Global Market Comments

June 6, 2022

Fiat Lux

Featured Trade:

(THE MAD HEDGE TRADERS & INVESTORS SUMMIT IS ON FOR JUNE 14-16)

(MARKET OUTLOOK FOR THE WEEK AHEAD, or PUTIN’S DEAD END),

(VIX), (HYG), (JNK), (PTON), (W), (MSTR), (RDFN), (BYND), (F), (TSLA), (NVDA)

The current consensus for market strategists is that volatility will remain high.

Please pinch me because I think I died and went to heaven. For every time the Volatility Index (VIX) tops $30, I make another 10%-15% for my followers.

The bulk of market players are now obsessing whether we are entering a recession or not, as if their investment faith depended on it.

Recession, resmession.

As long as I can keep making a 65.40% trailing one-year return, while the Dow Average is off -4.2% during the same time period, I could care less what the economy is actually going to do.

After an impressive 380-point, 10% rally in the S&P 500, it now looks like the stock market is failing once again. Best case, we revisit this year’s low at 3,800. Worst case, we break to new lows at 3,600. The very worst case, we break below 3,500 and wish you had never heard of the stock market.

If you are a trader, there is a fantastic opportunity here to buy low, sell high, and retire early. If you are disciplined, you still have a ton of cash left over from the end of 2021 (I was 100% cash) and will be cherry-picking on the big down days.

It's really very simple. The longer you have been doing this, the easier it gets and the more money you will make. After 52 years of practice, I can do this in my sleep.

As the bear market worsens, we are seeing old asset classes return from the dead like the revived dinosaurs of Jurassic Park. Call convertible bonds are the velociraptors of the bunch.

Take the main junk bond ETF like the iShares iBoxx High Yield Corporate Bond Fund (HYG) and the SPDR Barclays High Yield Bond Fund (JNK), which have seen yields double from 3% to over 6% in only six months.

If you are willing to take on more risk, individual busted convertible bonds yield infinitely more. You know all the names. Peloton (PTON) converts are paying a 10.4% yield to maturity, Wayfair (W) 11.0%, MicroStrategy (MSTR) 13.1%, Redfin (RDFN) 14.5%, and Beyond Meat (BYND) 19.5%. Buy ten of these and even if one goes under, you still earn a decent double-digit return.

Having run a convertible bond trading desk for ten years, I can tell you that the risk/reward balance for many individuals with this investment class is just right.

As my summer military duty approaches, information about the Ukraine War is pouring into me. I will share with you what I can, what has been declassified for the war is still a major factor in your investment outcomes. I have been able to use my “top secret” status for 50 years,= to your benefit.

The amazing thing is that in this modern age, information goes from “top secret” to declassified in only a day. It is a new strategy used by the current administration that is working incredibly well. Information is more valuable shared than locked up.

I have been getting a lot of questions from readers as to why Vladimir Putin committed such a disastrous error by invading Ukraine as he is considered a smart guy. My initial response was that he surrounded himself with “yes” men who only told him what he wanted to hear, leading to terrible outcomes, which I have seen happen many times.

The costs of the war for Putin have so far been enormous; 50,000 casualties, 1,000 tanks, 1,300 armored vehicles, banishment from the western economy, the loss of $1 trillion in foreign held assets, and the decline of the national GDP from $1.5 trillion to $1 trillion.

The costs are about to substantially rise. The US is now sending over its most advanced artillery systems, the MRLS, or Multiple Rocket Launch System, which can hit any target within 300 miles with an accuracy of one meter. All you have to do is dial in the latitude and longitude of the target and it never misses. This one weapon will certainly bring the war to a stalemate and consign it to page three of the newspapers.

But after doing a ton more research, my view has evolved. Putin has in fact launched a Resource War against the entire rest of the world. The result has been to boost the price of practically everything Russia produces, including oil ($123 billion), refined petroleum products ($63 billion), iron & steel ($28 billion), coal ($17 billion), fertilizer ($13 billion), wood ($12 billion), wheat ($9 billion), aluminium ($8 billion), platinum, palladium, uranium.

There is also the inflation angle. While the US benefits from many of these high prices as well, they have raised the US inflation rate from 5% to 8.3%. That damages the election prospects of Biden and the Democrats. High inflation improves the election of prospects of a former president who Putin seems to vastly prefer for whatever reason.

After covering Russia for 50 years, flying their front-line fighters, springing a wife out of jail in Moscow, I can tell you that everything there is a chess game, and they play a very long game.

Nonfarm Payroll Report comes in at 390,000, better than expected. Leisure & Hospitality led the gains with 84,000, and Professional & Business Services by 75,000. Manufacturing fell to only 18,000, largely because of a shortage of workers. The Headline Unemployment Rate remained the same at 3.6%. Average hourly earnings rose by an inflationary 5.2% YOY. The U6 “discouraged worker” rate rose back to 7.1%.

Weekly Jobless Claims jump 19,000 to 200,000, a two-month high, according to the Department of Labor. Compensation for American workers has hit a 30-year high. New York showed the largest increase followed by Illinois.

OPEC+ raises oil output to meet surging energy demand caused by the Ukraine War. Up 648,000 barrels a month for July and August. They could easily do a lot more. The cartel is aiming for the pre-pandemic 10 million barrels a day. No dent in prices at the pump yet.

Hedge Funds were slaughtered in May, with the flagship Tiger Global Fund down a massive 14%. Gee, Mad Hedge Fund Trader was UP 11% in May and am up 44% on the year. Maybe there’s something in the water here at Lake Tahoe. Or, maybe it’s the “Mad” that is giving me my edge?

S&P Case Shiller National Home Price Index tops 20.6%, a new all-time high. Tampa (34.8%), Miami (32.4%), and Phoenix (32.0%) lead the gains. Incredible as it may seem, price rises are accelerating. But expect that to cool off once current prices start feeding into the index.

Home Listings soar, with homes for sale up 9% YOY as homeowners fear missing getting out at the top. New listings have doubled in a year, according to Redfin. Outrageous over-market bids have definitely ended in California. So far, no hint of price drops….yet.

A Ford (F) Electric Pickup can power your house for ten days, but only if you live in a tiny house. Ford is the first company to introduce bidirectional charging that lets your home run off the vehicle’s 1,300-pound lithium-ion battery. All you need is a $3,895 hardware upgrade from Sunrun. The range is 320 miles, not as much as the latest Tesla Model X (TSLA). Good luck getting one. Ford isn’t taking any new orders until it fills the 200,000 it already has. Expect Tesla to copy the move.

The Fed may overshoot on raising interest rates if Fed governor Christopher Waller has his way. That’s because going too tight may be necessary to break the back of inflation. That’s what happened in 1980, when Fed Funds hit 17%, and ten-year bond yields hit 15.84%. My first home mortgage interest rate for a coop in Manhattan back then was 17%.

China Covid Cases fade, prompting a big Bitcoin rally. This could be the impetus for a sudden global economic recovery that will deliver a big US stock market rally. Good thing I loaded the boat with tech stocks two weeks ago.

The Fed Minutes were not so horrible, downplaying the risk of a full 1% rate rise, triggering a 1,000-point rally in the Dow. With five up days in a row this is starting to look like THE bottom. Is this the light at the end of the tunnel?

NVIDIA (NVDA) rips, surprising to the upside on almost every front, sending the stock up $30, or 18.75%. Mad Hedge followers bought (NVDA) last week. This is one of the best run companies in the world. I expect the shares to rise from the current $178.51 to $1,000 in five years. Buy (NVDA) on dips.

Q1 GDP dives 1.5%, in its final read. It’s the worst quarter since the pandemic began during Q2 2022. Weekly Jobless Claims dropped 8,000 to 210,000.

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyperaccelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

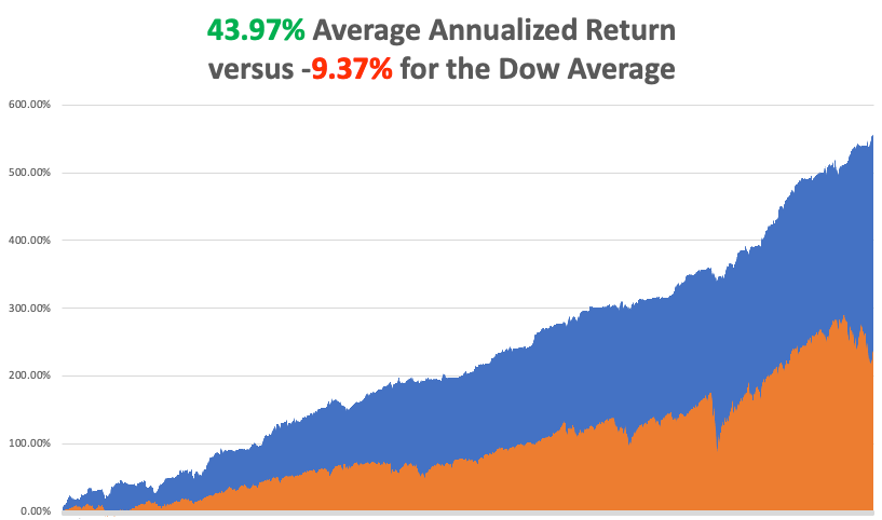

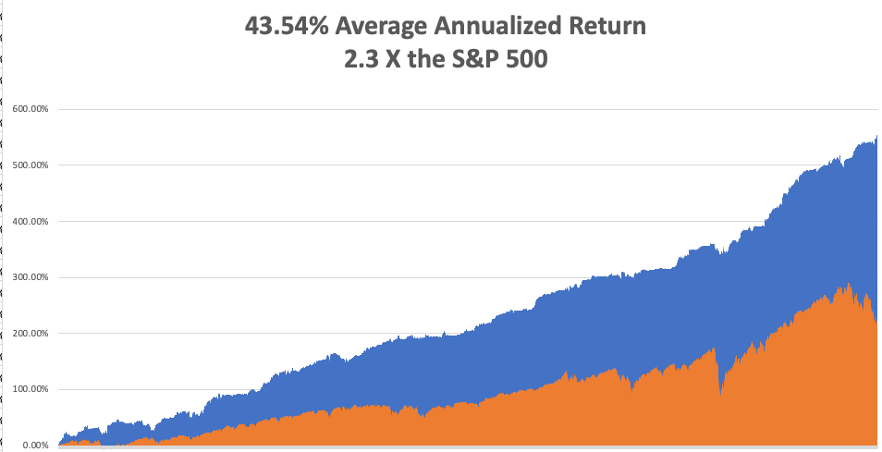

With some of the greatest market volatility seen since 1987, my June month-to-date performance recovered to +2.49%.

My 2022 year-to-date performance exploded to 44.36%, a new all-time high. The Dow Average is down -9.37% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky high 65.40%.

That brings my 14-year total return to 556.92%, some 2.37 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 43.97%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 84.7 million, up 300,000 in a week and deaths topping 1,000,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, June 6 is the 78th anniversary of the D-Day invasion of Normandy. All of the veterans I knew have long since passed. I’ll miss the memorial this year.

On Tuesday, June 7 at 8:30 AM, the US Balance of Trade for April is released.

On Wednesday, June 8 at 10:30 AM, US Crude Inventories are published.

On Thursday, June 9 at 8:30 AM, Weekly Jobless Claims are out.

On Friday, June 10 at 8:30 AM, the blockbuster US Core Inflation Rate is announced. More importantly, the new dinosaur movie, Jurassic World: Dominion, is released. At 2:00 the Baker Hughes Oil Rig Count are out.

As for me, this is not my first Russian invasion.

Early in the morning of August 20, 1968, I was dead asleep at my budget hotel off of Prague’s Wenceslas Square when I was suddenly awoken by a burst of machine gun fire. I looked out the window and found the square filled with T-54 Russian tanks, trucks, and troops.

The Soviet Union was not happy with the liberal, pro-western leaning of the Alexander Dubcek government so they invaded Czechoslovakia with 500,000 troops and overthrew the government.

I ran downstairs and joined a protest demonstration that was rapidly forming in front of Radio Prague trying to prevent the Russians from seizing the national broadcast radio station. At one point, I was interviewed by a reporter from the BBC carrying this hulking great tape recorder over his shoulder, as I was the only one who spoke English.

It seemed wise to hightail it out of the country, post haste, as it was just a matter of time before I would be arrested. The US ambassador to Czechoslovakia, Shirley Temple Black (yes, THE Shirley Temple), organized a train to get all of the Americans out of the country.

I heard about it too late and missed the train.

All borders with the west were closed and domestic trains shut down, so the only way to get out of the country was to hitch hike to Hungary where the border was still open.

This proved amazingly easy as I placed a small American flag on my backpack. I was in Bratislava just across the Danube from Austria in no time. I figured worst case, I could always swim it, as I had earned both, the Boy Scout Swimming, and Lifesaving merit badges.

Then I was picked up by a guy driving a 1949 Plymouth who loved Americans because he had a brother living in New York City. He insisted on taking me out to dinner. As we dined, he introduced me to an old Czech custom, drinking an entire bottle of vodka before an important event, like crossing an international border.

Being 16 years old, I was not used to this amount of high-octane 40 proof rocket fuel and I was shortly drunk out of my mind. After that, my memory is somewhat hazy.

My driver, also wildly drunk, raced up to the border and screeched to a halt. I staggered through Czech passport control which duly stamped my passport. I then lurched another 50 yards to Hungary, which amazingly let me in. Apparently, there is no restriction on entering the country drunk out of your mind. Such is Eastern Europe.

I walked another 100 yards into Hungary and started to feel woozy. So, I stumbled into a wheat field and passed out.

Sometime in the middle of the night, I felt someone kicking me. Two Hungarian border guards had discovered me. They demanded my documents. I said I had no idea what they were talking about. Finally, after their third demand, they loaded their machine guns, pointed them at my forehead, and demanded my documents for the third time.

I said, “Oh, you want my documents!”

I produced my passport, When they got to the page that showed my age they both started laughing.

They picked me and my backpack up and dragged me back to the road. While crossing some railroad tracks, they dropped me, and my knee hit a rail. But since I was numb, I didn’t feel a thing.

When we got to the road, I saw an endless stream of Russian army trucks pouring into Czechoslovakia. They flagged down one of them. I was grabbed by two Russian soldiers and hauled into the truck with my pack thrown on top of me. The truck made a U-turn and drove back into Hungary.

I contemplated my surroundings. There were 16 Russian Army soldiers in full battle dress holding AK-47s between their legs and two German Shepherds all looking at me quizzically. Then I suddenly felt the urge to throw up. As I assessed that this was a life and death situation, I made every effort to restrain myself.

We drove five miles into the country and then stopped at a small church. They carried me out of the truck and dumped me and my pack behind the building. Then they drove off.

The next morning, I woke up with the worst headache of my life. My knee bled throughout the night and hurt like hell. I still have the scar. Even so, in my enfeebled condition, I realized that I had just had one close call.

I hitch-hiked on to Budapest, then to Romania, where I heard that the beaches were filled with beautiful women. My Italian let me get by passably in the local language.

It all turned out to be true.

Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

One More Off to College

If You Don’t Like the Price, Don’t Use it

"If we live in a period of uncertainty long enough, it becomes the norm," said Drew Matus, an economist at UBS.

Global Market Comments

June 3, 2022

Fiat Lux

Featured Trade:

(JUNE 1 BIWEEKLY STRATEGY WEBINAR Q&A),

(AAPL), (GOOGL), (MSFT), (JPM), (BAC), (C), (UUP), (FXA), (FXC), (EEM),

(VIX), (CRM), (AAPL), (TSLA), (COIN), (EDIT), (CRSP), (LMT), (RTX), (GD)

Below please find subscribers’ Q&A for the June 1 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Silicon Valley.

Q: What are the 3 best stocks to own for the end of the year?

A: Apple (AAPL), Alphabet Inc. (GOOGL), and Microsoft (MSFT). Those you want to buy on meltdown days, kind of like today. Make sure you scale into these—so maybe buy 20% on every down-500-point Dow day. Eventually, you’ll end up with a pretty decent position at a market low in a stock that will double in 3-5 years.

Q: Why these three stocks?

A: Lots of reasons: They’re huge, they’re safe, two out of three pay dividends, Alphabet is about to split, and they have huge moats so nobody can get into their sectors. They have near monopolies in what they do, and they have immense cash on the balance sheet. These are the kind of stocks that portfolio managers dream about. And watch what rallied the hardest in the last dead cat bounce we had—it was these three names. That tells you that they will lead any long-term bull market in the future. These are the stocks that people want to own.

Q: What will bring your predicted second half-bull market in the stock market?

A: Inflation drops from 8% to 4%. That will happen for a couple of reasons. The year-on-year comparisons become highly favorable starting from next month when inflation started to take off a year ago. Inflation numbers are going to be climbing the wall of worry from here on out. That could get us down to 4% by the end of the year. The second reason is the Ukraine War either ends or becomes a stalemate and is no longer a factor in the global markets, and we’ve had time to replace all the Russian oil and Ukrainian wheat.

Q: Are banks positioned to benefit from the coming rally?

A: Absolutely. I think big tech and banks will be the top-performing stock sectors for the next five years because inflation will go away, recession fears will go expire, and credit quality will improve, but interest rates will remain 300 basis points higher than they were during the pandemic. Buy (JPM), (BAC), and (C) on dips.

Q: What will be the worst performing sector?

A: Energy—anything energy-related will get absolutely slaughtered, which is why I don't want to touch it with a ten-foot pole right now. That includes oil companies, exploration companies, E&P companies, and master limited partnerships, as well as coal and other natural gas stocks. So, if you’re long these names don’t forget to sit down when the music stops playing. You could get your head handed to you at the end.

Q: Can we make lower lows?

A: Yes, that’s entirely possible. Market moves are basically random when you get down to these levels— down more than 20%. And on all future downturns, I would be spending your cash going back into the market expecting a second half rally.

Q: What about green energy?

A: Unfortunately, green energy is very tied to old energy because $120 oil makes green companies much more competitive from a cost point of view. So, I’m not going to go piling into green companies right here, especially if I think oil is topping out in the near future. Buying green energy companies here is the same as buying oil at $120 a barrel.

Q: What is the best way to play the declining US dollar?

A: Buy the iShares MSCI Emerging Markets ETF (EEM). Also, the Aussie dollar (FXA) and the Canadian Dollar (FXC), which benefit tremendously from commodity prices, which will rise for another decade in a global economic recovery.

Q: Why will energy be the worst sector?

A: If you end the war in the Ukraine or you replace Russian oil, either by finding new sources of oil, getting other producers to increase production which they can do (including the US), or by accelerating the move to alternatives, then you move oil back to pre-invasion prices which were about $70 a barrel or $50 lower than they are here.

Q: Best way to hedge a falling market?

A: Do what I'm doing: keep a balanced portfolio of longs and shorts, that way you always have something that’s going up. And if you do it through the options, you have time decay working for you on both sides of the equation. If you want to go outright, buy outright puts on individual stocks because they had double the moves of the indexes. And go to my short selling school which you can find by going to my website at https://www.madhedgefundtrader.com. There’s actually 12 different ways to benefit from falling markets.

Q: How deep in the money can we go on our call spreads?

A: Wait for the Volatility Index (VIX) to go over $30, and then go 15-20% in the money. And yes, you only make 10, 15, or 20% on those positions in a month but then you put together ten of them and that adds up to quite a lot of money. You want to find the position that has the greatest probability of happening—i.e. something that’s 20% in the money. Do that when the market has just dropped 20%, which it already has, and then you have a position that has a minuscule chance of losing money.

Q: How much longer do you see this current bear market bounce lasting?

A: Until yesterday.

Q: What's your favorite commodity ETF?

A: My favorite commodity stock is Freeport McMoRan (FCX), the world’s largest copper producer. Rather than pay the extra management fees for an ETF, I prefer just to go straight to the source and buy (FCX).

Q: When do you think the Fed will pivot to dovish or neutral?

A: This summer. It’s just a question of whether it’s the July or the September meeting.

Q: When you say “buy on dips”, what does that mean? 1%, 3%, 5%?

A: Well in this market, a dip would be a retest of the previous lows which is going to be down 10% or 15% on the major positions in your portfolio. If you’re day trading, a dip is only 1%, so it really depends on your timeframe and your risk tolerance. That’s why I always tell people to scale by doing everything in incremental pieces—20%, 25%, and so on. You never know what the market’s actually going to do on a short-term basis. Randomness can’t be predicted.

Q: If you plan to enter a LEAPS on Apple, what strikes would you do?

A: Well, first of all, I want to see if Apple drops all the way to $125, which is a lot of people’s downside target. If it did, then I would do the $125/$135 call spread two years out, and that will probably double. And if it starts a long term up trend, then I’ll keep rolling up the strike prices. If, say, Apple goes to $125, you put your LEAPS on. If the stock rises to 150, then take profits on the $125/$135 and roll into the $150/$160. That’s how you can get like 1,000% returns like we got on Tesla (TESLA) a few years ago. You just keep rolling up your strike prices on every weak day and maintain your leverage.

Q: When do we bet the farms on Editas Medicine Inc. (EDIT) and Crispr (CRSP) Therapeutics?

A: Never. These are small, highly speculative companies which will make money someday, but if the someday is in five years and you’re betting the farm with a LEAPS, you lose the farm. It's going to take a long time for these smaller biotech stocks to come back. If you want to play biotech, go with the big ones like Amgen. It takes a long time to convert cutting-edge technology into profits. The big companies already have a stable of reliable money-making drugs on hand.

Q: Salesforce Inc. (CRM) is up big on earnings—what should I do with the stock?

A: Buy the dips. It’s still way, way below its all-time highs, so use the weekdays to accumulate Salesforce for the long term. It’s one of the best cloud plays out there.

Q: What do you think about NVIDIA Corporation (NVDA)?

A: I absolutely love it. It rallied 20% off the bottom. Use any other additional weak days like today to increase your position. This stock someday is worth $1,000, up from today’s $195.

Q: Do you like SPACS?

A: No, I hate them and think they’re a rip-off. And a lot of them have become totally illiquid and untradable, so you have no choice but for them to shut down and return their money if they have any left. I’ve hated SPACS from day one and people are now getting their comeuppance on these.

Q: What do you think about the weakness in Coinbase Global Inc. (COIN) down here?

A: It’s just going down with all the other high-risk, speculative, meme stock type plays, which include all of the crypto plays like Bitcoin. I would avoid all of those. You want to buy quality at the discount now, and you want to buy the Cadillacs at Volkswagen prices and leave the speculative plays for the next generation, Gen Z, who are already highly interested in stocks.

Q: What is your favorite non-US country to invest in?

A: Australia, because you get a double play there on the currency, which should go up 30% from here, and they will benefit from a global commodity boom which continues for another ten years. They pretty much sell a lot of the major commodities like iron ore, wheat, sheep, and so on. It’s also a really nice country to visit. The only negative with Australia are the sharks.

Q: Biotech takeover targets?

A: Well (EDIT) and (CRSP) would be two of them. Things in the sector are so cheap that they are all potential takeover targets. M&A (Mergers and Acquisitions) will be a major play in the biotech sector for the foreseeable future.

Q: Should we sell short the defense industry here?

A: No, even if the war ends tomorrow, you might get some profit-taking, but the fact is that long term military spending is increasing permanently. The peace dividend now has to be paid back, and that is great for all the defense companies, so I would not be shorting them. If anything, I’d be buying on dips. Buy Lockheed Martin (LMT), Raytheon (RTX), who make the Javelin antitank missile for which there is now a two-year order backlog. You can also throw in General Dynamics (GD) for good measure which builds nuclear submarines and the Stryker armored vehicle.

To watch a replay of this webinar with all the charts, bells, whistles, and classic rock music, just log in to www.madhedgefundtrader.com, go to MY ACCOUNT, click on GLOBAL TRADING DISPATCH, then WEBINARS, and all the webinars from the last 12 years are there in all their glory.

Good Luck and Stay Healthy,

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Keep Those Defense Plays

Global Market Comments

June 2, 2022

Fiat Lux

Featured Trade:

(WHY WATER WILL SOON BE WORTH MORE THAN OIL),

(CGW), (PHO), (FIW), (VE), (TTEK), (PNR), (BYND), (MCD)

Global Market Comments

May 31, 2022

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or WHY I LOVE INFLATION),

(SPY), (TLT), (TBT), (GOOGL),

(AAPL), (MSFT), (BRKB), (NVDA), (V)

I love inflation.

Thanks to the relentless increase in prices, the value of my home has risen by $4 million over the last ten years, and $2 million over the last three years alone.

And I’m not the only one.

Some 66% of Americans own their own homes and may have seen similar price increases or more.

So, what if the price of a gallon of milk goes up by $1? I’ll happily pay that if it means my largest personal investment appreciates at triple-digit rates. Besides, I’m lactose intolerant anyway, and all my kids have grown up.

I’ll tell you what else inflation does. It makes stocks really cheap. That’s because investors fear that the Fed will raise interest rates by too much, destroy company earnings, and trigger a recession.

This is counterintuitive because companies actually benefit from inflation because they can get away with faster price increases more often, boosting profits. I took my kids out to a graduation dinner yesterday and practically had to take out a second mortgage to do so.

Personally, I believe that such a stock market bottom is close. But while the last bottom was within 10%, or 200 S&P 500 (SPX) points in terms of price, it is only 50% in terms of time. That signals a great new bull market for stocks beginning sometime this summer. Then anything you touch will double in three years.

You will look like a genius….again!

You can see who agrees with me by looking at which stocks are already getting bought up. Coca-Cola (KO), Johnson & Johnson (JNJ), and Procter & Gamble (PG) are the kind of safe, dividend-paying, brand name stocks that very long-term investors like pension funds love to own. They tend to buy and hold….forever.

No meme stocks here.

It isn’t just the Fed that is raising interest rates, which can only control overnight rates. The US budget deficit is falling at the fastest rate since WWII, possibly taking us to a budget surplus by year-end. As a result, the money supply is shrinking at the fastest rate in 60 years.

QT, or quantitative tightening, will fan the flames when it starts on January 1, ultimately taking up to $9 trillion out of the financial system.

Remember all that liquidity from QE, near-zero rates, and massive government spending that saved the economy from Armageddon? Play for movie in reverse and you get the oppositive result, i.e. falling share prices….at least for a while.

The battle as to who is right about the direction of the economy continues unabated. Is it bonds or stocks? At the rates that stocks have been plunging, stocks are essentially anticipating another Great Depression.

Ten-year US Treasury yields that soared from 1.33% to 3.12% in a mere six months are proclaiming that happy days are here again and will last forever. Since January, the average monthly mortgage payment has jumped by $450 a month. If that isn’t recessionary, I don’t know what is.

As a 53-year veteran of these markets, I can tell you that the bond market is always right. That’s because the money spent on equity research has shrunk to a shadow of its former self in recent decades, while bond research is as strong as ever.

Always listen to the guy with the $10 million budget and ignore the one with the $500,000 budget, which means that in the coming months, equity prognosticators will realize the error of their ways and come over to my way of thinking once again.

The Fed Minutes were not so horrible, downplaying the risk of a full 1% rate rise, triggering a 1,000-point rally in the Dow. With five up days in a row, this is starting to look like THE bottom. Is this the light at the end of the tunnel?

Q1 GDP dives 1.5% in its final read. It’s the worst quarter since the pandemic began during Q2 2022. Weekly Jobless Claims dropped 8,000 to 210,000.

NVIDIA Rips, surprising to the upside on almost every front, sending the stock up $30, or 18.75%. Mad Hedge followers bought (NVDA) last week. This is one of the best-run companies in the world. I expect the shares to rise from the current $178.51 to $1,000 in five years. Buy (NVDA) on dips.

The Consumer will keep driving the economy, says Bank of America CEO Brian Moynihan. Betting against the American consumer has always been a fool’s errand. I’m with Brian. Cash levels this high were never followed by recessions.

Only 18% of Americans will increase stockholdings this year, which is usually what you get at market bottoms. It was closer to 100% at the December top. Yet another signal that we are approaching the bottom in price, if not time.

New Home Sales dive in April, down 16.6% on a signed contract basis, the weakest in two years. The macro is definitely conspiring against the market. It’s all about interest rates. The average monthly mortgage payment has rocketed by $450 a month since January. Inventories have also soared from 6 to 9 months.

Advertising is in free fall, especially the online version, a usual pre-recession indicator. It is the easiest and first expense companies cut when they expect flagging sales. Look no further than yesterday’s astonishing 43% collapse in Snap (SNAP). Notice that TV commercials are getting endlessly repeated as the number of advertisers and ad rates fall. If I see one more ad for Interactive Brokers, I’ll shoot myself.

The EV Shortage worsens, with wait times for a new Tesla extending beyond a year. I can sell my Model X for more than I paid for it three years ago. Gasoline at $6.00 is converting a lot of drivers, and gas lines this summer loom. Big three dealers are price gouging on the few EVs they have, charging well over list. Good luck finding a Rivian pick-up; that’s a two-year wait. Maybe that makes (TSLA) a “BUY” down here?

My Ten-Year View

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still historically cheap, oil peaking out soon, and technology hyper-accelerating, there will be no reason not to. The Dow Average will rise by 800% to 240,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 240,000 here we come!

With some of the greatest market volatility seen since 1987, my May month-to-date performance recovered to +8.80%.

My 2022 year-to-date performance exploded to 38.98%, a new high. The Dow Average is down -9.30% so far in 2022. It is the greatest outperformance on an index since Mad Hedge Fund Trader started 14 years ago. My trailing one-year return maintains a sky-high 61.22%.

Last week was a quiet one, with me using the monster rally to add new shorts in Apple (AAPL) and the S&P 500 (SPY).

That brings my 14-year total return to 551.54%, some 2.40 times the S&P 500 (SPX) over the same period and a new all-time high. My average annualized return has ratcheted up to 43.54%, easily the highest in the industry.

We need to keep an eye on the number of US Coronavirus cases at 84 million, up 1.5million in a week, and deaths topping 1,004,000 and have only increased by 2,000 in the past week. You can find the data here.

On Monday, May 30, markets are closed for Memorial Day.

On Tuesday, May 31 at 9:00 AM EST, the S&P Case Shiller National Home Price Index for March is released.

On Wednesday, June 1 at 10:00 AM, JOLTS Job Openings for April are published.

On Thursday, June 2 at 8:30 AM, Weekly Jobless Claims are out. We also learn the ADP Private Employment Report for May.

On Friday, June 3 at 8:30 AM, the big Nonfarm Payroll Report for May is disclosed. At 2:00 the Baker Hughes Oil Rig Count is out.

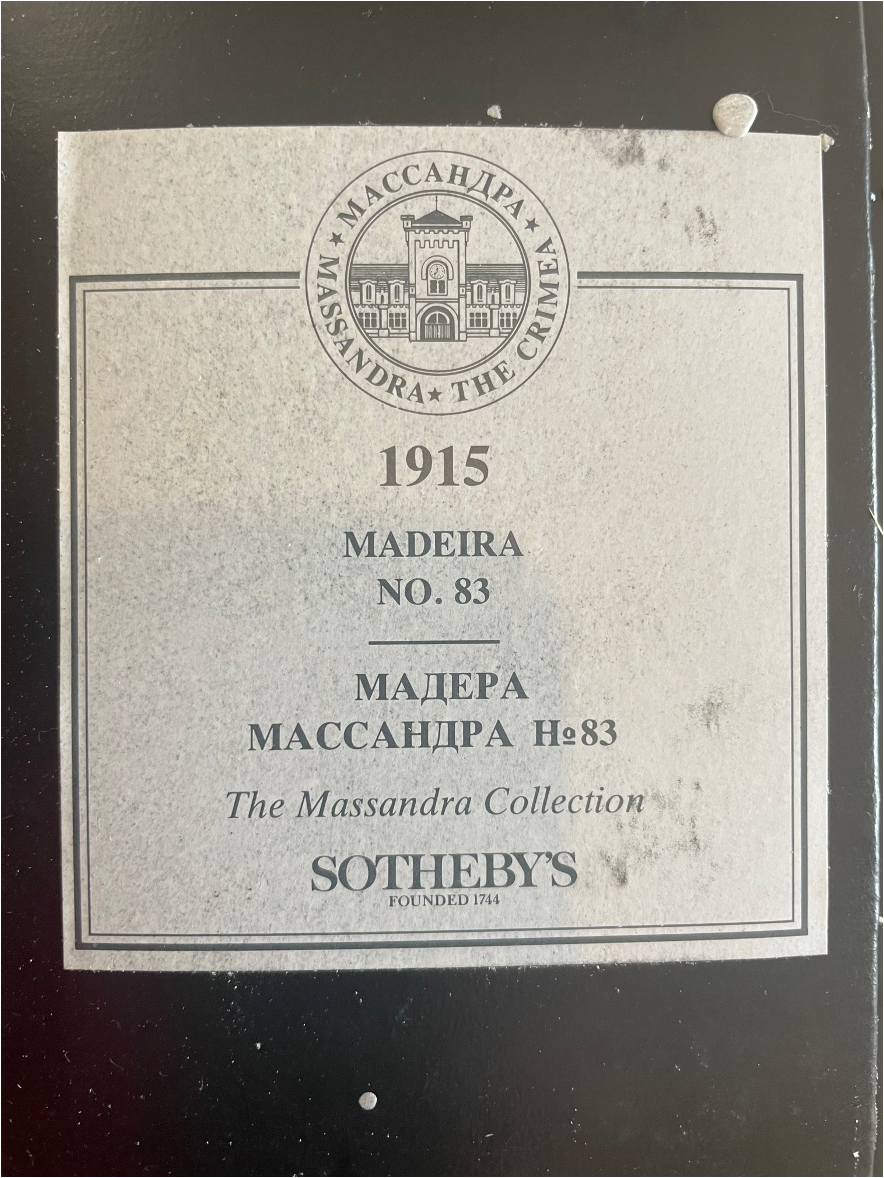

As for me, as a lifetime oenophile, or wine lover, I long searched for the Holy Grail of the perfect bottle. I finally found my quarry in 1989.

During the 19th century, Russia was still an emerging country that sought to import advanced European technology. So, they sent agents to the top wine-growing regions of the continent to bring back grapevine cuttings to create a domestic wine industry. They succeeded beyond all expectations building a major wine industry in Crimea on the Black Sea.

Then the Russian Revolution broke out in 1918.

Czar Nicholas II and his family were executed, and eventually, the wine industry was taken over by the Soviet state. They kept it going because wine exports brought in valuable foreign exchange with which the government could use to industrialize the country.

Then the Germans invaded in 1941.

Not wanting the enemy to capture a 100-year stockpile of fine wine, the managers of the Massandra winery dug a 100-yard-deep cave, moved their bottles in, bricked up the entrance, and hid it with shrubs. Then everyone involved in storing the wine was killed in the war.

Some 45 years later, looking to expand the facility, some Massandra workers stumbled across the entrance to the cave. Inside, they found a million bottles dating back to the 1850s kept in perfect storage conditions. It was a sensation in the wine collecting world.

To cash in, they hired Sotheby’s in London to repackage and auction off the wine one case at a time. It was the auction event of the year. For years afterwards, you could buy glasses of 100-year-old ports and sherries from the Czar’s own private stock at your local neighborhood restaurant for $5, the deal of the century.

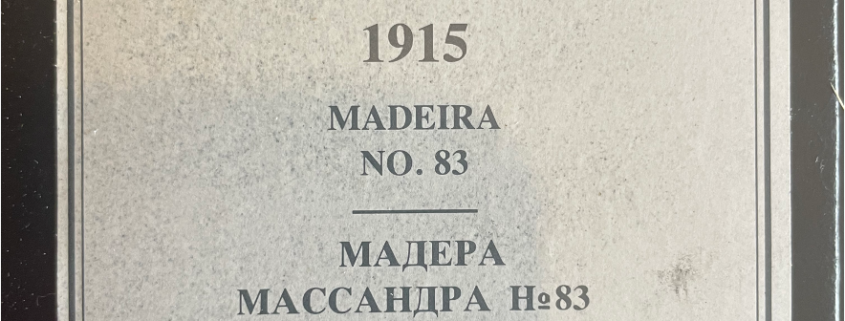

I attended the auction at Sotheby’s packed Bond Street offices. The superstars of the wine collecting world were there with open checkbooks. I sat there with my paddle number 138 but was outbid repeatedly and wondered if I would get anything. In the end, I managed to pick up some of the less popular cases, a 1915 Madeira, a 1936 white port, and a 1938 sherry for about $25 a bottle each.

For years, these were my special occasion wines. I opened one when I was appointed a director of Morgan Stanley. Others went to favored clients at Christmas. My 50th, 60th, and 70th birthdays ate into the inventory. So did the birth of children number four and five. Several high school fundraisers saw bottles earn $1,000 each.

One of the 1915’s met its end when I came home from the Gulf War in 1992. Hey, the last Czar didn’t drink it and looked what happened to him! Another one bit the dust when I sold my hedge fund at the absolute market top in 1999. So did capturing 6,000 new subscribers for the Mad Hedge Fund Trader in 2010.

It turns out that the empties were quite nice too, 100-year-old hand-blown green glass, each one is a sculpture in its own right.

I am now reaching the end of the road and only have a half dozen bottles left. I could always sell them on eBay where they now fetch up to $1,000 a bottle.

But you know what? I’d rather have six more celebrations than take in a few grand.

Any suggestions?

Stay Healthy,

John Thomas

CEO & Publisher

Global Market Comments

May 30, 2022

Fiat Lux

SPECIAL MEMORIAL DAY ISSUE

Featured Trade:

(A TRIBUTE TO A TRUE VETERAN)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.