Last year, whenever anyone asked me for a stock most likely to double in 2017, I uniformly responded with the same name: NVIDIA (NVDA).

For me, it was a no-brainer.

The processor manufacturer occupied the nexus of the entire movement towards machine learning and artificial intelligence, and then was still relatively unknown.

I lied.

The stock didn't double, it more than tripled, from $67 to a high of $219.

These days, I am being asked the same question.

But this time, I'm going to be boring. Believe it or not, the name to double again in 2018 is (NVDA).

You would think I am MAD to be chasing the big winner of 2017.

But take a look at their blockbuster earnings announced last week first, which blew away the street's most optimistic expectations.

Q3 revenue leapt 54% to just over $2.64 billion, and net profits of $1.33 a share, up 33% YOY, and 41.5% greater than expected.

Their gross operating margin is an eye popping 59.7%.

It is dominating in the fastest growing sectors of the technology space, including AI, virtual reality, and fast data processing.

Every automobile company is basing its self-driving technology on its XP computer.

And now there is a new game in town.

(NVDA) is a major beneficiary of the exponential growth of cryptocurrencies, whose need for processing power is growing voraciously.

At this point, the company has a huge installed base of users on which to build on.

Look at the spec sheets of anything you buy these days and you will find NVIDIA parts somewhere in the guts.

I bought a Dell Alienware Area 51gaming PC to run the Oculus Rift virtual reality hardware for my kids this Christmas (they don't read this letter on a daily basis). It came with a state of the art NVIDIA GeForce GTX 1080 graphics card.

I also happen to know that NVIDIA chips are lurking somewhere in my Tesla (TSLA) Model S-1 and Model X.

Most companies have only one or two artificial intelligence experts. NVIDIA has over 1,000.

While the stock is priced for perfection, it is continuing to deliver just that. The shares actually fell on the earnings announcement.

But let's face it. The momentum of this stock has been unassailable.

However, the company is so far ahead of its competitors it is actually increasing its lead. Nobody has a chance of catching them.

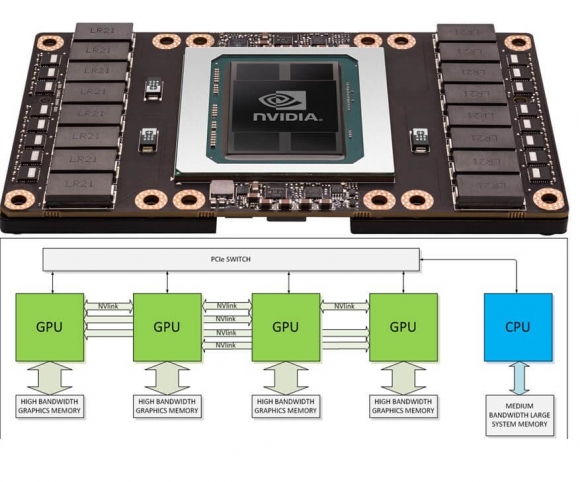

The company is managing an industrywide migration of processing power from the CPU to the GPU. You have to use their architecture, or you will go out of business.

This is why every PC manufacturer, including Dell (DVMT) and Hewlett Packard (HPQ), are partnering with them. IBM (IBM) is using their chips in their high-end machines.

This is because (NVDA) is now first to market with everything important.

Nvidia's dominance of the high-end GPU market is allowing it to soak up all of the spending that would normally have been at least somewhat split between itself and AMD.

Gaming was the big revenue booster for Nvidia, which now accounts for 59% of sales.

Sales of Nvidia's flagship product, the passively cooled 16GB Tesla P100 GPU, is being ravenously consumed by data centers around the country, and should double again in 2018.

And the company has just started to ship its new Volta-based Tesla V100 GPU, which offers a tenfold increase over previous generations.

Hold one of these dense, wicked fast processors in your hand and you possess nothing less than the future of western civilization.

Over the long term, the picture looks even better. It should continue with annual earnings growth of at least 20%-30% a year for the foreseeable future.

At a minimum, the shares have at least another double in them. If I'm wrong, they'll only go up 50%.

Not a bad choice to have.

To learn more about Nvidia, please visit their website by clicking here.

For those of you who did the trade at the beginning, or better yet, bought deep out of the money one year option LEAPS, well done!

I am hearing of 800% returns, or better.