Global Market Comments

December 23, 2016

Fiat Lux

Featured Trade:

(THE EIGHT WORST TRADES IN HISTORY),

(TESTIMONIAL)

First and foremost, thank you for what you do.

The small cost of this newsletter pays for itself a thousand times over. My returns mimic those of your portfolio for the year and for that I am grateful.?

The only suggestion I would offer is to keep doing what you are doing. It is people like you that will help return the once storied name to Wall Street.

Regards,

Shirin

Tampa, Florida

?Interest rates are the physical gravity of financial assets. The lower they are, the higher assets will levitate,? said Anthony Scaramucci, the founder and managing partner of SkyBridge Capital, a leading hedge fund of funds.

?

?

Global Market Comments

December 22, 2016

Fiat Lux

Featured Trade:

(REPORT FROM THE FROZEN WASTELANDS OF THE WEST)

I am writing this from a High Sierra peak at 12,000 feet in the dead of winter. It is 15 degrees and the wind is gusting at 70 miles an hour, turning by backpack into a sail and practically blowing me off the mountain. Over the side, the next stop is 1,000 feet below. I am thirsty, but the water in my canteen is frozen solid.

I had planned to follow my tracks in the snow back down to my car, but the wind has totally obliterated them. So I am using an old-fashioned army compass to navigate back in total white out conditions. Good thing I got the letter out early today!

Actually, I am not writing this, I am thinking it. If I took my hands out of my heavy mittens, my fingers would freeze in seconds. Remember, no fingers, no Trade Alerts!

A couple times a year, I feel the need to abandon civilization and contemplate the meaning of life, while accomplishing a great physical challenge. For me, this is a mandatory religious experience.

This time, I attempted to emulate one of the great physical feats in history. In October, 1847, the Donner Party?s wagon train was hopelessly snowed in at a Sierra pass. Starvation loomed. When word reached Sacramento, four rescue parties were sent out, only to be repulsed by driving blizzards.

Finally, a giant of heroic strength, the famous Snowshoe Thompson, who stood at 6?6?, broke through. He emptied his massive wood frame backpack of food, and then stuffed it with the two smallest children he could find. He snowshoed back to safety 120 miles over three days, nonstop. The kids grew up to become the founding fathers of modern day Marin County, California.

I thought, ?Gee, I wonder if I could do that??

So I sought to replicate the feat, subject to a few modern compromises. Today, Interstate 80 sits astride Thompson?s original route. Instead, I determined to snowshoe 120 miles of the Tahoe Rim Trail around Lake Tahoe, with an average elevation of 9,000 feet. I figured that the 60-pound pack I usually carry was worth the weight of two kids.

My one concession to my advanced age was that instead of going nonstop, or camping out at night, I would break the epic trek into ten days at 12 miles each. That allowed me to repair to my Tahoe lakefront estate nightly to thaw out my toes, treat injuries, and get some shuteye. Howling winds keep you awake at night.

I fasted while accomplishing this, eating only 600 calories a day of raw fruit and nuts. I?m down about ten pounds since I began.

Hint to readers: almonds have unique, hunger fighting chemical properties. Eat a handful before you go to sleep, and hunger pangs won?t wake you in the middle of the night. I did some industrial strength eating this Christmas, things like Tom and Jerry?s and See's peanut brittle, so I need to do damage control now. (Note to self: 223 calories in a cup of eggnog).

My friends call this a death march, make excuses why they can?t come, and worry about my sanity. I think of it as a cleansing and a general stocktaking, and I feel great! I always go alone. How many other 64 year olds do you know who are in condition to do this sort of thing?

Sure, I might break my ankle someday, die of exposure, and have my bones scattered by wild animals. Who cares? It would be a good death. It?s worth it.

The scenery up here is so spectacular that I almost didn?t feel the pain. Almost. On more than one occasion, while gazing at the endless shades of blue the pristine waters of Lake Tahoe offered, I tripped on my snowshoes.

Once, I landed on some tree roots, which cut right through to the bone in my left forearm. I managed to stop the bleeding by tying off a tourniquet with my teeth. When I got home, I then soaked the wound in Jack Daniels to ward off infection. It works every time! (See pics below). In a pinch, Stolichnaya Vodka works just as well. It?s an old combat first aid trick.

While hiking along the East Ridge, succeeding mountain ranges in northern Nevada explored every kind of purple. I managed to summit each major peak around the body of water the Washoe Indians called ?da-ow-a-ga?, or edge of the lake, which they considered the origin of the universe. Those included Squaw Peak (8,885), Mt Tallac (9,735 feet), Monument Peak (10,067), and Mount Rose (10,776 feet). When the trail got too steep, my trusty ice ax and crampons saw me through.

I was constantly reminded that I was in the ?Old West? by the many artifacts I encountered. Prominent granite boulders displayed prehistoric Indian petroglyphs. I found a few abandoned log cabins, complete with potbelly stoves and canned food from the 1950s. Rusted out cast iron mining equipment was strewn about everywhere, covered with snow. Along the old Pony Express Trail one finds old horseshoes and the occasional ancient bottle turned purple by the sun.

Lake Tahoe supplied all of the water and bracing wood for the Comstock silver mining boom of the 1870s. A hundred years ago, not a single tree was left standing, except for the southwest section of the lake owned by mining baron ?Lucky Baldwin? who won it in a card game and made it his private retreat. It was all covered in meticulous and colorful detail for the Virginia City newspaper, The Territorial Enterprise, by a budding young newspaperman who went by the name of Mark Twain.

My ambitious goals often saw me hiking well into darkness. After the batteries died on my three backup headlamps, that flashlight app on the iPhone 5s proved a real lifesaver. It?s good for a full hour, and illuminates the eyes of onlooking wildlife a bright yellow up to 200 yards.

One night I got back to the car and found that my keys had frozen. So I sat on them. In 15 minutes, the car flashed its lights and the doors magically opened. There was barely enough charge to get the engine started, a trick I accomplished by holding the key right up to the ignition button. Toyota designs them to do this. It?s no fun getting stranded at 10,000 feet at 10 degrees in the middle of nowhere. No Auto Club here!

I often looked behind to make sure a mountain lion was not stalking me. Don?t worry. Only 20 people have been killed by mountain lions in California over the last 100 years. More are killed by their pet dogs every year in the Golden State, mostly by pit bulls. Besides, I am good at staring down mountain lions and black bears. It is just a matter of attitude.

The old souvenir stand for the Ponderosa Ranch, of the TV series Bonanza fame, is now the Tunnel Creek Station Caf? and bike rental. Good luck to Patty and Max! The nearby Flume Trail offers some of the best cross country skiing in the world.

Of course, I am not just thinking ?great thoughts? during these hikes. An endless series of economic and market data points are constantly churning around in the back of my mind, and I occasionally reach a ?eureka? moment. I keep a pen and notebook in my pack so I don?t forget these earth shaking revelations.

It was during a similar expedition up the face of the Matterhorn in the Swiss Alps (14,692 feet) a few summers ago when I realized that the S&P was beginning a long run up that would take it to 1,800 by year end. I?ll never forget the expression on my guide?s face when I stopped midpoint through an abseil and started feverishly writing notes. That little maneuver cost me a bottle of schnapps. The readers and Trade Alert followers prospered mightily.

What is this year?s ?Eureka? conclusion?

The stock market could keep going up in 2016, but with more volatility. We are going to have to work harder for less money.

That can be worthwhile as my 40% return in 2015 testifies, despite a flat market.

I have been doing this sort of thing since I was 22, and in somewhat better shape. Then, I was one of the few foreigners attending karate school in Japan, learning the iron discipline and focus of samurai warriors, known as ?bushido?. The actor, Steven Seagal, studied at a competing school down the street.

E

very February, we underwent ?kangeiko?, or ?winter training?. This involved the entire class running the five miles around Tokyo?s Imperial palace in a pack, suffering freezing temperatures, barefoot, every day for a week. When we returned to the dojo, we were hosed down with ice-cold water, our feet senseless, bloody stumps. Then we would train for three more hours.

The idea was that the extreme pain and exhaustion would deliver insights into ourselves and the world at large. It worked. At least one current reader endured the experience with me and is still alive. Remember that, David? By the way, thanks for knocking out my front teeth.

On the way home I stopped in Sacramento for a well-deserved double cheeseburger, fries, and chocolate shake at In and Out Burger. You can?t take this diet and health thing too seriously. Snowshoe Thompson would have envied me.

Well, next month, it is back to normal. I?ll be glued in front of my screens scouring the planet for the next great trading opportunity, although, I?m not sure I?ll find many. Buying market tops is against my nature. What are you supposed to do when all of your forecasts and predictions come true? I have a feeling that the answer is not to make more forecasts and predictions.

Perhaps, the right answer is to take another hike. Anyone care to join me?

![John Thomas Hiking]() Your Intrepid Reporter

Your Intrepid Reporter

![Sierras]() My Morning Commute

My Morning Commute

The Only Guy I Saw All Week

The Only Guy I Saw All Week

![View]() The View From the Office

The View From the Office

![John Thomas Christmas Tree]() Can?t Beat the Price

Can?t Beat the Price

![Altimeter Scratched Arm]() Oops!

Oops!

![Atimeter Sleeved Arm]() Double Oops!

Double Oops!

![Altimeter 10000 FT]() The View at 10,000 Feet

The View at 10,000 Feet

![John Thomas Top of Mountain]() Altitude Sickness Can Be a Cruel Master

Altitude Sickness Can Be a Cruel Master

Global Market Comments

December 21, 2016

Fiat Lux

Featured Trade:

(THE BOND CRASH HAS ONLY JUST STARTED),

($TNX), (TLT), (TBT),

(TESTIMONIAL)

CBOE Interest Rate 10 Year T No (^TNX)

iShares 20+ Year Treasury Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

When I was a little kid in the early 1950s, my grandfather used to endlessly rail against Franklin Delano Roosevelt. The WWI veteran, who was mustard gassed in the trenches of France and was a lifetime, died-in-the-wool Republican, said the former president was a dictator and a traitor to his class who trampled the constitution with complete disregard. Candidates Hoover, Landon, and Dewey would have done much better jobs.

What was worse, FDR had run up such enormous debts during the Great Depression that, not only would my life be ruined, so would my children's lives. As a six year old, this disturbed me deeply, as it appeared that just out of diapers, my life was already pointless.

Grandpa continued his ranting until three packs a day of unfiltered Lucky Strikes finally killed him in 1977. He insisted until the day he died that there was no definitive proof that cigarettes caused lung cancer, even though during to war they were referred to as ?coffin nails?.

What my grandfather?s comments did do was spark in me a permanent interest in the government bond market, not only ours, but everyone else?s around the world.

So, whatever happened to the despised, future ending Roosevelt debt? In short, it went to money heaven.

I like to use old movies as examples. Remember, when someone walked into a diner in those old black and white flicks? The prices on the wall menu? said: ?Coffee: 5 cents, Hamburgers: 10 cents, Steak: 50 cents.?

That is where the Roosevelt debt went. By the time the 20 and 30-year Treasury bonds issued in the 1930s came due, WWII, Korea, and Vietnam happened, along with the great inflation that followed.

The purchasing power of the dollar cratered, falling roughly 90%, Coffee was now $1.00, a hamburger $2.00, and a cheap steak at Outback cost $10.00. The government, in effect, only had to pay back 10 cents on the dollar in terms of current purchasing power on whatever it borrowed in the thirties.

Who paid for this free lunch? Bond owners, who received minimal and, often, negative real inflation adjusted returns on fixed income investments for three decades.

In the end, it was the risk avoiders who picked up the tab. This is why bonds were known as ?certificates of confiscation? during the seventies.

This is not a new thing. About 300 years ago, governments figured out there was easy money to be made by issuing paper money, borrowing massively, stimulating the local economy, and then repaying the debt in devalued future currencies.

This is one of the main reasons why we have governments, and why they have grown so big. Unsurprisingly, France was the first, followed by England and every other major country.

Ever wonder how the new, impoverished United States paid for the Revolutionary War? It issued paper money by the bale, which dropped in purchasing power by two thirds by the end of the conflict in 1783. The British helped too by flooding the country with counterfeit paper money.

The really fascinating thing about financial markets so far this year is that I see history repeating itself. Owners of bonds had a great start, but I think the worm has turned.

I agree with bond maven, Geoffrey Gundlach, that bonds peaked in both the US and Europe last week, and that we are eventually heading back to a 2.75%-3.0% yield on the ten-year Treasury bond. Geoffrey has been long bonds until now.

Sell every rally for the rest of the year.

Bondholders can expect to receive a long series of rude awakenings when they get their monthly statements. No wonder Bill Gross, the former head of bond giant, PIMCO, says he expects to get ashes in his stocking for Christmas this year.

The scary thing is that we could be only two years into a new 30-year bear market for bonds that lasts all the way until 2042.

This is certainly what the demographics are saying, which predict an inflationary blow off in decades to come that could take short-term Treasury yields to a nosebleed 12% once more.

That scenario has the leveraged short Treasury bond ETF (TBT), which has recently leapt from $31 to $43, soaring all the way to $200.

If you wonder how yields could get that high in a decade, consider one important fact. The largest buyers of American bonds for the past three decades have been Japan and China. Between them, they have soaked up over $2 trillion worth of our debt, some 12% of the total outstanding.

Unfortunately, both countries have already entered very negative demographic pyramids, which will forestall any future large purchases of foreign bonds. They are going to need the money at home to care for burgeoning populations of old age pensioners.

So, who becomes the buyer of last resort? No one, unless the Federal Reserve comes back with QE IV, V, and VI.

Check out the chart below, and it is clear that the downtrend in long term Treasury bond yields going all the way back to April, 2011 is broken, and that we are now heading substantially up.

The old resistance level at 2.40% will become the new support. That targets a new range for bonds of 2.40%-2.90%, possibly for the rest of 2016.

There is a lesson to be learned today from the demise of the Roosevelt debt. It tells us that the government should be borrowing as much as it can right now with the longest maturity possible at these ultra low interest rates and spending it all.

With inflation at nil, they have a free pass to do so. In effect, it never has to pay it back, but enables us to reap immediate benefits. My friend, Fed Reserve Chairwoman, Janet Yellen, certainly thinks so.

If I were king of the world, I would borrow $5 trillion tomorrow and disburse it only in areas that create domestic US jobs. Not a penny would go to new social programs. Long-term capital investments should be the sole target. Here is my shopping list:

$1 trillion ? new Interstate freeway system

$1 trillion ? additional infrastructure repairs and maintenance

$1 trillion ? conversion of our transportation system to natural gas

$1 trillion ? construction of a rural broadband network

$1 trillion ? investment in R&D for everything

The projects above would create 5 million new jobs quickly.

Who would pay for all of this? Today?s investors in government bonds, half of whom are foreigners, principally the Chinese and Japanese.

How did my life turn out? Was it ruined, as my grandfather predicted? Actually, I've done pretty well for myself, as did the rest of my generation, the baby boomers. My kids are doing OK too.

Grandpa was always a better historian than a forecaster. But he did have the last laugh. He made a fortune in real estate, betting correctly on the inflation that always follows borrowing binges.

Grandpa (Right) in 1916 Was a Better Historian than Forecaster

Thanks to both of you for taking the time to answer me back. I am going to hang in there. I like your newsletter because the unbiased perspectives you share and the way in which you look at market opportunities in a realistic, factual manner.? I am just hoping to turn that advantage into profit and learn.

I don?t like financial advisors as they open your account, offer canned advice, and disappear after they take your money. I want to have the independent skills needed to manage my own wealth, as I grow old. I don?t expect that to happen overnight or without advice, but I am hoping that your newsletter is something above par not just in appearance, but in results.

Time will tell.

Thank you again for returning my emails. That says a lot.

Best,

Ryan

Hammond, New York

Global Market Comments

December 20, 2016

Fiat Lux

Featured Trade:

(IS THERE A BITCOIN IN YOUR FUTURE?),

(TESTIMONIAL)

I often am asked at lunches and speaking engagements whether people should be investing in bitcoin. My answer was always that it was a scam and to be avoided at all costs.

I was vindicated when the value of the online cryptocurrency collapsed 74% from its peak, from $1,230 to $320 to the US dollar.

After all, why should an arbitrarily valued currency, like bitcoin, be worth more than any other, like the US dollar?

I really hope the pizza parlor in New York City that sold a pizza for 8 bitcoins years ago unloaded their proceeds before the crash.

After some major security upgrades, the cryptocurrency has since rallied back up to $670.

Then Marc Andreessen, of leading venture capital firm, Andreessen Horowitz, made some comments the other day that piqued my interest.

He said that he was a major investor in several parts of the bitcoin ecosystem. He thought it had a great long-term future and he was especially interested in bitcoin infrastructure plays.

Smelling a rare opportunity to smash my own preconceived notions, biases, and prejudices, I started making a few phone calls around Silicon Valley.

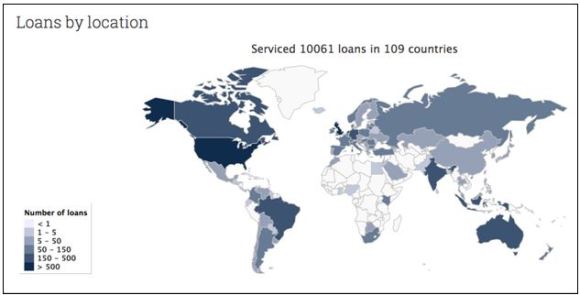

It wasn?t long before someone put me in touch with Mr. Celso Pitta, the CEO of BTCJam. BTCJam is the world?s first peer-to-peer bitcoin lending company and they are paving the way for alternative crypto-currency investing.

What I learned from him was fascinating.

Long considered a ?gold for nerds? and ?online gold?, the financial community is in fact taking bitcoins seriously. Recently, the US Treasury and the Department of Homeland Security held a conference in Florida to bring the industry into its anti-money laundering payments standards.

Where do bitcoins come from? Bitcoins are ?mined? by computers. Every couple of minutes the bitcoin network releases an algorithm and the computer that solves the algorithm first, receives the bitcoin.

They are created from scratch by bitcoin ?miners? who exchange them for local currencies to cover their own costs and compensation for the bitcoin infrastructure.

Bitcoins are a completely decentralized, transparent, and digitally traded currency. Some predict that cryptocurrencies like bitcoin may replace traditional fiat paper currencies in the near future.

In the end, bitcoins are just a giant global payment ledger balanced out by debtors and creditors. As it is electronic, it can be sent and administered for free.

BTCJam has created from scratch a global online marketplace of borrowers and lenders in over 180 countries. Go to their site (https://btcjam.com) and you will find a parade of borrowers from around the planet looking to take out loans and bitcoin lenders looking to invest. Look at the individual players and it is clear that they are young and tech savvy.

Each potential borrower lists the details for their loan, along with a host of personal information. The purposes cited I found included a new transmission for a broken down car in England, a vacation to Japan and the start up of many small business. It also seems a lot of young Americans are seeking to consolidate student loans.

Once a user signs up, BTCJam subjects every application to its credit evaluation software, which examines more than 300 different parameters.

BTCJam uses traditional data that banks use such as personal identification, banking confirmation, and income verification, but they also use a host of other resources such as: LinkedIn, Facebook, PayPal, and eBay accounts.

Believe it or not, a person with 1000 Facebook friends has a much better credit standing and a lower default rate than someone with only 1 friend.

Customers are then given an ?A? to ?E? rating based on their loan algorithm. This software was developed by CEO Pitta, a native of Brazil, who boasts a heavy background in artificial intelligence and facial recognition software.

The company is taking advantage of the void of lending resources in emerging nations; frequently, these people can only turn to loan sharks and other risky loan sources.

Large international banks are reluctant to invest in these places because of the local currency risk. When a loan on BTCJam is fully funded, the borrowers convert their bitcoin into local currencies to spend in the local economy.

Remember how the poorest countries leapfrogged telephone landlines and went straight to cell phones 20 years ago? Well, the same thing is now happening in consumer credit through peer-to-peer lending.

Many developing countries suffer from the complete lack of credit rating agencies. There, every client is considered high risk, and lending is priced according to the standards of the worst borrowers.

Credit card interest rates run as high as 200% in Brazil, 90% in Mexico, and are well into double digits in Indonesia and the Philippines. Overall, they average 175% in the BRICS. As a result, the rates charged by BTCJam seem like a bargain by comparison.

When borrowers sign up at BTCJam and input all their information, they are given a suggested interest rate. They then have the choice to set their monthly interest rate as high or low as they want.

Loans that follow the suggested interest rate are more likely to be funded quickly by investors. Over time, the loan is gradually paid back in full by the borrower as they convert their money back into bitcoin.

Now for the lender side of the equation. BTCJam has investors from all over the world: they attract people that already have bitcoins and are looking for returns on their bitcoins. They also bring in lenders who are new to bitcoin and buy a few for the purpose of investing in BTCJam.

Lenders are completely free to choose which loans they want to invest in and how much they want to invest. Interest rates vary based on the risk profile of the borrower. They range all the way from 14% for the highest quality ?A+? borrowers to 100% for the low-end ?E-? hopefuls.

BTCJam is a bitcoin-only platform: lenders invest bitcoin and borrowers receive bitcoin. Borrowers have the option to link their loan to USD, which helps them avoid the risk of volatility long term. This enables them to lock in the bitcoin price at the time they receive the loan.

BTCJam lists every outstanding loan, and the investors connected to that individual. There is an online discussion on the potential advantages and disadvantages of each borrower. Some of the comments are quite funny. Others are downright rude.

It gets better: BTCJam will soon introduce automatic investments. Lenders will then have the opportunity to set specific criteria such as: the amount they want to invest, which asset class they want to invest in, and for how long. This will significantly enhance the use of the website and lenders will never have to miss out on good loans.

Pitta told me that globally, the total loan portfolio has a 10% default rate. But if you focus on only their ?A? rated customers, that rate plunges to a mere 1.8%. This is in the same ballpark as the largest US consumer lenders.

Do the math with high yields and a non-payment rate this low, and you can easily see that risk sophisticated and tolerant depositors will do these loans all day long.

The peer-to-peer lending model is one of the fastest growing corners of the financial industry. The giant Credit Ease in China is the largest, with a $9 billion loan portfolio. They are followed by the $3-$4 billion Lending Club. The UK has Zopa, with a $1 billion loan book.

This all compares to total credit card debt for the US alone of $1 trillion. Clearly, there is an enormous, high cost, low return, entrenched market to be explored here.

The entire bitcoin story did get tarnished by the bankruptcy of Mt. Gox operation in Japan, which went under with $60 million in liabilities. They claimed they were the victims of the hackers.

Industry insiders say that incompetent management, inferior software, and lax controls are much more likely culprits. These

are common transgressions in every start up industry.

Which brings me to BTCJam?s own business model, which recently obtained several million in seed capital from venture capitalists, like Ribbit Capital and the Founders Club.

They are poised to eat the lunches of emerging nation banks, which have always ignored, overcharged, or abused their local customers. It all seems to me ripe ground for disruption.

I think it is safe to say that in 20 years, the global financial system will be unrecognizable from what it is today. Ultimately, Bitcoin and BTCJam may have a large influence in the transition from traditional currencies to an all out system of online money.

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.