lightweight agent, the Falcon platform defends against today's most sophisticated threats with unmatched speed and simplicity.

Simply put, companies need to employ a holistic breach prevention strategy rather than overly relying on malware prevention.

Nearly every breach you have ever heard of had two things in common, the victims had both a firewall and an antivirus solution, which is why management decided to build the Falcon platform from the ground up to stop breaches and not just prevent malware.

Meanwhile, competitors have fallen further behind as they continue to blindly promote a strategy that relies on malware prevention versus a comprehensive solution, focused on people, process, and technology that stops breaches.

Today, more than half of the detections analyzed were not malware-based.

Attackers are increasingly attempting to accomplish objectives without using malware.

They are exploiting the proliferation of vulnerabilities and abusing systemic weaknesses in identity architecture to get on the system and then move laterally.

This makes it more difficult for legacy and next-gen malware-focused products to be effective because they are not focused on breach prevention.

To further demonstrate my point, I'd like to share a situation with a certain unnamed company using Microsoft's legacy security products that failed to rise to the challenges of today's adversaries and ended up unnecessarily costing them.

This company experienced a long and difficult deployment process, particularly in low bandwidth environments where endpoint performance was critical.

Notably frustrated, this company began to evaluate alternatives when it was unfortunately hit by ransomware that encrypted their primary and backup data, causing weeks of business disruption and a financial impact estimated to be in the tens to hundreds of millions of dollars.

This is a typical story that is told to CrowdStrike and more will follow as the volume of companies ill-prepared is voluminous.

Many of these damaging experiences by companies are then followed by their in-house IT teams connecting with CrowdStrike’s incident response team to remediate and stabilize their IT operations — followed up with deploying Falcon Complete across their environment.

The Falcon platform processes approximately 1 trillion events per day from millions of agents, delivering unprecedented security insights.

This empowers Falcon to benefit from crowdsourcing and economies of scale unlike any other solution on the market today, which I believe enables AI algorithms to be uniquely effective.

CrowdStrike’s success hinges on growing leadership as the trusted security partner of choice and especially growing the Falcon platform.

Several outside reports have praised Falcon Complete and recognized its strength in its breach prevention warranty, fully remote automated remediation, breadth of threat hunting capabilities, and strong machine learning and artificial intelligence capabilities for detection and response.

The net result of focusing on the Falcon platform to increase revenue upside is the subscription revenue growing 71% over Q2 to reach $315.8 million.

While it’s understandable that subscription gross margin fluctuates quarter to quarter, management expects it to remain solidly within an increased target model range of 77% to 82%.

For the next quarter, CrowdStrike expects total revenue to be in the range of $358 million to $365.3 million, reflecting a year-over-year growth rate of 54% to 57%.

Management has reaffirmed that demand for their Falcon platform is still hot, but I am not thrilled that the total revenue growth is expected to drop to the mid-50% from 70%.

Even though this drop is a seasonal adjustment, it was only just in 2018 when the company was doing $100 million in total revenue, and we are talking now about reaching $2 billion per year after almost surpassing $1 billion per year in 2020.

The stock has substantially more upside and any significant drop should be bought.

We are hovering near all-time high’s so any 5-10% drops should be bought into.

I am still highly bullish on this cloud security company and believe its best days are ahead of them.