Global Market Comments

November 21, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or SLOWING TO STALL SPEED),

(SPY), (TLT), (SLV), (WPH), (MAT), (NVDA), (MS), (GS)

Global Market Comments

November 21, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or SLOWING TO STALL SPEED),

(SPY), (TLT), (SLV), (WPH), (MAT), (NVDA), (MS), (GS)

I got a call from my daughter the other day, who is a Computer Science major at the University of California at Santa Cruz. The university was on strike and shut down, so she suddenly had a lot of free time on her hands.

The Teaching Assistants were only getting $12 an hour, which is not enough to live on in the San Francisco Bay Area by a mile. Some one-third were living in their cars, which can get chilly on the Northern California coast in winter.

Fast food workers in California will get $22 an hour from January, thanks to a bill passed in the recent election. The TAs, most of whom are working on master’s degrees and PhD’s in all kinds of advanced esoteric subjects, are simply asking to bring their pay in line with Taco Bell.

The entire UC system is on strike, affecting ten campuses, 17,000 TAs and 200,000 students. I have noticed that the most liberal universities often have the most draconian employment policies. It’s legalized slave labor. I speak from experience as a past victim, as I was once an impoverished work-study student at UCLA earning $1.00 an hour experimenting with highly radioactive chemicals.

What was my tuition for four years at the best public university in the world? Just $3,000, and I didn’t even pay that, as I was on a full scholarship, something about rocket engines I built when I was a kid. Werner Von Braun liked them. The 800 Math SAT score probably helped a tiny bit too.

UCSC is the feeder university for Silicon Valley. Graduates in Computer Science earn $150,000 a year out the door and $200,000 with a Master's degree. PhDs get offered founders’ stock in the hottest Silicon Valley startups.

I hope the TAs get their raise.

My daughter was calling me to apologize for her poor trading performance this year. I thought, “My goodness, did she just lose her entire college fund in some crypto scam?”

“How much did you lose,” I asked.

She answered that she didn’t lose anything and in fact was up 59% this year. She knew my performance was topping 78%, and that some subscribers had made up to 1,000%.

But she missed the October low because she had a midterm and was late on my (TLT) LEAPS because she was on a field trip. She promised to pay closer attention so she could earn the money to pay for her PhD.

My kids never ask me for money. If they need it, they just go into the markets and get it themselves. But then this is a family that discussed implied volatilities, chaos theory, and the merits of the Black Scholes equation over dinner every night. That’s what it’s like to have a hedge fund manager for a dad. Any extra money I have I give away to kids not as lucky as mine.

Then we talked about the most important issue of the day, how to cook the turkey this week. Brine, or no brine, with or without a T-shirt, or deep fat fry? She cautioned me to take it out of the freezer three days early to thaw. I bought my turkey a month ago because I knew prices would rise, and they have done so mightily. In case I get in over my head, I can always call the Butterball Thanksgiving Turkey Emergency Hotline at 844-877-3436.

But that’s just me.

Whenever making money gets too easy, I get nervous.

There’s a 90% chance we saw the bottom in this bear market on October 14. But how we proceed from here is the tricky part. Too much now depends on a single monthly data point, namely the Consumer Price Index, and that is a tough game to play. The next one is out on December 13.

The truth is that even with overnight interest rates at 4.75%-5.00% , the economy is holding up far better than anyone imagined possible. Some sectors, like financials, are positively booming. And while housing is weak, we really have not seen any major price falls that could threaten a financial crisis. Consumers are in good shape with savings near record levels.

There isn’t going to be a hard landing. There isn’t even going to be a soft landing. In fact, we may not have a landing at all, with the economy continuing to motor along, albeit at a slower rate just above stall speed.

Which begs me to repeat that the next new trend in interest rates will be down, and that this will be the principal driver of all your investment decisions going forward. Bonds may make the initial move up, as last week’s trade alerts suggested. But I have no doubt that equities will have a big move in 2023 as well.

Producer Price Index Fades, up only 0.2%, half of what was expected. That’s a big decline from 8.4% to 8.0% YOY. It’s another bell ringing that inflation has topped. Stocks rallied 500 on the news.

Bonds Continue on a Tear, with the (TLT) up a breathtaking eight points from the October low. It could reach $120 in 2023. Keep buying (TLT) calls, call spreads, and LEAPS on dips.

FTX Keeps Getting Worse, as it is looking like it’s a Bernie Madoff X 10, or an Enron X 20. A new CEO has been appointed by the bankruptcy court, John Ray, the former liquidator of Enron and a distant relative of mine. This will spoil investment in most digital coins and tokens for good, which are now worthless, and coins unless they are guaranteed by JP Morgan (JPM) or Goldman Sachs (GS). FTX never had a CFO, and Sam Bankman-Fried is blaming it all on his girlfriend, not exactly what creditors want to hear. In any case, Bitcoin has been replaced by Taylor Swift tickets.

A Massive Silver Shortage is Developing, with demand up 16% in 2023 to 1.21 million ounces. With EV production increasing from 1.5 million to 20 million units a year within the decade, its share of the market will rise from 5% to 75%. Solar panel demand is also rising. Buy (SLV) and (WPM) on dips. My next LEAPS will be for silver on the next dip.

NVIDIA Sales Rise, but profits dip, taking the stock up 3%. Games sales dropped a heartbreaking 50% and crypto took a big hit. The company expects $6 billion in sales in Q4 and is still operating at an incredible 53.6% gross margin. The company is creating a new line of dumbed-down products to comply with China export bans. Keep buying (NVDA) on dips. We caught a 50% move in the past month.

Retail Sales Rise 1.3% in October, causing analysts to raise Q4 GDP forecasts. Rising prices are a major factor. Where is that darn recession?

Who Has the World’s Worst Inflation? Not the US, where price gains have been relatively muted. Venezuela leads with 21,912%, followed by Zimbabwe at 2019%, Lebanon at 1071%, Argentina at 194%, Turkey at 124%. Even Russia is at 25%. Who has the lowest? Japan at 1.0%, but their currency has just collapsed by 40%.

The 60/40 Portfolio is Back, after a 15-year hiatus. JP Morgan Chase says that keeping 60% of your money in stocks and 40% in bonds should deliver a 7.2% annual return. I believe the balanced portfolio return will be much higher, as everything will go up in 2023 and fixed income is now yielding 5% or better. 2022 saw the worst 60/40 return in 100 years.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With the economy decarbonizing and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, November 21 at 8:00 AM, the Chicago Fed National Activity Index for October is out.

On Tuesday, November 22 at 8:30 AM, the Richard Fed Manufacturing Index is released.

On Wednesday, November 23 at 8:30 AM, Durable Goods for October is published. At 11:00 AM, the FOMC minutes from the previous meeting are out. Weekly Jobless Claims are announced. New Homes Sales for October are out.

On Thursday, November 24, Markets are closed for Thanksgiving.

On Friday, November 25, stock markets close early at 1:00 PM. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, I have dated a lot of interesting women in my lifetime, but one who really stands out is Melody Knerr, the daughter of Richard Knerr, the founder of the famed novelty toy company Wham-O (click here). I dated her during my senior year in high school.

At six feet, she was the tallest girl in the school, and at 6’4” I was an obvious choice. After the senior prom and wearing my cheap rented tux, I took her to the Los Angeles opening night of the new musical Hair.

In the second act, the entire cast dropped their clothes onto the stage and stood there stark naked. The audience was stunned, shocked, embarrassed, and even gob-smacked. Fortunately, Melody never revealed the content of the play to her parents, or I would have been lynched.

In a recurring theme of my life, while Melody liked me, her mother liked me even more. That enabled me to learn the inside story of Wham-O, one of the great untold business stories of all time.

Richard Knerr started Wham-O in a South Pasadena garage in 1948. His first product was a slingshot, hence the company name, the sound you make when firing at a target. Business grew slowly, with Knerr trying and discarding several different toys.

Then in 1957, he borrowed an idea from an Australian bamboo exercise hoop, converted it to plastic, and called it the “Hula Hoop.” It instantly became the biggest toy fad of the 20th century, with Wham-O selling an eye-popping 25 million in just four months. By 1959, they had sold a staggering 100 million.

The Hula Hoop was an extremely simple toy to manufacture. You took a yard of cheap plastic tubing and stapled it together with an oak plug, and you were done. The markup was 1,000%. Knerr made tens of millions and bought a mansion in a Los Angeles suburb with a stuffed lion guarding his front door which he had shot in Africa.

The company made the decision to build another 50 million Hula Hoops. Then the bottom absolutely fell out of the Hula Hoop market. Midwestern ministers perceived a sexual connotation in the suggestive undulating motion to use it and decried it the work of the devil. Orders were cancelled en masse.

Whamo-O tried to stop their order for 50 million oak plugs, which were made in England, but to no avail. They had already shipped. So, to cut their losses Whamo-O ordered the entire shipment dumped overboard in the North Atlantic, where they still bob today. The company almost went bankrupt.

Knerr saved the company with another breakout toy, the Frisbee, a runaway success which is still sold today. Even Incline Village, Nevada has a Frisbee golf course. The US Army tested it as a potential flying hand grenade. That was followed by other monster hits like the Super Ball, the Slip N Slide, and the Slinky.

Richard Knerr sold his company to toy giant Mattel (MAT) for $80 million in 1994. He passed away in 2008 at the age of 82.

As for Melody, we lost touch over the years. The last I heard she was working at a dive bar in rural California. Apparently, I was the high point of her life. The last time I saw her I learned the harshest of all lessons, never go back and visit your old high school girlfriend. They never look that good again.

Stay healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

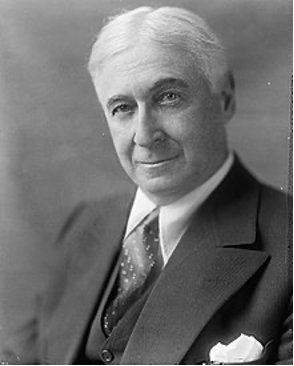

Hula Hoop Inventor Chuck Knerr

“The two things the Fed can’t do is print humans to fill jobs and print oil to stop inflation,” said Bryn Talkington of Requisite Capital Management.

Global Market Comments

November 18, 2022

Fiat Lux

Featured Trade:

(NOVEMBER 16 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (JNK), (HYG) or (TLT), (UUP), (FXE), (FXC), (FXA), (ALB), (FCX), (PYPL), (FXI), (GLD), (CCJ), (BHP), (RCL)

Below please find subscribers’ Q&A for the November 16 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: What do you see Tesla (TSLA) moving to from here until next year?

A: Not much; I mean if you’re lucky, Tesla won’t move at all. The problem is Twitter is looking like a disaster of huge proportions—firing half the staff on day one? Never good for building a business. Tesla has also been tied to the rest of big tech, which has been in awful condition and may not see a continuous move upward until the Fed actually starts lowering interest rates in the second quarter of next year. Tesla could be dead money here for a while; eventually, a company growing at 50% a year will go up—especially when it’s just had a 50% decline in the share price. As to when that is, I don’t know, and asking me 15 more times will get you just the same answer.

Q: Should we start piling into iShares 20 Plus Year Treasury Bond ETF (TLT) longs now or wait?

A: You go now. Every day you waited meant paying one point more in TLT. I think the bottom is in; we have a 20-30 point move ahead of us. Everybody in the world is now trying to get into this trade, just like I spent all this year trying to get out of it. And if anything, November CPI could be a long term-term top in inflation, especially if we came in with another cold number. So, I would start scaling in now, even though we’re over $100 in the (TLT) today and I first recommended this around $95.

Q: If the Fed keeps raising interest rates, will the US Treasury market fall?

A: Probably not because the Fed only has control of overnight interest rates—the discount rate, the interbank rate—whereas the (TLT) is a 10-to-20-year maturity bond. No matter what short term rates do, the inversion will just keep getting bigger, but in fact, the bond market itself was yielding 4.46%, yielding 8% with junk, has bottomed and will probably start going up from here. So that is the difference between the Fed and what the actual market does.

Q: Do you prefer Junk (JNK), (HYG), or (TLT)?

A: I always go for the highest risk. Junk has about an 8% yield here compared to 3.75% for the TLT. By the way, if you want to do one trade and go to sleep, buy the junk on 2 to 1 margin, get your 16% yield next year, and just take a one-year vacation. That’s what some people do.

Q: When you say the dollar is going to go down what do you mean?

A: I mean the US dollar, while Canadian (FXC) and Australian dollars (FXA) will go up.

Q: What is the best time to buy US dollars?

A: Maybe in five years, as it could go down for five or 10 years from here, now that it’s going to imminently give up its yield advantage.

Q: What's the forecast for casinos?

A: I think casinos do better. Las Vegas was absolutely packed, you couldn’t get into the best hotels—people are spending money like crazy.

Q: What’s the best way to play (TLT)?

A: With a one-year LEAP. I put out the $95/$100 last week for my concierge members. Here, you probably want to do the $100/$105; that’ll still give you a one-year return of 100%.

Q: How do you short the dollar?

A: There are loads of short dollar ETFs out there, or you can just sell short the Invesco DB US Dollar Index Bullish Fund (UUP), which is the dollar basket, or buy the (FXA) or (FXE).

Q: Freeport McMoRan (FCX) just went from 25 to 38; is it time to take a profit and re-enter at a lower point?

A: Short term yes, long term no. My long-term target for (FCX) is $100 because of the exponential growth of copper demand caused by EV production going from 1.5 million to 20 million a year in the next 10 years. Each EV needs 200 pounds of copper, so by 2030, annual copper demand for EVs only will be 20 billion pounds. In 2021, the total annual global copper production was 46.2 billion pounds. In order words, global copper production has to double in eight years just to accommodate EV growth only.

Q: Do you think there’ll be a rail worker strike?

A: I have no idea, but it will be a disaster if there is. There’s your recession scenario.

Q: What strike prices do you like for a Tesla LEAP?

A: Anything above here really. You could be cautious and do something like a $200/$210 two years out—that has a double in it. Or you could be more adventurous and go for a 400% return with like a $250/$260 in two years. I’m almost sure that we’ll have a major recovery in Tesla within two years.

Q: What’s your opinion on PayPal (PYPL) and Albemarle (ALB)?

A: I’m trying to stay away from the fintech area, partly because it’s tech and partly because the banks are recapturing a lot of the business they were losing to fintech a couple of years ago by moving into fintech themselves. That is the story and we’re clearly seeing that in the share prices of both banks and PayPal. I like Albemarle because the demand for lithium going forward is almost exponential.

Q: What’s your thought on the Australian dollar (AUD)?

A: Buy it with both hands as it is going to parity. Australia is a great indirect play on trade with China (FXI), gold (GLD), uranium (CCJ), and iron ore (BHP). It’s a great play on the recovery of the global economy, which will start next year.

Q: What do you think about Royal Caribbean Cruises Ltd (RCL)?

A: Probably a buy but remember all the cruise lines will be impaired to some extent by the massive debts they had to take on to survive two years of shutdown with the pandemic. I took the Queen Victoria last July on their Norwegian Fjord cruise, and it had not been operated for two years. None of the staff had any idea what to do. I had to show them.

Q: Will big tech have a good second half?

A: Probably, but it’s going to be a slow first quarter, and I think if we start getting actual cuts in interest rates, then it’s going to be off to the races for tech and they’ll all go to all-time highs as they always do.

Q: How come you haven’t issued any trade alerts yet on the currencies?

A: Calling a five-year turnaround is a big job. Now that we have the turnaround in play, we’re in dip-buying mode. So, you will see these in the future. But I also have to look at what currency trades are offering compared to other trades in other asset classes. And for the last year or two, the big opportunities have all been in stocks. You had volatility constantly visiting the mid $30s, you didn’t get that in the currencies, and more money was to be made in stock trades than foreign currency trades. That is changing now; let's see if we have a sustainable trend and if we get a good entry point. There’s a lot that goes into these trade alerts that you don’t always get to see. We only get a 95% success rate by being very careful in sending out trade alerts and that means long periods of doing nothing when the risk/reward is mediocre at best, which is right now. The services that guarantee you a trade alert every day all lose money.

Q: What is the recommended minimum portfolio size to amortize the cost of the concierge service?

A: I tell people to have a half a million in assets because we want people who are financially sophisticated to understand what we’re telling them. That said, we do have people with as little as 100,000 in the concierge service and they usually make the money back on the first trade. This is a very sophisticated high-return, very active service. You get my personal cell phone number and all that, plus your own dedicated website, and specific concierge-only research. It’s a much higher level of service. It’s by application only and we currently have no places available for new concierge members. However, if you’re interested, we can put you on the waitlist so that when another millionaire retires, we can open up a space.

Q: Despite recent moves, the algo looks bearish. There are lots of mixed signals.

A: Yes, it does. And yes, that’s often the case when the market timing index hangs around 50.

Q: Do concierges go for short term moves?

A: No, concierges are looking for the big, long-term trades that they can just buy and forget about. That is where the big money is made. At least 90% of the people that try day trading lose money but make all the brokers rich.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH or Technology Letter, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Something everyone knows isn’t worth knowing,” said Bernard Baruch, one of the greatest stock traders of all time and advisor to President Franklin Roosevelt.

Global Market Comments

November 17, 2022

Fiat Lux

Featured Trade:

(WATCH OUT FOR THE COMING COPPER SHOCK)

(FCX), ($COPPER)

You remember the two oil shocks, don’t you? The endless lines at gas stations, soaring prices, and paying close attention to OPEC’s every murmur?

Now we are about to get the 2020’s environmentally friendly, decarbonizing economy version: the copper shock.

For copper is about to become the new oil.

The causes of the coming supply crunch for the red metal are manifold.

If you take all of the commitments to green energy made by the Paris Climate Accord, which the US just reentered, they amount to demand for copper about three times current world production.

Oops, nobody thought of that.

Copper is needed in enormous quantitates to build millions of electric cars, solar panels, batteries, windmills, and long-distance transmission lines for a power grid that is going to have to triple in size. Lift a 50-pound rotor from a Tesla wheel as I have and most of the weight is in the copper.

You basically don’t have a green movement without copper.

In addition, existing copper miners seem utterly clueless about the coming shortage of their commodities. Capital spending has been deferred for decades and maintenance delayed.

New greenfield mines are scant and far between. Copper inventories are at a ten-year low. Mines were closed for months in 2020 thanks to a shortage of workers caused by the pandemic.

Copper is the last of the old-school commodities that are still actively traded. It takes 5-10 years at a minimum to bring new mines online. By the time potential sites are surveyed, permits obtained, heavy equipment moved on-site, rail lines laid, water supplies obtained, and bribes paid, it can be a very expensive proposition.

That’s why near-term prospects are only to be found in Chile, Peru, and South Africa, not your first choices when it comes to political stability.

Copper is the single best value-for-money conductor of electricity for which there are very few replacements. Aluminum melts and corrodes. And then there is silver (SLV), right below copper of the periodic chart, which gangster Al Capone used to wire his bulletproof 1928 Cadillac so electricity could move faster. Below silver is gold (GLD), a fine conductor of electricity but is somewhat cost-prohibitive.

As a result, base metal copper prices could more than quadruple from here to $15,000 a metric tonne or more. The last time the price was that high was in 1968, when the Vietnam War was in full swing, as the military needs a lot of copper to fight wars. The economy was then booming.

You can’t have a synchronized global economic recovery without a bull market in commodities, and the mother of all recoveries is now in play according to the latest economic data. Phoenix, AZ Freeport-based McMoRan (FCX) is one of the world’s largest producers of copper and a long-time Mad Hedge customer.

The stock has been on a tear for a month. (FCX) has soared from a 25 low in October to near $39 at the recent high. I believe this move will continue for years with a final target of $100. The old high for the stock in the last cycle was $50.

Short term, the demand for copper will be driven by Chinese real estate constructions, with all the Covid lockdowns now weak.

Long term it will be driven by EV production, which will soar from 1.5 million units this year to 20 million by 2030. Each EV required 200 pounds of copper.

I’ll let you do the math.

These Tesla Copper Rotors Weigh About 50 Pounds Each

Global Market Comments

November 16, 2022

Fiat Lux

Featured Trade:

(THEY’RE NOT MAKING AMERICANS ANYMORE)

Global Market Comments

November 15, 2022

Fiat Lux

Featured Trade:

(LEARNING THE ART OF RISK CONTROL)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.