So far, 2023 is playing out just as I expected. A fantastic first half is being followed by a flat second half. Since the October 15 bottom, the Dow Average has risen by an eye-popping 3,000 points.

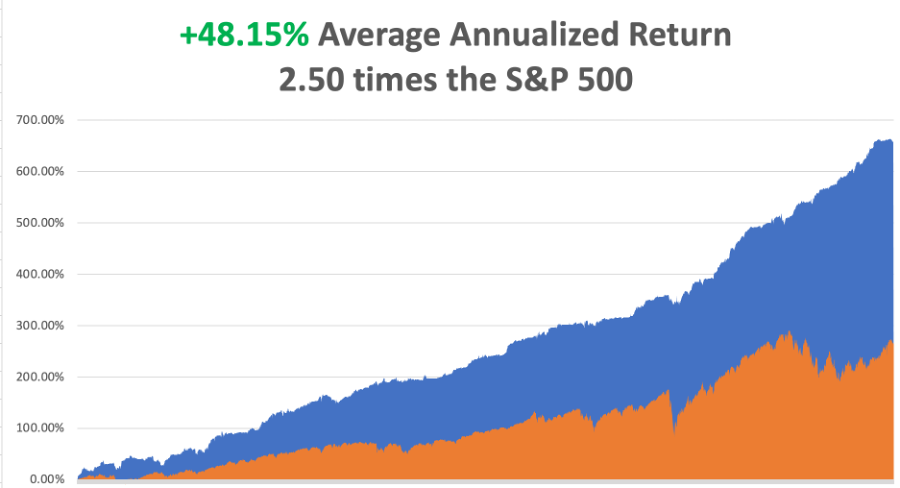

Followers of the Mad Hedge Fund Trader are already up by 60% so far in 2023.

However, I have been getting some pushback from some of my readers, especially the many new ones. Yes, the Dow Average is still off 2,500 points from its all-time high, after one of the sharpest selloffs in history.

However, we are only just getting started.

While climbing the base of Italy’s Cinque Torre recently at 9,000 feet (where I always get my best ideas), I had an epiphany.

I finally realized that nothing less than a New Theory of Equities was needed to get followers to understand WHY the Dow will rise from 34,500 to 240,000 by 2030, a gain of 695%. If I’m wrong, it will happen by 2031 or 2032.

It’s really very simple. Recall the laws of supply and demand?

From 2010 to 2020, roughly $6 trillion was invested in financial assets. Because the Great Recession and the 2008-9 crash had just happened, some 94% of this money went into bonds, while only 6% went to equities.

During the entire decade, portfolio managers, strategists, and hedge fund managers pronounced that bonds were overpriced and would imminently crash.

Instead, they went up for ten years.

Fast forward to 2021. A new decade has begun and bonds around the world were offering negative inflation-adjusted real returns. The planet was massively overweight bonds.

Many people don’t realize how stupidly low-interest rates still are right now. Triple “C” rated bonds are yielding what Triple “A” paper was a decade ago, about 7.5%.

I looked at municipal bond yields the other day and my eyes almost popped out of my head when I saw 2.45%. This is a yield that is so low that it is beyond any economic rationale.

So, what happens next.?

Let’s say that those bond/equity cash flow weightings reverse, that all new investment for the coming decade goes 94% into equities and 6% into bonds. Stock markets would rise for the decade while bonds fall. There’s your Dow at 240,000 right there.

Portfolio managers, strategists, and hedge fund managers predicting that stocks are overpriced and ready for a crash will be wrong for ten years. We won’t be massively overweight equities until 2030.

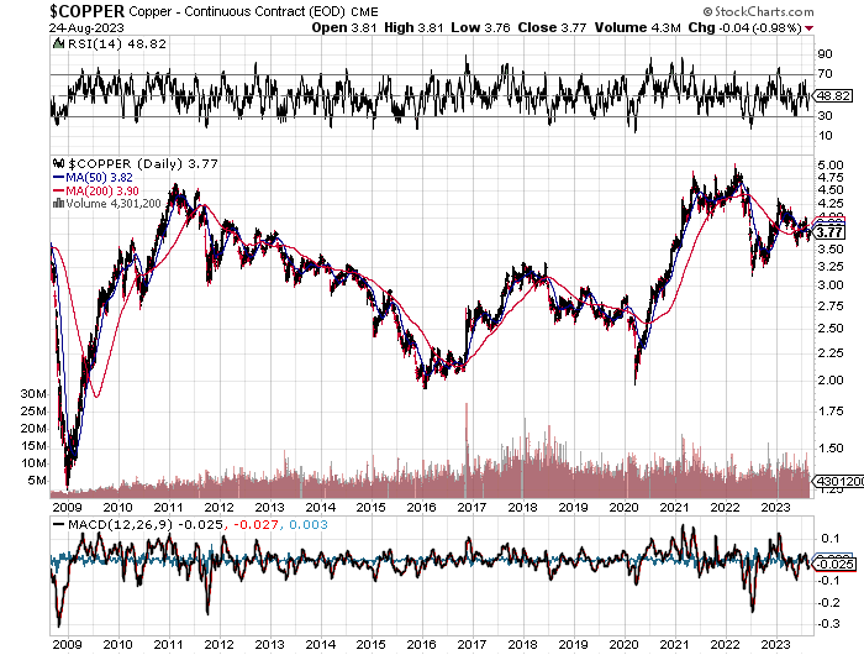

They are wringing their hands that stock prices have outrun fundamentals. In fact, the opposite is true. Fundamentals are outrunning stock prices….in a big way. Productivity and profit margins are exploding. Think AI, quantum computers, and rapid robotization.

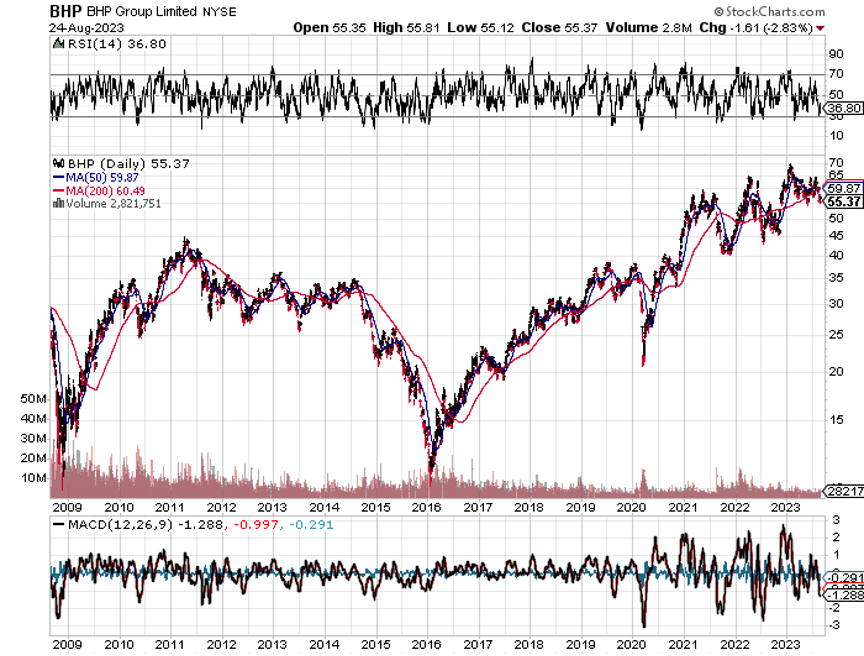

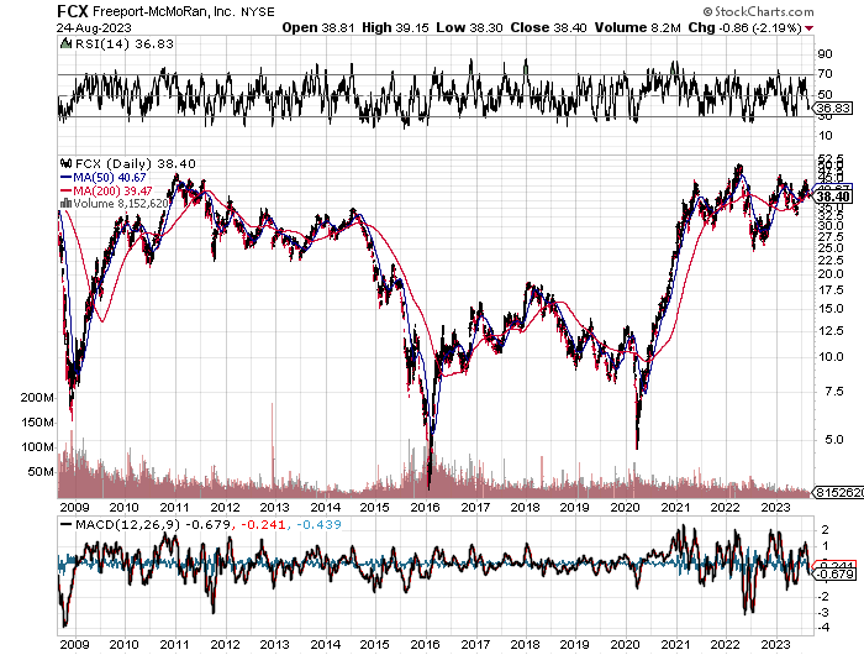

Traditional asset managers would correctly point out that price-earnings multiples are not exactly cheap. And they’d be right if you were only looking at tech growth stocks, the market leaders since 2009. The big caps are priced at mid-20s multiples.

This ignores the huge chunk of the market, the value stocks, that are selling at low teens or single-digit multiple and basically haven’t moved in a decade.

What happens next is that value stock multiples rise to match those of the FANG. Add in earnings growth and that gets you to 240,000 also. By the way, in this scenario price earnings rise a lot, from the current 20 to 30, 35, or even 40.

I’ve seen it all before.

The fact is that American companies cut costs so dramatically since 2020 that they have spectacular earnings leverage in 2023 and beyond. This year, it was cut, or die. Many US companies are now over-prepared for a recession that may not actually happen.

Where are the breadlines and soup kitchens?

Except that this time it’s different.

Remember the 2009 Obama stimulus package? It amounted to a measly $831 billion because Republicans were doing everything they could to block it and Obama was new at the job. Only major banks, brokers, insurance companies, and car makers got bailed out. The rest of us were left to twist in the wind.

This time, the aggregate stimulus is looking like $10 trillion by the time you add in packages 1,2,3,4, Covid-19 rescues, an infrastructure bill, and Biden’s latest $729 Climate/Inflation Fighting/Deficit Reducing bill which is only just now hitting the economy.

But wait, there’s more!

It gets better.

You have to live in Silicon Valley to know this, but the rate of technology innovation has increased by tenfold since the nineties and is far broader than ever imagined. You won’t believe what’s coming your way!

You might ask what happens if interest rates rise further, and they will. The answer here is simple: only invest in the non-borrowing part of the stock market. It turns out that all big tech companies are in fact are net lenders to the system because their cash flows are so enormous. That explains the “Magnificent Seven.”

Other industries benefit from rising rates, like banks, brokers, insurance companies, payday lenders, and money managers. Companies that DO borrow substantially you don’t want to buy anyway, as they are in the wrong industries.

Interest rates would have to get really high before they act as a drag on the stock market, like 6%, 7%, or 8% and that is probably a 2030 event.

The bottom line here is that we are about to see the biggest binge of equity buying in 50 years. Yes, it really WILL be a new American Golden Age and Roaring Twenties.

Start practicing that Charleston!

Yes, stocks are about to become what bonds were in 2010.

I have run this scenario past several of my big-time hedge fund buddies and they ask why I’m being so conservative. They are looking at a Dow Average of 300,000 or 400,000 by 2030 if everything plays out as I expect.

I guess I’m just a conservative kind of guy. Old age and arthritis will do that to a person. Even one that climbs mountains.

Is That A 240,000 Dow?

On Cortina’s Cinque Torre