Global Market Comments

October 28, 2022

Fiat Lux

Featured Trade:

(QUEEN MARY II SEMINAR AT SEA)

Global Market Comments

October 28, 2022

Fiat Lux

Featured Trade:

(QUEEN MARY II SEMINAR AT SEA)

Global Market Comments

October 27, 2022

Fiat Lux

Featured Trade:

(WHY RIVIAN IS THE NEXT TESLA),

(RIVN), (TSLA)

I had the good fortune to grab a few minutes this week with RJ Scaringe, the founder and CEO of electric truck maker Rivian (RIVN).

Rivian produces three types of EVs: the R1T pickup truck, the R1S SUV, and Amazon's EDV (electric delivery van). Its R1 vehicles start at under $70,000 and can travel more than 300 miles on a single charge. High-end Rivian competitors include Range Rover, Mercedes G Class Gelandewagen, and Tesla Cybertruck. Rivian doesn't manufacture any electric sedans, the focus of other EV competitors.

And here is the key to buying Rivian at this particular time. At 25,000, it is right at the mass production point where Tesla shares went ballistic all those years ago. And it already has an 80% decline in the price in the rearview mirror.

Scaringe has been a car nut his whole life, spending his youth restoring vintage classics in his garage. He is no lightweight. He earned a bachelor’s degree from the famed Rensselaer Polytechnic in upstate New York, and a PhD from MIT in Mechanical Engineering.

Today, he is a billionaire in his own right. It’s nice to know that Rivian has a backup plan. Rivian now has 14,000 employees and boasts a market capitalization of $30.4 billion. Sure, that is down from a peak value of $176 billion in 2020. But that is where the big money is made, buying Cadillacs at Volkswagen prices.

Of course, Rivian’s will be compared with the Tesla (TSLA) Model X, which lacks the ground clearance and towing power of a Rivian. Perhaps a better comparison will be made against the Tesla Cybertruck, due out in 2023.

In 2024, Rivian plans to open its second plant in Georgia. After it fully expands its Illinois plant, it expects its annual production capacity to reach 600,000 vehicles -- but it hasn't set a firm deadline for reaching that milestone yet. Rivian expects to produce 25,000 vehicles in 2022 and has already added a second shift. The company came in with a strong performance, with 4,400 units manufactured in Q2 ending in July.

To say that Rivian is the hot car of the day would be a vast understatement. New cars are trading for double list on the grey market. Owners complain of getting mobbed with gawkers whenever they hit the beach or the ski slopes. The buzz has led to an outstanding order book of an impressive 98,000, or four years of current production. The obvious cool factor allows enormous pricing power.

Rivian just completed deployments of its 600 horsepower, four-wheel drive R1 vehicle across the country to gain operational feedback.

Inflation Reduction Act passed this summer greatly accelerated rollout of the entire EV industry, which created a $7,500 per vehicle tax credit on top of state benefits. Rivian is expanding charging network to accommodate greater traffic.

Looking at the earnings report shows this company is still at the venture capital level. It posted $364 million Q2 revenues but lost $704 million. High material costs, supply chain problems, and $304 million in write-downs on accounting changes added to operating woes. That brought a $1.3 billion total Q2 loss. There should be a $5.45 billion loss for all of 2022.

Scaringe remains optimistic. Rivian has $15 billion in cash to complete its buildout. He sees a clear path to 25% gross profit margin, EBITDA in the high teens, and a 10% free cash flow.

Building four vehicles on two assembly lines is costing it money. As sales ramp up, dedicated model assembly lines become more cost-efficient. Supply chain problems with semiconductors, as with the rest of the EV industry, are inevitable.

Data collection could eventually make the company more valuable than truck manufacturing alone, as is the case with Tesla. Rivians are hard to buy because Amazon (AMZN), a 25% owner of the company, gets first dibs on deliveries.

Yes, this company offers venture capital-type risks. But it offers venture capital type returns as well, up 10X-50X from here.

Global Market Comments

October 26, 2022

Fiat Lux

Featured Trade:

(FRIDAY, OCTOBER 28, 2022 INCLINE VILLAGE, NEVADA STRATEGY LUNCHEON)

Come join me for lunch at the Mad Hedge Fund Trader’s Global Strategy Update, which I will be conducting in Incline Village, Nevada on Friday, October 28. An excellent meal will be followed by a wide-ranging discussion and an extended question-and-answer period.

I’ll be giving you my up-to-date view on stocks, bonds, currencies, commodities, precious metals, and real estate. And to keep you in suspense, I’ll be throwing a few surprises out there too. Tickets are available for $249.

I’ll be arriving early and leaving late in case anyone wants to have a one-on-one discussion, or just sit around and chew the fat about the financial markets.

The lunch will be held at the premier restaurant in Incline Village, Nevada on the sparkling shores of Lake Tahoe. Those who live there already know what it is. The precise location will be emailed with your purchase confirmation.

I look forward to meeting you and thank you for supporting my research.

To purchase tickets for the luncheons, please click here.

Global Market Comments

October 25, 2022

Fiat Lux

Featured Trade:

(FRIDAY, NOVEMBER 4, 2002 LAS VEGAS, NEVADA GLOBAL STRATEGY LUNCHEON)

Global Market Comments

October 24, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or MY SECRET MARKET INDICATOR),

(SPY), (USO), (TSLA), (TBT), (NFLX), (FXY), (SNAP)

I have access to inside information that is worth far more than any other technical or fundamental data out there.

It is almost always right and has made fortunes for me over the year, the dreams of avarice.

If the SEC knew about it, they would lock me up and throw away the key.

Here it is. But first, let me tell you about the performance it has delivered.

With some of the greatest market volatility in market history, my October month-to-date performance ballooned to +6.55%.

I used last week’s option expiration to take profits on my longs in JP Morgan (JPM), Visa (V), and Tesla (TSLA), and my one short in the S&P 500 (SPY). That leaves me with only one short in the (SPY) and 90% cash.

My 2022 year-to-date performance ballooned to +76.23%, a new high. The Dow Average is down -14.37% so far in 2022.

It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high +76.50%.

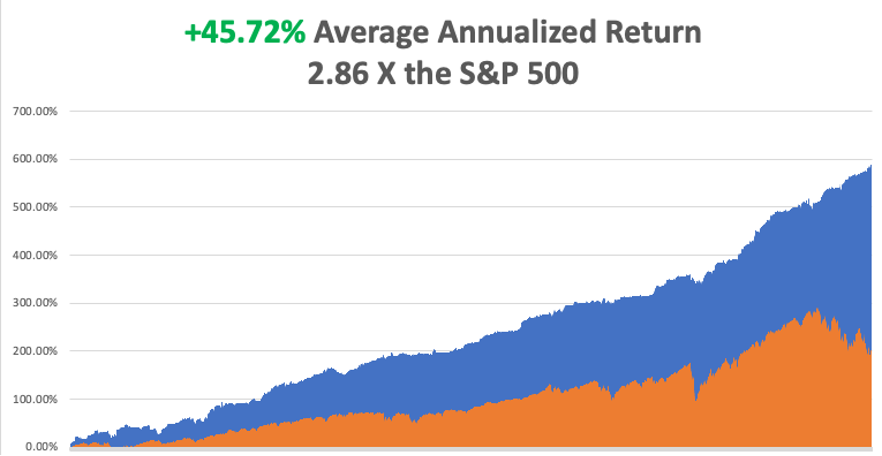

That brings my 14-year total return to +586.79%, some 2.86 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to +45.72%, easily the highest in the industry.

So here is my unfair advantage:

I get to see what my own customers do, and I’m the only one who sees it.

For my own subscribers are among the most highly trained and disciplined in the market. 50% a year profits are common and every year, I learn of a couple of 1,000% profits (or 10X returns).

And here is what my customers are telling me today.

The end of the bear market is near. In fact, a “Big Turn” across all asset classes may be upon us.

Bonds are about to bottom out and yields peak. The US dollar may be double-topping. Commodities are crawling off a bottom. Price earnings multiples for stocked have just cratered from 21X to a decade low of 16X. Many stocks, like Tesla are trading at the lowest multiples in their lives.

Thus, the demand for LEAPS recommendations that offer tenfold two-year returns on far more modest equity appreciation has been skyrocketing.

I can’t blame them.

A final capitulation in the bond market is fast approaching. The United States Treasury Bond Fund (TLT) has collapsed by $88, from $180 to $92, or some 48.89%, covering the last six points in two days.

Ten-year yields have rocketed from 2.55% to 4.43% since August. The 2X short bond ETF (TBT) has spiked from $14 to $39 in a year. If you don’t cover the bond market on a daily basis, you may not know this.

It just so happens that I do.

It's an old investment nostrum that if you want to know what stocks are going to do, then take a close look at the bond market.

As Winston Churchill once said, “This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

If you believe that the last interest rate hike in this cycle is only two months off, and we see interest rate cuts after that, then you need to be buying stocks now. You may be risking 10% of downside if you do, but miss out on 100% of upside if you don’t.

Here's another market old reliable. Markets always move more than you expect.

These may all sound like bold predictions. But then my followers are coming off of the best year for trading and investment in their entire lives. Confidence begets confidence.

If you are searching for global contagion, you don’t have far to look. The Japanese yen has cratered some 24% this year and is down by half from its last peak. That’s because the Bank of Japan, one of my old haunts, remains stubbornly insistent that ten-year JBG yields remain pegged at 0.25% while the US was raising from 0.25% to 4.43%.

You have to wonder what they are smoking in the Land of the Rising Sun. Their goal was to create a massive export boom with an ultra-cheap currency and runaway inflation with all the money printing. So far it hasn’t happened. GDP growth in Japan is stuck at snail-like 1.7%, while inflation remains a lowly 3.00%.

Go to Japan for the sushi, the public baths, and the Kurosawa samurai movies, not for inspiration on economic policy, which has been a disaster for 45 years. It’s tough to prosper against a gail-force demographic headwind.

Foreign exchange markets are easy to trade. You just follow the money and pile into the currency with the best yield advantage. Right now, that happens to be the US dollar (UUP).

Why wasn’t I selling short the Japanese yen (FXY) earlier this year? Because there were far better opportunities selling short US stocks, which I amply took advantage of.

It’s all in my numbers.

UK Government Collapses, with the resignation of prime minister Liz Truss in the shortest government in history. A new conservative leader will be elected next week. Truss took over a sinking ship. Her promised tax cuts delivered a fall in the British pound to a 40-year low. No matter what any future leader does, the UK standard will drop by half in the coming years, thanks to Brexit. THE HEAD OF LETTUCE WON!

30-Year Fixed Rate Mortgage Hits an Eye-popping 7.4%, in a clear Fed effort to shut down the real estate market. If this doesn’t kill the economy, nothing will. But home prices are nowhere near to 50%-70% declines seen in 20098-2011.

Existing Home Sales Plunge 23.8% YOY, in September, in the eighth straight month of sales declines. There are 1.2 million homes for sale, a six-month supply. The median home prices rose to $384,800.

Housing Starts Hit Two-Year Low, as the luxury end takes a hit. Starting families can no longer buy more houses than they can afford.

US Budget Deficit Drops by Half, after the sharpest decline in government spending in history. The red ink shrank from $2.78 trillion to only $1.38 trillion. It’s why I think the bond market may soon be bottoming out, with the (TLT) at $92 and the (TBT) at $38. A trillion here, a trillion there, and sooner or later, it adds up to a lot of money.

Ten-Year US Treasury Yields Hit 20-Year High, at 4.43%. If you’re waiting for rates to peak before buying stocks, it’s not yet. I’m looking for 4.50% before the crying is all over.

Fed Beige Book Says the Economy is Growing Modestly, an improvement from the last one. Travel & tourism is booming, auto sales are sluggish, and retail spending is flat. Manufacturing is steady, thanks to easing supply chain problems. High mortgage rates are a problem. Labor is still tight. It’s a very mixed report.

Tesla Earnings Beat Estimates for the 13th consecutive quarter profitability, taking the shares down 5%. Revenues came in at 24 billion, while units sold hot 340,000. The strong dollar is weakening Chinese and European sales. Tesla is still a decade ahead of the competition and boasts a global footprint. Production could hit 450,000-500,000 in Q4 once Austin and Berlin go to full production. The only competition will come from China. The Cybertruck comes out in 2023 and already has a million orders.

Netflix Earnings Blow Out, taking the stock up 15%, after a massive crackdown on password sharing. Some 30 million views are still watching the streaming channel for free. Some 2.41 new subscribers joined in Q3. The shift to advertising is next. Buy (NFLX) on dips.

SNAP Dives by 25%, thanks to a horrific earnings shortfall. Advertising Demand went from overwhelming to non-existent practically overnight. Small-cap growth is still being punished severely for any disappointments. The company is cutting 20% of its staff. Avoid (SNAP).

Supply Chain Problems are Disappearing, as two years of port congestion ease. A slowing economy is helping. After a year, I finally got my sofa from Vietnam. Overorders are coming back to haunt big retailers.

My Ten-Year View

When we come out the other side of the recession, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With the economy decarbonizing and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The America coming out the other side will be far more efficient and profitable than the old. Dow 240,000 here we come!

On Monday, October 24 at 8:30 AM, the S&P Global Flash PMI for September is released.

On Tuesday, October 25 at 7:00 AM, the S & P Case Shiller National Home Price Index for July is out.

On Wednesday, October 26 at 8:30 AM, New Home Sales for September are published.

On Thursday, October 27 at 8:30 AM, Weekly Jobless Claims are announced. US Q3 GDP is also announced.

On Friday, October 28 at 8:30 AM US Personal Income & Spending is printed. At 2:00 the Baker Hughes Oil Rig Count is out.

As for me, back in 2002, I flew to Iceland to do some research on the country’s national DNA sequencing program called deCode, which analyzed the genetic material of everyone in that tiny nation of 250,000. It was the boldest project yet in the field and had already led to several breakthrough discoveries.

Let me start by telling you the downside of visiting Iceland. In the country that has produced three Miss Universes over the last 50 years, suddenly you are the ugliest guy in the country. Because guess what? The men are beautiful as well, the decedents of Vikings who became stranded here after they cut down all the forests on the island for firewood, leaving nothing with which to build long boats. I said they were beautiful, not smart.

Still, just looking is free and highly rewarding.

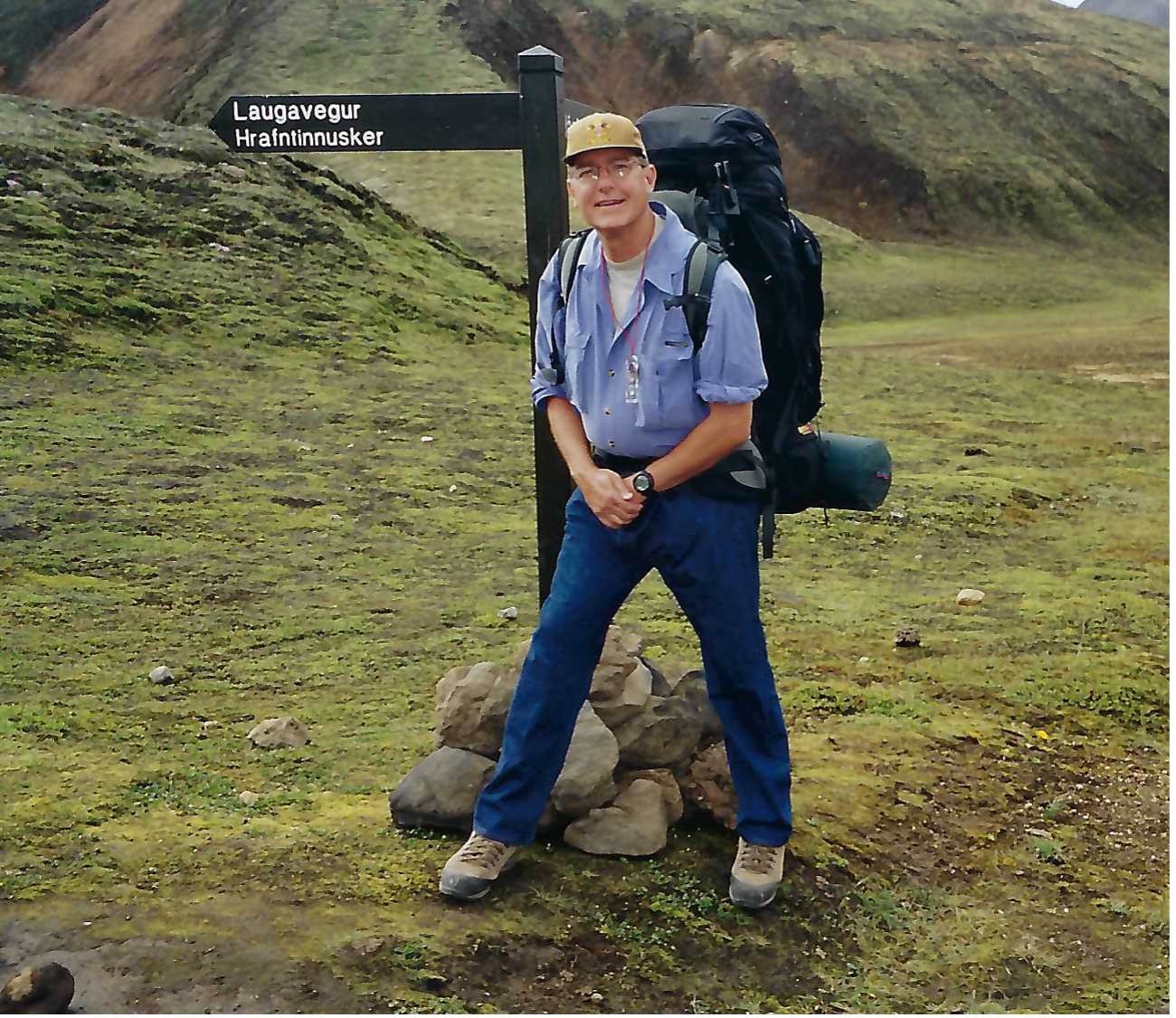

While I was there, I thought it would be fun to trek across Iceland from North to South in the spirit of Shackleton, Scott, and Amundsen. I went alone because after all, how many people do you know who want to trek across Iceland? Besides, it was only 150 miles, or ten days to cross. A piece of cake really.

Near the trailhead, the scenery could have been a scene from Lord of the Rings, with undulating green hills, craggy rock formations, and miniature Icelandic ponies galloping in herds. It was nature in its most raw and pristine form. It was all breathtaking.

Most of the central part of Iceland is covered by a gigantic glacier over which a rough trail is marked by stakes planted in the snow every hundred meters. The problem arises when fog or blizzards set in, obscuring the next stake, making it too easy to get lost. Then you risk walking into a fumarole, a vent from the volcano under the ice always covered by boiling water. About ten people a year die this way.

My strategy in avoiding this cruel fate was very simple. Walk 50 meters. If I could see the next stake, I proceeded. If I couldn’t, I pitched my tent and waited until the storm passed.

It worked.

Every 10 kilometers stood a stone rescue hut with a propane stove for adventurers caught out in storms. I thought they were for wimps but always camped nearby for the company.

One of the challenges in trekking near the north Pole is getting to sleep. That because the sun never sets and its daylight all night long. The problem was easily solved with the blind fold that came with my Icelandic Air first class seat.

I was 100 miles into my trek, approached my hut for the night and opened the door to say hello to my new friends.

What I saw horrified me.

Inside was an entire German Girl Scout Troop spread out in their sleeping bags all with a particularly virulent case of the flu. In the middle was a girl lying on the floor soaking wet and shivering, who had fallen into a glacier-fed river. She was clearly dying of hypothermia.

I was pissed and instantly went into Marine Corp Captain mode, barking out orders left and right. Fortunately, my German was still pretty good then, so I instructed every girl to get out of their sleeping bags and pile them on top of the freezing scout. I then told them to strip the girl of her wet clothes and reclothe her with dry replacements. They could have their bags back when she got warm. The great thing about Germans is that they are really good at following orders.

Next, I turned the stove burners up high to generate some heat. Then I rifled through backpacks and cooked up what food I could find, force-fed it into the scouts, and emptied my bottle of aspirin. For the adult leader, a woman in her thirties who was practically unconscious, I parted with my emergency supply of Jack Daniels.

By the next morning, the frozen girl was warm, the rest were recovering, and the leader was conscious. They thanked me profusely. I told them I was an American “Adler Scout” (Eagle Scout) and was just doing my job.

One of the girls cautiously moved forward and presented me with a small doll dressed in a traditional German Dirndl which she said was her good luck charm. Since I was her good luck, I should have it. It was the girl who was freezing to death the day before.

Some 20 years later, I look back fondly on that trip and would love to do it again.

Anyone want to go to Iceland?

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

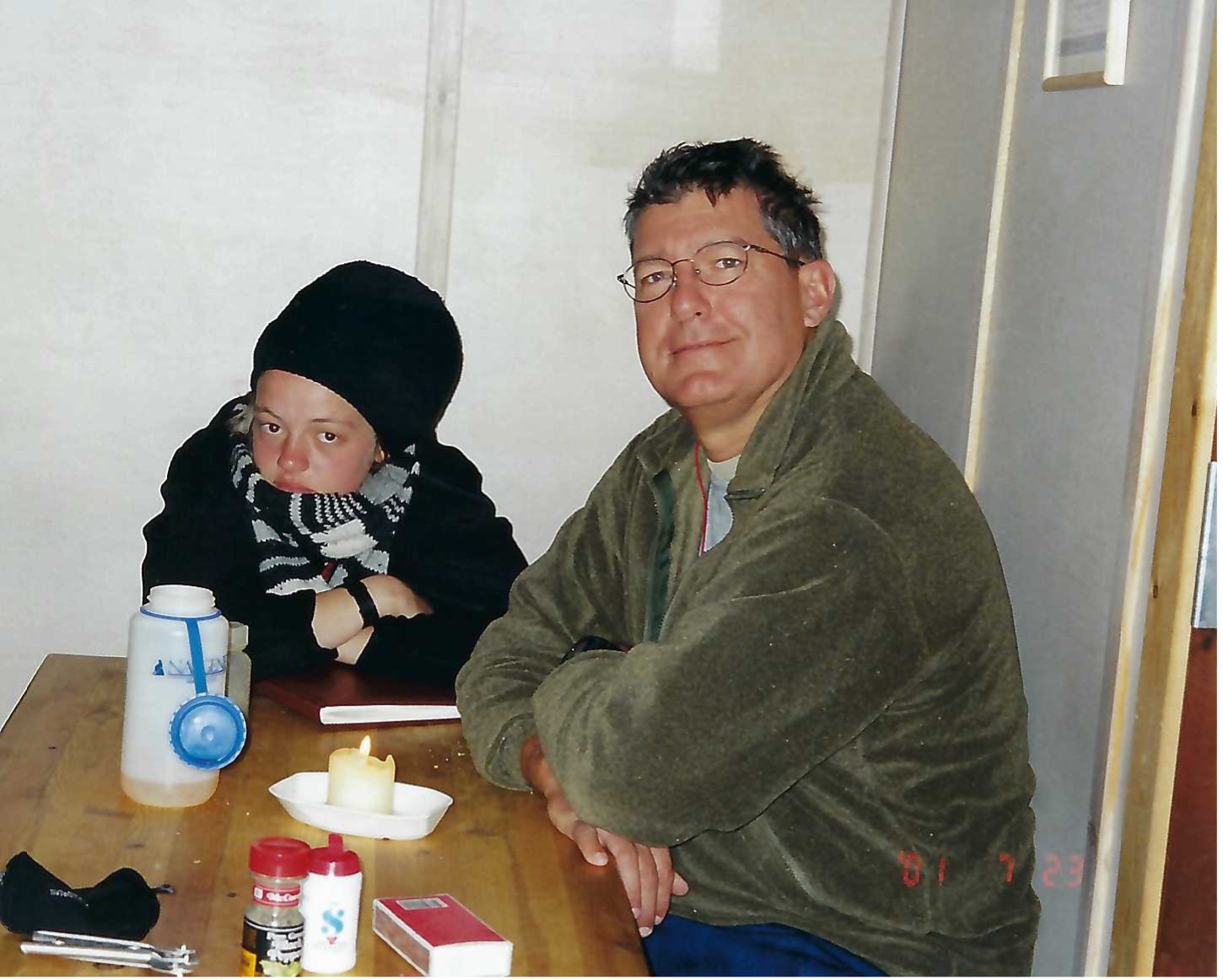

Iceland 2001 with German Girl Scout

If a cluttered desk is a sign of a cluttered mind, what is an empty desk a sign of?” asked Albert Einstein.

Global Market Comments

October 21, 2022

Fiat Lux

Featured Trade:

(OCTOBER 19 BIWEEKLY STRATEGY WEBINAR Q&A),

(BAC), (USO), (SPY), (TSLA), (NFLX), (TBT), (PLTR), (SNOW)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.