"People are investing with a rear view mirror. Last year, you had people legitimately scared out of the market. Unfortunately, you are losing a generation of investors at a time when they ought to be thinking about buying high quality stocks." said Hersh Cohen of Clearbridge Advisors.

Global Market Comments

December 12, 2017

Fiat Lux

Featured Trade:

(THURSDAY DECEMBER 28 MINNEAPOLIS STRATEGY LUNCHEON)

(DINNER WITH LAM RESEARCH),

(LRCX), (AMAT), (ASML), (TOELY),

(THERE ARE NO GURUS),

(TESTIMONIAL)

It was one of those normally mundane end of year seasonal events.

But what I heard blew my mind and will substantially shape my trading and investment strategy for 2018.

By now you already know that I used some of my stock market winnings this year to buy a vintage Steinway concert grand piano (click here for "The Inflation Hedge You've Never Heard Of.")

Well, you can't own a Steinway without a recital, and ours was held last weekend.

After listening to an assortment of children display their skills with Pachelbel, Ode to Joy, and The Entertainer, we adjourned for a celebratory buffet dinner.

Making small talk with the other parents, I asked one particularly articulate gentleman what he did for a living. He too had enjoyed an excellent year, and also used his profits to buy a Steinway, although his was a cheaper upright model.

It turned out that he was the chief technology officer at LAM Research (LRCX).

Had I heard of it?

Not only did I know the company intimately, I had recommended it to my clients and caught the better part of the nearly 400% move since the beginning of 2016. Furthermore, I was expecting another double in the share price in the years ahead.

Was I right to be so bullish?

The man then launched into a detailed review of the company's prospects for the next three years.

The blockbuster development that no one outside the industry sees coming is China's massive expansion of its semiconductor production.

More than a dozen gigantic fabrication plants are planned, the scale of which is unprecedented in history. Some of these fabs are ten times larger than those built previously.

This is creating exponential growth opportunities for the tiny handful of companies that produce the highly specialized machines essential to the manufacture of cutting edge semiconductors, including Applied Materials (AMAT), ASML (ASML), Tokyo Electron (TOELY), KLA-Tencor, and LAM Research (LRCX).

Everyone in the industry has boggled minds over the demand they are seeing for their products.

The reality is that artificial intelligence is rapidly working its way into all consumer and industrial products far faster than anyone realizes, creating astronomical demand for the chips needed to implement it.

Bitcoin mining is also creating enormous new demand for chips that no one remotely imagined possible even two years ago.

As a result, the industry has been caught flat footed with severe capacity shortages. They are all racing to add capacity as fast as they can. Profit margins are exploding.

On October 17, (LRCX) announced Q3 revenues of $2.48 billion, a staggering increase of 51.84% over the previous year, and a gross margin of 46.4%. The operating margin was 28%, generating net income of $591 million.

That gives the shares a very reasonable price earnings multiple of 16.95X, a 10% discount to the 18X multiple for the S&P 500. That is an incredible deal for one of the fastest growing companies in America.

Samsung of South Korea was far and away it largest customer, accounting for 38% of total sales.

On November 14 the company announced an eye-popping $2 billion share repurchase program that is certain to drive the price higher.

If there is one dark cloud on the horizon, it is the loss of the research & development tax credit embedded deep in the proposed Republican tax bill.

This will have a noticeable and negative impact on (LRCX)'s bottom line. Still, my friend thought that the company could offset this loss with faster sales growth and margin expansion.

However, many other technology companies in Silicon Valley won't be able to bridge that gap. It is a hugely anti-technology move for the government to take.

My fellow Steinway owner thought that LAM Research could easily see sales double in three years as long as there is no recession, which I believe is at least two years off. As for the share price, he couldn't comment, but remained hopeful, as he was a large owner himself.

Of course, the trick is how to buy a stock that has just risen by 400% in two years. Right here at $185.15 we are 15.84% off the all-time high of $220. So you could start scaling in here, and build a larger position over time.

You only get opportunities like this a couple of times a decade, and it's better to be too aggressive than too cautious.

To learn more about LAM Research, click here to visit their website.

Thanks John...rough ride out of the gates here...but I wouldn't want to be riding with anyone but you...you are my life raft in this treacherous world of investing, and thank you for being who you are and for all that you do.

Take care,

Greg

Agoura, California

Global Market Comments

December 11, 2017

Fiat Lux

Featured Trade:

(CHICAGO WEDNESDAY, DECEMBER 27 GLOBAL STRATEGY LUNCHEON),

(MARKET OUTLOOK FOR THE WEEK AHEAD, or

FRON RUNNING 2018),

(AAPL), (BAC), (UUP), (TLT), (BITCOIN),

(THE "INTRODUCTION TO RISK MANAGEMENT" TRAINING VIDEO IS POSTED)

Investors have started to front run 2018 big time.

If you want a handy crystal ball to look into how asset classes will perform in 2018, merely surmise what took place last week.

Banks (BAC) took off like a rocket, industrials (X) outperformed FANG's, bonds (TLT) got crushed, and the US dollar (UUP) went from strength to strength. Expect these newly born trends to carry well into the New Year.

Banks in particular are a no brainer. They trade at discount earnings multiple to the market (15X vs 18X). They benefit when interest rates rise (they are). And they are huge beneficiaries of deregulation that has already started.

It turns out that a short position in the bond market is quite a nice thing to have when congress is threatening to shut down the government and default on its interest payments. The Friday deadline was missed by hours, thanks to temporary measures, and the new deadline for Armageddon is December 22.

As for the FANG's (AAPL), the only real argument for them to rise faster than their earnings growth is that their multiples are still only a fraction of the 2000 dotcom highs.

Some of the new action can be traced to a tax bill that may pass eventually. But the big driver will be an expansion of corporate earnings continuing for a ninth year. A lot of this is just traditional late cycle stuff.

The good news is that the S&P 500 is up 18% on the year, and 21% with dividends.

The bad news? I only have seven days to lose ten pounds so I can fit into my winter weight suits I will wear at my upcoming December 27 and 28 Chicago and Minneapolis strategy luncheons. To buy tickets please click here.

Running around doing my last-minute Christmas shopping, I find an economy that is the strongest in 20 years. Nary a parking space is to be found at the malls. The lines are endless. And good luck finding an empty seat on an airplane anywhere.

The November Nonfarm Payroll Report, up 228,000, certainly gives credence to this view. The headline Unemployment Rate stayed level at a decade low at 4.1%, while wage growth was almost nil.

Speaking on the phone to clients around the world, it is clear than many made fortunes following my trading and investment advice this year. I am hearing stories of mortgages paid off, college degrees financed, and once in a lifetime vacations enjoyed.

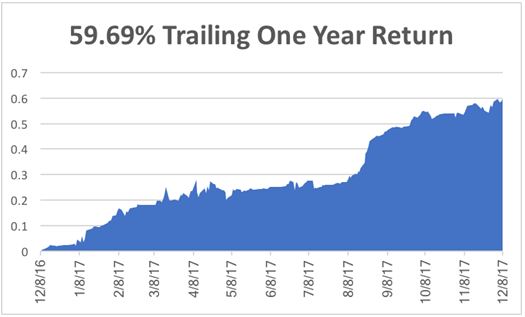

It's all music to my ears because I do this not for the money, but to give the regular guy an unfair advantage in the markets. It seems to be working. You can see it all in my trailing one year performance, now up a ballistic 59.69%, a decade high (see chart below).

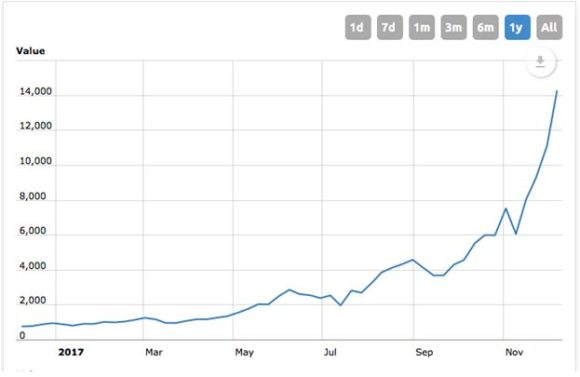

If there is one dark cloud on the horizon it is Bitcoin, whose parabolic move has left long time pros stunned, aghast, and incredulous. Not even 16th century tulips saw this meteoric rate of price appreciation. It hit $17,500 one point last week.

When the total market capitalization of crypto currencies was a mere $50 million niche for Silicon Valley geeks and nerds, veterans could snicker. Now they are worth $500 billion.

If the market size soars to $1 trillion, which it could do in a few months, and then goes to zero, the event could reach the magnitude of the 2008 financial crisis in terms of vaporized wealth. The onset of Bitcoin futures trading this weekend will simply add fuel to the fire.

Bitcoin is now sucking money in from all over the world, and speculators are selling every other asset class on the planet to finance it. The history of this instrument shows that it can pull back by 75% at any time without warning.

I'll be watching Bitcoin from the sidelines, thank you very much. If I am wrong, you can all take me out to dinner with your profits. If I can buy (BAC) with a 1.67% dividend just before it is about to double, I'll take that all day long.

On Monday, December 11, at 10:00 AM EST, the JOLTS report is out on job openings and hiring.

On Tuesday, December 12 the last FOMC meeting of the year begins. At 6:00 AM EST the November NFIB Small Business Optimism Index is published.

On Wednesday, December 13 at 8:30 AM EST, we obtain the November Consumer Price Index. The Fed is likely to announce a 25 basis point hike in interest rates at 2:00 PM EST. The weekly EIA Petroleum Status Report is out at 10:30 AM EST.

Thursday, December 14 leads with the 8:30 EST release of the Weekly Jobless Claims. At the same time, we get November Retails Sales, which should be blistering.

On Friday, December 15 is a quadruple witching for the options market. At 9:15 AM the important November Industrial Production is published.

Then at 1:00 PM, we receive the Baker-Hughes Rig Count, which lately has started to turn up again.

And most importantly, it is my last working day of 2017.

As for me, I'll be packing up the car for Tahoe, trying to cram in a few days of skiing and snowshoeing before my winter trip to the Midwest for Christmas and New Year's. I'll be bringing every pair of silk long underwear I own.

Now that you know how to make money in the options market, thanks to my Trade Alert service, I am going to teach you how to hang on to it.

There is no point in being clever and executing profitable trades only to lose your profits through some simple, careless mistakes.

So I have just posted a new training video on Risk Management.

The first goal of risk control is to preserve whatever capital you have. I tell people that I am too old to lose all my money and start over again as a junior trader at Morgan Stanley. So I am pretty careful when it comes to risk control.

The other goal of risk control is the art of managing your portfolio to make sure it is profitable, no matter what happens in the marketplace. Ideally, you want to be a winner whether the market moves up, down, or sideways.

Remember, we are not trying to beat an index here. Our goal is to make absolute returns, or real dollars, at all times. You can't eat relative performance, nor can you use it to pay your bills.

So the second goal of every portfolio manager is to make it bomb proof. You never know when a flock of black swans are going to come out of nowhere, or another geopolitical shock occurs, causing the market crash.

I'll also show you how to use my Trade Alert service the squeeze every dollar out of your trading.

So, let's get on with it!

To watch the video, please click Introduction to Risk Management.

Global Market Comments

December 8, 2017

Fiat Lux

Featured Trade:

(A NOTE ON OPTIONS CALLED AWAY),

(BAC), (TLT), (FXE),

(THE TECHNOLOGY NIGHTMARE COMING TO YOUR CITY)

(TESTIMONIAL)

With the December 15 options expiration only five trading days away, we have the good fortune to have four profitable deep in-the-money options positions.

Those include:

The Bank of America (BAC) December, 2017 $25-$26.50 in-the-money vertical BULL CALL spread

The iShares Barclays 20+ Year Treasury Bond Fund (TLT) December, 2017 $129-$131 in-the-money vertical BEAR PUT Spread

The Currency Shares Euro Trust (FXE) December, 2017 $111-$113 in-the-money vertical BULL CALL spread

The Currency Shares Euro Trust (FXE) December, 2017 $116-$118 in-the-money vertical BEAR PUT spread

The probability is now high that all of these positions will expire at their maximum profit point and that you will close out December with another blockbuster month.

It is remotely possible that some of you may receive notices from your brokers over the next few days warning that your short call or short put positions may get called away.

Brokers have recently started doing this to avoid getting sued for failure to give notice, which they always do.

While it is theoretically possible that your in-the-money calls could get called away, it is highly unlikely.

Weird stuff happens on options expirations.

A call owner may need to cover a short position right at the close today and exercising his long calls (your short calls) is the only way to cover it.

There are thousands of algorithms out there, which may arrive at some twisted logic that the calls needs to be exercised.

And yes, calls get exercised by accident. There are still a few humans left in this market.

All of these fun and games happen right at the market close.

If you do receive such an exercise notice, take it as a gift. It means you don't have to wait until the expiration day to come out of you position with its maximum profit, you can exit RIGHT NOW.

When options owners exercise their positions before expiration day, they are giving up all of the premium in those options. That lost premium becomes your profit, as you are short.

If your calls or puts ARE called away, this is what you do.

Call your broker and tell him you want to exercise YOUR long calls or puts to meet the short position in your calls or puts. This is a perfect hedge.

This exercise process is now full automated at most brokers, but it never hurts to follow up with a phone call if you get an exercise notice. Mistakes do happen.

If any of you are the slightest bit worried or confused by all of this, come out of your position RIGHT NOW at a small profit! You should never be worried or confused about any position tying up YOUR money.

Professionals do these things all day long, and exercises become second nature, just another cost of doing business. If you do this long enough, eventually you get hit. I bet you don't.

Calling All Options!

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.