Global Market Comments

January 13, 2021

Fiat LuxFeatured Trade:

(MY RADICAL VIEW OF THE MARKETS),

(INDU), (SPY), (AAPL), (FB), (AMZN), (ROKU)

What if the consensus is wrong?

What if instead of being in the 12th year of a bull market, we are actually in the first year, which has another decade to run? It’s not only possible but also probable. Personally, I give it a greater than 90% chance.

There is a possibility that the bear market that everyone and his brother have been long predicting and that the talking heads assure you is imminent has already happened.

It took place during the first quarter of 2020 when the Dow Average plunged a heart-rending 40%. How could this be a bear market when historical ursine moves down lasted anywhere from six months to two years, not six weeks?

Blame it all on hyperactive algorithms, risk parity traders, Robin Hood traders, and hedge funds, which adjust portfolios with the speed of light. If this WAS a bear market and you blinked, then you missed it.

It certainly felt like a bear market at the time. Lead stocks like Amazon (AMZN), Apple (AAPL), Facebook (FB), and Alphabet (GOOGL) were all down close to 40% during the period. High beta stocks like Roku (ROKU), one of our favorites, were down 60% at the low. It has since risen by 600%.

It got so bad that I had to disconnect my phone at night to prevent nervous fellows from calling me all night.

In my experience, if it walks like a duck and quacks like a duck, then it is a bear. If true, then the implications for all of us are enormous.

If I’m right, then my 2030 target of a Dow Average of $120,000, an increase of 300% no longer looks like the mutterings of a mad man, nor the pie in the sky dreams of a permabull. It is in fact eminently doable, calling for a 15% annual gain until then, with dividends.

What have we done over the last 11 years? How about 13.08% annually with dividends reinvested for a total 313% gain.

For a start, from here on, we should be looking to buy every dip, not sell every rally. Institutional cash levels are way too high. Markets have gone up so fast, up 12,000 Dow points in eight months, that many slower investors were left on the sideline. Most waited for dips that never came.

It all brings into play my Golden Age scenario of the 2020s, a repeat of the Roaring Twenties, which I have been predicting for the last ten years. This calls for a generation of 85 million big spending Millennials to supercharge the economy. Anything you touch will turn to gold, as they did during the 1980s, the 1950s, and well, the 1920s. Making money will be like falling off a log.

If this is the case, you should be loading the boat with technology stocks, domestic recovery stocks, and biotech stocks at every opportunity. Although stocks look expensive now, they are still only at one fifth peak valuations of the 2000 market summit.

Let me put out another radical, out of consensus idea. It has become fashionable to take the current red-hot stock market as proof of a Trump handling of the economy.

I believe the opposite is true. I think stocks have traded at a 10%-20% discount to their true earnings potential for the past four years. Anti-business policies were announced and then reversed the next day. Companies were urged to reopen money-losing factories in the US. Capital investment plans were shelved.

Yes, the cut in corporate earnings was nice, but that only had value to the 50% of S&P 500 companies that actually pay taxes.

Now that Trump is gone, that burden and that discount are lifted from the shoulders of corporate America.

It makes economic sense. We will see an immediate end to our trade war with the world, which is currently costing us 1% a year in GDP growth. Take Trump out of the picture and our economy gets that 1% back immediately, leaping from 2% to 3% growth a year and more.

The last Roaring Twenties started with doubts and hand wringing similar to what we are seeing now. Everyone then was expecting a depression in the aftermath of WWI because big-time military spending was ending.

After a year of hesitation, massive reconstruction spending in Europe and a shift from military to consumer spending won out, leading to the beginning of the Jazz Age, flappers, and bathtub gin.

I know all this because my grandmother regaled me with these tales, an inveterate flapper herself, which she often demonstrated. This is the same grandmother who bought the land under the Bellagio Hotel in Las Vegas for $500 in 1945 and then sold it for $10 million in 1978.

And you wonder where I got my seed capital.

It all sets up another “Roaring Twenties” very nicely. You will all look like geniuses.

I just thought you’d like to know.

Global Market Comments

January 12, 2021

Fiat Lux

Featured Trade:

(MAD HEDGE 2020 PERFORMANCE ANALYSIS),

(SPY), (TLT), (TBT), (TSLA), (GLD),

(SLV), (V), (AAPL), (VIX), (VXX)

(TESTIMONIAL)

When a Marine combat pilot returns from a mission, he gets debriefed by an intelligence officer to glean whatever information can be obtained and lessons learned.

I know. I used to be one.

Big hedge funds do the same.

I know, I used to run one.

Even the best managers will follow home runs with some real clangors. Every loss is a learning experience. If it isn’t, investors will flee and you won’t last long in this business. McDonald’s beckons.

By subscribing to the Mad Hedge Fund Trader, you get to learn from my own half-century of mistakes, misplaced hubris, arrogance, overconfidence, and sheer stupidity.

So, let’s take a look at 2020.

It really was a perfect year for me during the most adverse conditions imaginable, a pandemic, Great Depression, and presidential election. I made good money in January, went net short when the pandemic hit in February, and played the big bounce in technology stocks that followed.

Right at the March crash bottom, I sent out lists of 25 two-year option LEAPS (Long Term Equity Participation Securities). Many of these were up ten times in months. I then used a Biden election win as a springboard for a big run with domestic recovery stocks and financials.

One client turned $3 million into $40 million last year. He owes me a dinner and my choice on the wine list. (Hmmmmm. Lafitte Rothschild 1952 Cabernet Sauvignon with a shot of Old Rip Van Winkle bourbon as a chaser?). I usually get a few of these every year.

See, that’s all you have to do to bring in a big year. Piece of cake. It’s like falling off a log. But then I’ve been practicing for 50 years.

In the end, I managed to bring in a net return of 66.5% for all of 2020. That compares to a net return for the Dow Average of 5.7%.

My equity trading in general brought in 71.94% in profits, with 216 trade alerts, and were far and away my top performing asset class. This was the best year for trading equities since the 1999 Dotcom bubble top.

Of course, the best single trade of the year was with Tesla (TSLA), with 18 trades bringing in a 10.55%. I dipped in and out during the 10-fold increase from the March low to yearend.

Readers were virtually buried with an onslaught of inside research about the disruptive electric car company. It’s still true if you buy the stock, you get the car for free, as I have done three times.

Some 26 trades in Apple (AAPL) brought in a net 5.94%. It did get stopped out a few times, hence the lower return.

The second most profitable asset class of the year was in the bond market, with 58 trades producing a 31.16% profit. Virtually all of these trades were on the short side.

I sold short the United States Treasury Bond Fund from $180 all the way down to $154. I called it my “rich uncle” trade of the year, writing me a check every month and sometimes several a month. This is the trade that keeps on giving in 2021. Eventually, I see the (TLT) falling all the way to $80.

I did OK with gold (GLD), making 4.88% with eight trades in the SPDR Gold Shares ETF. Gold rose steadily until August and then fell for the rest of the year. I picked up another 1.77% on two silver trades (SLV).

It was not all a bed of roses.

Easily my worst asset class of the year was with volatility, selling short the iPath Series B S&P 500 VIX Short Term Volatility ETN (VXX). I was dead right with the direction of the move, with the (VIX) falling from $80 to $20. But my timing was off, with time decay eating me up. I lost 7.29% on six trades.

Two trades in credit card processor Visa (V) cost me 4.37%. I had a nice profit in hand. Then right before expiration, rumors of antitrust action from the administration emerged, a spate of bad economic data was printed, and an expensive acquisition took place.

I call this getting snakebit when unpredictable events come out of the blue to force you out of positions. Visa shares later rose by an impressive 22% in two months.

I lost another 0.99% on my one oil trade of the year with the United States Oil Fund (USO), buying when Texas tea was at negative -$5.00 and stopping out at negative $15.00. Oil eventually fell to negative -$37.00.

Go figure.

I didn’t offer any foreign exchange trades in 2020. I got the collapse of the US dollar absolutely right, but the moves were so small and so slow they could compete with what was going on in equities and bonds.

However, I played the weak dollar in other ways, with bullish calls in commodities and bearish ones in bonds. It always works.

Anyway, it’s a New Year and we work in the “You’re only as good as your last trade” business. 2021 looks better than ever, with a 5% profit straight out of the gate during the first five trading days.

It really is the perfect storm for equities, with $10 trillion about to hit the US economy, most of which will initially go into the stock market.

Good luck and good trading.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Dear John Thomas,

I want to thank you for getting me and my portfolio through this stressful year. Through the use of breathing techniques and devotion to reading your new letters, I managed to have a monster year. I am up 338% YTD.

I look forward to trading alongside you in the years ahead and can't wait to meet you in person at one of your Tahoe seminars.

Sincerely,

Justin in Santa Rosa

Global Market Comments

January 11, 2021

Fiat Lux

Featured Trade:

(MARKET OUTLOOK FOR THE WEEK AHEAD, or A WEEK FOR THE HISTORY BOOKS),

($INDU), (TSLA), (TBT), (TLT), (JPM), (WFC)

A man came at me with a crowbar last week.

I drove into Reno to buy some used backpacks for my Boy Scout troop and parked my Tesla in a nice residential neighborhood. Out of nowhere, a man ran down the street at me screaming profanities, crowbar in hand.

He shouted that I was from Antifa and that I had hired people to invade the Capitol Building to make President Trump look bad.

I reached into my car for my own crowbar. Then the local residents interceded, separating us. The man turned around and walked away, fuming.

“Who the heck was that?” I asked.

“He has mental issues,” said a neighbor. “We’ve had many problems with him before.”

Another said “He’s a Trump supporter. He saw your Tesla and thought you were a liberal.”

Wow! Looks like the nation has a very long way to heal.

Last year, the US defense budget amounted to $622 billion. When the greatest threat to congress in the nation’s history presented itself, it was antique chairs piled against the door that provided the best defense. Maybe we should ditch some big-ticket nuclear missiles and buy more chairs.

Of course, once the insurrection started on Wednesday, I was inundated with international calls from investors asking if they should pull all their money out of the US. I answered “NO” and that it was in fact time to double down. Those who did made a killing.

Ask any professional money manager what his reaction to a coup d’état in Washington would be, their response definitely would NOT be to run out and buy a ton of Tesla (TSLA). Yet, that was exactly the perfect thing to do, the stock soaring an astonishing $135, or 18% in two days. I have many followers who did exactly that and they made millions.

All I can say is that if a market gets hit with an insurrection, and exploding pandemic, and a crashing economy and only goes down 400 points and then bounces back the next day, you want to buy the hell out of it.

I’m talking about going on margin and taking a second mortgage on your home and pouring it into stocks. You might even consider going to a loan shark and borrowing at 18% because you can easily make double that in the right stocks.

After the Biden win and the Georgia sweep, there is now more rocket fuel pouring into the stock market than ever. Call it the “Biden blank check”. Estimates of new spending and subsidies about to hit the market now go up to $10 trillion. Let me list some of them:

*$2 trillion in enforced savings by locked up American consumers.

*Credit card balances have collapsed to multi-year lows, making available hundreds of billions in spending power.

*Trillions of Money market balances sitting on the sidelines yielding zero

*$908 billion stimulus package passed in the closing days of 2020

*A further $2 trillion stimulus package to pass shortly, including $2,000 checks for all 150 million US taxpayers.

*Add another $2 trillion infrastructure budget

*$1 trillion in student loan forgiveness for 10 million borrowers at $10,000 each

*Enormous subsidies for any alternative energy companies and Tesla cars

*The return of the deductibility of $1 trillion worth of state and local real estate taxes (known as (SALT)).

MUCH OF THIS CASH MOUNTAIN IS GOING STRAIGHT INTO THE STOCK MARKET!

It all sets up a stock market that has the potential to have “extreme” moves to the upside, according to my friend, Fundstrat’s Tom Lee.

All you need to retire early is someone to point you in the right direction, into the right sectors and the right stocks. Actually, I happen to know just the right person who can do that and that would be me!

Storming of the Capital shut down markets. After the initial crash, markets flatlined as the entire country dropped what they were doing and glued themselves to a TV, their jaws hanging open. The Dow dove 400 points, bonds and the US dollar stabilized, Tesla and oil took big hits, and gold and silver took off. The electoral college vote has been suspended, gunfights broke out on the house floor, and several explosive devices placed. Trump incited his followers to attack the capitol and they did exactly that. Washington DC is now subject to a 6:00 PM curfew for two weeks. Is this the beginning of the 2024 presidential election? It’s the worst day in Washington since the British burned it in 1814.

Democrats took Georgia, giving them Senate control and a blank check on spending for at least two years. Trump clearly blew the election for his party. My 3X short in bonds soared as the market crashed. Banks rocketed on a 10-basis point leap in interest rates. Infrastructure plays went ballistic. The US dollar faded. Add another couple of percentage points of US GDP growth for 2021.

Tesla Shorts posted biggest loss in history, setting on fire a staggering $38 billion in short positions. Many of these were financed by big oil looking to put Tesla out of business. The short interest in the stock has plunged from 37% to 5%. Did I mention that Tesla was the biggest Mad Hedge long of 2020? I’ve been buying it since it was a split-adjusted $3.30 a share in 2010 against a Friday close of $880, a gain of 290X. Elon Musk is now the richest man in the world and he’s only just getting started!

Tesla met its 500,000-unit 2020 target, far in excess of analyst forecasts. Q4 came in at a surprise 180,570 units. The firm’s 2021 target is 1.1 million units. The market Cap is about to touch $1 trillion, more than all of the global car industry combined. The Model 3 is doing the heavy lifting. Model Y production in Shanghai is about to ramp up and Berlin is to follow. If Tesla can mass-produce their solid-state batteries, they’ll attain a global monopoly in the car industry with 25 million units a year and a share price of $10,000.

A Saudi surprise production cut, a million barrels a day, sent oil over $50. But with demand that weak, how long can the rally last? The market is entering short-selling territory. I bet you didn’t use much gas today commuting from your bedroom to your home office. Use the rally to unload what energy you have left. Sell the (XLE) on rallies.

Bitcoin topped $42,000, more than doubling in a month, and exceeded $1 trillion as an asset class. A Biden-run economy means more money creation which has to find a home. My friend’s pizza purchase for 8 Bitcoin a decade ago is now worth $320,000. I hope it was good!

The Nonfarm Payroll came in at a loss of 140,000, giving more credence to the Q1 double-dip scenario and far worse than expected. The headline Unemployment Rate came in unchanged at 6.7%, Leisure & Hospitality lost a mind-blowing 498,000 and an incredible 3.9 million since January. Private Education lost 63,000 and Government 45,000. Professional & Business Services gained 161,000. The real U-6 Unemployment Rate is a very high 11.6%.

The bond crash has only just begun, with the (TLT) down $8 on the week. The risk/reward is the worst of any financial asset anywhere. I am maintaining my triple short position. Massive government borrowing will be a death knell for fixed income investors.

When we come out the other side of pandemic, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil cheap, there will be no reason not to. The Dow Average will rise by 400% to 120,000 or more in the coming decade. The American coming out the other side of the pandemic will be far more efficient and profitable than the old. Dow 120,000 here we come!

My Mad Hedge Global Trading Dispatch closed out a blockbuster 2020 with a blockbuster 10.20% in December, taking me up to an eye-popping 66.64% for the year. I’m up 81% since the March low. In 2021, I shot out of the gate with an immediate 5.93% profit for the first four trading days of the year.

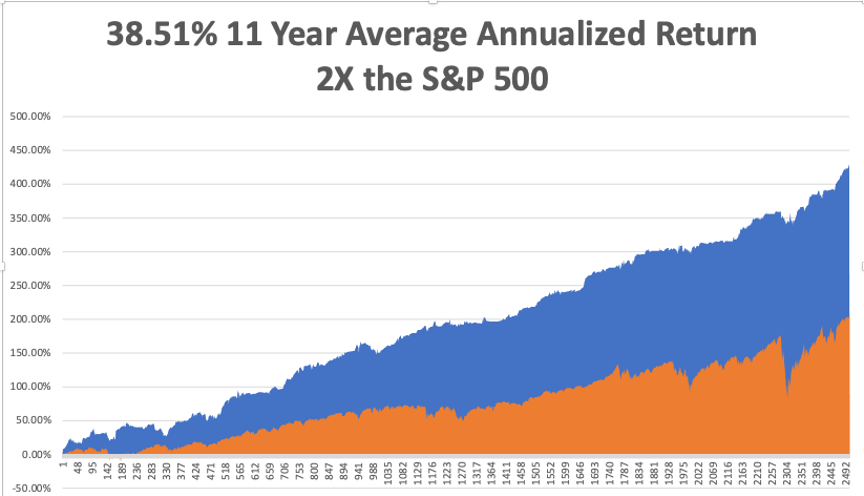

That brings my eleven-year total return to 428.48% double the S&P 500 over the same period. My 11-year average annualized return now stands at a nosebleed new high of 38.51%. My trailing one-year return exploded to 72.57%, the highest in the 13-year history of the Mad Hedge Fund Trader. We have earned 89% since the March low.

The coming week will be a slow one on the data front after last week's fireworks. We also need to keep an eye on the number of US Coronavirus cases at 22 million and deaths 370,000, which you can find here.

When the market starts to focus on this, we may have a problem.

On Monday, January 11 at 11:00 AM EST, US Inflation Expectations are released, which will increasingly become an area of interest.

On Tuesday, January 12 at 4:30 PM, API Crude Inventories are published.

On Wednesday, January 13 at 8:30 AM, the US Inflation Rate for December is announced.

On Thursday, January 14 at 8:30 AM, the Weekly Jobless Claims are published. We also get November Housing Starts.

On Friday, December 15 at 8:30 AM, December Retail Sales are printed. Q4 earnings seasons starts, with JP Morgan Chase (JPM) and Wells Fargo (WFC) reporting. At 2:00 PM we learn the Baker-Hughes Rig Count.

As for me, I’ll be taking my old Toyota Highlander down to the dealer in Reno. Squirrels moved into the engine and ate the wiring, knocking out the heater and the fan. All part of the cost of living in a mountain paradise. However, you have to share it with the critters.

I’ll also be investing in some pepper spray.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

“Getting rid of your great companies and adding to you bad companies is like cutting the flowers and watering the weeds,” said my former client and mentor, Magellan Fund’s Peter Lynch.

Global Market Comments

January 8, 2021

Fiat Lux

Featured Trade:

(JANUARY 6 BIWEEKLY STRATEGY WEBINAR Q&A),

(TSLA), (SQM), (GLD), (SLV), (GOLD), (WPM), (TLT), (FCX), (IBB), (XOM), (UPS), (FDX), (ZM), (DOCU), (VZ), (T), (RTX), (UT), (NOC),

(FXE), (FXY), (FXA), (UUP)

Below please find subscribers’ Q&A for the January 6 Mad Hedge Fund Trader Global Strategy Webinar broadcast from Incline Village, NV.

Q: Any thoughts on lithium now that Tesla (TSLA) is doing so well?

A: Lithium stocks like Sociedad Qimica Y Minera (SQM) have been hot because of their Tesla connection. The added value in lithium mining is minimal. It basically depends on the amount of toxic waste you’re allowed to dump to maintain profit margins—nowhere close to added value compared to Tesla. However, in a bubble, you can't underestimate the possibility that money will pour into any sector massively at any time, and the entire electric car sector has just exploded. Many of these ETFs or SPACs have gone up 10 times, so who knows how far that will go. Long term I expect Tesla to wildly outperform any lithium play you can find for me. I’m working on a new research piece that raises my long-term target from $2,500 to $10,000, or 12.5X from here, Tesla becomes a Dow stock, and Elon Musk becomes the richest man in the world.

Q: Won’t rising interest rates hurt gold (GLD)? Or are inflation and a weak dollar more important?

A: You nailed it. As long as the rate rise is slow and doesn't get above 1.25% or 1.50% on the ten-year, gold will continue to rally for fears of inflation. Also, if you get Bitcoin topping out at any time, you will have huge amounts of money pour out of Bitcoin into the precious metals. We saw that happen for a day on Monday. So that is your play on precious metals. Silver (SLV) will do even better.

Q: What are your thoughts on TIPS (Treasury Inflation Protected Securities) as a hedge?

A: TIPS has been a huge disappointment over the years because the rate of rise in inflation has been so slow that the TIPS really didn’t give you much of a profit opportunity. The time to own TIPS is when you think that a very large increase in inflation is imminent. That is when TIPS really takes off like a rocket, which is probably a couple of years off.

Q: Will Freeport McMoRan (FCX) continue to do well in this environment?

A: Absolutely, yes. We are in a secular decade-long commodity bull market. Any dip you get in Freeport you should buy. The last peak in the previous cycle ten years ago was $50, so there's another potential double in (FCX). I know people have been playing the LEAPS in the calendars since it was $4 a share in March and they have made absolute fortunes in the last 9 months.

Q: Is it a good time to take out a bear put debit spread in Tesla?

A: Actually, if you go way out of the money, something like a $1,000-$900 vertical bear put spread, with the 76% implied volatility in the options market one week out, you probably will make some pretty decent money. I bet you could get $1,500 from that. However, everyone who has gone to short Tesla has had their head handed to them. So, it's a high risk, high return trade. Good thought, and I will actually run the numbers on that. However, the last time I went short on Tesla, I got slaughtered.

Q: Any thoughts on why biotech (IBB) has been so volatile lately?

A: Fears about what the Biden government will do to regulate the healthcare and biotech industry is a negative; however, we’re entering a golden age for biotech invention and innovation which is extremely positive. I bet the positives outweigh the negatives in the long term.

Q: Oil is now over $50; is it a good time to buy Exxon Mobil (XOM)?

A: Absolutely not. It was a good time to buy when it was at $30 dollars and oil was at negative $37 in the futures market. Now is when you want to start thinking about shorting (XOM) because I think any rally in energy is short term in nature. If you’re a fast trader then you probably can make money going long and then short. But most of you aren't fast traders, you’re long-term investors, and I would avoid it. By the way, it’s actually now illegal for a large part of institutional America to touch energy stocks because of the ESG investing trend, and also because it’s the next American leather. It’s the next former Dow stock that’s about to completely disappear. I believe in the all-electric grid by 2030 and oil doesn't fit anywhere in that, unless they get into the windmill business or something.

Q: With Amazon buying 11 planes, should we be going short United Parcel Service (UPS) and FedEx (FDX)?

A: Absolutely not. The market is growing so fast as a result of an unprecedented economic recovery, it will grow enough to accommodate everyone. And we have already had huge performance in (UPS); we actually caught some of this in one of our trade alerts. So again, this is also a stay-at-home stock. These stocks benefited hugely when the entire US economy essentially went home to go to work.

Q: Should we keep our stay-at-home stocks like DocuSign (DOCU), Zoom (ZM), and UPS (UPS)?

A: They are way overdue for profit-taking and we will probably see some of that; but long term, staying at home is a permanent fixture of the US economy now. Up to 30% of the people who were sent to work at home are never coming back. They like it, and companies are cutting their salaries and increasing their profits. So, stay at home is overdone for the short term, but I think they’ll keep going long term. You do have Zoom up 10 times in a year from when we recommended it, it’s up 20 times from its bottom, DocuSign is up like 600%. So way overdone, in bubble-type territory for all of these things.

Q: Are telecom stocks like Verizon (VZ) and AT&T (T) safe here?

A: Actually they are; they will benefit from any increase in infrastructure spending. They do have the 5G trend as a massive tailwind, increasing the demand for their services. They’re moving into streaming, among other things, and they had very high dividends. AT&T has a monster 7% dividend, so if that's what you’re looking for, we’re kind of at the bottom of the range on (T), so I would get involved there.

Q: Should we sell all our defense stocks with the Biden administration capping the defense budget?

A: I probably would hold them for the long term—Biden won’t be president forever—but short term the action is just going to be elsewhere, and the stocks are already reflecting that. So, Raytheon (RTX), United Technologies (UT), and Northrop Grumman (NOC), all of those, you don’t really want to play here. Yes, they do have long term government contracts providing a guaranteed income stream, but the market is looking for more immediate profits, or profit growth like you have been getting in a lot of the domestic stocks. So, I expect a long sideways move in the defense sector for years. Time to become a pacifist.

Q: Is it safe to buy hotels like Marriott (MAR), Hyatt (H), and Hilton (HLT)?

A: Yes, unlike the airlines and cruise lines, which have massive amounts of debt, the hotels from a balance sheet point of view actually have come through this pretty well. I expect a decent recovery in the shares, probably a double. Remember you’re not going to see any return of business travel until at least 2022 or 2023, and that was the bread and butter for these big premium hotel chains. They will recover, but that will take a bit longer.

Q: How about online booking companies like Expedia (EXPE) and Booking Holdings Inc, owner of booking.com, Open Table, and Priceline (BKNG)?

A: Absolutely; these are all recovery stocks and being online companies, their overhead is minimal and easily adjustable. They essentially had to shut down when global travel stopped, but they don’t have massive debts like airlines and cruise lines. I actually have a research piece in the works telling you to buy the peripheral travel stocks like Expedia (EXPE), Booking Holdings (BKNG), Live Nation (LYV), Madison Square Garden (MSGE) and, indirectly, casinos (WYNN), (MGM) and Uber (UBER).

Q: What about Regeneron (REGN) long term?

A: They really need to invent a new drug to cure a new disease, or we have to cure COVID so all the non-COVID biotech stocks can get some attention. The problem for Regeneron is that when you cure a disease, you wipe out the market for that drug. That happened to Gilead Sciences (GILD) with hepatitis and it’s happening with Regeneron now with Remdesivir as the pandemic peaks out and goes away.

Q: What about Chinese stocks (FXI)?

A: Absolutely yes; I think China will outperform the US this year, especially now that the new Biden administration will no longer incite trade wars with China. And that is of course the biggest element of the emerging markets ETF (EEM).

Q: Will manufacturing jobs ever come back to the US?

A: Yes, when American workers are happy to work for $3/hour and dump unions, which is what they’re working for in China today. Better that America focuses on high added value creation like designing operating systems—new iPhones, computers, electric cars, and services like DocuSign, Zoom—new everything, and leave all the $3/hour work to the Chinese.

Q: What about long-term LEAPS?

A: The only thing I would do long term LEAPS in today would be gold (GOLD) and silver miners (WPM). They are just coming out of a 5-month correction and are looking to go to all-time highs.

Q: What about your long-term portfolio?

A: I should be doing my long-term portfolio update in 2 weeks, which is much deserved since we have had massive changes in the US economy and market since the last one 6 months ago.

Q: Do you have any suggestions for futures?

A: I suggest you go to your online broker and they will happily tell you how to do futures for free. We don’t do futures recommendations because only about 25% of our followers are in the futures market. What they do is take my trade alerts and use them for market timing in the futures market and these are the people who get 1,000% a year returns. Every year, we get several people who deliver those types of results.

Q: Will people go back to work in the office?

A: People mostly won’t go back to the office. The ones who do go back probably won't until the end of the summer, like August/September, when more than half the US population has the Covid-19 vaccination. By the way, getting a vaccine shot will become mandatory for working in an office, as it will in order to do anything going forward, including getting on any international flights.

Q: What is the best way to short the US dollar?

A: Buy the (FXE), the (FXY), the (FXA), or the (UUP) basket.

Q: Silver LEAP set up?

A: I would do something like a $32-$35 vertical bull call spread on options expiring in 2023, or as long as possible, and that increases the chance you’ll get a profit. You should be able to get a 500% profit on that LEAP if silver keeps going up.

Q: What about agricultural commodities?

A: Ah yes, I remember orange juice futures well, from Trading Places, where I also once made a killing myself. Something about frozen iguanas falling out of trees was the tip-off. We don’t cover the ags anymore, which I did for many years. They are basically going down 90% of the time because of the increasing profitability and efficiency of US farmers. Except for the rare weather disaster or an out of the blue crop disease, the ags are a loser’s game.

Q: Can we view these slides?

A: Yes, we load these up on the website within two hours. If you need help finding it just send an email or text to our ever loyal and faithful Filomena at support@madhedgefundtrader.com and she will direct you.

Q: Do you have concerns about Democrats regulating bitcoin?

A: Yes, I would say that is definitely a risk for Bitcoin. It is still a wild west right now and there are massive amounts of theft going on. It is a controlled market, with bitcoin miners able to increase the total number of points at any time on a whim.

Good Luck and Stay Healthy

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.