In 1942, after the First Marine Division won the battle of Guadalcanal and my Uncle Mitch won his Medal of Honor, they were shipped to Melbourne, Australia for six months of rest and relaxation.

Since their uniforms were in rags and many men were barefoot, they were handed scratchy WWI surplus wool uniforms. That’s all the Aussies had, as their army was off fighting Rommel in North Africa.

All 8,000 men lived in the Melbourne Cricket Ground, and the government delivered a truckload of beer barrels every day. Whenever the men went outside, they were invited by local families off the street to have dinner. After four months, they were fat and happy.

Then one day, they were placed on a train with full battle gear, taken 50 miles out of town, and told to walk back with no food and a canteen of water. They were retraining for the next battle, which would be in New Guinea.

When economic data flip-flops, so does the market.

The red-hot January Nonfarm Report with the Unemployment Rate at a 50-year low of 3.5% gave the bulls every reason to buy stock. So stocks can’t fall.

But a strong jobs market means the Fed will keep interest rates higher for longer gives plenty of fodder for the bears. So stocks can’t rise.

My Mad Hedge Market Timing Index is equally confused at 55. You can’t get any closer to 50, which means you should do absolutely nothing.

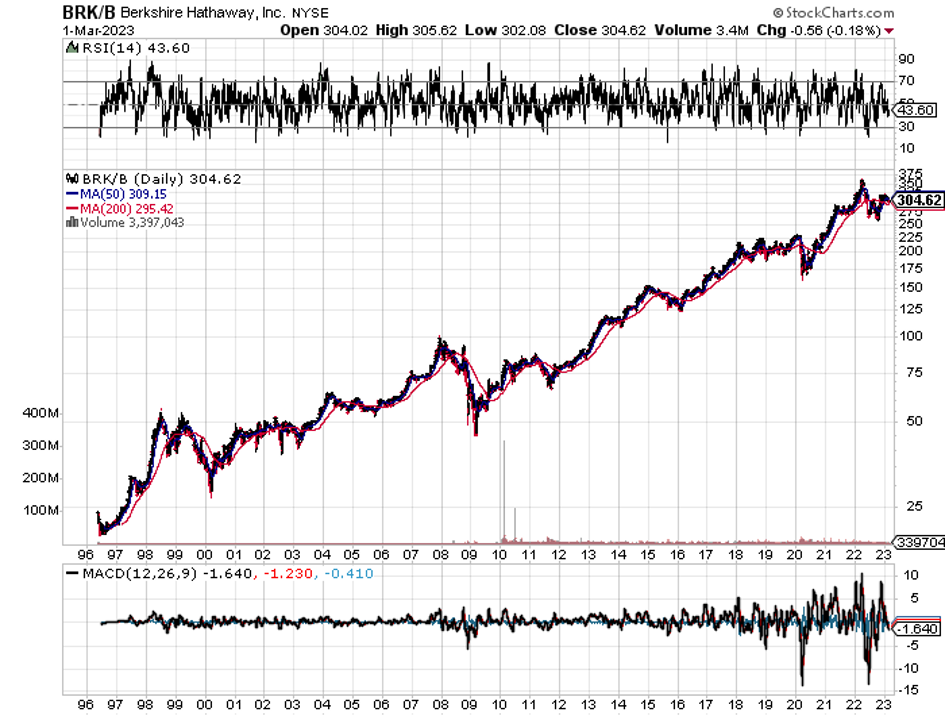

Notice that the S&P 500 (SPY) bounced off the 200-day moving average at $390.95 to the penny and rallied, a perfect symptom of this disease. When the fundamentals are confused, technicals win.

At this late age, the only one I take orders from is named Mr. Market. Ignore his instructions at your own peril and expense. Everyone else can get lost.

That leaves us nothing to do but to wait for the next events of market consequence, the March 14 CPI and the December 22 Fed interest rate decision. We might as well twiddle our thumbs and watch the clock until then.

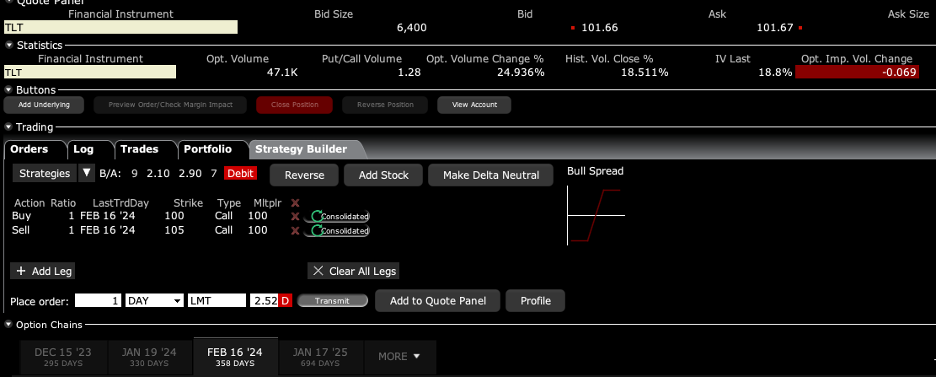

So I will stick to my market-neutral strategy as long as I must take in enough money to keep the lights on. I keep doing this knowing full well that the last time I do will lose money.

This could go on for months.

In the meantime, I will keep researching the long term, which continues to look better and better. The dross ends in months. It’s the next decade we need to focus on now.

It's time to polish our armor, sharpen our weapons, and get back in shape, just as the First Marine Division did 81 years ago.

Remember that we are in the “what’s next” business. Whatever you buy now has to be discounting the following coming trends:

Falling interest rates

A weak dollar

Rising commodity prices

Rising energy prices

Reaccelerating tech earnings

A new boom in real estate

Precious metals going to record highs

Strong emerging markets

A Ukraine win leading to global peace

America’s principal adversary is rendered impotent

A second peace dividend ensues

Every trade alert I send you this year will be taking of one or more of these trends. It’s just a matter of time before they begin if they haven’t already.

We had a really great last two days of February, pushing me back in the green for February, taking me up +3.41% on the month. March has so far come in at +0.80%.

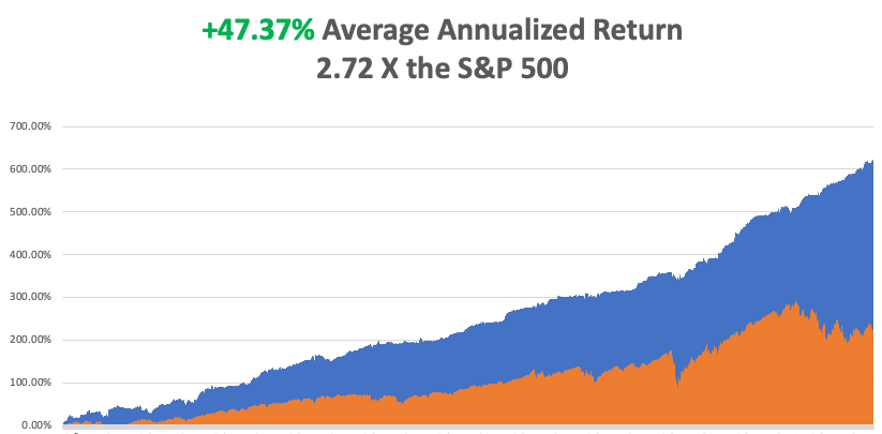

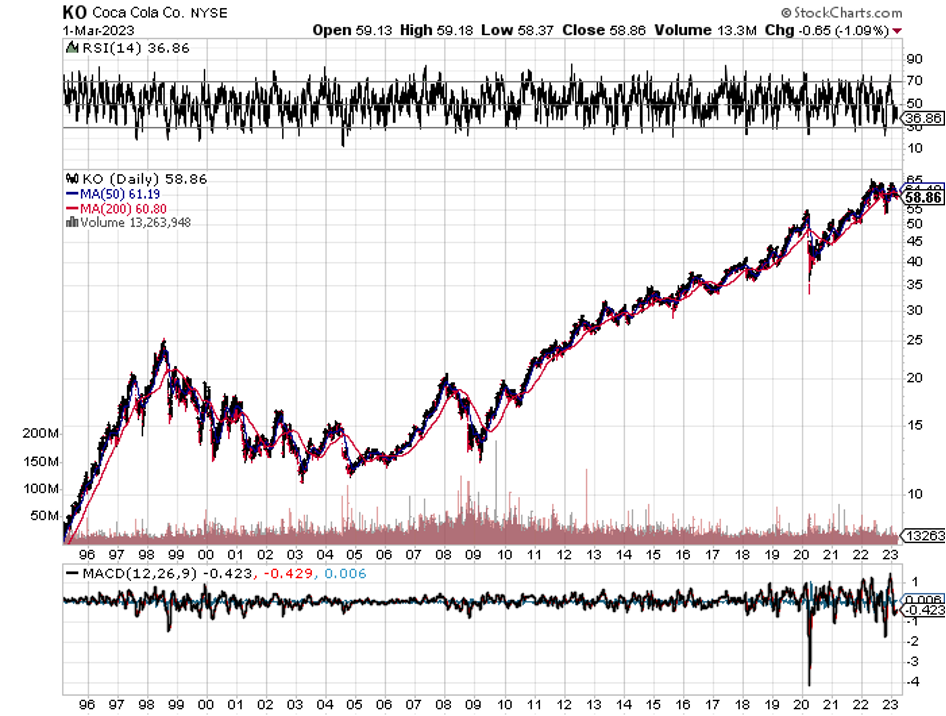

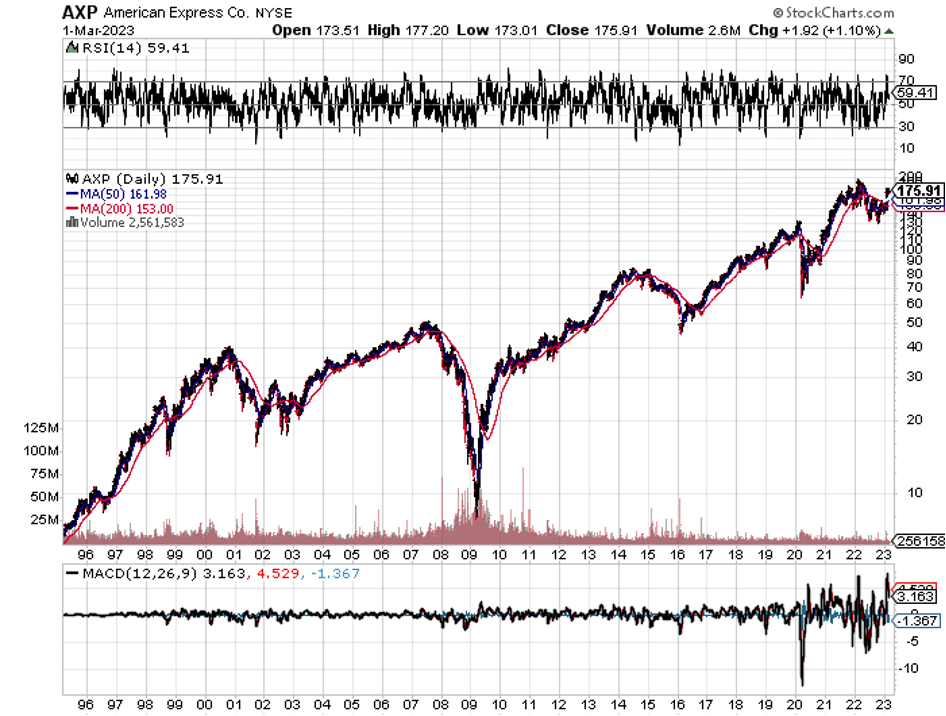

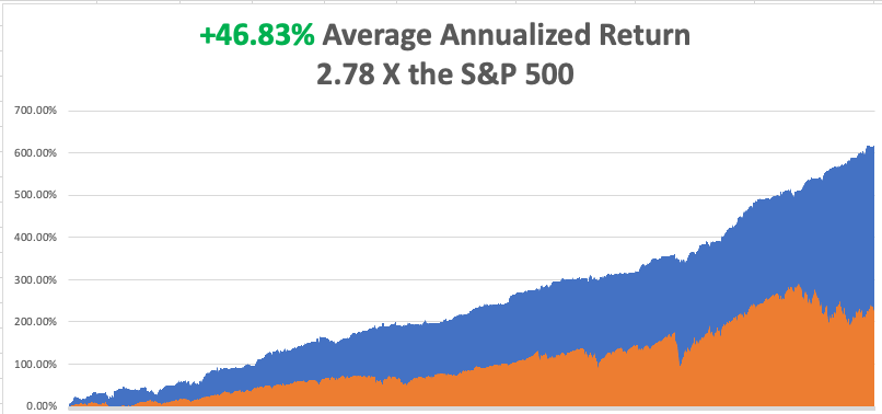

My 2023 year-to-date performance is still at the top at +26.56%. The S&P 500 (SPY) is up +6.36% so far in 2023. My trailing one-year return maintains a sky-high +85.51% versus -5.66% for the S&P 500.

That brings my 15-year total return to +623.75%, some 2.72 times the S&P 500 (SPX) over the same period. My average annualized return has recovered to +47.37%, still the highest in the industry.

Nothing Happens Until March 14, at 8:30 AM EST when the next big inflation read, the Core CPI comes out. It’s all about inflation right now. Look for a flat line until then. That’s why it’s a good time to run short strangles and own lots of cash. A dollar at a market bottom is worth $10 at a market top.

S&P Case Shiller Gains 5.7% in December, YOY according to its National Home Price Index. That’s a quarter of the gains seen a year ago. Miami (15.9%), Tampa (13.9%), and Atlanta (10.4%) showed the biggest gains. High mortgage interest rates are still a big drag and will continue for another six months.

Pending Home Sales Soar 8.7% in January on a signed contract basis. It is the second straight month of gains and the biggest in 2 ½ years. See what a 1.5% drop in mortgage rates can do? While rates are back up now it shows how much demand is building up in the residential real estate market. I think this market explodes to the upside by yearend.

Mortgage Rates Jump to 6.65%, snuffing out the green shoots that briefly appeared in January. Mortgages are still maintaining an unprecedented 200 basis point premium to 30-year Treasury bond rates, which should disappear by yearend. The seeds of the next housing boom are germinating.

Tesla Tanks Semiconductor Shares, after Elon Musk announced that he plans to cut silicon carbide chips by 75%. Improved new designs will also slash the number of chips needed for EVs, whose supply and prices are notoriously volatile. New chip designs will appear in the $25,000 model 2 due out in 2025.

Ark’s Dirty Little Secret. Cathy Woods’ ARK Innovation Fund (ARKK) is one of the top-performing funds so far in 2023, up 24%. But strip out the performance of Tesla (TSLA) and the five-year return has been precisely zero. Good thing (TSLA) is up 110% this year. Maybe its cheaper just to buy (TSLA) and skip the dross and high management fees at Ark? Elon Musk thinks it’s going to $1,000 a share and so do I. Oh, and they just dropped the price of their top end Model X by $20,000.

Stellantis (STLA) Buys a Copper Mine, taking a 14.2% stake in Argentina’s McEwen Copper mine. Gee, do you think the owner of the Chrysler brand is going into EVs? They also laid off 2,000 because with 80% fewer parts EVs require far less workers. Buy Copper and Freeport McMoRan (FCX) on dips. The global copper shortage is imminent.

China Manufacturing PMI Hits 11-Year High, at 52.6 in a surprising comeback from the end of covid lockdowns. The news hit the bond market, worried about rising inflation prospects. Supply chain problems in the US should ease as a result.

Wheat Prices Crash, seeing a 6% dive in February. What always follows a food shortage? A food glut, as farmers overplant to cash in on generous government subsidies, creating a bumper crop. It’s only a 100-year cycle. Prices will stay low as long as Ukraine can keep exporting.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. The economy decarbonizing and technology hyper accelerating, creating enormous investment opportunities. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The new America will be far more efficient and profitable than the old.

Dow 240,000 here we come!

On Monday, March 6 at 7:00 AM EST, US Factory Orders are out.

On Tuesday, March 7 January 31 at 7:00 AM EST, the Federal Reserve Governor Jerome Powell testifies in front of congress.

On Wednesday, March 8 at 7:00 AM EST, the JOLTS Job Opening Report is released.

On Thursday, March 9 at 8:30 AM EST, the Weekly Jobless Claims are announced.

On Friday, March 10 at 8:30 AM EST, the Nonfarm Payroll Report for February is released.

As for me, while I was in Hawaii the other week, I took the opportunity to meet up with my old friend, David, who reminded me of the week to end all week 25 years ago.

I first met David at a Tokyo karate dojo in 1974 when he was 16 and his dad was the Associated Press Bureau Chief.

As we were about the same size, Higaona Sensei paired is off as sparing partners. But to fight, David had to take off his glasses. It wasn’t long before I saw my front teeth flying across the room and skittering across the teak floorboards.

I next met David at Morgan Stanley when I was a London director, and he was a junior trader in Tokyo. After that, I took off to start my own hedge fund.

When Morgan ordered him to meet with their traders in Zurich, Switzerland, I saw the perfect excuse for an adventure. Starting in London, we first dropped off our wives for a week of shopping in Paris, flying my twin Cessna 340.

I used my old trick of getting permission to fly over the center of Paris so I could waggle my wings at the tourists as we passed the top of the Eiffel Tower.

In Zurich, I got in a fight with the tower because they ordered me into a parking stand that was still under construction. I left David to his meetings, thus enabling us to bill the entire trip to Morgan Stanley, aviation fuel, five-star hotels, three-star restaurants, and all. If you did that today at (MS) you’d probably get fired.

I then flew off to pick up a couple of cases of first-growth French wines from the owners in Bordeaux to kill time.

When I picked up David the next day, we headed south. It was a clear day, so I thought it might be a good time to visit the Matterhorn summit. As we circled, the day’s successful climbers waved their ice axes. Then it was up the Rhone River Valley, threading an Alpine valley.

When I realized that I couldn’t climb fast enough to escape the valley, I executed a quick Immelman turn. You’re never supposed to do this in a twin because there is a risk of entering a flat spin (watch the Top Gun movie to see what this is).

But I had my British Aerobatics license, my Swiss Alpine license, plenty of speed, and an oversupply of confidence, so I figured we’d be OK. I performed the first half of a loop, then at the top, I flipped the plane 180 degrees, thus righting it and heading in the opposite direction. But I think we singed the rear ends of a few mountain goats on the way.

Needless to say, this caught David’s attention.

When I popped out of the top of the Alps, I was immediately intercepted by a Mirage fighter from the Swiss Air Force. I was now in military air space. He took a few runs at me at just under Mach 1, using me for target practice. Once I was identified he went on off his merry way.

Now I was lost.

All the maneuvering put me too low to intercept any European navigational aids. So we just looked out the window. Eventually, we noticed that to roof tiles of the city below us were red, which meant we had to be over Italy. I correctly identified it as Bolzano. From there I calculated a direct track to the airfield at St. Moritz in Switzerland.

We stayed at the legendary Badrutt’s Palace Hotel. The next day, we took a cable car to the highest peak. While American ski resorts offer cheeseburgers or pizza, Swiss ones have Michelin Three Star Restaurants. We enjoyed the meal of a lifetime.

When the Tokyo stock market crashed, Morgan Stanley let go of most of its Tokyo staff. David landed on his feet, taking over as the head of trading at Lehman Brothers. He later moved on to a hedge fund, cashing in its Lehman stock well before he went under.

David later retired to the North Share of Oahu in Hawaii, and I visit whenever I’m in town. He is very proud of his tropical fruit orchard. When the 50-foot waves crash at nearby Waimea Bay, the ground shakes.

Whenever I see David, he reminds me of our “lost week” over the Alps. It was the most exciting week of his life. And I always respond, “But David, every week is like that for me.”

When I visit Bolzano this summer to research the battles there in WWI in which my great uncle perished, I’ll ask the residents if they noticed a lost airplane overhead 25 years ago.

Good Luck and Good Trading

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The First Marine Division in the Melbourne Cricket Ground in 1942

Higaona Sensei in 1974

Badrutt’s Palace Hotel in St. Moritz

Refueling my Cessna 340 in 1988