Global Market Comments

November 4, 2022

Fiat Lux

Featured Trade:

(NOVEMBER 2 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (LLY), (TSLA), (GOOG), (GOOGL), (JPM), (BAC), (C), (BRK), (V), (TQQQ), (CCJ), (BLK), (PHO), (GLD), (SLV), (UUP)

Global Market Comments

November 4, 2022

Fiat Lux

Featured Trade:

(NOVEMBER 2 BIWEEKLY STRATEGY WEBINAR Q&A),

(SPY), (LLY), (TSLA), (GOOG), (GOOGL), (JPM), (BAC), (C), (BRK), (V), (TQQQ), (CCJ), (BLK), (PHO), (GLD), (SLV), (UUP)

Below please find subscribers’ Q&A for the November 2 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley in California.

Q: The country is running out of diesel fuel this month. Should I be stocking up on food?

A: No, any shortages of any fuel type are all deliberately engineered by the refiners to get higher fuel prices and will go away soon. I think there was a major effort to get energy prices up before the election. If that's the case, then look for a major decline after the election. The US has an energy glut. We are a net energy exporter. We’re supplying enormous amounts of natural gas to Europe right now, and natural gas is close to a one-year low. Shortages are not the problem, intentions are. And this is the problem with the whole energy industry, and the reason I'm not investing in it. Any moves up are short-term. And the industry's goal is to keep prices as high as possible for the next few years while demand goes to zero for their biggest selling products, like gasoline. I would be very wary about doing anything in the energy industry here, as you could get gigantic moves one way or the other with no warning.

Q Is the SPDR S&P 500 ETF (SPY) put spread, correct?

A: Yes, we had the November $400-$410 vertical bear put spread, which we just sold for a nice profit.

Q: I missed the LEAPS on J.P. Morgan (JPM) which has already doubled in value since last month, will we get another shot to buy?

A: Well you will get another shot to buy especially if another major selloff develops, but we’re not going down to the old October lows in the financial sector. I believe that a major long-term bull move has started in financials and other sectors, like healthcare. You won’t get the October lows, but you might get close to them.

Q: I’m waiting for a dip to get into Eli Lilly (LLY), but there are no dips.

A: Buy a little bit every day and you’ll get a nice average in a rising market. By the way, I just added Eli Lilly to my Mad Hedge long-term model portfolio, which you received on Thursday.

Q: Any thoughts about the conclusion of the Twitter deal and how it will affect tech and social media?

A: So far all of the indications are terrible. Advertisers have been canceling left and right, hate speech is up 500%, and Elon Musk personally responded to the Pelosi assassination attempt by trotting out a bunch of conspiracy theories for the sole purpose of raising traffic and not bringing light to the issue. All indications are bad, but I've been with Elon Musk on several startups in the last 25 years and they always look like they’re going bust in the beginning. It’s not even a public stock anymore and it shouldn’t be affecting Tesla (TSLA) prices either, which is still growing 50% a year, but it is.

Q: In terms of food commodities for 2023, where are prices headed?

A: Up. Not only do you have the war in Ukraine boosting wheat, soybean, and sunflower prices, but every year, global warming is going to take an increasing toll on the food supply. I know last summer when it hit 121 degrees in the Central Valley, huge amounts of crops were lost due to heat. They were literally cooked on the vine. We now have a tomato shortage and people can’t make pasta sauce because the tomatoes were all destroyed by the heat. That’s going to become an increasingly common issue in the future as temperatures rise as fast as they have been.

Q: Do I trade options in Alphabet (GOOG) or Alphabet (GOOGL)?

A: The one with the L is the holding company, the one without the L is the advertising company and the stock movements are really identical over the long term, so there really isn’t much differentiation there.

Q: Why can’t inflation be brought down by increasing the supply of all goods?

A: Because the companies won’t make them. The companies these days very carefully manage output to keep prices as high as possible. It’s not only the energy industry that does that but also all industries. So those in the manufacturing sector don’t have an interest in lowering their prices—they want high prices. If they see the prices fall, they will cut back supply.

Q: What do you think about growth plays?

A: As long as interest rates are rising, growth will lag and value will lead, and that has been clear as day for the last month. This is why we have an overwhelming value tilt to our model portfolio and our recent trade alerts. They’ve all been banks—JP Morgan (JPM), Bank of America (BAC), Citigroup (C), plus Berkshire Hathaway (BRK) and Visa (V) and virtually nothing in tech.

Q: I don’t know how to execute spread trades in options so how do I take advantage of your service?

A: Every trade alert we send out has a link to a video that shows you exactly how to do the trade. I have to admit, I’m not as young as I was when I made the videos, but they’re still valid.

Q: Is the US housing market about to crash?

A: There is a shortage of 10 million houses in the US, with the Millennials trying to buy them. If you sell your house now, you may not be able to buy another one without your mortgage going from 2.75% to 7.75%—that tends to dissuade a lot of potential selling. We also have this massive demographic wave of 85 million millennials trying to buy homes from 65 million gen x-ers. That creates a shortage of 20 million right there. That's why rents are going up at a tremendous rate, and that's why house prices have barely fallen despite the highest interest rates in 20 years.

Q: If we get good news from the Fed, should we invest in 3X ETFs such as the ProShares UltraPro QQQ (TQQQ)?

A: No, I never invest in 3X ETFs, because they are structured to screw the investor for the benefit of the issuer. These reset at the close every day, so do 2 Xs and not more. If you're not making enough money on the 2Xs, maybe you should consider another line of business.

Q: Do you think BlackRock Corporate High Yield Fund (HYT) will show the pain of slights because of their green positioning?

A: No I don’t, if anything green investing is going to accelerate as the entire economy goes green. And you’ll notice even the oil companies in their advertising are trying to paint themselves as green. They are really wolves in sheep’s clothing. They’ll never be green, but they’ll pretend to be green to cover up the fact that they just doubled the cost of gasoline.

Q: Where do you find the yield on Blackrock?

A: Just go to Yahoo Finance, type in (BLK), and it will show the yield right there under the product description. That’s recalculated by algorithms constantly, depending on the price.

Q: Do you like Cameco (CCJ)?

A: Yes, for the long term. Nuclear reactors have been given an extra five years of life worldwide thanks to the Russian invasion of Ukraine. Even Japan is opening theirs.

Q: Should I short the US dollar (UUP) here?

A: The answer is definitely maybe. I would look for the dollar to try to take one more run at the highs. If that fails, we could be beginning a 10-year bear market in the dollar, and bull market in the Japanese yen, Australian dollar, British pound, and euro. This could be the next big trade.

Q: What is your outlook on Real Estate Investment Trusts (REITs) now?

A: I think it looks great. REITs are now commonly yielding 10%. The worst-case scenario on interest rates has been priced in—buying a REIT is essentially the same thing as buying a treasury bond, but with twice the leverage, because they have commercial credits and not government credits. We’ll be doing a lot more work on REITS. We also have tons of research on REITS from 12 years ago, the last time interest rates spiked. I'll go in and see who’s still around, and I'll be putting out some research on it.

Q: How do you see the price development of gold (GLD)?

A: Lower—the charts are saying overwhelmingly lower. Gold has no place in a rising interest rate world. At least silver (SLV) has solar panel demand.

Q: Do you have any fear of Korea going into IT?

A: Yes, they will always occupy the low end of mass manufacturing, and you can see that in the cellphone area; Samsung actually sells more phones than Apple, but they’re cheaper phones with lower-end lagging technology, and that’s the way it’s always going to be. They make practically no money on these.

Q: When can we get some more trade alerts?

A: We are dead in the middle of my market timing index, so it says do nothing. I’m looking for either a big move down or big move up to get back into the market. This is a terrible environment to chase trades when you're trading, so I'm going to wait for the market to come to me.

Q: What about water as an investment? The Invesco Water Resources ETF (PHO)?

A: Long term I like it. There’s a chronic shortage of fresh water developing all over the world, and we, by the way, need major upgrades of a lot of water systems in the US, as we saw in Jackson, MS, and Flint, MI.

Q: Will REITs perform as well as buying rental properties over the next 10 to 20 years?

A: Yes, rental properties should do very well, as long as you’re not buying any city that has rent control. I have some rental properties in SF and dealing with rent control is a total nightmare, you’re basically waiting for your tenants to die before you raise the rent. I don’t think they have that in Nevada. But in Las Vegas, you have the other issue that is water. I think the shortage of water will start to drag on real estate prices in Las Vegas.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log on to www.madhedgefundtrader.com go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

It’s Been a Tough Market

Global Market Comments

November 3, 2022

Fiat Lux

Featured Trade:

(LONG TERM PORTFOLIO UPDATE)

(BMY), (AMGN), (CRSP), (LLY), (EEM), (BABA),

(GOOGL), (AAPL), (AMZN), (SQ), (TBT), (JNK), (JPM),

(BAC), (MS), (GS), (FXA), (FXC), (SLV)

“Innovation has not died at the tech companies, but valuation has,” said Mark Lehman, CEO of JPM Securities.

Global Market Comments

November 2, 2022

Fiat Lux

Featured Trade:

(WHY THERE WON’T BE A HOUSING CRASH),

(LEN), (PHM), (KBH)

(WHY SENIORS NEVER CHANGE THEIR PASSWORDS)

Lately, my inbox has been flooded with emails from subscribers asking if the housing market is about to crash as a result of the recent bubble and if they should panic and sell their homes.

They have a lot to protect.

Since prices hit rock bottom in 2011 and foreclosures crested, the national real estate market has risen by 100%.

The hottest markets, like those in Seattle, San Francisco, and Reno, are up by more than 200%, and certain neighborhoods of Oakland, CA have shot up by 500%.

Looking at the recent housing statistics, I can understand their concern. In February, the data were the hottest on record across the board:

* Housing prices are still exploding to the upside with S&P Case Shiller Rising 21%, the one-month biggest spike in history

*Your Check is in the Mail, with the passage of the $1.9 trillion rescue package. A big chunk of this went into housing upgrades

* Goldman Sachs is Forecasting a Jobs Boom, that will take the headline Unemployment Rate down to 3.5% by yearend. Employed people buy houses.

*Workforce at home will double post-pandemic, maintaining demand for large homes. One-third of new stay-at-home workers are never going back.

*We are all now mortgage prisoners, trapped by our 2.75% fixed rate mortgages refied last year. Selling your home and rolling into a 7.5% mortgage isn’t that appealing. Selling so far has been minimal, the markets just shut down.

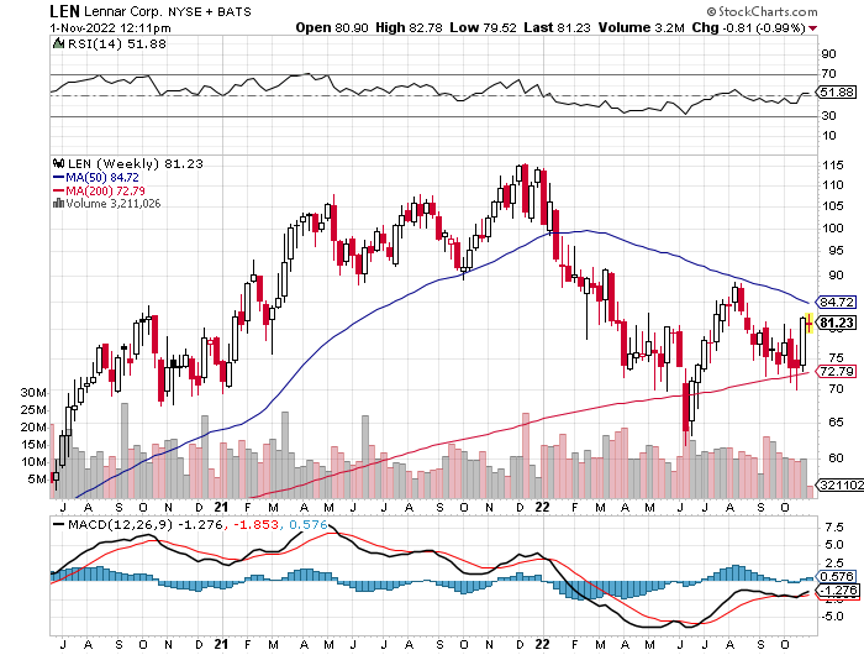

I have a much better indicator of future housing prices than the depressing numbers above. With the way homebuilder stocks like Lennar (LEN), KB Homes (KBH), and Pulte Homes (PHM) are trading since June, I’d say your home will be worth a lot more in a year, and possibly double in another five years. Many of these stocks are up nearly 35% since then, beating the market by far.

What I call “intergenerational arbitrage” will be the principal impetus. The main reason that we have just endured two “lost decades” of economic growth over the last 20 years is that 85 million baby boomers are retiring to be followed by only 65 million “Gen Xers”. When you are losing 20 million consumers, economies don’t grow very fast. For more about millennial investing habits, please click here.

When the majority of the population is in retirement mode, it means that there are fewer buyers of real estate, home appliances, and “RISK ON” assets like equities, and more buyers of assisted living facilities, healthcare, and “RISK OFF” assets like bonds. That’s what got us to a 0.32% yield in the ten-year at the low.

The net result of this is slower economic growth, higher budget deficits, a weak currency, and registered investment advisors who have distilled their practices down to only municipal bond sales.

Fast forward to the other side of the pandemic and the reverse happens. The baby boomers will be out of the economy, worried about whether their diapers get changed on time or if their favorite flavor of Ensure is in stock at the nursing home.

That is when you have 65 million Gen Xers being chased by 85 million of the “Millennial” generation trying to buy their assets!

By then, we will not have built new homes in appreciable numbers for 15 years and a severe scarcity of housing starts. Even before the pandemic, new home construction was taking place at half the 2008 peak. Residential real estate prices will naturally soar. Labor shortages will force wage hikes.

The middle-class standard of living will then reverse a 40-year decline. Annual GDP growth will return from the subdued 2% rate of the past many years to near the torrid 4% seen during the 1990s. It all leads to my “Return of the Roaring Twenties” scenario which you can learn about by clicking here.

It gets better.

It is certain that the current administration will restore tax deductions for state and local real estate taxes (SALT) lost in the 2017 tax bill. The cap on home mortgage interest rate deductions will also rise.

These two events will trigger an immediate 10% increase in the value of your home on an after-tax basis, and more on the coasts.

So, if someone approaches you with a discount offer for your home, I would turn around and run a mile the other way.

You should also pile into the stocks, options, and LEAPS of housing stocks in any future market dip.

Not to Worry

WINDOWS: Please enter your new password.

USER: Cabbage

WINDOWS: Sorry, the password must be more than 8 characters

USER: Boiled cabbage

WINDOWS: Sorry, the password must contain 1 numerical character.

USER: 1 boiled cabbage

WINDOWS: Sorry, the password cannot have blank spaces

USER: 50damnboiledcabbages

WINDOWS: Sorry, the password must contain at least one upper case character

USER: 50DAMNboiledcabbages

WINDOWS: Sorry the password cannot use more than one upper case character consecutively.

USER: ‘50damnBoiledCabbagesShovedUpYourAssIfYouDon'tGiveMeAccessNow!

WINDOWS: Sorry, the password cannot contain punctuation.

USER: ReallyPissedOff50DamnBoiledCabbagesShovedUpYourAssIfYouDontGiveMeAccessNow

WINDOWS: Sorry, that password is already in use.

“The radio elected Hitler, the television elected Kennedy, and Facebook elected Obama and Trump. That’s the way it works with technology,” said Ben Horowitz, founder of the top performing venture capitalist Andreeson Horowitz

Global Market Comments

November 1, 2022

Fiat Lux

Featured Trade:

(LAS VEGAS NOVEMBER 4 GLOBAL STRATEGY LUNCHEON)

(TESTIMONIAL)

Come join me for lunch for the Mad Hedge Fund Trader’s Global Strategy Update, which I will be conducting in Las Vegas, Nevada on Friday, November 4 at 1:00 PM.

A three-course lunch will be followed by an extended question-and-answer period.

I’ll be giving you my up-to-date view on stocks, bonds, foreign currencies, commodities, precious metals, and real estate.

And to keep you in suspense, I’ll be throwing a few surprises out there too. Enough charts, tables, graphs, and statistics will be thrown at you to keep your ears ringing for a week. Tickets are available for $249.

I’ll be arriving early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at a world famous restaurant at a major Strip casino. The exact location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research. To purchase tickets for this luncheon, please click here.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.