“If massive government spending was the secret to economic success, then Venezuela would be ruling the world. Massive government spending is no indicator of economic success,” said Charles Bobrinksoy of Ariel Investments.

-

Global Market Comments

May 11, 2021

Fiat LuxFeatured Trade:

(THE NEXT TRADE OF THE CENTURY IS HERE!),

(TLT), (TBT), $TNX)

We are getting to the point where great equity trades with potential huge returns are becoming few and far between. At the very least, they are only a fraction of the opportunities we saw a year ago, which was a once-in-a-century event.

So, when your trade of the century runs out, what do you do?

You find another trade of the century!

It just so happens I have such an animal.

You are all well aware of the short-selling opportunities available in the US Treasury bond market (TLT), where I have been running triple short positions since the beginning of the year. That has allowed us to rake in 6% a month in profits like clockwork.

How would you like to make more than that, a lot more, like three times more?

I have been dealing in the front-month options so far and managed to catch a $25 crash in the United States Treasury Bond Fund (TLT). If you believe that there is another $25 in the works, there are much bigger fish to fry. Simply extend your maturities and lower your strike prices through LEAPS, or Long-Term Equity Anticipation Securities.

I’ll show you how to do that, first with a conservative position, and then a much more aggressive one. Better yet, an excellent entry point for both positions is close.

The case for lower bond prices and higher interest rates is overwhelming.

With 2021 expected to be one of the strongest years for economic growth in history, there is no chance you’ll see a major rally in the US Treasury bond market from here. The only question is how fast it will fall.

This trade is basically betting that interest rates will rise in front of the biggest borrowing since civilization began.

The national debt rose from a record $23 trillion to an eye-popping $28 trillion in 2020. In 2021, it is expected to explode to $32 trillion, and possibly as high as $37 trillion by the end of 2022. The US Treasury demands on the bond market are going to be incredible.

As much as you may admire or despise Biden’s “guns and butter” policy (the guns being aimed at Covid-19), a flood over government bond selling is on our doorstep.

It is almost mathematically impossible in this environment for bond prices to rise and interest rates to fall substantially from here. They can only go sideways at best, or down big in the worst case.

Sounds like a great short to me.

Currently, LEAPS are listed for the (TLT) all the way out until January 2023.

However, the further expiration dates will have far less liquidity than near-month options, so they are not a great short-term trading vehicle. That is why entering limit orders in LEAPS only, as opposed to market orders, is crucial.

These are really for your buy-and-forget investment portfolio, defined benefit plan, 401k, or IRA.

Because of the long maturities, premiums can be enormous. However, there is more than one way to skin a cat, and the profit opportunities here can be astronomical.

Like all options contracts, LEAPS gives its owner the right to "exercise" the option to buy or sell 100 shares of stock at a set price for a given time.

LEAPS have been around since 1990 and traded on the Chicago Board Options Exchange (CBOE).

To participate, you need an options account with a brokerage house, an easy process that mainly involves acknowledging the risk disclosures that no one ever reads.

If LEAPS expires "out-of-the-money" by the expiration date, you can lose all the money you spent on the premium to buy it. There's no toughing it out waiting for a recovery, as with actual shares of stock. Poof, and your money is gone.

Note that a LEAPS owner does not vote proxies or receive dividends because the underlying stock is owned by the seller, or "writer," of the LEAPS contract until the LEAPS owner exercises.

Despite the Wild West image of options, LEAPS are actually ideal for the right type of conservative investor.

They offer vastly more margin and more efficient use of capital than traditional broker margin accounts. And you don’t have to pay the usurious interest rates that margin accounts usually charge.

And for a moderate increase in risk, they present hugely outsized profit opportunities.

For the right investor, they are the ideal instrument.

So, let’s get on with my specific examples for the (TLT) to discover their inner beauty.

By now, you should all know what vertical bear spreads are. If you don’t, then please click this link for my quickie video tutorial (you must be logged in to your account).

Warning: I have aged since I made this video.

Today, the (TLT) is trading at $139.75

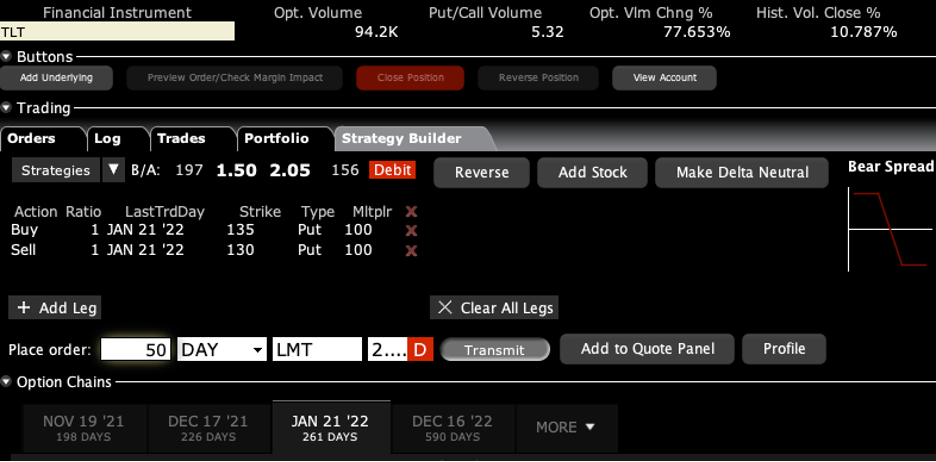

The cautious investor should buy the (TLT) January 2022 $130-$135 vertical bear put debit spread for $2.00. Some 50 contracts get you a $10,000 exposure. This is a bet that ten-year US Treasury yields will rise above 1.75% in eight months. Sounds like a total no-brainer, doesn't it?

expiration date: January 21, 2022

Portfolio weighting: 10%

Number of Contracts = 50 contracts

Here are the specific trades you need to execute this position:

Buy 50 January 2022 (TLT) $135 puts at………….………$6.00

Sell short 50 January 2022 (TLT) $130 puts at…………$4.00

Net Cost:………………………….………..………….........….....$2.00

Potential Profit: $5.00 - $2.00 = $3.00

(50 X 100 X $3.00) = $15,000 or 150.00% in eight months. In other words, your $10,000 investment turned into $15,000 with an almost sure thing bet.

This is a bet that the (TLT) will stay below $130.00 by the January 21, 2022 options expiration in eight months. To lose money on this position, ten-year US Treasury yields would have to stay below 1.75% from the current 1.57%, which they won’t.

Pigs would have to fly first.

Let’s say that you’re so convinced that exploding US debt will cause the (TLT) to crash again that you’re willing to take on more risk and place a bigger bet.

Here is your dream trade:

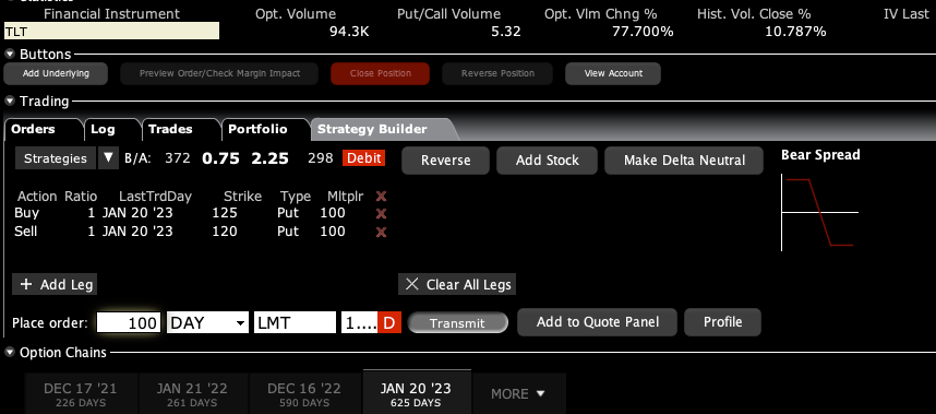

Buy the (TLT) January 2023 $120-$125 vertical bear put debit spread for $1.00. Some 100 contracts get you a $10,000 exposure. This is a bet that ten-year US Treasury yields will rise above 2.25% in 20 months.

That’s what you would expect to see during a normal economic recovery. This is the greatest economic recovery of all time.

expiration date: January 20, 2023

Portfolio weighting: 10%

Number of Contracts = 100 contracts

Here are the specific trades you need to execute this position:

Buy 100 January 2023 (TLT) $125 puts at………….………$7.75

Sell short 100 January 2023 (TLT) $120 puts at…………$6.75

Net Cost:………………………….………..………….….....$1.00

Potential Profit: $5.00 - $1.00 = $4.00

(100 X 100 X $4.00) = $40,000 or 50.00% in 20 months. In other words, your $10,000 investment turned into $40,000 with an almost sure thing bet.

This is a bet that the (TLT) will stay below $120.00 by the January 20, 2023 options expiration in 20 months.

Why do a put spread instead of just buying the $130 puts outright?

You need a much bigger downside move to make money on this trade. By paying only $2.00 instead of $6.00 for a position, you can triple your size, from 16 to 50 contracts for a $10,000 commitment. That triples your downside leverage on the most probable move in the (TLT), the one from $135 to $130.

That’s what real hedge funds do all day long, find the most likely profit and leverage up on it like crazy.

Let’s do the math on the two positions. If you buy the (TLT) January 2022 $130-$135 vertical bear put debit spread for $2.00, you reach a maximum value of $5.00 on expiration day at $130.

If you buy the (TLT) January 2022 $130 puts outright, at $130 on expiration day, your position is worth zero, nada, bupkiss. It gets worse. To make the same amount of profit as the spread the (TLT), or $15,000, it has to fall all the way to $122.50 to break even. Below that, you make more money than the spread, but at half the rate.

How could this trade go wrong?

There is only one thing. We get a new variant on Covid-19 that overcomes the existing vaccines and brings a fourth wave in the pandemic.

In this case, the (TLT) doesn’t crash to $120 but soars to $160 or more. We go back into recession. Both of the above positions go to zero. But if we get a fourth wave, you are going to have much bigger problems than your options positions.

So there it is. You pay your money and take your chances. That's why the potential returns on these simple trades are so incredibly high.

Enjoy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

The Fat Lady is Singing for the Bond Market

“The market is untradable now. We are one tweet away from a new all-time high, or a 10% correction,” said a hedge fund friend of mine.

Global Market Comments

May 10, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or THE SUSHI HITS THE FAN),

(SPY), (TLT), (TBT), (V), (UNP), (DAL), (MSFT), (GS), (JPM), (FCX)

During my senior year in High School, I had the good fortune to date the daughter of Richard Knerr, the founder of Wham-O, the inventor of Hula Hoops, Silly Putty, Super Balls, Frisbee’s, and Slip & Slides (click here).

At six feet, she was the tallest girl in the school, and at 6’4” I was an obvious choice.

After the senior prom and wearing my tux, I took her to the Los Angeles opening night of the new musical Hair. In the second act, the entire cast dropped their clothes onto the stage and stood there stark naked. The audience was stunned, shocked, embarrassed, and even gob-smacked.

Those were the reactions I saw on Friday, when the April Nonfarm Payroll Report was released showing a gain of only 266,000 jobs. A million had been expected.

So, how does that work? Red hot ADP private jobs and a year low in Weekly Jobless Claims, but a horrific monthly Payroll report?

They say economic data can be “noisy”. This time it was positively cacophonous. The fact is that these data points were never created to handle times like this, the most disruptive in history.

When the data are useless, all you have to do is take a walk down Main Street. There are “Help Wanted” signs at virtually every business.

The data dissonance created a wild day in the markets on Friday. Bonds soared, causing ten-year yields to dive to 1.48%. Then they rallied all the way back up to 1.58%.

That was seen as the end of the two-month long rally in bonds, so stock took off like a rocket. Essentially everything went up, both cyclicals, banks, AND tech.

All those bond shorts you have been nursing since March? They are about to explode to the upside. The next leg down in the year-old bear market in bonds is about to begin.

And what about that 266,000-payroll report? If you didn’t get a million jobs print in April, then you’ll almost certainly get it in May. Stocks could well keep rally until then. That’s how traders are seeing it.

Just another reason to buy.

By the way, I learned one of the great untold business stories from Richard Knerr. When the Hula Hoop was first launched in 1957, sales went ballistic. Some 25 million were sold in the first four months.

The Hula Hoop was made of a plastic tube stapled together with an oak cork made in England. Since demand seemed infinite, Wham-O ordered 50 million corks. Then the republican party claimed the toy was a communist conspiracy to destroy the youth of America as the swiveling of hips was deemed obscene. This was at the tail end of the McCarthy period.

Sales of Hula Hoops collapsed.

They cancelled the order for 50 million oak corks, which were thrown overboard mid-Atlantic. They are still floating out there somewhere today. Wham-O almost went bankrupt from the experience but was eventually saved by the Frisbee.

Richard Knerr died in 2008 at the age of 82. Wham-O was taken over by Mattel in 1995. For his obituary, please click here.

April Nonfarm Payroll Report is a huge disappointment, at 266,000 when up to one million was expected. April’s hiring boom goes bust. March was revised down massively, from 916,000 to 770,000. The headline Unemployment Rate rose to 6.1%. It was one of the most confusing reports in recent memory. Bonds rocketed, interest rates crashed, and tech stocks took off like a scalded chimp. Inflation expectations have been shattered. Leisure & Hospitality kicked in at 331,000. But Professional & Business Services collapsed by 111,000. The two million businesses that went under last year aren’t hiring. Much of the return to work has been by people who already have jobs.

Weekly Jobless Claims plunged to 488,000, one of the sharpest drops on record at 100,000. Go down any Main Street today and instead of a sea of plywood, it is plastered with “Help Wanted” signs. Productivity is soaring, while average labor costs are actually falling.

ADP Private Employment Report soars, up by 742,000 in April, the biggest gain since September. It makes the coming Friday Nonfarm Payroll Report look outstanding. The jobs market is booming, but competition for the top jobs is also fierce.

Europe’s Q1 GDP falls by 0.6%. That’s better than expected, but disastrous when compared to America’s spectacular 6.4% print. Blame the bumbled slow-motion vaccine rollout. European governments wasted time negotiating on price like it was just another government program, while the US poured billions into vaccine makers, no questions asked. European vaccines, like Astra Zeneca’s, were flawed. It’s amazing that a big government continent can’t perform a big government task, even when millions of lives depend on it.

US Factory Orders gain, up 1.1% in March, providing more evidence that stimulus is working. Most economists are expecting double-digit growth in Q2. Driving up to Lake Tahoe, the number of trucks on the road has doubled in the last month.

Personal Income Explodes, up 21.1% in March, the most since 1945 according to the Bureau of Economic Analysis. What the heck happened in 1945? $1,400 stimulus checks are clearly burning holes in the pockets of consumers. Expect all numbers to hit lifetime highs in the coming months. The sun, moon, and stars are all lining up and standard of living is soaring.

Chicago PMI rockets to a 40-year high, up to 72.1 versus an expected 65. It seems everyone is already trying to buy what I am trying to buy. My bet is that the stock market is wildly underestimating the coming onslaught of economic numbers and will go to new highs once it figures out the game.

Lumber Prices are becoming a big deal, soaring 70% in two months and a staggering 340% in a year, igniting inflation fears. It’s only a tiny fraction of our tiny spending but is adding $36,000 to the cost of a new home. Someone in four homes sold today are newly built, the highest ratio ever. Punitive Trump lumber tariffs against Canada years ago shut down a lot of production and now that we need it, it isn’t there.

IBM brings out the 2-Nanometer Chip, taking semiconductor technology to the next evolutionary level. Any smaller and electrons will be too big to squeeze through the gates. The current battle is over 7 nm technology. It promises to bring much faster computing at a lower price and will act as a temporary bridge to lightening quantum computing.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch profit reached 2.38% gain during the first week of May on the heels of a spectacular 15.67% profit in April.

I took profits in my long in Goldman Sachs (GS) and my short in the United States Treasury Bond Fund (TLT). I then plowed the cash into a new June short position in the (TLT) and a new short in the S&P 500 (SPY). That gave me a heart attack on my bond shorts when bond prices soared and then an immediate rebirth when they collapsed two points in the afternoon.

That leaves me 100% invested, as I have been for the last six months.

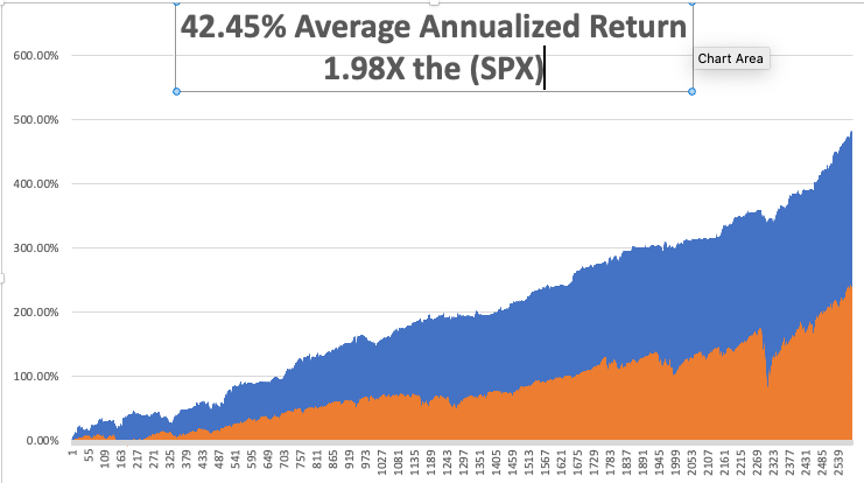

My 2021 year-to-date performance soared to 62.14%. The Dow Average is up 14.45% so far in 2021.

That brings my 11-year total return to 484.89%, some 2.00 times the S&P 500 (SPX) over the same period. My 11-year average annualized return now stands at an unbelievable 42.45%, easily the highest in the industry.

My trailing one-year return exploded to positively eye-popping 127.09%. I truly have to pinch myself when I see numbers like this. I bet many of you are making the biggest money of your long lives.

We need to keep an eye on the number of US Coronavirus cases at 32.7 million and deaths topping 581,000, which you can find here. New cases are in free fall, with only 12 here in Washoe County Nevada out of a population of 500,000. We could approach zero by the summer.

The coming week will be weak on the data front.

On Monday, May 10, at 9:45 AM, the April ISM New York Index is out. Roblox (RBLX) and BioNTech (BNTX) report earnings.

On Tuesday, May 11, at 10:00 AM, the NFIB Small Business Optimism Index for April is released. Palantir reports results (PLTR).

On Wednesday, May 12 at 2:00 PM, the US Core Inflation Rate for April is published. Softbank (SFTBY) reports results.

On Thursday, May 13 at 8:30 AM, the Weekly Jobless Claims are published. Walt Disney (DIS), Airbnb (ABNB), and Alibaba (BABA) report results.

On Friday, May 14 at 8:30 AM, Retail Sales for April are indicated. At 2:00 PM, we learn the Baker-Hughes Rig Count.

As for me, I’ve found a new series on Amazon Prime called Yellowstone. It is definitely NOT PG-rated, nor is it for the faint of heart. But it does remind me of my own cowboy days.

When General Custer was slaugherted during his last stand in Montana at the Little Big Horn in 1876, my ancestors spotted a great buying opportunity. They used the ensuing panic to pick up 50,000 acres near the Wyoming border for ten cents an acre.

Growing up as the oldest of seven kids, my parents never missed an opportunity to farm me out with relatives. That’s how I ended up with my cousins near Broadus, Montana for the summer of 1967.

When I got off the Greyhound bus in nearby Sheridan, I went into a bar to call my uncle. The bartender asked his name and when I told him “Carlat” he gave me a strange look.

It turned out that My uncle killed someone in a gunfight in the street out front a few months earlier, which was later ruled self-defense. It was the last public gunfight seen in the state, and my uncle hadn’t been seen in town since.

I was later picked up in a beat-up Ford truck and driven for two hours down a dirt road to a log cabin. There was no electricity, just kerosene lanterns and a propane-powered refrigerator.

Welcome to the 19th century!

I was hired on as a cowboy, lived in a bunkhouse with the rest of the ranch hands, and was paid the princely sum of a dollar an hour. I became popular by reading the other cowboys' newspapers and their mail since they were all illiterate. Every three days, we slaughtered a cow to feed everyone on the ranch. I ate steak for breakfast, lunch, and dinner.

On weekends, my cousins and I searched for Indian arrowheads on horseback, which we found by the shoebox full. Occasionally, we got lucky finding an old rusted Winchester or Colt revolver just lying out on the range, a remnant of the famous battle 90 years before. I carried my own six-shooter to help reduce the local rattlesnake population.

I really learned the meaning of work and had callouses on my hands in no time. I had to rescue cows trapped in the mud (stick a burr under their tail), round up lost ones, and saw miles of fence posts. When it came time to artificially inseminate the cows with superior semen from Scotland, it was my job to hold them still. It was all heady stuff for a 16-year-old.

The highlight of the summer was participating in the Sheridan Rodeo. With my uncle, one of the largest cattle owners in the area, I had my pick of events. So, I ended up racing a chariot made from an old oil drum, team roping (I had to pull the cow down to the ground), and riding a Brahma bull. I still have a scar on my left elbow from where a bull slashed me, the horn pigment clearly visible.

I hated to leave when I had to go home and back to school. But I did hear that the winter in Montana is pretty tough.

It was later discovered that the entire 50,000 acres was sitting on a giant coal seam 50 feet thick. You just knocked off the topsoil and backed up the truck. My cousins became millionaires. They built a modern four-bedroom house closer to town with every amenity, even a big screen TV. My cousin built a massive vintage car collection.

During the 2000s, their well water was poisoned by a neighbor’s fracking for natural gas, and water had to be hauled in by truck at great expense. In the end, my cousin was killed when the engine of the classic car he was restoring fell on top of him when the rafter above him snapped.

It all did give me a window into a lifestyle that was then fading fast. It’s an experience I’ll never forget.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Global Market Comments

May 7, 2021

Fiat Lux

Featured Trade:

(HOW TO JOIN THE EARLY RETIREMENT STAMPEDE)

(TESTIMONIAL)

Global Market Comments

May 6, 2021

Fiat Lux

Featured Trade:

(THE DEATH OF THE FINANCIAL ADVISOR)

Global Market Comments

May 5, 2021

Fiat Lux

Featured Trade:

(HOW TO HEDGE YOUR CURRENCY RISK)

(FXA), (UUP)

(TESTIMONIAL)

Global Market Comments

May 4, 2021

Fiat Lux

Featured Trade:

(WHATEVER HAPPENED TO THE GREAT DEPRESSION DEBT?)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.