I was born in the middle of a pandemic.

It was polio, and in the early 1950s, it was claiming 150,000 kids a year just in the US. You know polio. You’ve seen the pictures of the kids with withered legs or living in iron lungs, the ventilators of their day.

My mom contracted polio in the 1930s and spent a year in quarantine. They didn’t understand then that the virus was in the drinking water.

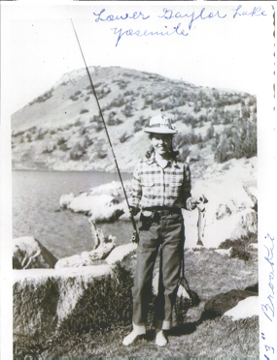

She lost the use of her legs for a time. My grandfather’s cure was to take her hiking in the High Sierras every weekend to rebuild her muscles. During WWII, he had to buy gas coupons on the black market to make the round trip from LA to Yosemite.

It worked well enough for mom to earn a scholarship to USC where she met my dad, a varsity football player. By the time I came along, Jonas Salk discovered a vaccine, which was infused into a sugar cube and given to me at the Santa Anita Racetrack along with tens of thousands of others. It was one of the big events of American history.

Some 70 years later, I am maintaining the family tradition, forcing my kids out on backpacks a couple of times a week, they're moaning and complaining all the way.

It looks like the first wave of the Corona pandemic isn’t even over yet. That’s why the Dow Average managed to puke out some 10% in days.

So, here is the conundrum: How much can we take the market down in the face of the greatest monetary and fiscal stimulus in history. Some $9 trillion has already been spent and there is at least another $5 trillion behind it.

My bet is a few more thousand points down to 24,000 but not much more than that. If this turns into a rout and a retest of the lows, the Fed will simply turn on the presses and print more money. After all, the marching orders from the top are to keep stocks high into the election, whatever the cost.

One of the reasons we are seeing such wild swings in the market is that the market itself doesn’t know what it’s worth. That’s because this is the most artificially manipulated market in history, thanks to the government stimulus, 20 times what we saw in 2008-2009.

Stocks can’t figure out if they are worthless, or worth infinity, and we are wildly whipsawing back and forth between two extremes.

Take that stimulus away and the Dow Average would be worth 14,000 or less. Stimulus will go away someday, and when it goes away, there will be a big hit to the market. It’s anyone’s guess as to timing. Ask the Covid-19 virus.

We have seen countless market gurus being wrong about this market, many of whom are old friends of mine. That’s because they, like I, see the long-term damage being wrought to the economy. Recovering 80% of what we lost will be easy. The last 20% will be a struggle.

That alone amounts to one of the worst recessions we have ever seen. This is going to be a loooong recovery. Some forecasters don’t expect US GDP to recover to the 2019 level of $21.43 trillion until 2025.

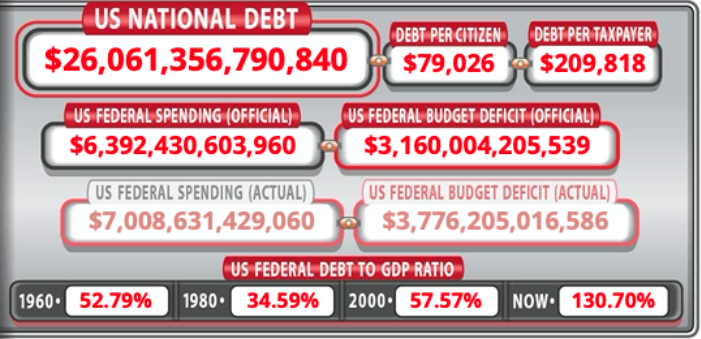

In the meantime, the national debt is soaring, now at $26 trillion, and will soon become a major drag on the economy. The budget deficit alone this year is now pegged at an eye-popping $3 trillion, the largest in history.

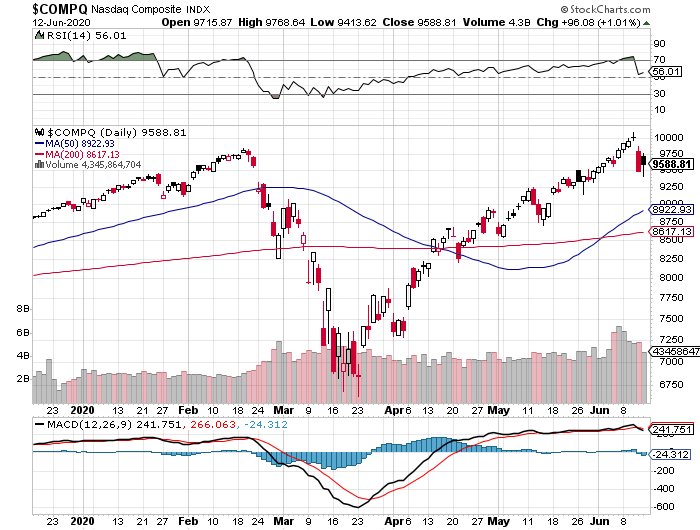

The S&P 500 turned positive on the year for a whole day. It’s been an amazing move, the largest in history in the shortest time, some 47% in ten weeks. NASDAQ hit my year-end target of $10,000, then immediately gave back 10%.

The problem now is that stocks are still the most overbought in history and risk is the highest since January. Much trading is now dominated by newly minted day traders chasing bankrupt stocks like Hertz (HTZ) with their $1,200 stimulus check. Far and away, the better trade is to sell short bonds. After that, buy gold (GLD) and sell short the US Dollar (UUP).

Stocks then dove 7.4% on second wave fears as US cases top 2 million and deaths exceeded 114,000. Jay Powell says he won’t raise interest rates until 2023 at the earliest. The “reopening” stocks of airlines, hotels, and cruise lines are leading the downturn from crazy overbought levels.

Houston may have to close down again, in the wake of soaring Corona cases after a too early reopening. Other cities will follow. Cases in Arizona are also hitting new highs. It’s not what the market wanted to hear.

Weekly Jobless Claims hit 1.54 million, at a falling rate, but still at horrendous absolute levels. That’s better than last week’s 1.9 million. Some 20.9 million are still receiving state unemployment benefits, or 13.1% or the total workforce. These numbers certainly don’t justify a stock market near an all-time high.

The Fed expects Unemployment to remain stubbornly high, not falling to 9.3% by yearend. I think that’s highly optimistic. Some 20% of the 43 million lost jobs are never coming back, giving you an embedded U-6 rate of over 10%. It is easier and faster to fire people than to hire them back.

Election Poll numbers are starting to affect the market. Polls showing Trump 10%-14% points behind Joe Biden in the November presidential election opened stocks down 400 points on Monday. The betting polls in London are confirming these numbers.

The Republican leadership is jumping ship. A Biden win will bring higher corporate taxes, balanced budgets, less liquidity for the stock market, fewer Tweets, and clipped wings for the top 1%. Is this a trigger for the next market correction? We’ll find out in five months. When will stocks notice that?

Bond King Jeffrey Gundlach absolutely hates stocks, predicting we could take out the March lows. He believes the monster rally in big tech is unsustainable. The better trades are to sell short the US dollar (UUP) and to buy gold (GLD). I agree with much of this, but Geoff’s calls can take 6-12 months to come true, so don’t hold your breath, or bet the ranch.

Tesla hit a new all-time high, as I expected, ticking at $1,220. An 11% price cut is boosting sales and market share, while (GM) and (F) are dying. The Model Y, which looks like the love child of a Model X and Tesla 3, is expected to be their biggest seller ever. This is one bubble stock that IS worth chasing. Buy (TSLA) dips up to $2,500. No kidding!

New Zealand became the first Corona-free country, with zero cases, so it can be done. An island country with all international flights grounded, aggressive social distancing restrictions, and an ambitious contract tracing, the land of kiwis had everything going for it. Most importantly, they had the right leadership that listened to scientists, which the worst-hit countries of Sweden, Brazil, and the US are sadly lacking.

The Mad Hedge June 4 Traders & Investors Summit recording is up. For those who missed it, I have posted all 9:15 hours of recordings of every speaker. This is a collection of some of the best traders and investors I have stumbled across over the past five decades. To find it please click here.

When we come out on the other side of this, we will be perfectly poised to launch into my new American Golden Age, or the next Roaring Twenties. With interest rates still at zero, oil at a cheap $34 a barrel, there will be no reason not to. The Dow Average will rise by 400% or more in the coming decade.

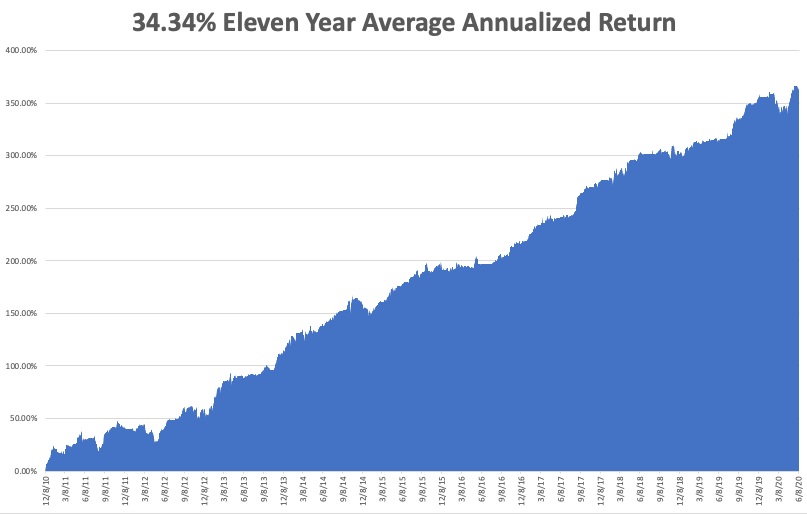

My Global Trading Dispatch performance took it on the nose last week. I got stopped out of my shorts at the market top, then took a hit on my bonds shorts. My 11-year performance stands at 360.61%.

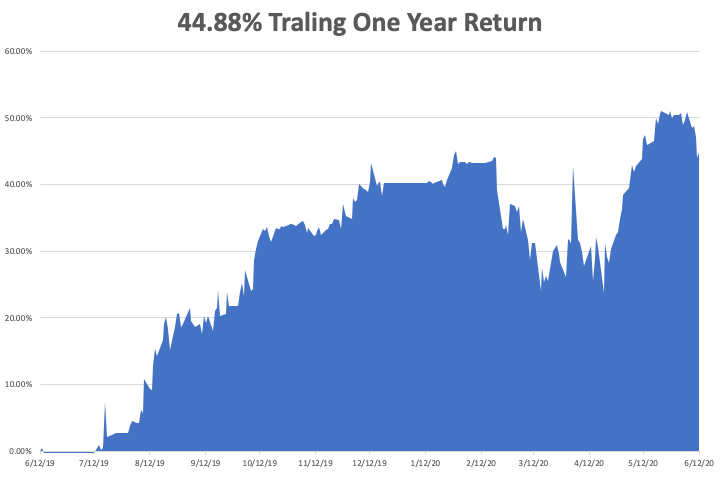

That takes my 2020 YTD return up to a more modest +4.70%. This compares to a loss for the Dow Average of -12.2%, up from -37%. My trailing one-year return retreated to 44.88%. My eleven-year average annualized profit backed off to +34.34%.

The only numbers that count for the market are the number of US Coronavirus cases and deaths, which you can find here.

On Monday, June 15 at 12:00 PM EST, the June New York State Manufacturing Index is out.

On Tuesday, June 16 at 12:30 PM EST, US Retail Sales for May are released.

On Wednesday, June 17 at 8:15 AM EST, Housing Starts for May are announced.

At 10:30 AM EST, the EIA Cushing Crude Oil Stocks are published.

On Thursday, June 18 at 8:30 AM EST, Weekly Jobless Claims are announced.

On Friday, June 19 at 2:00 PM EST, the Baker Hughes Rig Count is out.

As for me, I am waiting for my sugar cube.

In the meantime, I will spend the weekend carefully researching the recreational vehicle market. If everything goes perfectly, a Covid-19 vaccine will be not available to the general public for at least two years.

Until then, my travel will be limited to the distance I can drive. Travel while social distancing with my own three-man “quaranteam” will be the only safe way to go.

When the New York Times highlights it, as they did this weekend, it’s got to be a major new thing.

Stay healthy.

John Thomas

CEO & Publisher

The Diary of a Mad Hedge Fund Trader