It's becoming increasingly obvious to me that there is a single great trade shaping up.

S&P 500 (SPY) gains this year have been delivered by just seven stocks, which by now you all know well.

What happens next? The other 493 start to rise.

It just so happens that these troubled 493 stocks are close to their 2023 lows, with many of these the cheapest stocks in the market.

What kind of stocks are these?

Domestic industrial, commodity, and energy stocks have already discounted a deep recession. If the recession arrives, they are fairly priced. If we get only a modest recession, they should rise by 30%-50% reasonably quickly.

In fact, we have already seen recessions play out in broad swaths of the economy, including residential and commercial real estate, and you guessed it, industrials, commodities, and energy.

It gets better.

These sectors are usually the top performers when the stock market shifts from bear to bull. And guess what happened last week? The stock market rose 20% off its October low, officially moving from bear to bull market.

In fact, this bear lasted a depressing 248 days, making it the longest since 1948, or 75 years. This means that we now have the best entry point for domestic recovery stocks in 75 years.

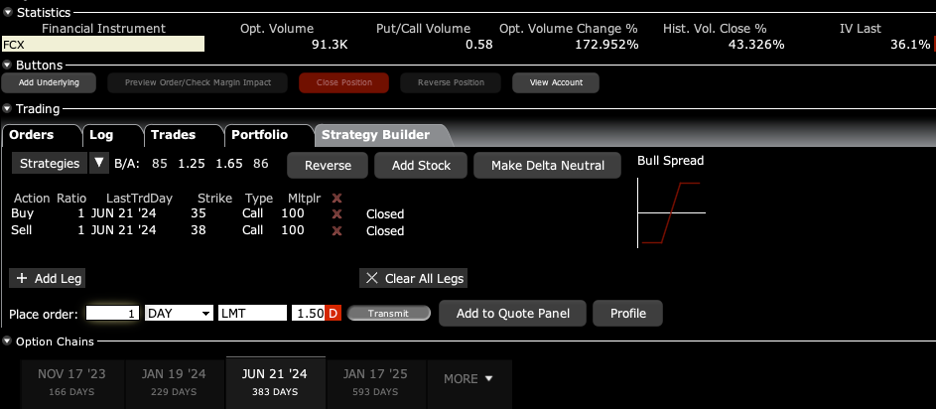

You can see that individual stocks are starting to sense that the all-clear signal has sounded. Last week, they edged out small, tentative gains as if to see if the coast was clear. I also started sending out my first LEAPS for this cycle, those for Freeport McMoRan (FCX) and US Steel (X).

As a pioneer and very early investor in technology, you have not seen many recommendations from me to buy US Steel. I normally don’t look at industries that are besieged by foreign competition, undercut by cheap imports, bedeviled by union problems, are major polluters, and whose principal product has declined in output by 32% since 1970, from 140 million tons a year to only 94.7 million tons.

Yet, here it is.

It gets better still.

The collapse of the Volatility Index ($VIX) from $31 to $13 in three months has suddenly made trading front month call spreads tricky. However, it has made two-year LEAPS (Long Term Equity Anticipation Securities) the bargain of the century.

Two years LEAPS in sectors just coming off multiyear bottoms just as the Fed is about to reverse a harsh interest rate policy and igniting an economic revival sounds like the trade of the year, if not the decade, to me.

The sun, moon, and stars have aligned.

Now, here comes the turbocharger, the gasoline on the fire, the force multiplier.

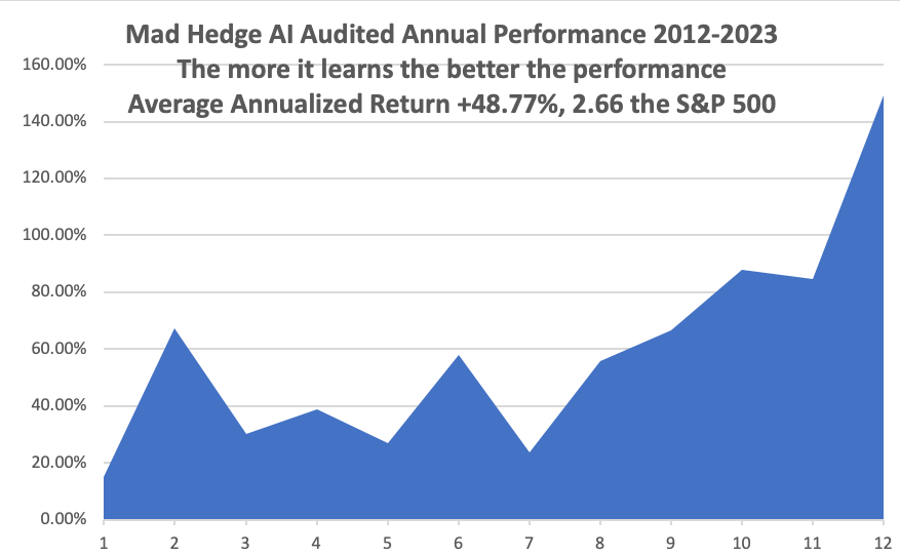

I was playing around with our database last week in preparation for the launch of our Mad Hedge AI Service and drew some astonishing conclusions (see chart below).

Mad Hedge has been using AI now for 11 years, longer than almost anyone in the market. The longer the AI runs and the more data it accumulates, the smarter it gets. This is manifested in rapidly improving trading performance, which this year went ballistic. It is unbelievable to see this, but the numbers don’t lie.

Read it and weep.

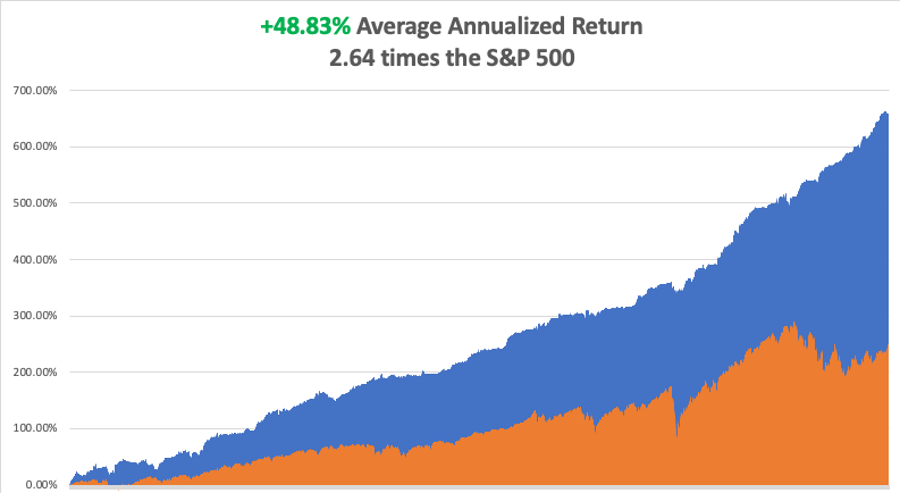

So far in June, we are up +0.37%. My 2023 year-to-date performance is still at an eye-popping +62.12%. The S&P 500 (SPY) is up only a miniscule +12.63% so far in 2023. My trailing one-year return reached +101.03% versus +10.08% for the S&P 500.

That brings my 15-year total return to +659.31%. My average annualized return has blasted up to +48.83%, another new high, some 2.64 times the S&P 500 over the same period.

Some 42 of my 46 trades this year have been profitable. 23 of my last 24 consecutive trade alerts have been profitable.

I executed no trades last week. Concierge members received a LEAPS trade on US Steel (X), which regular subscribers should receive shortly. My longs in Tesla (TSLA) and Freeport McMoRan are now at max profit, which I will easily run into the June 16 option expiration this week. I now have a very rare 80% cash position due to the lack of high-return, low-risk short-term trades.

Tesla Model Y Became World’s Top Selling Car, in Q1, the first EV to do so. Some 267,200 Ys were shifted, edging out Toyota’s Corolla by 10,800 units, which led the field for decades. Elon Musk’s price-cutting volume play is working to the competition’s chagrin. The Model Y is on track to top one million sales this year. Buy (TSLA) on dips.

Tesla Drops Model 3 Price to $33,000, net of $7,500 federal EV tax credit. That helped it become the world’s top-selling car. Late to the market EV makers are getting killed, hemorrhaging cash. That took the shares up to a new 2023 high of $231. Keep buying (TSLA) on dips.

General Motors Adopts Tesla’s Charging System, essentially giving a near monopoly to Elon Musk. (GM) is joining Ford’s (F) capitulation from two weeks ago. This should grow into a $20 billion-a-year profit item for Tesla. All my outrageous forecasts are coming true. Buy (TSLA) on dips.

US to Send Another $2 Billion Worth of Advanced Missiles to Ukraine. The package includes advanced Raytheon (RTX) Himars and Lockheed (LMT) Patriot 3 missiles. Buy both (RTX) and (LMT) on dips as both missiles now have order backlogs extending for years.

Weekly Jobless Claims Jump to 261,000, an increase of 28,000, as the deflationary effects of high-interest rates take hold.

Europe Enters a Recession, with a -0.1% GDP print in Q1. Sharp rises in Euro interest rates get the blame.

Volatility Index Hits 3 ½ Year Low, at $14.26. Complacency with the S&P 500 is running rampant, which always ends in tears. The level implies a maximum up-and-down range of only 8.2% for 30 days.

Airline Profits to Double in 2023, as service sharply deteriorates with revenge travel accelerating. Looks for this summer to be a perfect travel storm. Low fuel costs are another plus.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology is hyper-accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, June 12 at 8:00 AM EST, the Consumer Inflation Expectations are out.

On Tuesday, June 13 at 8:30 PM, Core Inflation Numbers are released. The Fed begins a two-day Open Market Committee Meeting.

On Wednesday, June 14 at 5:30 AM, the US Producer Price Index is published. At 11:00 AM, the Fed interest rate decision is announced. The press conference follows at 11:30 AM.

On Thursday, June 15 at 8:30 AM, the Weekly Jobless Claims are announced. US Retail Sales are also out.

On Friday, June 16 at 7:00 AM, the University of Michigan Consumer Sentiment Index is published. At 2:00 PM, the Baker Hughes Rig Count is printed.

As for me, the call from Washington DC was unmistakable, and I knew what was coming next.

“How would you like to serve your country?” I’ve heard it all before.

I answered, “Of course, I would.”

I was told that for first the first time ever, foreign pilots had access to Russian military aircraft, provided they had enough money. The Russian Air Force was so broke, they couldn’t afford the fuel to allow their pilots to maintain minimum flight hours. They needed foreign pilots to pay for the fuel.

You see, in 1992, everything in the just-collapsed Soviet Union was for sale. All they needed was someone to masquerade as a wealthy hedge fund manager looking for adventure.

No problem there.

And can you fly a MiG-29?

“Probably.”

A month later, I was wearing the uniform of a major in the Russian Air Force, my hair cut military short, sitting in the backseat of a black Volga limo, sweating bullets.

“Don’t speak,” said my driver.

The guard shifted his Kalashnikov and ordered us to stop, looked at my fake ID card, and waved us on. We were at Russia’s Zhukovky Airbase 100 miles north of Moscow, home of the country’s best interceptor fighter, the storied Fulcrum, or MiG-29.

I ended up spending a week at the top-secret base. That included daily turns in the centrifuge to make sure I was up to the G-forces demand by supersonic flight. Afternoons saw me in ejection training. There in my trainer, I had to shout “eject, eject, eject,” pull the right-hand lever under my seat, and then get blasted ten feet in the air, only to settle back down to earth.

As a known big spender, I was a pretty popular guy on the base, and I was invited to a party every night. Let me tell you that vodka is a really big deal in Russia, and I was not allowed to leave until I had finished my own bottle, straight. My memory of what happened after 8:00 PM every night is pretty foggy.

After being taught to fear Americans for their entire lives the Russians were fascinated to actually meet one in person.

In 1993, Russia was realigning itself with the West, and everyone was putting on their best face going forward. I had been warned about this ahead of time and judiciously downed a shot glass of cooking oil every evening to ward off the worst effects of alcohol poisoning. It worked.

Preflight involved getting laced into my green super-tight gravity suit, a three-hour project. Two women tied the necessary 300 knots, joking and laughing all the while. They wished me a good flight.

Next, I met my co-pilot, Captain A. Pavlov, Russia’s top test pilot. He quizzed me about my flight experience. I listed off the names: Laos, Cambodia, Thailand, Israel, Croatia, Serbia, Bosnia, Kuwait, Iraq, and Saudi Arabia. It was clear he still needed convincing.

Then I was strapped into the cockpit.

Oops!

All the instruments were in the Cyrillic alphabet….and were metric! They hadn’t told me about this, but I would deal with it.

We took off and went straight up, gaining 50,000 feet in two minutes. Yes, fellow pilots, that is a climb rate of an astounding 25,000 feet a minute. They call them interceptors for a reason. It was a humid day, and when we hit 50,000 feet the air suddenly turned to snowflakes swirling around the cockpit.

Then we went through a series of violent spins, loops, and other evasive maneuvers (see my logbook entry below). Some of them seemed aeronautically impossible. I watched the Mach Meter carefully; it was frequently dancing up to the “10” level. Anything over ten is invariably fatal, as it ruptures your internal organs. For a few seconds, I thought Pavlov was trying to kill me.

Then Pavlov said, “I guess you are a real pilot, and he handed the stick over to me. I put the fighter into a steep dive, gaining the maximum handbook speed of March 2.5, or 2.5 times the speed of sound, or 1,918 miles per hour in seconds. Let me tell you, there is nothing like diving a fighter from 90,000 feet to the earth at 1,918 miles per hour.

Then we found a wide river and buzzed that at 500 feet just under the speed of sound. Fly over any structure over the speed of sound and the resulting shock wave shatters concrete.

I noticed the fuel gages were running near empty and realized that the Russians had only given me enough fuel to fly an hour. That’s so I wouldn’t hijack the plane and fly it to Finland. Still, Pavlov trusted me enough to let me land the plane; no small thing in a $30 million aircraft. I made a perfect three-point landing and taxied back to base.

I couldn’t help but notice that there was a MiG-25 Foxbat parked in the adjoining hanger and asked if it was available. They said “yes”, but only if I had $10,000 in cash on hand, thinking this was an impossibility. I said, “No problem” and whipped out my American Express gold card.

Their eyes practically popped out of their heads, as this amounted to a lifetime of earnings for the average Russian. They took a picture of the card, called in the number, and in five minutes I was good to go.

Thank you American Express!

They asked when I wanted to fly, and as I was still in my gravity suite I said, “How about right now?” The fuel truck duly backed up and in 20 minutes I was ready for takeoff. Pavlov, once again, my co-pilot. This time, he let me do the takeoff AND the landing.

The first thing I noticed was the missile trigger at the end of the stick. Then I asked the question that had been puzzling aeronautics analysts for years. “If the ceiling of the MiG-25 was 90,000 feet and the U-2 was at 100,000 feet how did the Russians make up the last 10,000 feet?

“It’s simple,” said Pavlov. Put on full power, stall out at 90,000 feet, then fire your rockets at the apex of the parabola to make up the distance. There was only one problem with this. If your stall forced you to eject, the survival rate was only 50%. That is because when the plane in free fall hits the atmosphere at 50,000 feet it’s like hitting a wall of concrete. I told him to go ahead, and he repeated the maneuver for my benefit.

It was worth the risk to get up to 90,000 feet. There you can clearly see the curvature of the earth, the sky above is black, you can see stars in the middle of the day, and your forward vision is about 400 miles. We were the highest men in the world at that moment. Again, I made another perfect three-point landing, thanks to flying all those Mustangs and Spitfires over the decades.

After my big flights, I was taken to a museum on the base and shown the wreckage of the U-2 spy plane flown by Francis Gary Powers shot down over Russia in 1960. After suffering a direct hit from a missile there wasn’t much left of the U-2. However, I did notice a nameplate that said, “Lockheed Aircraft Company, Los Angeles, California.”

I asked “Is it alright if I take this home? My mother worked at this factory during WWII building bombers.” My hosts looked horrified. “No, no, no, no. This is one of Russia’s greatest national treasures,” and they hustled me out of the building as fast as they could.

It's a good thing that I struck while the iron was hot as foreigners are no longer allowed to fly any Russian jets. Perhaps that’s why I have suddenly become very popular in Washington DC once again.

My MiG 25 in Russia

Russian Test Pilot A. Pavlov

Good Luck and Good Trading,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader